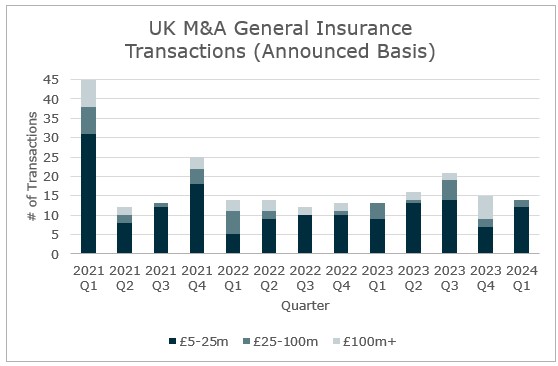

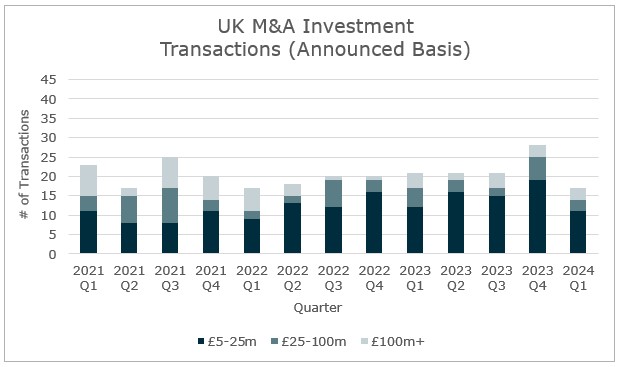

Q1 2024 saw a slight dip in mergers and acquisitions (M&A) activity in the UK General Insurance and Investment sectors, but this is likely normal variability that is typical of M&A activity. More telling possibly is that in Q1 2024 the UK insurance sector saw no new deals with values in excess of £100m. Looking back at Q1 2021, the notable burst of activity in the insurance sector was driven by a fear of an imminent rise in capital gains tax. Unsurprisingly insurance deal volumes then dipped the subsequent quarter as those fears became unfounded.

For the last five quarters, insurance averaged 16 deals per quarter, while investment averaged 22. While this suggests that investment is consolidating at a faster pace, it should be noted that the investment sector has approximately three times the number of groups (with an estimated value in excess of £5m), according to MarshBerry’s data. ;

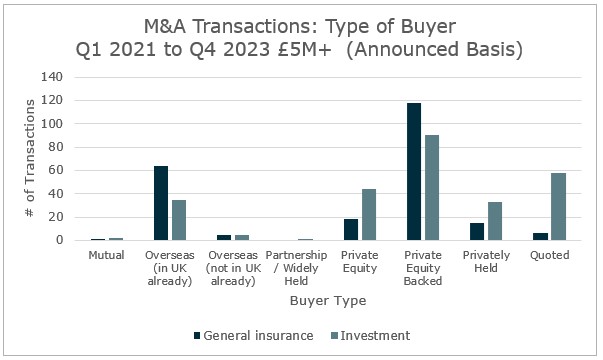

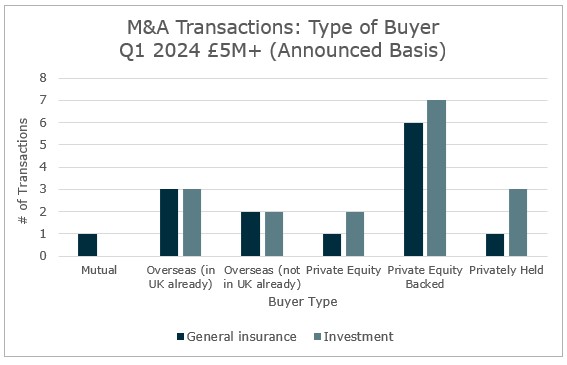

Based on an analysis of the buyer types across these deals, two compelling facts stand out. First, private equity is now playing a far more active role in the investment sector and catching up on the insurance sector. Secondly, in the three years from 2021 to 2023 there were a total of only six buyers coming into the UK and undertaking M&A for the first time (many “new entrants” are in fact existing small UK operations of overseas groups) while in Q1 2024 alone this number was four.

While this is a significant development, the sale of IMAS Corporate Finance LLP (IMAS) to MarshBerry last year reflected this information. As part of MarshBerry, IMAS has unmatched access to U.S. and continental financial services businesses.

