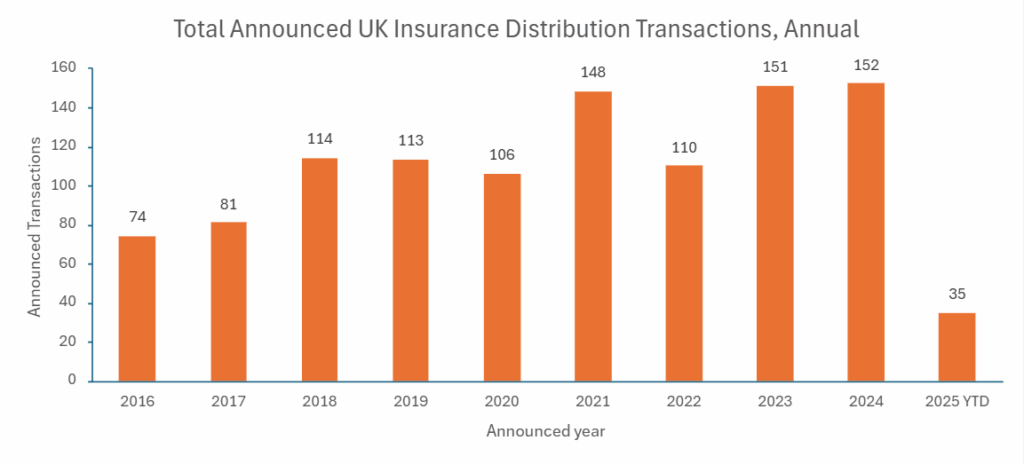

After a very quiet first quarter, April saw the beginning of a new tax year and 16 new transactions involving a UK insurance distribution target, making it by far the busiest month of the year so far for mergers and acquisitions (M&A), and well above the long-term monthly average of 9.7 transactions. However, 2025 is still shaping up to be a quieter year for deal volumes than 2023 or 2024. Furthermore, the data from the first four months of the year suggests an acceleration of a trend MarshBerry has been commenting on for some time now: the average deal size in the UK is getting smaller, with many of the most active buyers increasingly willing (and indeed compelled) to spend time doing small transactions.

M&A Market Update

After an unusually sluggish start to 2025, April has seen a flurry of new deal announcements. Buyers included both a number of the ‘usual suspects’ but also some privately owned firms and, interestingly, two insurers. There were 16 new transactions to report on, taking the year-to-date (YTD) total to 35, which is significantly down (-26%) compared to the 47 announced deals at the same point last year.

April of course saw the beginning of the new tax year and a change in the rate of Business Asset Disposal Relief (which increased from 10% to 14%) affecting private sellers. However, on the basis that the relief is only available on up to £1 million of gains (i.e. the change from 6 April 2025 added a maximum of £40,000 of additional tax to any individual vendor) it was probably not enough to have precipitated a great rush to transact before the deadline, particularly when doing so would bring the date the tax is payable forward by 12 months. That is to say the tax payment on a deal done before 5 April 2025 will be due by 31 January 2026, instead of 31 January 2027 for a deal struck in the new tax year. But it is possible that some sellers were driven to get a deal done before the last tax year ended.

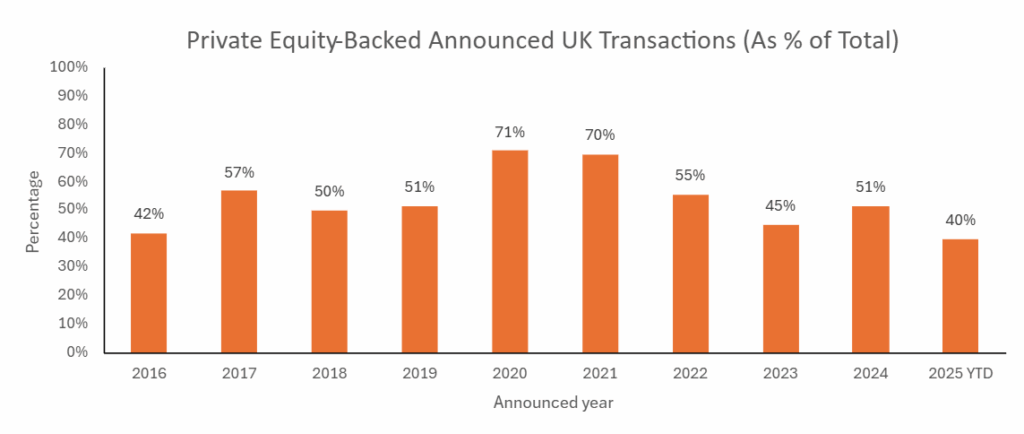

The market has got used to private equity (PE) – both directly and indirectly – driving the majority of transaction volume in the sector. This is a trend that is expected to run and run. And so while it is early in the year to draws too many conclusions, April’s transactions and the YTD statistics provide some interesting talking points. PE and PE-backed transactions have accounted for only 40% of deals in 2025 so far, a lower proportion than in any full year since before 2016.

With increased economic uncertainty and more difficult market conditions, including softening rates, it is becoming tougher to deliver the high levels of return that PE investors demand. But PE has never had a monopoly on insurance distribution M&A. April’s deals included two transactions involving carriers (Markel and Zurich, in MGA deals for MECO and Icen Risk, respectively) in what may become a more common sight in a softer market, as well as a rare return of the lesser-spotted MBO, with commercial broker Yutree Insurance choosing to maintain its independence with a change of ownership that demonstrates that business succession does not always involve a sale to a consolidator.

