The bond market turmoil in the UK that accompanied the short-lived premiership of Liz Truss during 2022 made it more difficult and costly to raise debt finance, but was not enough to put a meaningful dent in UK M&A transaction volume in financial services. Deals typically take 6 to 12 months from start to finish and so weathered the short-term market panic.

Fear that the government was planning to increase UK capital gains tax in its March 2021 budget drove a spectacular jump in the number of privately owned insurance brokers rushing for the exit. In the end the rumoured increase never happened and CGT rates remain the same today as they were then.

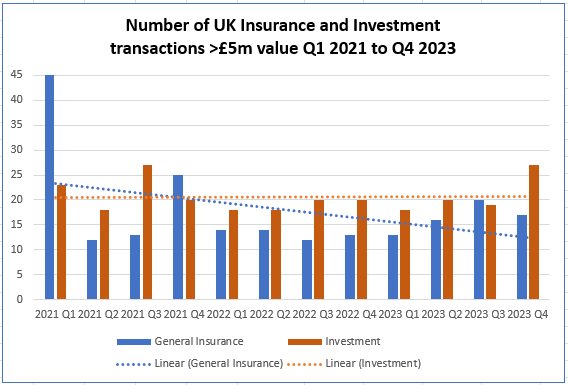

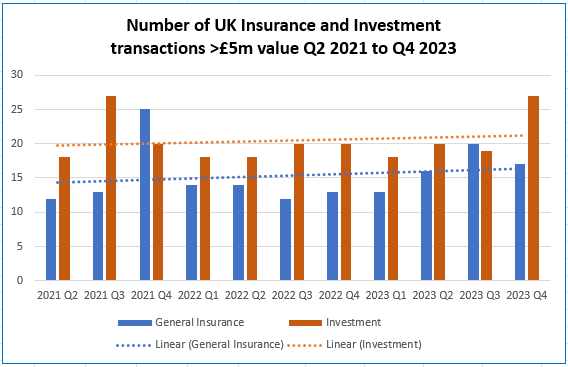

M&A activity over the last three years

Ignoring the anomalous Q1 2021 deal activity both the UK insurance and investment sectors have actually seen M&A volumes marginally increasing over the past two years.

This is not all good news for buyers with strong appetites. In insurance, we have seen a significant increase in prices being paid since the March 2021 budget (no doubt the increased supply depressed pricing in Q1 2021). Our cut-off point for the data shown here is deal values of £5m or more. Therefore there will be some businesses that in early 2021 would not have achieved a valuation above our of £5m threshold, but will be doing so in 2023.

It is also worth remembering that a £1 in April 2021 has, in real terms, lost over 15% of its value. So a business selling for £4.5m in April 2022, and excluded from data would today have made the £5m cut-off point.

But for sellers the above is good news, as it points to a reduction in supply. This is particularly marked in insurance being less than half the size of the investment industry. The replenishment rate (i.e. how quickly new businesses are being established and grown) is well below the exit rate and we see this as an important driver in the price increases we refer to above.

The internationalisation of the UK financial services sector is also driving value. Now as part of MarshBerry, we have unparalleled reach.

We will be publishing our annual M&A reviews (insurance and investment) which take a deep dive into the data. If you wish to receive a copy, please send us your email address to info@imas.uk.com and we will send you the reviews once published.

Insurance

The final month of 2023 proved to be a busy one for insurance M&A, with 13 new UK deals to report on, including four in the £100m+ bracket, to round off a year that has actually bucked some wider trends to see near-record levels of sector M&A in terms of volume, but a reduced level of overall M&A by value, with an increased number of very small deals being announced. We will be publishing detailed analysis of these trends in our annual review in a few weeks’ time.

Insurance broking M&A

The biggest UK deal of the month came with the news that Miller Insurance’s PE backer Cinven had agreed a deal to divest its interest in the business to GIC, the Singapore Sovereign Wealth Fund with which they had coinvested in the business as part of its buyout from Willis in a deal announced in 2020.

Other sizeable broking transactions included the announcement by Specialist Risk Group that it had agreed its sixth deal of 2023 and largest to date, acquiring B.P. Marsh-backed broker CBC Partnerships in a deal that SRG has said will add c.£10m of EBITDA to the group, AssuredPartners adding CIA Insurance Services in Rugby, and Jensten Group making another acquisition with a deal for Scrutton Bland in East Anglia.

