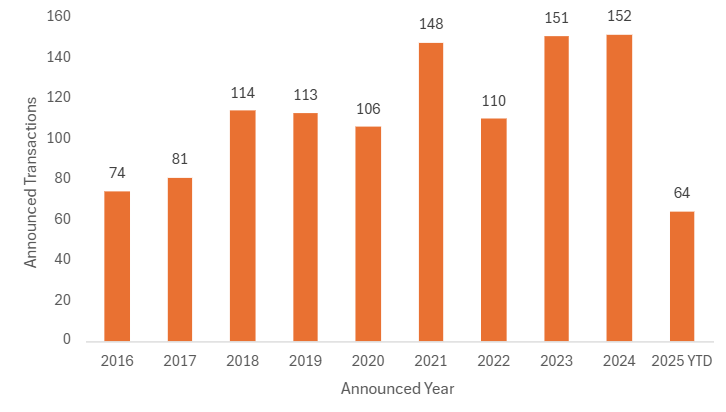

It may have been a warm August, but for buyers and sellers in UK insurance distribution mergers and acquisitions (M&A) it was an uncharacteristically cool month, with only five new sector deals to report on. It is now two thirds of the way through 2025 and there have only been 64 announced transactions during the year. To put that in context, by the end of August in both 2023 and 2024 there had been more than 100 deals announced. On a year-to-date (YTD) basis M&A volumes are down 38% on 2024 and at the current run rate, 2025 is shaping up to be the quietest year for deal activity since 2017. But deal statistics in isolation are pretty uninteresting – the important questions are really around why this has happened in 2025, and when, why and whether this trend might reverse.

M&A market update

With only five new deals during the month, it was the quietest August for UK insurance distribution M&A since 2016 and well below the long-term UK average of 9.6 deals a month. But the month did see one sizeable deal announced, with the news that Leeds-based MGA platform Bspoke Insurance has been acquired by NFP, itself now part of Aon. With Aon now clearly acquisitive in the UK again (they acquired Griffiths & Armour in 2024) after several years focused solely on organic growth here, there is some speculation that either Marsh or Willis may similarly begin to look more closely at UK acquisitions.

Total Volume of Announced UK Insurance Distribution M&A, Annual

Demand and supply

So what is behind the lull in deal activity in 2025? As always, there is no simple explanation and no single factor at play. MarshBerry UK has discussed at length that after years of consolidation there is a reduced supply of suitably attractive brokers available for acquisition by the consolidators, particularly at the medium-sized level (20+ staff) that can really move the needle. But this was equally true in 2024, when M&A volumes were running at record levels. So it is not just a supply issue. Does looking at the demand side yields more answers?

Rates have softened in 2025. This has put pressure on broker revenues and EBITDA (earnings before interest, taxes, depreciation, and amortization). No one can say with any real certainty when this situation will reverse. Interest rates (i.e., debt costs) remain above the longer-term average and wider macroeconomic uncertainty remains high. Inflation and higher staff costs are squeezing margins in many businesses.

These uncertainties have made capital providers – including (crucially) the private equity (PE) investors that have fuelled so much sector M&A – more skittish. Additionally, big sector deals and refinancings closing at lower-than-expected multiples have made them nervous about their own exit value assumptions, which in turn colours their views on the acquisitions their portfolio companies are making. Depressed M&A valuations for unintegrated groups have also undermined the idea that size alone should command a premium – coherence matters, which is increasing buyers’ selectivity and putting more emphasis on integration. The big deals, both the ones that happen and the ones that don’t, are also a major distraction for management, acting as a further brake on smaller ticket sector M&A.

A shifting backdrop for valuations

Against this backdrop, deal valuations have eased back from multi-year highs. This in itself can derail or prolong transactions. Vendors are (unsurprisingly) quick to adapt and adjust their expectations when prices are rising, but they are somewhat less biddable when the opposite occurs. It can be difficult to psychologically accept that your business, which might be trading very well and still growing, is worth less to a buyer than it was six months ago. A gap between the prevailing views of buyers and sellers on value has prolonged, postponed or indeed killed off several deals in 2025.

What next?

Will the situation reverse? And when? While no one can point to a single event or catalyst that will drive deal activity up again, insurance distribution’s robust fundamentals are unchanged, including: Products that will always be required, high levels of renewable income, cash generation, low capital requirements, opportunities to improve efficiency and grow margins through better use of technology, and a (still) high level of fragmentation, with many hundreds of privately owned UK firms in the hands of ageing individuals that will in most cases elect to sell to a larger firm. Sector consolidation will not stop and PE appetite for the segment will not disappear, while the drivers of both continued domestic consolidation and increasing cross-border M&A will remain in place.

