Investment sector M&A market update

The volume of investment sector merger and acquisition (M&A) transactions above £5m of value increased in March to six, twice as many as in February, and higher than in January. March included another deal in actuarial and employee benefits consultancy, highlighting strong demand for the business model, as well as several deals involving wealth managers helped by the backing of private equity (PE) capital. But, perhaps most noteworthy was the PE-backed platform Wealthtime buying a sizeable financial planning group to add a new proposition to their organisation. There was also activity in the pensions administration space where FTSE 250-listed AJ Bell announced it had sold its non-platform SIPP and SSAS business to InvestAcc and Kingswood. Listed entity Kingswood was subject to an offer from HSQ seeking to acquire the remaining 10% of the group, another example of the shift from public to private ownership of companies in the investment sector, a trend which has been developing over the last few years.

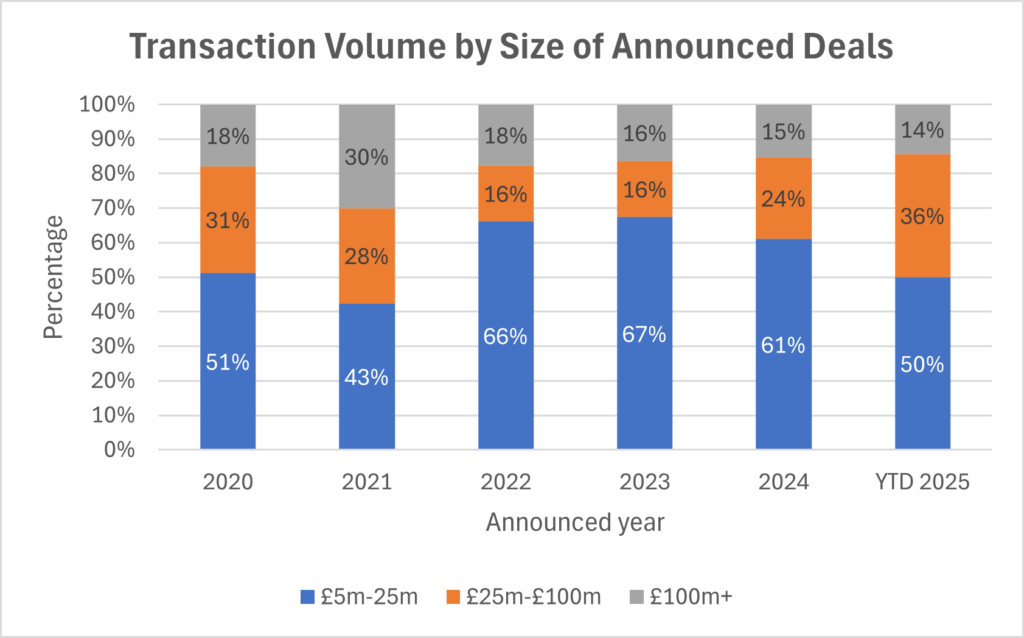

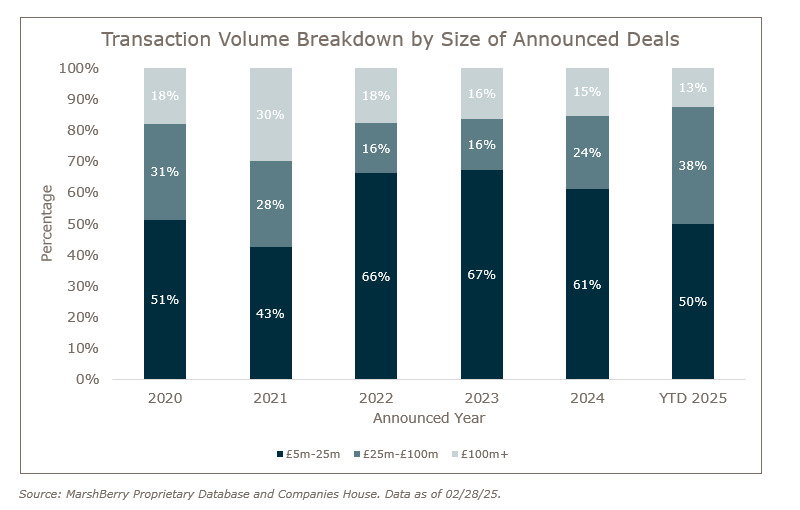

