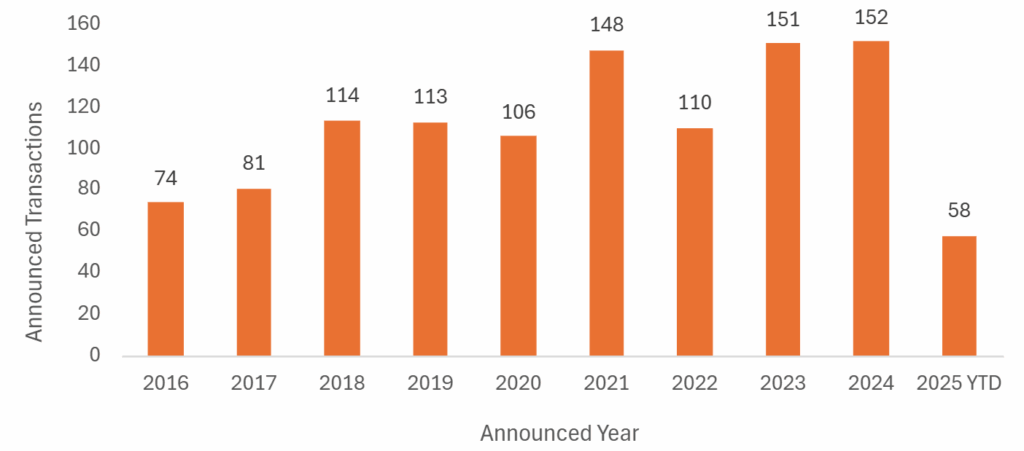

There is a persistent myth in the City that M&A (mergers and acquisitions) activity slows down during the summer as people all disappear on holiday. The deal statistics – at least in UK insurance distribution M&A – don’t really support this. Yes, deals might take longer and decision-makers might be more difficult than usual to reach, but looking at the numbers, July has on average been the fifth busiest month of the year for sector M&A over the past ten years, averaging 10.2 deals since 2016. July 2025 has been no different: with nine new sector deals to report on it was the third most active month of 2025 so far. Seven different buyers made acquisitions during the month, across nine deals involving firms that collectively employ 140 staff. Year-to-date (YTD) there have been 58 sector deals in 2025, compared to 92 at the same point in 2024, a 37% decrease.

M&A Market Update

With nine new deals in July it was the busiest month for UK insurance distribution M&A since April (when the tax year ended and Business Asset Disposal Relief was increased), albeit the average deal size was small, with no new ‘blockbuster’ deals to report on. Indeed, the most headline grabbing M&A in July was the big deal that didn’t happen, namely the widely rumoured sale of PIB Group to Gallagher, with the former confirming that sale discussions had ceased and announcing a new £400 million debt raise that will allow it to maintain its independence and continue its rapid expansion in Europe.

Total Volume of Announced UK Insurance Distribution M&A, Annual

The fact that a deal for PIB Group will not close in 2025, and the valuations reportedly ascribed to the business by prospective purchasers, has implications that will be felt across the sector. Other consolidators and their private equity (PE) backers are evaluating what it means for their own business and looking for lessons. Whether they draw the right lessons remains to be seen, but it will likely impact several consolidators’ views around business mix, cross-border M&A, deal valuations, equity incentive structures, and integration. Taken together with the pricing on several major recent U.S. deals and the effects of the soft market on income growth and profitability, it is contributing to increased nervousness around deal pricing across the sector.

Having said that, we do not expect buyers to go on strike, and there continues to be massive interest in sector M&A, from an increasingly broad pool of buyers. July 2025 saw one new entrant to the UK market in the form of Santévet, a leading French pet insurer, but deal activity in the month was nevertheless dominated by several of the ‘usual suspects.’ Specialist Risk Group, DR&P (now part of BMS), Brown & Brown (Europe), Seventeen Group and JMG Group have all been among the top 10 most active buyers of the past five years and all revealed new acquisitions in July.

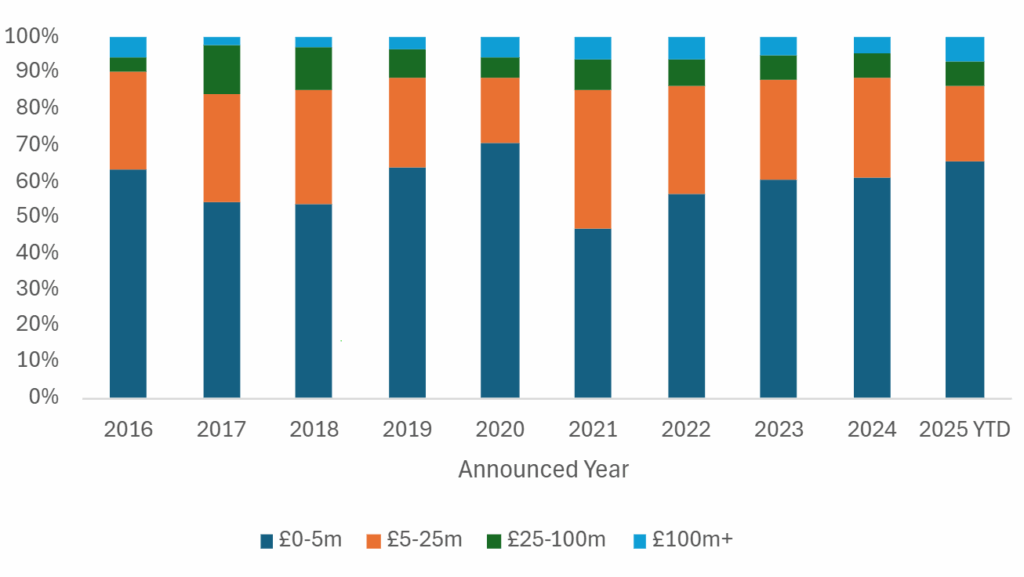

UK Insurance Distribution M&A – Announced Transactions by Deal Size (EV basis, bandings)

