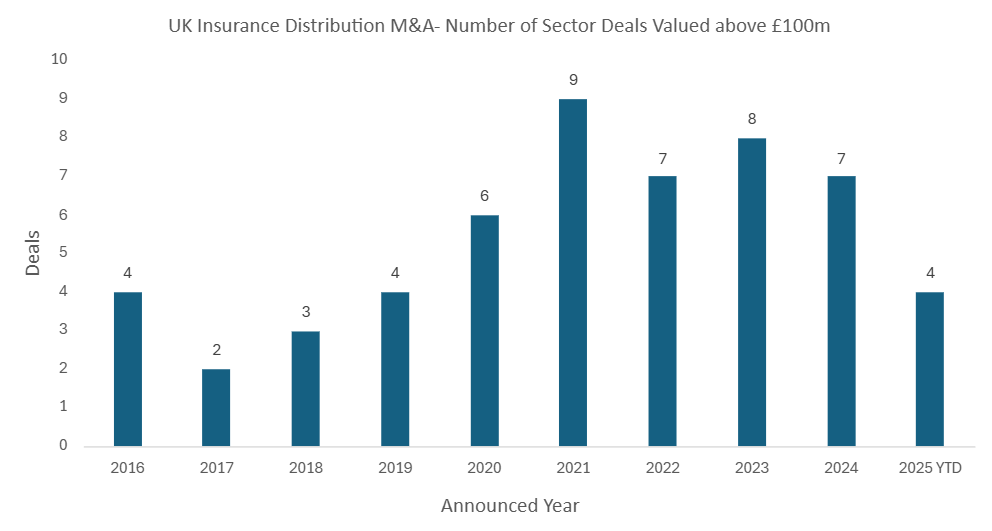

One summer does not a swallow make and following a busy April for UK Insurance Distribution mergers and acquisitions (M&A), May saw a return to the slower pace that has so far characterised 2025, with only seven new announced sector deals to report on. On a year-to-date (YTD) basis sector deal volumes are down 30% compared to the same period in 2024. Furthermore, the majority of announced deals in 2025 have been relatively small: 69% of announced deals in 2025 have been for targets with a value below £5m (vs. a longer-term average of 59%, based on 1,000+ deals since 2016). Only 14 deals in 2025 have involved a target with 20 or more staff. But at the other end of the spectrum, May saw another very large deal, the fourth of 2025 with a value over £100m, with several others rumoured for later this year.

M&A Market Update

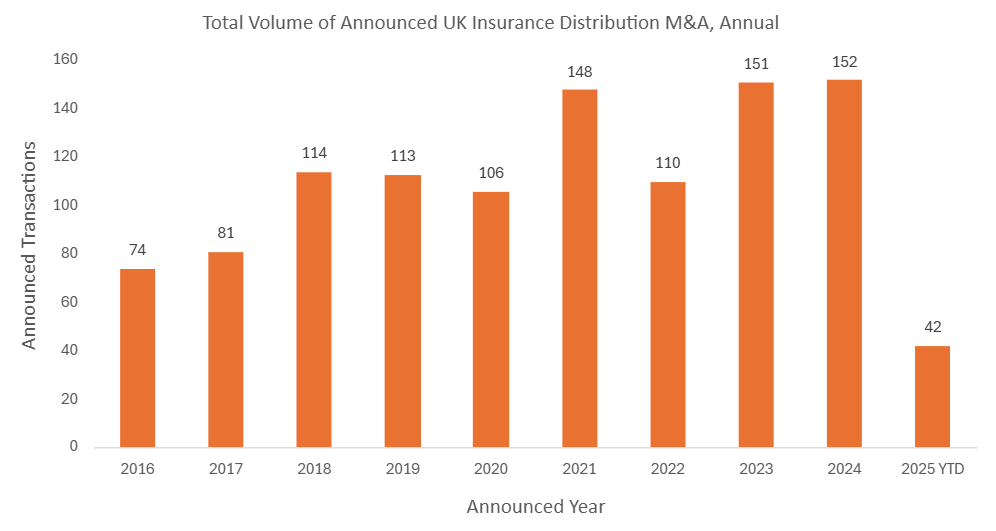

After a flurry of new deals in April, which marked the end of the tax year and an increase in the rate of Business Asset Disposal Relief, May saw a return to the low levels of announced M&A transactions seen in 2025. Another below-average monthly deal count means that at the end of May there have been 42 deals YTD, compared to 60 at the same time last year (-30%). The 150+ level of sector deals seen in 2023 and 2024 will likely not be matched in 2025.