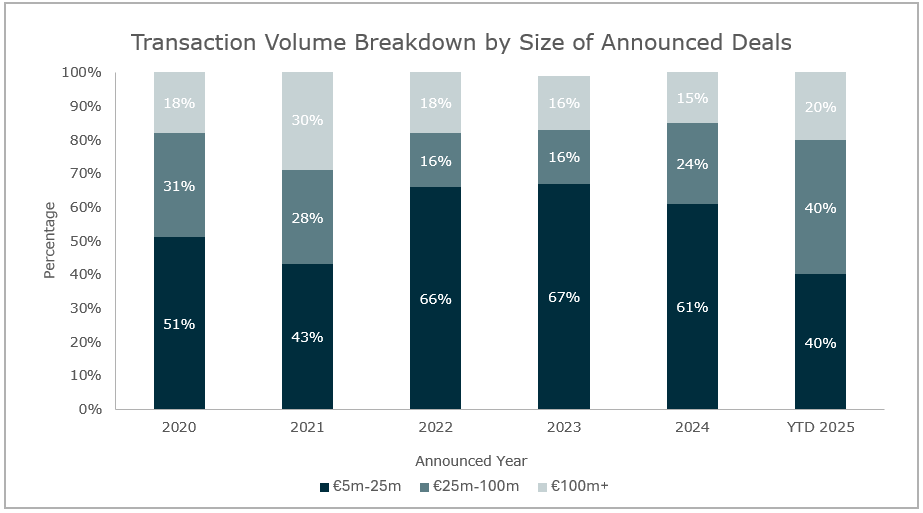

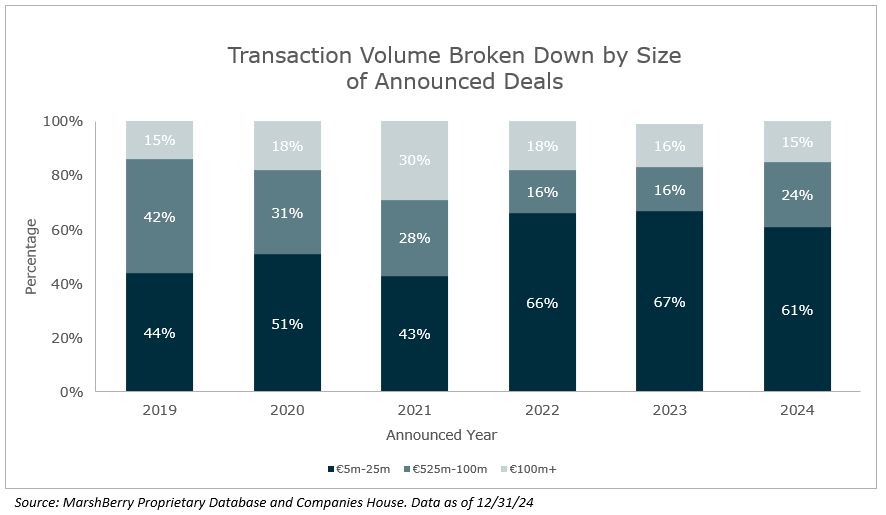

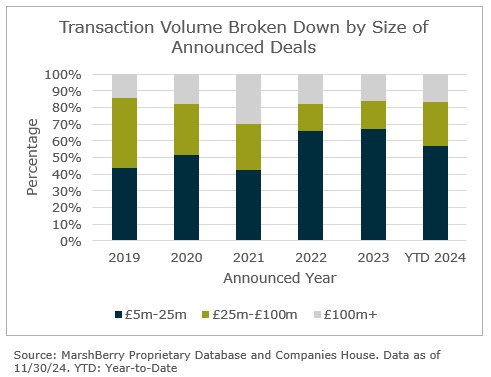

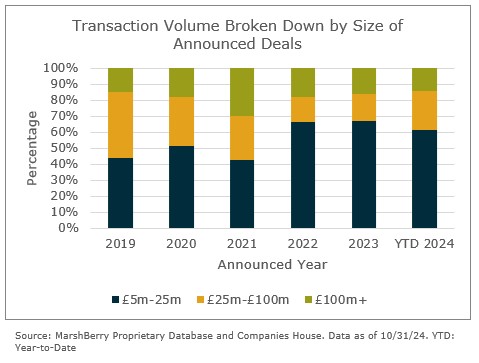

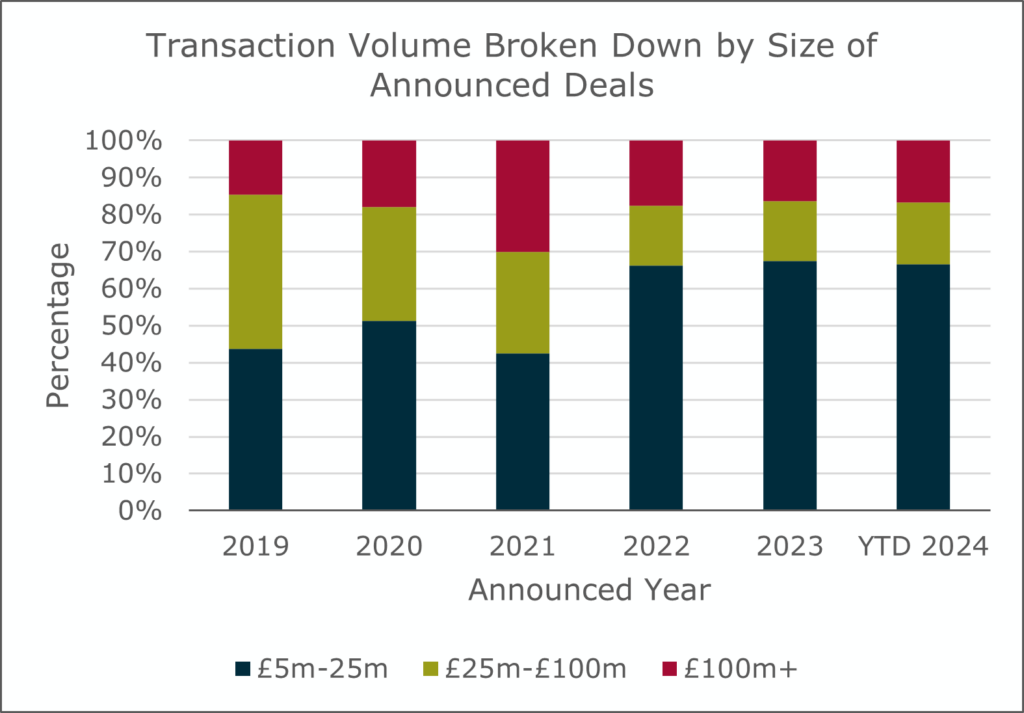

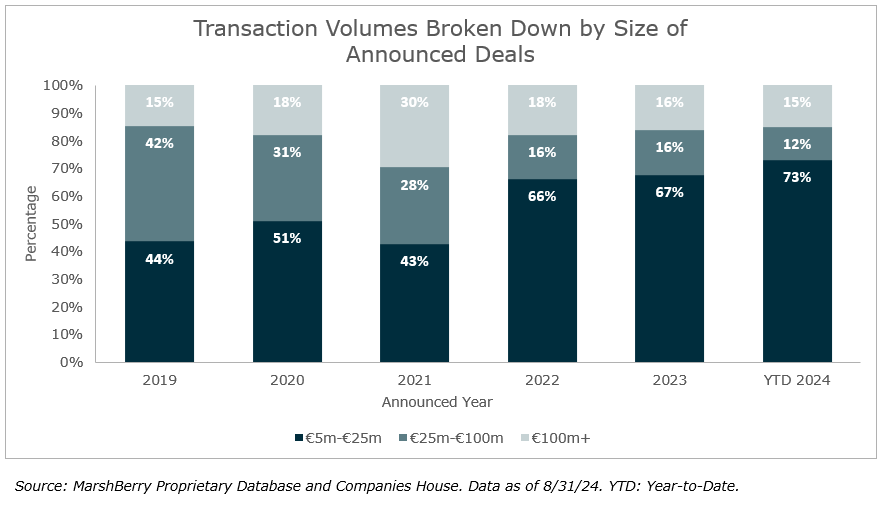

Most of the transactions in the first quarter were small, ranging from £5m to £25m in value, with only three deals larger than £25m of value. The largest deal was Howden’s acquisition of Barnett Waddingham, a provider of pensions, employee benefits and associated investment consultancy and risk services.