In terms of deal sizing, the proportion of all sector deals that are very small (less than £5m on an Enterprise Value basis) continues to creep up. YTD more than 60% of all sector deals have been in this range. On a headcount basis, 41 of the 58 sector deals announced in 2025 have involved a target employing fewer than 20 staff. As MarshBerry has previously remarked, the challenge for larger consolidators to really ‘move the dial’ with these deals has been a key driver behind many UK groups moving towards overseas M&A. At the other end of the spectrum, big deals (>£100m value) continue to happen, and there have been four already in 2025 (vs. an average of six a year since 2016). More are expected in H2 2025, and of course an increased proportion of large deals is consistent with a sector that is increasingly consolidating.

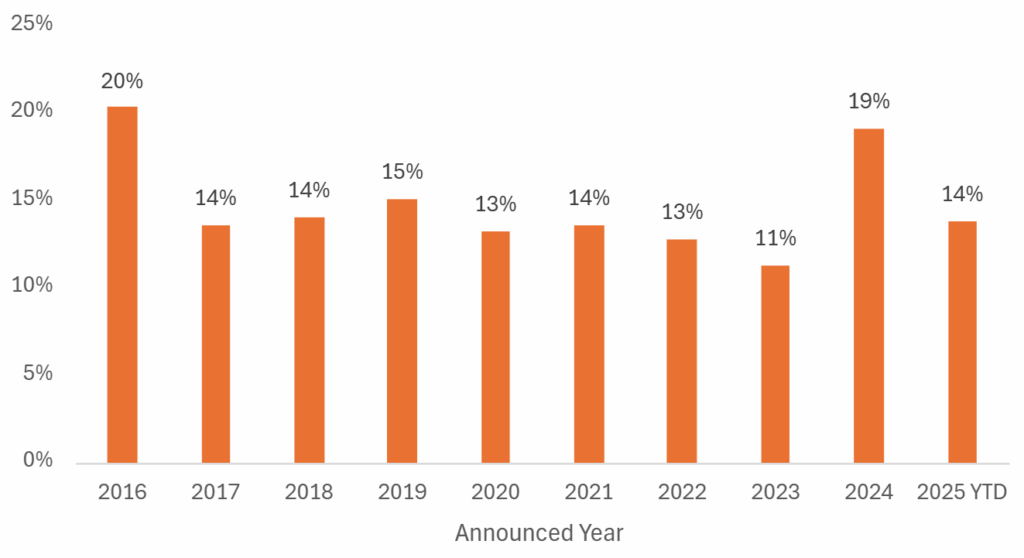

Targets in UK M&A: Personal Lines Deals as % of Announced UK Transactions

As MarshBerry noted in our 2025 Insurance Distribution Market Report – last year saw a record number of UK personal lines businesses being acquired (29), and we posited whether this could be the beginning of a more consistent period of consolidation for the segment, which has hitherto attracted less interest from PE than commercial lines businesses, which tend to have higher renewals and business models that have to date proven less susceptible to disruption from digital distribution. YTD there have been only eight personal lines deals in 2025 (or 14% of all deals), in line with the longer-term average, but three of those deals happened in July (see below). MarshBerry UK currently has sell-side instructions on two personal lines businesses and is aware of several others currently in due diligence, so would expect this number to increase in the coming months.

Notable transactions (July 2025):

- The biggest transaction of the month (based on target headcount) saw Brown & Brown (Europe) announce a deal for Weatherbys Hamilton, the broking JV between Charles Hamilton and the Weatherbys family. The business operates from seven UK locations and specialises in Private Client, Bloodstock, and Farm & Estate insurance.

- In a (relatively) rare example of a brand new entrant into the UK personal lines market, Columna Capital-backed French pet health insurance company Santévet, which is based in Lyon and arranges more than £100m in GWP (gross written premiums), acquired Tedaisy Insurance Group, the privately held UK group behind the Perfect Pet and Now Pet Insurance brands.

- Specialist Risk Group, which has been among the most consistently active UK acquirers for the past several years, announced the acquisition of Generation Underwriting, an SME-focused MGA based in Newcastle and previously part of WF Risk Group. The business will become part of MX Underwriting, SRG’s underwriting arm.

Other transactions (July 2025):

- Noble Insurance Group, the privately owned personal lines group that includes brands such as Noble Marine, acquired Caravanwise, a broker based in Dorset and specialising in, wait for it, caravan insurance.

- JMG Group, fresh with new funds following its recent refinancing with PE firms Synova and GTCR, made two new acquisitions in July, including London-based Profile Insurance Services, in a transaction billed as JMG Group‘s 50th acquisition.

- David Roberts & Partners, itself part of BMS Group, similarly added two new UK acquisitions in July, including Spedding Goldthorpe (Brokers), a c.£6m GWP commercial broker in West Yorkshire and trading as SGB Insurance Brokers.

- Seventeen Group, which took on new capital from IK Partners earlier this year, added Trelawney Insurance Solutions, a broker in Cornwall and an existing AR of James Hallam, Seventeen Group’s principal retail business.

The European insurance distribution M&A landscape during Q2 2025 showed a delicate balance between caution and a readiness to act, as dealmakers weighed macroeconomic uncertainties against the ongoing appeal of strategic growth opportunities. Read MarshBerry’s Q2 2025 report on M&A activity in Europe and the UK here.