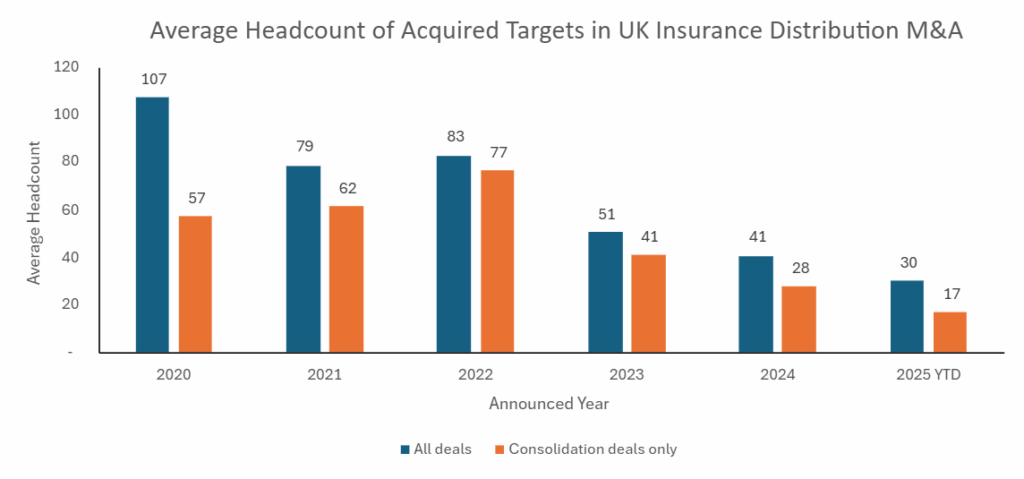

April’s uptick in deal volumes does not necessarily predict that 2025 marks a return to business as usual for insurance distribution M&A. Many purchasers are becoming more cautious and, as MarshBerry has remarked before, there is an acute lack of supply of mid-sized acquisition targets left to go for in the UK. Average deal sizes have again decreased in 2025, continuing a trend visible through 2023 and 2024. Of the 35 deals announced in 2025, 24 (or 69%) involved a target valued at below £5 million (vs. 59% of all deals since 2016, a period where inflation and higher valuations have increased deal sizes generally). Only two deals in 2025 have involved a target employing more than 100 staff, but both of those were minority transactions involving PE investors (i.e., not real industry consolidation).

The average headcount of all targets acquired in 2025 YTD is 30. In 2024 it was 41 and in 2023 it was 51. But adjust these figures to remove refinancing transactions and the 2025 YTD average falls to just 17. In a market where organic growth is becoming more and more difficult to achieve (and lets park for the moment the question of whether rate-driven increases in commission income is really organic growth at all) M&A-driven growth will be increasingly critical to many firms. But if the only targets available are very small ones, at some point the domestically focused consolidators – and particularly those with PE backing – may have to reevaluate their ability to sustain the levels of growth they have achieved in recent years.

Notable transactions (April 2025):

- The MECO Group (previously The Michael Else Company), the global marine insurance company that specialises in P&I Insurance, concluded its long-running sale process with a sale to Markel International, in what is a relatively rare (at least in recent years) deal involving an MGA of scale selling to a major carrier.

- Yutree Insurance, a chartered commercial broker and Lloyd’s coverholder based in Newmarket, announced that it had completed an MBO. Such deals used to be very common, but sector consolidation (and Yutree would not have been short of suitors) and high valuations have made it increasingly difficult for the ‘next generation’ to acquire businesses this way.

- Specialty MGA Nirvana, best known as a media and tech insurer in the London market, announced that it has joined forces with Pulse Insurance, which specialises in non-standard A&H and life coverages, in a merger deal between their UK underwriting businesses.

Other transactions (April 2025):

- Ardonagh Advisory announced its second UK deal in two months with the acquisition of ALP Holdings and its subsidiary Letton Percival, a long-established commercial broker based in Liverpool.

- Arthur J. Gallagher announced its first UK broking deal of 2025 with the acquisition of Bircroft Insurance Services, a London-based broker specialising in commercial property. MarshBerry advised Bircroft on the transaction.

- Brown & Brown (Europe) announced two new broking deals, for Sunderland-based BCM Acquisitions, a fleet specialist which trades as 1st UK Broking, and Irvine Commercial Insurance Brokers, based in Kenilworth.

- Partners& maintained its recent high rate of acquisitions with two deals, adding the Blackford Group in Scotland and Directors & Professionals, a commercial broker in Tunbridge Wells.

- JMG Group announced two broking acquisitions, adding (via its GS Group subsidiary) W K Insurance in Scotland and (via Greenwood Moreland) UKI Direct, a commercial broker based in York.

- Privately held Top 50 broker Alan Boswell Group further reinforced its dominant position in East Anglia with the acquisition of Andrew Thompson & Associates (AT&A) in East Suffolk.

- Clear Group, which was one of the top five most active UK acquirers in 2025, announced a deal for Moore Robinson, a commercial broker in London.

- The Broker Investment Group (TBIG) completed its second deal of 2025 by adding Andrew Powell in an asset deal that will see him and his £1m GWP book of business joining TBIG’s Needham Group subsidiary.

- Zurich Insurance announced that it had invested in a minority interest in Icen Risk, a £70m gross written premiums (GWP) business focused on M&A insurance risks, including W&I and tax liability.

- Brunel Insurance Brokers announced a renewal rights deal for John Walker Insurance (JWI), a community broker in North Devon.