M&A Market Update

The investment sector brimmed with merger and acquisition (M&A) deals in July, especially at the larger end, spanning the full breadth of the sector. Among the life and retirement solutions providers, Chesnara first announced the acquisition of HSBC Life for £260m and Athora agreed to pay £5.7bn for pension risk transfer specialist PIC. A week later, Legal & General announced a new partnership potentially worth up to $20bn with U.S. alternative assets manager Blackstone to support L&G’s annuities business and then, towards the end of the month, annuity provider Just Group agreed to be acquired by the Canadian insurance company Brookfield Wealth Solutions for £2.4bn.

Elsewhere in the sector, the American investment technology provider SS&C agreed to acquire Calastone for £766m, and Close Brothers sold its Winterflood businesses to Marex Group for £103.9m. In the asset management arena, a vehicle managed by Apax Partners and funded by Ares Management agreed to acquire Apax Global Alpha trust in a deal worth £794.5m, and Jupiter Fund Management acquired of CCLA Investment Management for £100m.

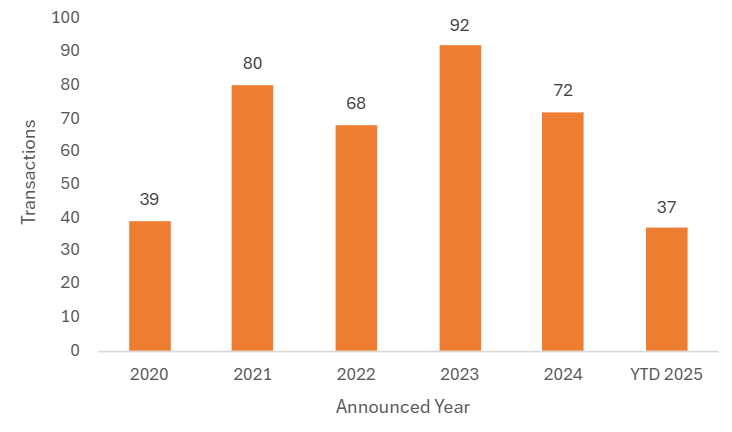

Total Announced UK Investment Sector Transactions, Annual

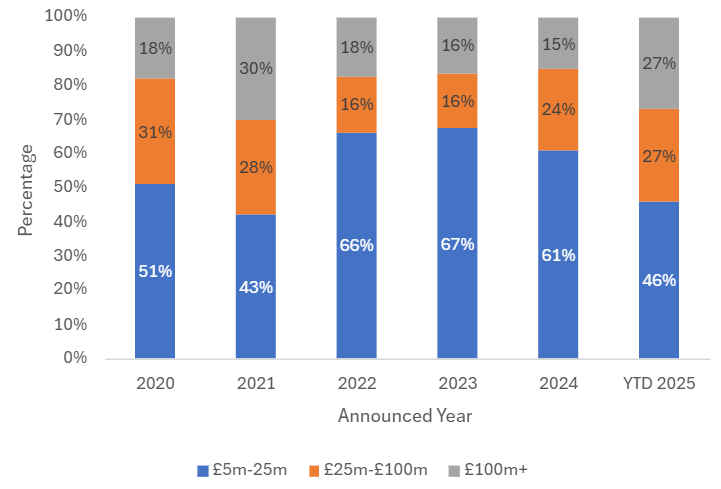

Larger scale deals dominated the market in July, with six deals over £100m of value and two deals below. This marks a radical change from the first half of this year when there were only four deals above £100m. But one swallow of deals in a month doesn’t make a summer, albeit the strong North American investor element remains a recurring theme in the deals of scale. Consistent with historical trends, the vast majority (73%) of transactions this year remain below £100m.

Announced UK Investment Sector Transactions by Target Size

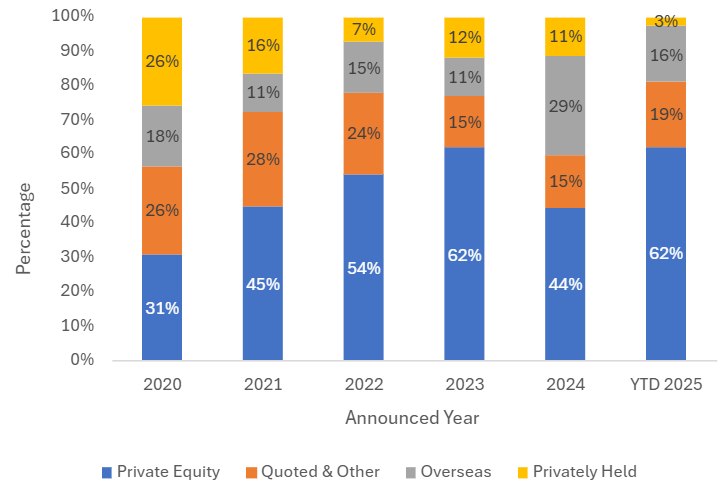

The proportion of acquirers other than private equity (PE) rose in July, marking another departure from the year-to-date (YTD) trends, with three overseas acquirers and three quoted acquirers vs. only two indirect PE acquirers. All the overseas acquirers already run operations in the UK, so there were no new entrants to the market, but it demonstrates the importance of North American investors when sourcing significant amounts of capital and their appetite for M&A opportunities in the UK.

