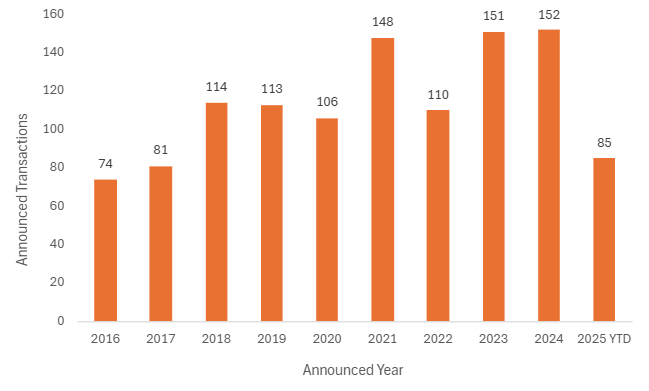

The fourth quarter got underway in October with another (relatively) busy month, with another ten transactions – the same number as last month – making it only the fourth month in 2025 where deal volumes reached double figures. Unlike in the U.S. market, where (for tax reasons) the last quarter of the year is always consistently more active than any other quarter, in the UK there is not really much seasonality in mergers and acquisitions (M&A). As such, with a year-to-date (YTD) total of 85 announced deals, it is clear that 2025 deal volumes will be materially lower than those in either 2023 or 2024, which both saw more than 150 deals in the sector.

M&A Market Update

October’s new deal count of ten was again marginally above the long-term average of 9.6 deals a month. There were 50 deals in the first half of 2025 and there were 35 in the first four months of H2 2025, in what has been a consistently slower year for sector M&A. At the same point in 2024 there were 126 announced deals, meaning this year has seen volumes drop by around a third.

Total Volume of Announced UK Insurance Distribution M&A, Annual

Demand remains but deal size is down

As MarshBerry has previously noted, 2025 has seen some of the most historically active buyers slow down their rate of acquisitions in the UK, including Ardonagh and Brown & Brown. There have been 47 separate buyers who made UK acquisitions in 2025, while ten separate firms have made two or more acquisitions. The top ten buyers have collectively been behind just over half of all M&A activity, so there is no shortage of demand. The most active buyer in 2025, by some margin, has been JMG Group. For the second successive month JMG Group announced a flurry of new deals (four in October, to add to their six in September) and as a buyer they represent more than 15% of all sector M&A volume in 2025.

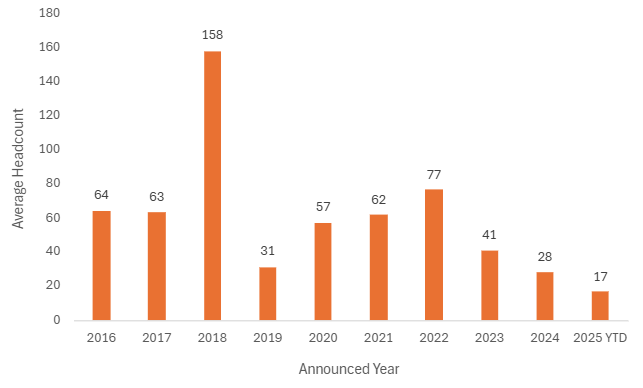

But the number of deals does not tell the full story – to understand the real level of consolidation taking place it is important to look at the size of targets being acquired, and 2025 has seen a continued trend towards smaller average deal sizes. Average deal sizes are down again: in 2025 more than two thirds of sector M&A has involved a target with a value of less than £5m, against a long term (10-year) average of 59% of all M&A. This is before making any adjustments for inflation or increased sector valuations over the past decade and marks a continuing shift, as several mainly PE-backed consolidators get around the paucity of available mid-sized targets by doing mainly smaller deals in higher volumes.

Average Headcount of All UK M&A Targets (ex-Refinancing Deals) Acquired in Period

Note: 2018 jump is caused by inclusion of Jardine Lloyd Thompson Group (JLT)/Marsh deal. JLT had more than 10,000 staff.

