M&A Market Update

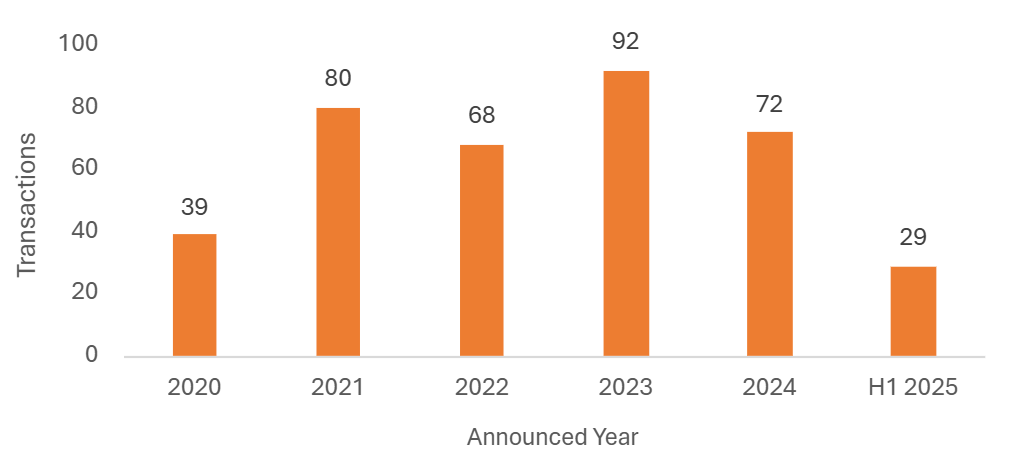

There were six merger and acquisition (M&A) transactions above £5m of value reported during June, resulting in 15 deals announced in Q2 2025 (compared to the 14 deals reported during Q1 2025) and 29 deals in total for the first half of 2025 (a modest increase on the 25 deals reported during H1 2024).

The most active part of the M&A market so far in 2025 has been in wealth management and financial planning, accounting for over 55% of the total deal count. In June alone, four deals involved targets operating in the space, including Lee Equity Partners’ acquisition of Shackleton, August Equity’s investment into Superbia Group, Openwork’s acquisition of Milecross Financial Solutions and Wren Sterling’s acquisition of City Financial. Year-to-date (YTD) there has also been several deals involving asset managers, actuaries, employee benefits consultants and pension administrators. The most recent such deal occurred in June with Brown Advisory acquiring asset management firm Marylebone Partners.

Total Announced UK Investment Sector Transactions, Annual

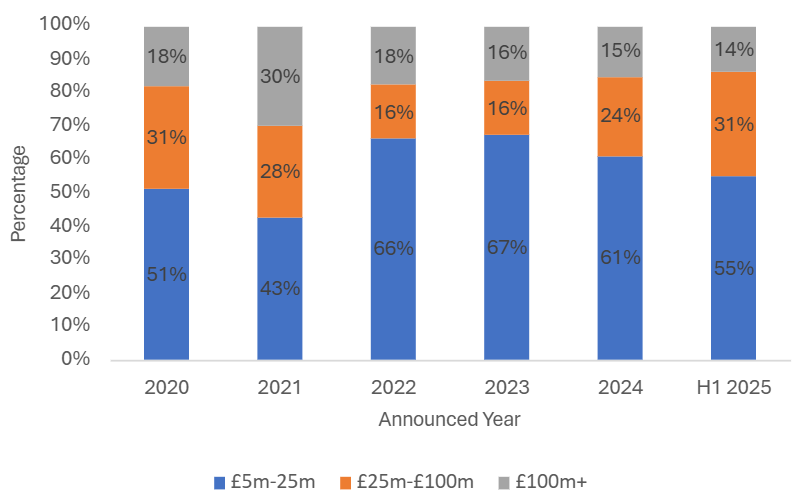

Deal values in June ranged in size, with four deals between £5-25m, one deal between £25-100m, and one deal above £100m. Similarly, and as expected, the majority of deals during H1 2025 have been at the smaller end of the market: 16 transactions between £5-25m were announced compared to nine between £25-100m and four above £100m of value. But there has been a significant rise in the number of transactions taking place in the mid-market between £25-100m of deal value, an increase of 80% compared to H1 2024.