Insurance M&A market update

March was another active month for UK insurance M&A, with 14 new announced insurance distribution transactions. This compares with a longer-term average of 9.2 per month (since 2016), or 10.8 per month over the past three years. But, in common with recent trends (see also our recent 2023 Insurance Distribution Market Report — UK), the majority of these deals were very small. In fact, five were book purchases, and only one involved a target with more than 50 employees. The average size of UK deals, measured by target headcount, fell sharply in 2023 and this trend continues into 2024, with an average headcount of only 23 across the 36 deals announced in the quarter.

Notably, March saw two overseas buyers that are new to the UK making acquisitions, more than in the whole of 2023 and reinforcing the fact that the UK remains a popular destination for overseas buyers. While most (92%) UK deals involving an overseas buyer are done by groups that are already present here, there are still new buyers seeking to enter the UK for the first time.

New entrants:

- U.S.-based wholesaler Novatae Risk Group announced it had reached a deal to acquire Lloyd’s broker Bretton Woods International (BWI).

- Australian insurtech Open, the embedded insurance business that came to prominence last year as a possible suitor for Acromas, announced a deal for So Sure, an MGA specializing in gadget business.

Other transactions:

- The Broker Investment Group continued its strong run of recent deals with two new announcements – increasing its investments in Callaway & Sons Insurance Consultants in Essex, and PHP Insurance in Macclesfield.

- Private equity-backed Academy Insurance made its largest acquisition to date in a carve out deal for Allianz Business Services, trading as Premierline, in a deal that will add 90 staff and approximately 17,000 new clients.

- Howden added Hencilla Canworth, a specialist in coverage for the performing arts sector, which will become part of Howden’s Sports & Entertainment division.

- Acrisure-owned Russell Scanlan in Nottingham acquired Building & Land Guarantees in Leicester.

- Seventeen Group acquired Keith Miller Insurance Services in Somerset.

- J.M. Glendinning added Madoc & Rhodes, a personal lines broker, in Birmingham.

Book deals:

- Kingfisher divested its travel bonding business Cork Bays & Fisher to Advantage Financial.

- Lonmar acquired a bloodstock portfolio from St Benedicts.

- German insurtech Getsafe divesting its UK business to Urban Jungle Insurance.

- Seventeen Group acquiring a book of business from Hendricks Insurance in Scotland.

- Brunel Insurance Brokers acquiring the renewal rights to Liability & General Insurance Brokers in East Anglia.

(Note that the above commentary covers all announced UK insurance distribution deals in March, whereas the charts included in this blog consider only deals with a value above £5m).

Investment M&A market update

M&A activity in the investment sector saw yet another public company being subject to a takeover offer this month. Mattioli Woods, the integrated wealth management group, was at the receiving end of a £432m offer from private equity firm Pollen Street Capital. Mattioli Woods, which is listed on AIM, has over £15bn in AUM and recorded £111m and £33m in revenue and adjusted EBITDA, respectively, in its last financial year.

Wealth management transactions:

- 7IM announced the acquisition of Birmingham-based Eastcote Wealth Management, adding £430m in client assets.

- Wren Sterling announced the acquisition of Newcastle-under-Lyme-based TW Financial planning, bringing £265m in client assets.

- Fairstone announced the acquisition of Nottingham-based James Ryan Thornhill, with £110m in client assets.

- Birmingham-based Elevation Wealth Management announced it had acquired Wolverhampton-based IFA Thornton Claverley, adding £68m in client assets.

- The Penny Group announced it had bought Midlands-based Roberts Financial Consultancy, setting the firm on track to exceed £1bn in client assets during 2024.

- Titan Wealth completed the acquisition of Gateshead-based Prism Financial Advice, adding £630m of client assets to the group.

Other transactions:

- Nationwide announced the acquisition of Virgin Money for £2.9bn.

- Fintel announced it had invested in mortgage technology firm Mortgage Brain and fintech provider ifaDash

- The advice network In Partnership announced it had bought paraplanning and administration support providers The Adviser Support Hub and The Admin Pod.

MarshBerry remains resolutely focused on providing our clients with access to the fullest range of options, ensuring the best fit – and typically the best price – if and when they come to sell. Talking about these issues is always valuable, whether you plan to sell now, or in the years to come.

Charts Source: MarshBerry Proprietary Database and Companies House. As of 3/31/24.

*IMAS Corporate Finance LLP has been acquired by MarshBerry.