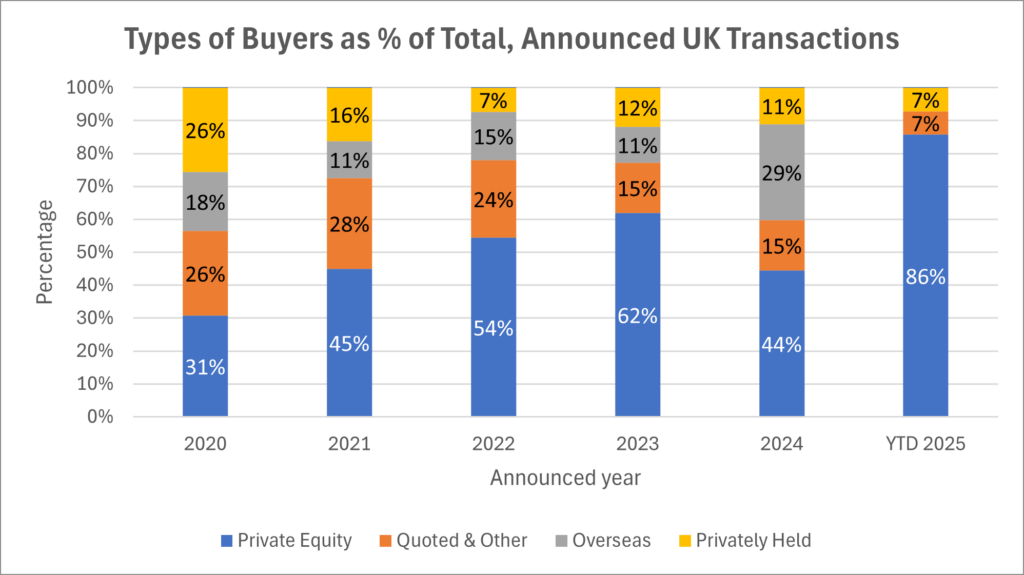

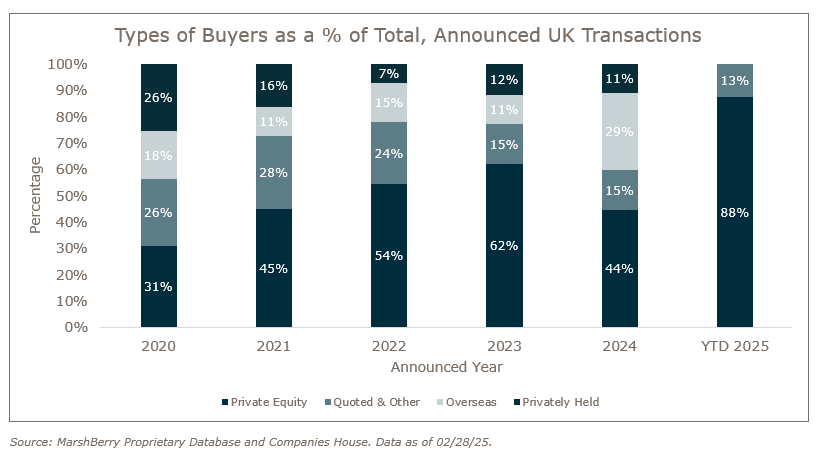

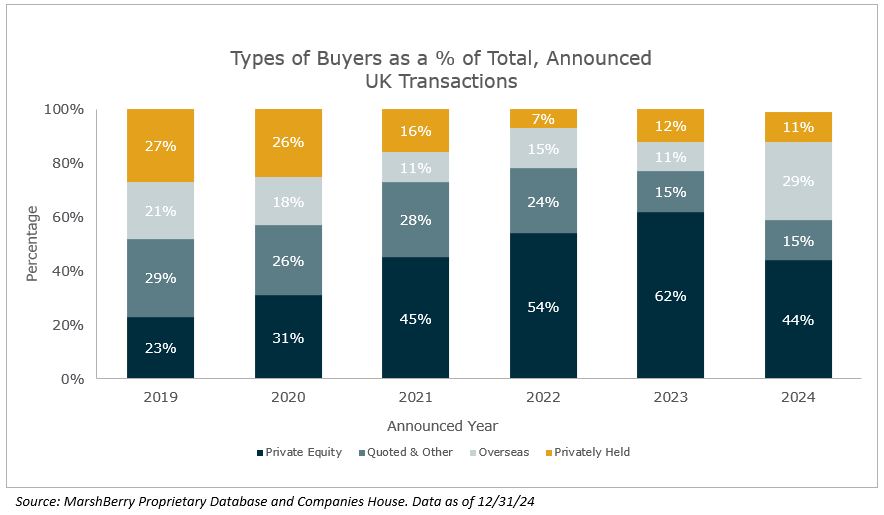

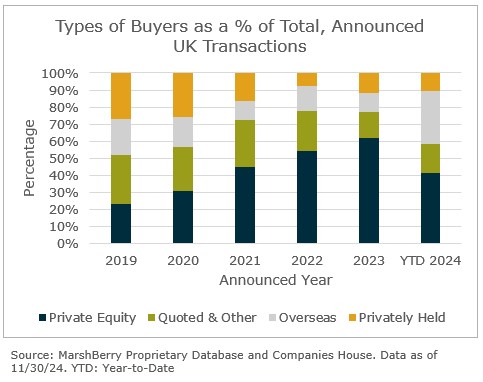

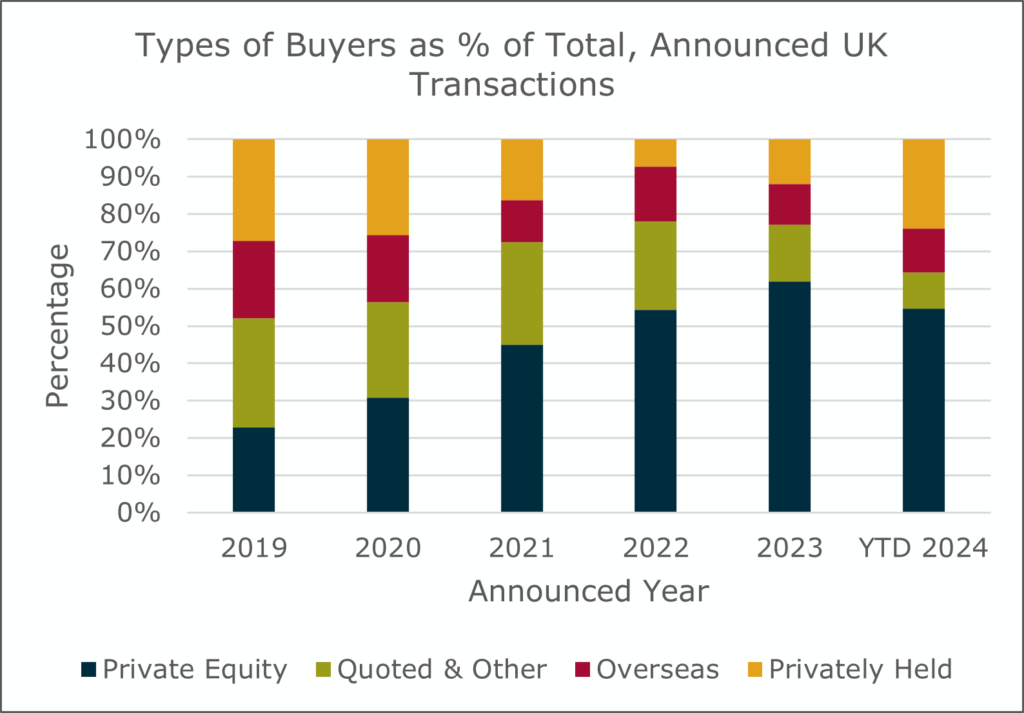

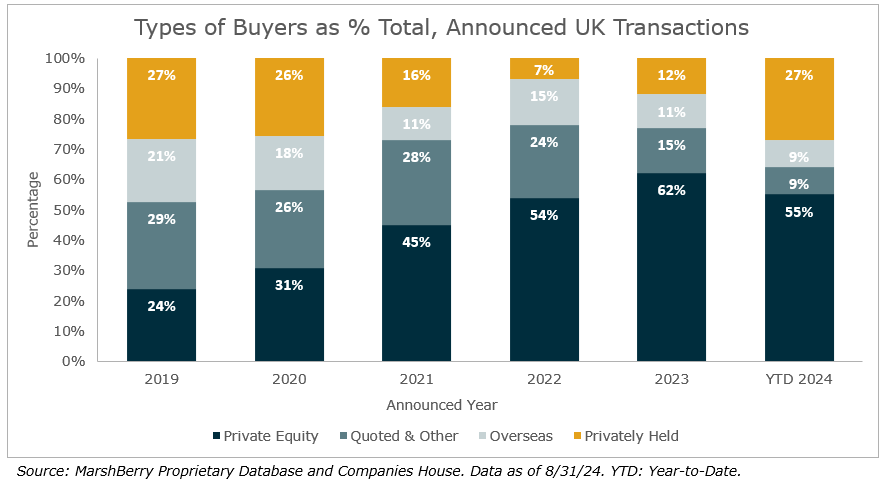

Among the buyers, PE was the most prolific acquirer group during Q1. 86% of the acquirers were linked to PE, either as direct investors or via their portfolio companies. The PE-backed consolidators accounted for a lot, and they continue to be very dominant in driving the shape of the industry. Their PE backers have gradually shifted from UK-based funds to more international, typically U.S.-based funds, albeit refinancings of consolidators have been less evident in 2025, with only one out of the four direct PE investments originating from a North American firm.