Announced UK Investment Sector Transactions by Target Size

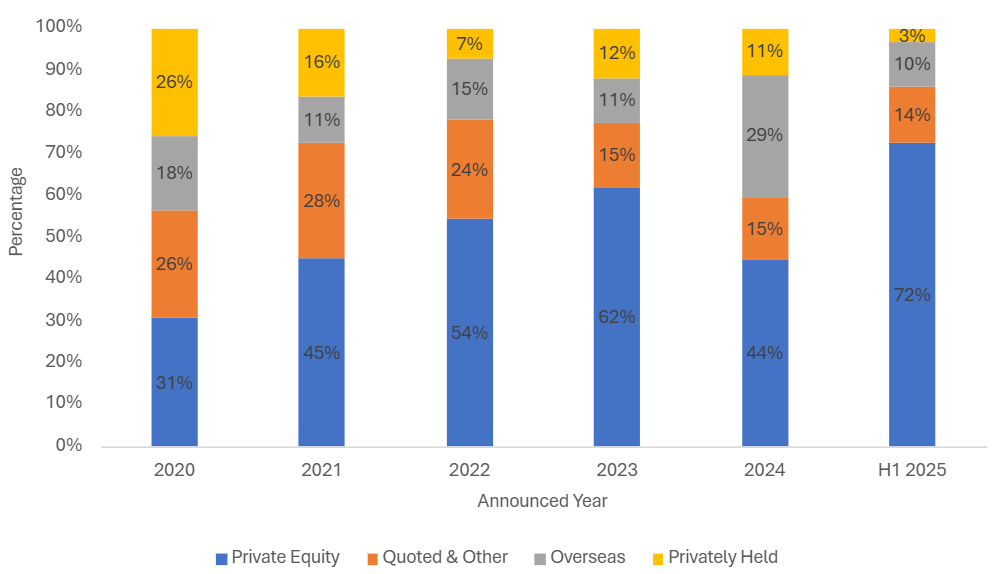

Private equity (PE) has consistently been the most prolific acquirer group during 2025, with 72% of all transactions involving a PE buyer. This represents an increase of over 90% in H1 2025 (compared to H1 2024) and suggests a resumption of the trend of a growing number of PE-backed companies driving an increasing share of the M&A activity in the investment sector after a temporary drop last year. This cohort constitutes PE funds making direct investments as well as investments via their portfolio companies. Whilst the latter accounted for the majority, 76%, of all PE deals in the YTD figures, the number of direct PE investments in the sector has materially increased with five direct PE investments in H1 2025 vs. one in H1 2024. Conversely, the number of transactions completed by overseas acquirers has declined by 63% in the YTD figures compared to the same period in 2024.

PE-Backed Transactions as a % of Total Announced Transactions

Notable transactions (June 2025):

- Lee Equity Partners announced it had acquired a majority stake in advice consolidator Shackleton. The U.S.-based PE firm succeeds Shackleton’s existing investor, Sovereign Capital Partners, who had been invested in the wealth manager since 2021. Since then, Shackleton has completed 18 acquisitions and grown assets under advice to £7bn.

- August Equity announced it had invested in Leicestershire-based wealth manager The Superbia Group. With a team of 80 employees, Superbia advises over 2,500 clients across the UK, providing financial advice, discretionary fund management and in-house investment solutions.

- The Openwork Partnership announced it had acquired one of its Northern Ireland-based advice member firms, Milecross Financial Solutions. Milecross has c.100 advisers across the UK, assets under management (AUM) of £750m and conducts £600m of mortgage lending each year.

Other UK transactions (June 2025):

- Wren Sterling announced the acquisition of Scottish advice firm City Financial. The deal expands Wren Sterling’s footprint in Aberdeen, Ellon and Inverness, and brings £700m of AUM.

- Marsh McLennan subsidiary, Mercer, announced it had acquired investment advisory firm Fundhouse. The transaction is expected to improve Mercer’s capabilities and increase its presence in UK wealth management. Fundhouse’s operations in South Africa were not included within the scope of the deal.

- U.S.-based investment firm Brown Advisory announced the acquisition of London-based boutique asset manager Marylebone Partners. Marylebone offers endowment style investments, combining direct investments in public equities, allocations to specialist funds managed by third party managers, and hard-to-access special investments. Marylebone is also the manager of the £147m Majedie Investments investment trust.

- River Global announced it had acquired boutique European equities manager Devon Equity Management. Launched in 2019, Devon Equity Management has c.£835m of assets and operates a high-conviction investment style focused on a concentrated portfolio.

- Suttons Independent Financial Advisers announced the acquisition of Bolton-based adviser Whitewell Financial Planning, adding £40m of client assets.

- Edinburgh-based investment firm Par Equity announced it would merge with Praetura Ventures and Praetura Investments. The newly created firm, PXN Group, will focus on backing early-stage and high-growth businesses across the North of England, Scotland and Northern Ireland.