This has certainly been true of JMG Group in 2025. Despite having done more than twice as many sector deals than the next most active buyer in 2025, its M&A activity involving broking and MGA targets has added just over 100 new employees, which in commercial business can be used as a broad proxy for income. Its average deal in 2025 has involved a target with fewer than ten employees. On a headcount basis, and excluding refinancing deals, it is actually only the third most active UK consolidator in 2025, marginally behind both NFP and Brown & Brown (Europe), whose deals in the year have both added more ‘heads.’

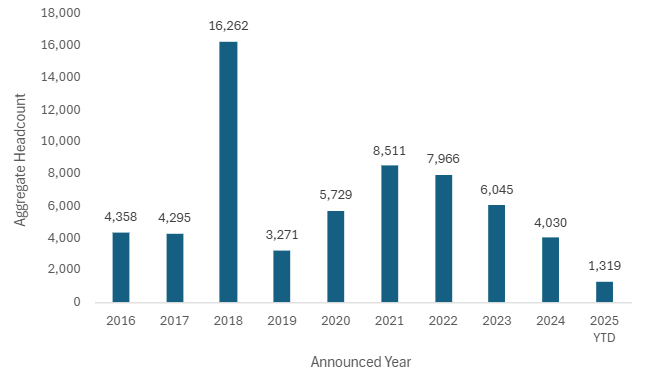

The trend towards smaller deal sizes also means that the continuing high (by historical standards) levels of deal activity are disguising the fact that in the absence of the occasional mega-deal, of which there have been none in the UK in 2025, the overall level of UK consolidation, as measured by GWP and income, has been falling. Given the continued demand for targets and ongoing, plentiful capital support for consolidation, this is clearly a supply-side driven reduction in activity.

Aggregate Headcount Across All UK M&A Targets Acquired in Period (ex-Refinancing Deals)

Note: 2018 jump is caused by inclusion of Jardine Lloyd Thompson Group (JLT)/Marsh deal. JLT had more than 10,000 staff.

Private equity activity in the MGA segment

October also saw an exit by a private equity (PE) investor in the sector, with Beech Tree selling managing general agent (MGA) Avid to Bishop Street Underwriters, a U.S. consolidator that is itself PE-backed. This is the fifth exit for a PE-owned sector investment in 2025, and the second to a U.S.-based business. There have however been four new direct PE investments into the sector in 2025, broadly maintaining an equilibrium in terms of the overall number of PE-controlled UK insurance distribution groups, which has been gently edging down in recent years and currently stands at just below 40 – and of course includes some of the largest firms in the sector (Howden, Ardonagh, PIB Group).

PE interest in the sector remains strong and PE capital is still behind more than half of all sector deals in 2025. The MGA segment in particular continues to be closely evaluated by PE investors, who are attracted to its dynamism, potential for rapid growth, and perhaps encouraged by the sense that it has been less well pored over than commercial broking. This growing interest – and there’s likely to be more PE capital backing the MGA sector as it continues to grow and mature – comes notwithstanding the fact that in the UK PE investors to date have arguably had mixed results investing in MGAs (CFC being a very notable exception), which often have a very different risk profile to broking businesses and are by no means a “sure thing” from an investment perspective. There were three new MGA deals in October, and M&A involving MGAs has accounted for 17% of all deal activity in 2025, up from only 12% in 2024.

Notable transactions (October 2025):

- PE-backed MGA Avid Insurance announced its sale to Bishop Street Underwriters, the U.S. MGA consolidator that recently acquired Landmark Underwriting in the UK. Avid had been backed by Beech Tree Private Equity since 2019.

- JMG Group announced another four broking acquisitions in October, taking the firm’s deal count to ten in the past two months: Taveo Group in Scotland, Glowsure Insurance Brokers in Hampshire, James Brown & Sons in Somerset, and R Todd Insurance Services in Norfolk.

- Brown & Brown (Europe) added All Medical Professionals, which trades as All Med Pro Dental, a specialist broker based in Swindon and serving the dental, life science and hospital sectors.

Other transactions (October 2025):

- Howden announced two further UK deals in October, including Gott And Wynne, a commercial broker in North Wales that is best known for its classic car scheme for Morgan vehicles.

- In its second deal of the month Brown & Brown (Europe) also added Pardus Underwriting, an MGA based in Kent and focused on Property Owners and Commercial Combined business.