M&A Market Update

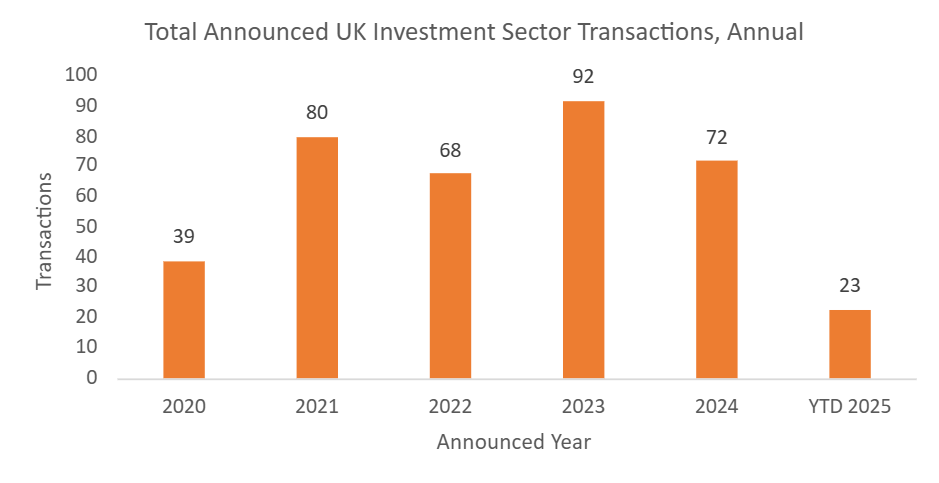

The volume of investment sector merger and acquisition (M&A) transactions above £5m of value doubled in May to six, returning activity to levels seen in March. Three of the deals during May were for targets operating within the wealth management and financial planning space. Two of these deals involved mergers of private equity-backed (PE) consolidators, with Mattioli Woods merging with Kingswood and Fidelius merging with Timothy James & Partners. There were also two deals during the month for fund managers, with Royal London acquiring Dalmore Capital and Dai-Ichi Life taking a 15% stake in M&G. The other deal this month was Broadstone’s acquisition of Railpen’s third-party administration business.

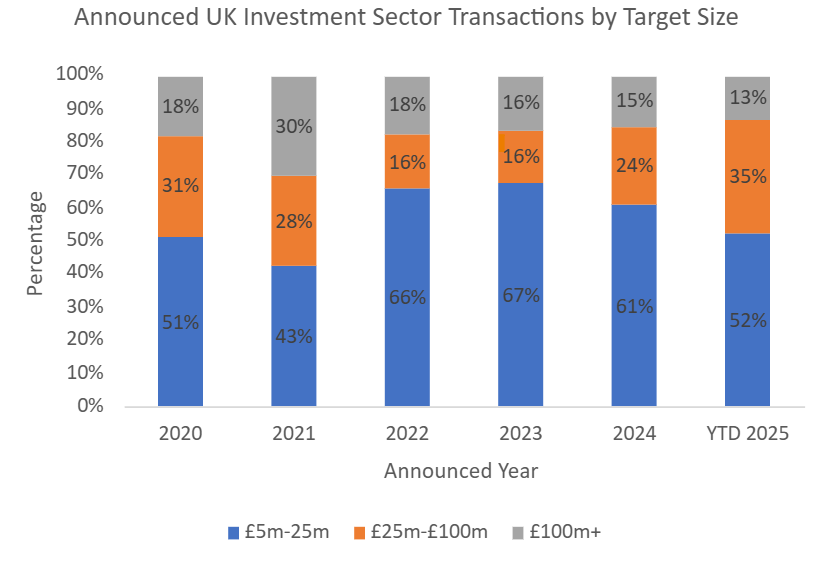

There were four smaller deals during May with values between £5-25m, one between £25-100m and one above £100m. Despite there being more deals at the lower end of the market in May, the year-to-date (YTD) trend still shows more activity at above £25m of deal value when compared with recent years. In fact, two of the deals in the £5-25m range involved targets that were already subject to an investment by the acquirer’s PE backer, with their enterprise values being comfortably above £25m. This continues the trend towards deals above £25m of value comprising an increasing proportion of the total count.