Notable transactions (March 2025):

- Barnett Waddingham, one of the UK’s leading independent pensions and employee benefits consultancies, was acquired by Howden, the global insurance and employee benefits group. The acquisition will create one of the largest pensions and employee benefits consultancies in the UK and will act as a platform for Howden to expand its provision of pensions and related investment and risk services. The transaction will result in Howden doubling its global employee benefits business in terms of employees, with c.4,000 professionals delivering combined revenue approaching £500m globally.

- Craven Street Wealth, the London-based financial planning business with £2bn of client assets and 90 staff (of which 30 are financial planners), was acquired by The Quanta Group, the recently rebranded parent company of PE-backed platform, Wealthtime. The acquisition will enable Wealthtime to offer clients the full spectrum of wealth management services, developing on its existing platform and discretionary fund management to now also include financial planning and advice. The transaction takes The Quanta Group’s total assets under advice to £16bn.

- AJ Bell Platinum, the SIPP and SSAS business of the FTSE 250 constituent AJ Bell, was sold to InvestAcc Group, a specialist pension administrator, in a deal worth up to £25m. The entity sold is part of AJ Bell’s non-platform business and has c.3,600 customers with £3.2bn of assets under administration. The transaction is expected to complete in the second half of 2025.

Other UK transactions (March 2025):

- Partners Wealth Management, part of 7IM, announced the acquisition of Aberdeen-based Johnston Carmichael Wealth, the wealth management arm of Scotland’s largest independent accountancy and advisory firm which has £855m in client assets.

- Private equity firm HSQ, a subsidiary of Pollen Street Capital, confirmed its unconditional offer to increase its investment in Kingswood and buy the remaining 10% of shares, with a view to de-list and merge the company with another wealth manager.

- Marlborough Fund Managers took a minority stake in London-based financial planning firm First Wealth, which has £480m in client assets.

- Shackleton Group, formerly Skerritts, announced the acquisition of Richmond-based PK Financial Planning, adding £200m of assets under management (AUM) and expanding its operations into the South East.

- Clifton Wealth Partnership announced the acquisition of seven advice businesses, collectively adding £500m of AUM. The deals were for Colchester-based Capel Court, Llanelli-based Financial Solutions Wales and Davies Craddock, Bristol-based Tailormade Financial Services, Nottingham-based Absolute Financial Services, London Private Wealth, and of its AR firms Clifton Wealth Partnership Portishead (previously named Pure Advanced Financial Planning).

- Wren Sterling announced the acquisitions of three advisory firms collectively adding a total of £300m of AUM. The deals were for Kent-based Investment Choices, Cotswolds-based Broadway Financial Planning, and Perth-based JLS Associates.

- Finli Group announced the acquisition of Somerset-based Schaefer Financial Management and Birmingham-based MMR Financial Planning.

- Radiant Financial Group announced the acquisition of Newcastle-based independent financial adviser Seven Bridges.

- Amber River announced the acquisition of Belfast-based Finance Matters through its Northern Irish business Johnston Campbell.

- Lumin Wealth announced the acquisition of the mortgage arm of RBS Associates.

If you have questions about Today’s ViewPoint, or would like to learn more about how MarshBerry can help your firm determine its path forward, please email or call Fred Hansson, Managing Director, at +44 (0)20 7444 4393.

February 2025 UK Investment Sector M&A Market Update:

The volume of investment sector merger and acquisition (M&A) transactions was low in February with just three transactions over £5m, half of the average monthly deal volume in 2024. One took place in the actuarial and employee benefits consultancy area and two were consolidations in the wealth management space. The latter included Shackleton, formerly named Skerritts Consultants. It was featured more than once in the news during the month, after announcing the acquisition of an IFA in Norwich, as well as Shackleton’s private equity (PE) backer, Sovereign Capital’s planned exit.