But is this a supply or demand issue? Principally the former. MarshBerry has for some time been publishing analysis of the UK market showing that the number of privately owned brokers available for consolidators to acquire – the ‘fuel’ for sector M&A – has been rapidly decreasing. Unlike in the MGA segment, where the level of new business formation is very high, the rate of new broker formation (and the subsequent scaling of those new brokers to a meaningful size, which is very difficult in an industry that enjoys such high levels of renewal retention) is not nearly high enough to ‘replenish’ the numbers of independent brokers that are lost through sector M&A every month.

That is not to say that the level of demand for targets doesn’t also ebb and flow, impacting M&A activity. There are still a very high number of active consolidators in the UK market, as well as a long line of overseas buyers keen to buy here, if they can find the right target. But as many of those buyers go through their own cycles of refinancing and changes in ownership, refocusing M&A efforts to overseas markets, and/or addressing the integration of businesses they have previously acquired, the levels of domestic M&A they undertake can speed up or slow down. Several of the most prolific UK buyers of the past few years have done very little or no M&A (so far) in 2025. Taken alongside the supply constraints noted above, this is likely dampening current sector M&A levels.

If this all reads like doom and gloom, it isn’t. Of the 42 deals announced YTD in 2025 there have been 32 unique buyers (vs. 35 at the same point in 2024). Several major international groups already active in the UK have recently publicly stated their ambitions to undertake more M&A here. Three of the most active UK consolidators of the past few years have taken on new private equity (PE) investment in 2025, which will provide capital support for further M&A. And the number of large deals (£100m+) in 2025 is running ahead of the longer-term average, as sector consolidation reaches a more mature phase and there are larger groups to be acquired. Equally importantly, the macroeconomic uncertainties that are creating headwinds for M&A in many other sectors are likely to have a less pronounced effect in Insurance Distribution, which has proven its resilience over many cycles of wider economic turbulence.

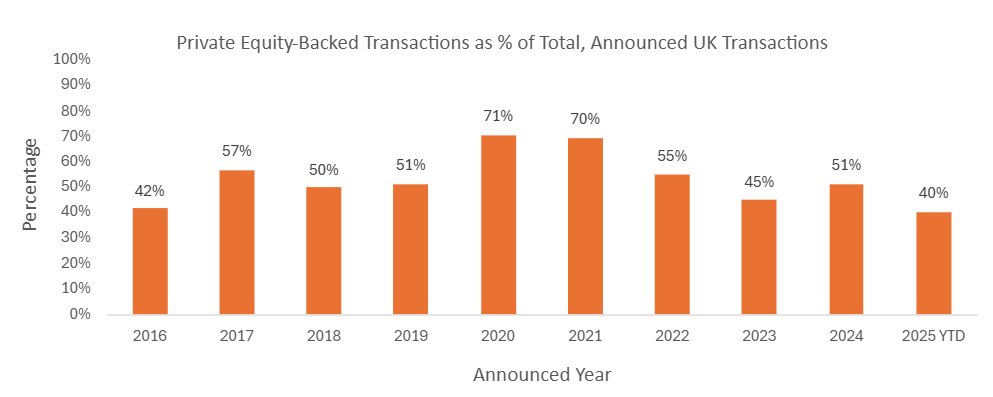

On a YTD basis only 40% of announced UK deals have involved private equity. This is below the level in any full year since before 2016. However, in value terms PE is still dominating M&A: the biggest deals of the year have all involved PE money, either directly – BPL, Seventeen Group and JMG Group (see below) have all secured new investment from PE in 2025 – and indirectly, with Miller, PIB, Ardonagh, Clear and SRG all having been active in M&A in recent months.