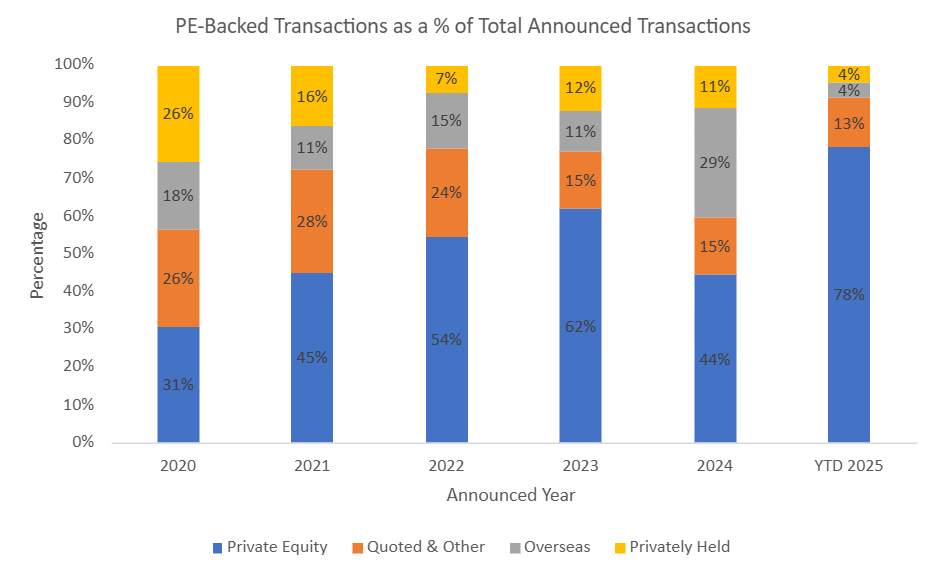

PE remained the most prolific acquirer group during May, with four of the acquirers having PE-backing. In the YTD figures, 78% of acquirers were linked to PE, either as direct investors or via their portfolio companies. One of the deals during the month involved an overseas group, the first deal concerning an overseas acquirer so far in 2025. In 2024 overseas acquirers increased their share of the total deal count significantly. Although it is still too early to tell the outcome for 2025, the current YTD statistics suggest this trend may have slowed.

Notable transactions (May 2025):

- Mattioli Woods and Kingswood agreed to merge creating a £25bn wealth management and financial planning group. The combined business will have over 200 financial advisers, over 40 offices nationwide, and serve over 25,000 clients. Both Mattioli Woods and Kingswood have ties to PE firm Pollen Street Capital, with Mattioli Woods being acquired by Pollen Street in March 2024 and Kingswood being backed by HSQ Investments, a Pollen Street subsidiary.

- Sӧderberg-backed advice and wealth management firms Fidelius and Timothy James & Partners agreed to merge, creating a group with 50 advisers and £3bn in assets under management (AUM). In a separate transaction during May, Fidelius took a stake in high-net-worth specialist financial planning firm Vobis, which has over £140m in AUM.

- Royal London announced the acquisition of Dalmore Capital, the infrastructure asset manager that manages £6bn of assets across five flagship funds. The deal will support Royal London’s strategy to broaden its private assets capabilities and, as part of the acquisition, Royal London will commit up to £500m in future Dalmore funds.

- M&G and Dai-Ichi Life announced that they had entered into a long-term strategic partnership covering asset management and life insurance. As part of the agreement, Dai-Ichi Life will acquire 15% of M&G plc’s shares, and the partnership results in M&G becoming Dai-Ichi Life’s preferred asset management partner in Europe.

Other UK transactions (May 2025):

- Saltus announced it had acquired Hertfordshire-based financial planning business Delta Financial Management, adding over £400m of client assets and 500 clients.

- Tribe Impact Capital announced the acquisition of Snowball Impact Management. Both Tribe and Snowball operate within the impact wealth management space, with the latter focusing on multi-asset impact fund management with a strong presence in private markets.

- Railpen announced it had sold its third-party administration business to Broadstone. The scope of the transaction includes over 20 pension schemes, more than 110,000 members, and Railpen’s third party administration employees.