So far this year, the majority of transactions have been small, ranging from £5m to £25m. Three of the deals have been between £25m and £100m, and one has surpassed £100m in value. The largest deal this month involved XPS Pensions Group, the FTSE 250-listed pensions consultancy and administration business, acquiring Polaris Actuaries and Consultants.

Among the buyers, PE has been a very dominant force. Nearly 90% of the acquirers this year are linked to PE, either as direct investors in firms or via their portfolio companies. Whilst the consolidation of the wealth management market has counted for a large proportion of the capital deployed, other sectors have also had their fair share of the flow to date, including in the pensions consultancy and administration market.

Notable transactions (February 2025):

- XPS Pensions Group agreed to acquire Polaris Actuaries and Consultants for up to £58.4m, with an initial cash payment of £23.4m and a further contingent payment of up to £35m in three years subject to performance targets. The acquisition accelerates XPS’s expansion in the UK insurance consulting market, providing immediate access to key insurer relationships. Polaris will integrate into XPS’s insurance team, enhancing its service offering and growth potential.

- Saltus acquired Newcastle-based Lowes Financial Management, which advises on £1bn in client assets and employs 90 staff. This follows Saltus’s acquisition of Tavistock’s advice network in October and GM2 in 2023. Since 2022, when Preservation Capital Partners took a majority stake, Saltus has grown rapidly, managing £7.5bn in assets and employing over 300 people. The firm has also launched a partnership programme to support advice firms with scaling, compliance, and buyout capital.

- It was reported that Sovereign Capital is targeting a £600m valuation for Shackleton (formerly Skerritts), with around a dozen PE firms, including U.S.-based Stone Point Capital, expressing interest in acquiring the advice group. Investment bank Lazard is advising on the sale, which remains in the early stages. Since backing Shackleton in March 2021, Sovereign Capital has supported 16 acquisitions, including £1bn AUM Ellis Bates, Save & Invest, and this month, Norfolk-based Harrold Financial Planning, which added £300m in assets and expanded Shackleton’s presence into the East of England. Shackleton now manages £5.5bn in assets and employs 81 advisers across 17 UK locations as it continues its national growth strategy.

Other UK transactions (February 2025):

- Benchmark Capital, part of the Schroders Group, acquired Robertson Baxter, a four-adviser firm with £200m in client assets. The deal expands Benchmark’s adviser base with full integration expected over two years.

- Fairstone expanded its Scottish presence by acquiring a stake in Edinburgh-based 336 Financial Management through its Downstream Buy-out (DBO) scheme.

- Verso Group acquired WH Ireland’s Henley-on-Thames-based wealth team, who advise on £150m in assets, as part of its goal to reach £5bn in assets under management by 2027.

- Lumin Wealth acquired Berkshire-based Professional Financial Centre, adding over £50m in assets under management. This marks Lumin’s ninth acquisition since 2019, as it continues to expand with the backing of Switzerland’s VZ Group.

- WBR Group acquired Standard Life’s SSAS book, adding 270 schemes and £403m in assets, with clients continuing to be managed by the same team.

British groups were also busy abroad, including:

- IQ-EQ acquired Agama Group, expanding its regulatory compliance services in France and Luxembourg. The deal strengthens IQ-EQ’s presence in continental Europe, with Agama’s leadership team remaining in place.

- M&G acquired a 70% stake in Stockholm-based P Capital Partners, expanding its £73bn private markets business. The deal aligns with M&G’s strategy to grow in private markets and is expected to close in mid-2025.