PE-Backed Transactions as a % of Total Announced Transactions

Notable transactions (July 2025):

- Bermuda-based Athora, an insurer backed by U.S. private capital group Apollo, announced the acquisition of Pension Insurance Corporation (PIC) for approximately £5.7bn. PIC will become Athora’s UK insurance business, continuing under the PIC brand. The deal creates a group with over €130bn in assets, serving more than three million savers across Europe. PIC, with £50.9bn in assets and a strong UK investment footprint, will represent 45% of Athora’s total assets and be its largest and fastest-growing business.

- Canadian insurer Brookfield Wealth Solutions (BWS) announced the acquisition of Just Group in a £2.4bn deal. BWS plans to merge Just Group with its UK operations, Blumont, and operate the combined business under the Just Group’s brand. The acquisition enables Just Group to expand its reach in the UK pension risk transfer market, supported by BWS’s balance sheet and expertise.

- U.S.-based SS&C Technologies announced the acquisition of Calastone for c. £766m. Calastone, the largest global funds network, connects over 4,500 financial organizations across 57 markets. The acquisition enhances SS&C’s global fund distribution and automation capabilities, creating a unified, real-time operating platform to reduce complexity and improve outcomes for asset and wealth managers.

Other UK transactions (July 2025):

- Ares Management announced the acquisition of Apax Global Alpha, a London-listed investment trust, in a take-private transaction valued at c. £795m. The transaction marks the first-ever take-private of a listed private equity investment trust. Apax Partners, Apax Global Alpha’s current investment adviser, will continue to advise the vehicle.

- Chesnara plc announced the acquisition of HSBC Life for £260m, adding 454,000 policies and £4bn in assets under administration. The deal materially increases Chesnara’s scale and positions it for FTSE 250 inclusion. It aligns with Chesnara’s strategy of acquiring capital-efficient portfolios and enhances its dividend profile.

- Marex Group announced the acquisition of Close Brothers’ Winterflood business for £103.9m, which includes Winterflood Securities, the execution services and securities business, and Winterflood Business Services, which provides outsourced dealing, settlement and custody services to a diverse range of clients, including large institutions, investment platforms, wealth managers, and retail aggregators. The acquisition strengthens Marex’s UK equities business and expands its distribution capabilities.

- Jupiter Fund Management announced the acquisition of CCLA Investment Management for £100m, adding £15bn in assets under management (AUM) and expanding its reach into the non-profit sector. CCLA will retain its brand and client engagement model. The deal supports Jupiter’s strategic goal of increasing UK scale and is expected to deliver significant cost synergies.

- Shackleton announced the acquisition of wealth manager Chetwood Group, adding £900m in AUM and 45 staff. The Chetwood Group consists of Chetwood Wealth Management, Chetwood Investment Management, Chetwood Private Wealth, Ermin Fosse Financial Management and Darnells Wealth Management. The acquisition strengthens Shackleton’s presence in the South West and marks its 19th deal since 2021.

- Titan Wealth announced the acquisitions of East Anglia-based advice firm Finance Shop and discretionary fund manager FS Wealth Management, adding £750m in assets under advice (AUA) and £340m in AUM respectively.

- The Finli Group announced the acquisition of six firms, including Letchworth-based Accomplish Wealth Management, Tonbridge-based G&D Bignell, Cardiff-based Wynford Davies & Co, Carmarthen-based Wheeler Wicks & Co, Dundee-based EP Wealth Management, and Rochester-based GTM Financial. The deals add a total of £264m in client assets, bringing Finli’s total AUA to £5bn.

- The Penny Group announced the acquisition of Kettering-based advice firm Isham Financial Centre. The Penny Group is the largest appointed representative in the Openwork Partnership and will see its total client assets reach £1.5bn.

- Partners Wealth Management announced it had acquired Surrey-based advice firm Navigate Capital Management. The merged firm will manage over £6.2bn in assets for c. 5,700 clients.

- Integrity365 announced the acquisition of Essex-based advice firm Peter Murray Financial Management. The acquisition will enable Integrity365 to strengthen its position in the South East.

- Wagestream announced the acquisition of Zippen, a workplace savings platform. The deal enhances Wagestream’s financial wellbeing offering by integrating Zippen’s salary-linked savings technology, supporting its mission to improve financial resilience for employees.

- Westerby Group announced it had acquired Cabot Trustees, a Bristol-based professional trustee and pension administration firm. The acquisition expands Westerby’s SIPP and SSAS administration capabilities and adds further technical expertise to its pension services division.