Smaller broking deals in the month included Adler Fairways acquisition of Intelligent Real Estate Due Diligence (IREDD), Gomm Insurance Brokers in the West Midlands combining with Daulby Read Insurance in Chester, Hallsdale Insurance Brokers acquiring Allbright Bishop Rowley (ABR Insurance) in Leicester, Brown & Brown (Europe) making another acquisition in Wales with a deal for R McGee Insurance Brokers in Glamorgan, Ardonagh announcing the acquisition of Westfield Insurance in West Sussex, and Clear Group concluding its tenth UK acquisition of 2023 with a deal for the general insurance book of PW White & Partners in Buckinghamshire.

Other notable sector transactions

Away from broking, there were notable deals in the MGA segment (where 2023 was a record year for M&A in terms of deal volumes), in insurance services, and between insurers.

- In a major MGA deal that had previously been speculated on in the press, US-listed group Ryan Specialty announced that it would acquire Castel Underwriting Agencies, a London-based MGU platform, from Arch.

- Among risk carriers, it was announced that Admiral will acquire the UK direct personal lines business of Intact Financial subsidiary RSA Insurance, in a deal reportedly worth £115m.

- Ardonagh announced a deal to acquire RiskSTOP Group, a provider of insurance technology and risk management services that employs more than 200 staff.

Relevant overseas M&A

The biggest announced deal in the month was actually a US deal, but involving parties that both have sizeable UK operations so it worth a mention here. Aon announced that it will acquire NFP in a $13.4bn deal, the largest sector transaction of the year globally. NFP has a relatively low profile in the UK but has made a number of acquisitions here in the past few years, across both employee benefits and broking.

Unannounced transactions

Our annual roundup of sector M&A activity will include more detailed analysis (including headcount) of all of the deals included in these newsletters over the past twelve months, but also picks up deals that have not been publicly announced or reported on by the trade press, that we uncover through our research. A couple of recent examples to mention here include Stubben Edge Group becoming the controlling shareholder of Lloyd’s broker Blackmore Borley (notified in September), and Adler Fairways taking over the book of business of Bryan James & Co., a broker best known for its expertise in musical instruments cover.

Investment

M&A activity remained high amongst wealth managers until the very last few days before Christmas, maintaining the momentum in the sector that has been so strong throughout 2023. Notably, 7IM acquired London-based Amicus Wealth adding £1bn of client assets, while Liberate Wealth acquired Somerset-based Stafford House Investments, adding £275m of client assets and establishing a presence in the South West. Skerritts announced the acquisition of Chester-based Chadwick McLean adding £230m of client assets and Close Brothers acquired Dorset-based Bottriell Adams adding £220m in client assets. MKC Wealth aggregated an additional £90m of client assets with the purchases of Buxton-based Crescent Independent, and the clients of IFA Christine Brearley. Perspective announced it had acquired the client banks of Simon McGechie and Paul Adams, adding a total of £55m in client assets, as well as Colchester-based Park Lane Independent Financial Advisers, adding £135m in client assets. Similarly, Atomos also announced two transactions during the month, acquiring Plymouth-based Shore Financial Planning and Reigate-based Define Wealth. HFMC Wealth announced the acquisition of Edgware-based Harford Financial, taking its total AUA to £2bn, while Benchmark Capital acquired West Sussex-based Champain Financial Services adding £111m in client assets. Team Asset Management announced it had bought Jersey-based Homebuyer Financial Services adding £135m in AUA, while Soderberg & Partners announced the investment in a minority stake in London-based Generation Financial Services, and Finura announced the acquisition of Tenacity Wealth Management in Haslemere, adding £90m of client assets.

Finally, Fairstone ended the year by announcing a hattrick of acquisitions, including Kent-based advice firm Goodman Chartered Financial Planners, increasing its client assets by £160m, as well as two mortgage firms, Perthshire-based Next Home and Kent-based Bellegrove Mortgage Services, bolstering its mortgage lending arm.

There was also activity elsewhere in the sector, with Fintel agreeing to acquire Synaptic Software, a provider of adviser planning tools, for £3.5m plus a commitment of £0.5m for development, and Evelyn Partners acquiring Beaconsfield-based accountancy firm Harwood Hutton, further strengthening its professional services offering.

In the asset management space, US-based private equity firm Lincoln Peak Capital acquired a substantial minority stake in Troy Asset Management while US-based investment manager Polen Capital announced it was to take on the funds of Somerset Capital.

*IMAS Corporate Finance LLP has been acquired by MarshBerry.