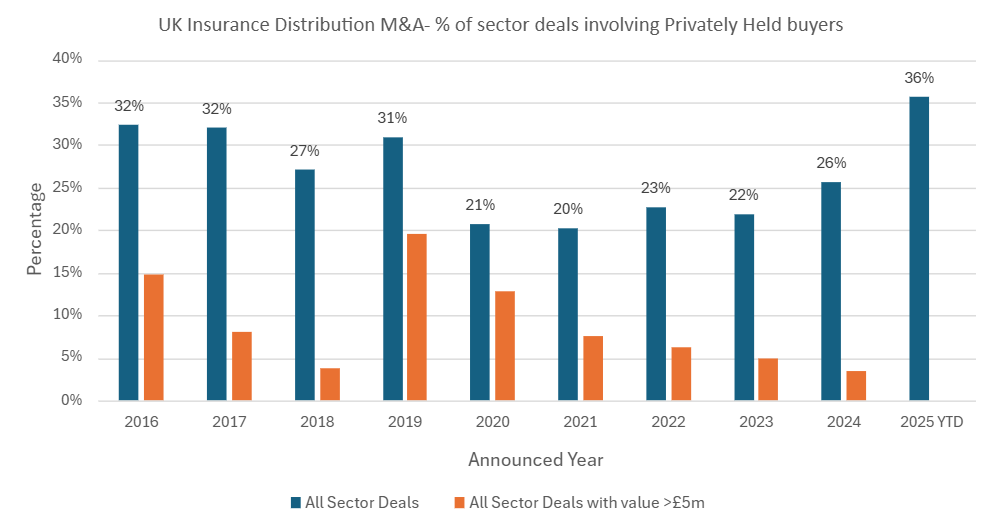

One corollary of this trend is that privately owned brokers, who have been increasingly squeezed out as buyers in M&A over recent years, have been behind an increasing proportion of all deals in 2025. More than half of the new deals in May involved a privately owned buyer. This is only the sixth month in the past five years that this has been true. Admittedly the sector deals involving privately owned buyers are mostly small, and indeed exclusively below the £5m value mark this year (see below), but it does demonstrate that for smaller local brokers there are options that go beyond the ‘usual suspects.’

Notable transactions (May 2025):

- In by far the biggest deal of the month and the fourth £100m+ UK transaction of 2025, JMG Group announced that it had secured new backing from U.S. PE firm GTCR, who will invest alongside existing backer Synova, with Nick Houghton continuing to lead the business as CEO. The transaction comes at a time when a number of PE-backed firms in the UK have been struggling to secure similar refinancing deals.

- Following a number of recent acquisitions overseas, MGA consolidator Optio Group added another UK MGA with Custodian Management, which specialises in Professional Liability and Management Liability.

- Clear Group followed the recent launch of Shape Underwriting, a new brand for its MGA division, with a new acquisition that will sit within Shape. It has added Protect Underwriting, an MGA best known for its Private Client High Net Worth business.

Other transactions (May 2025):

- Personal lines broker Niche Box Group acquired Next Generation Ins Group, which trades as Cycler, adding Cycler’s dedicated bicycle and e-bike insurance brand and products to its existing suite of specialist products.

- Ex-BGL co-founder Phil Hayes’ new broker Sentreos, which trades as GOAT Insurance, announced that it had acquired the full book of business of Rockland Risk Services, which trades as IGG Insurance.

- The Broker Investment Group (TBIG) announced its fourth deal of 2025 with the acquisition of Welsh community broker David Vaughan & Co, which was acquired by TBIG-owned Deva Risk Group.

- Delta Corporate Risk, a commercial broker in Macclesfield, acquired a book of business from Colmore Insurance Brokers in a deal that will see four members of staff moving over to Delta.