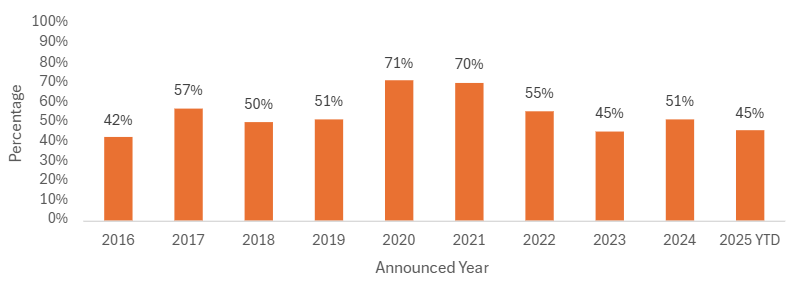

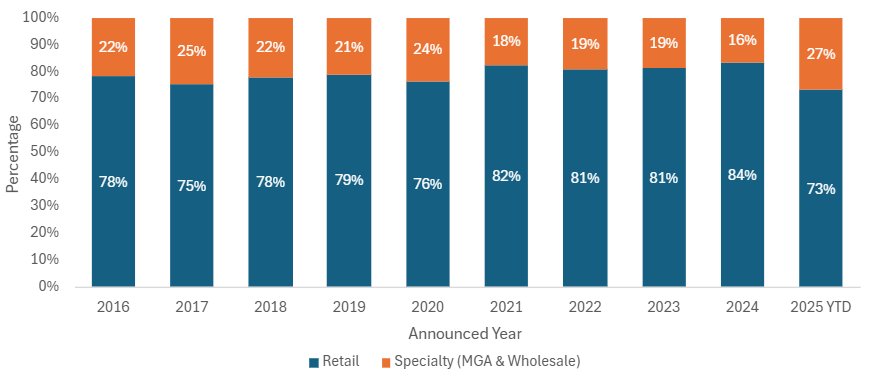

And as for those uninteresting deals statistics, see below. PE and PE-backed transactions have accounted for 45% of sector deals YTD and are running at the lowest level for several years. Specialty targets (being MGA and wholesale business, including Lloyd’s brokers) have accounted for more than a quarter of all deals in 2025 (and three of the five deals in August), above the longer-term average, and are seeing continued robust demand from both dedicated consolidators, groups seeking to widen their existing capability, and overseas buyers.

Private Equity-Backed Transactions as % of Total, Announced UK Transactions

Source: MarshBerry Proprietary Database and Companies House. Data as of 8/31/2025.

Targets in UK M&A: Retail vs. Specialty Distributors, % of Announced UK Transactions

Notable transactions (August 2025):

- The biggest transaction of the month saw MGA platform Bspoke Insurance being acquired by NFP, which is now part of Aon. Bspoke had been backed by PE (RCapital) and so the transaction is another example of PE capital flowing out of the sector and a further concentration of sector ownership in the hands of the large U.S.-listed multinationals.

- Specialist Risk Group continued its strong run of deals in 2025, during which it has acquired both in the UK and overseas, with the acquisition of City Quarter Brokers, a London-based wholesale broker with a global footprint and focused on the construction, engineering and infrastructure sectors. MarshBerry advised City Quarter Brokers on the transaction.

- Liberty Blume, the business solutions arm of multinational Liberty Global and whose activities also include providing working capital solutions for corporate clients, announced the acquisition of PHL Insurance Brokers, a small Lloyd’s broker. The deal is something of a collector’s item for sector M&A watchers, being a rare example of a strategic buyer from outside the industry getting into broking through the acquisition of a regulated business and again demonstrating that the right buyer of a business can sometimes come from leftfield.

Other transactions (August 2025*):

- It was reported during the month that David Roberts & Partners, itself part of BMS, acquired London-based Umbrella Insurance Services.

- In its fifth announced acquisition of 2025, Peter Cullum’s The Broker Investment Group announced the acquisition of KSL Thomas Insurance, a £2m GWP commercial broker in Essex.

* Eagle-eyed readers may be wondering why JMG Group’s acquisition of PI MGA XS Assure is not included here, having hit the headlines during August. The deal was actually completed in July and identified and included in MarshBerry’s July Viewpoint figures, albeit without MarshBerry actually naming XS Assure.