Investment sector M&A market update

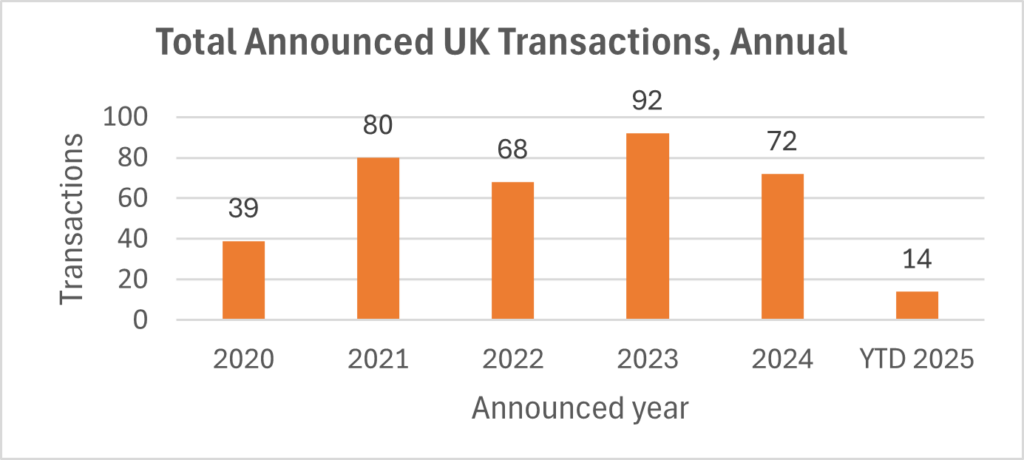

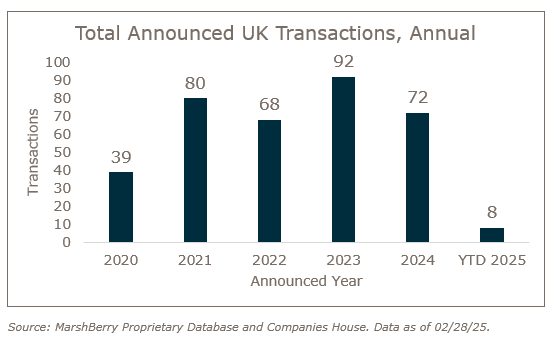

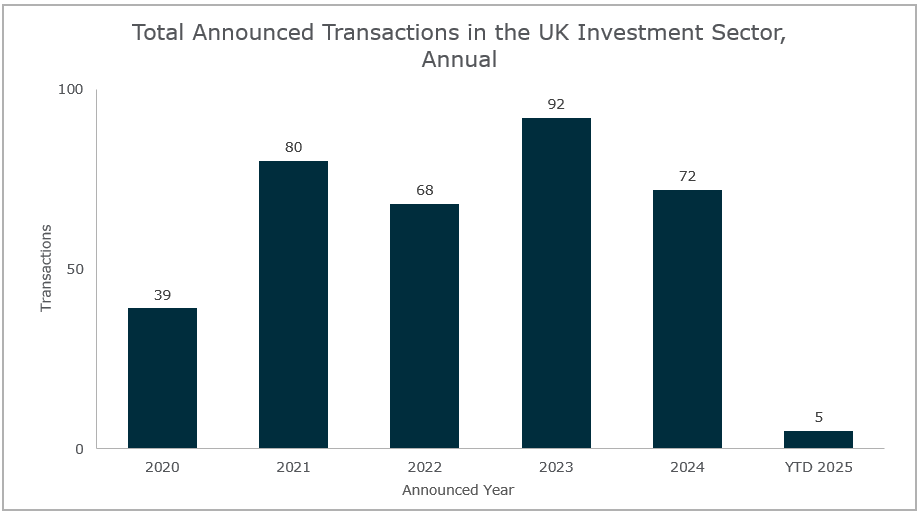

In 2024, the investment sector averaged six merger and acquisition (M&A) deals per month, with Q4 being particularly active. While January 2025 saw a slight dip, with five transactions over £5m, the month still brought plenty of action. Rather than the usual flow of consolidators snapping up financial planning and wealth management firms, this month saw Broadstone, the pension consultancy group, raising capital for growth from a U.S.-based international fund, and Fundment, a platform for the financial advice industry, securing £45m in venture capital investment, bringing fresh dynamics to the sector this month.

Source: MarshBerry Proprietary Database and Companies House. Data as of 1/31/25.

The investment sector saw two deals between £5m and £25m, two deals between £25m and £100m, and one deal exceeding £100m in January. These include the sale by Evelyn Partners of its Fund Solutions business to streamline its services with focus on its core wealth management service, after having also sold their professional services arm to Apax Partners late last year.

Source: MarshBerry Proprietary Database and Companies House. Data as of 1/31/25.

All deals over £5m this month involved private equity funds, either as a direct investor or via one of their portfolio companies. A similar trend was evident in transactions below £5m, with private equity-backed businesses that made acquisitions in December continuing their activity into January. Notably, Söderberg & Partners announced three more minority investments, Foster Denovo acquired another independent financial advice firm (IFA), and Titan Wealth purchased a Jersey-based IFA. Interestingly, there was only one acquisition by a quoted company this month, with Isle of Man-headquartered Manx Financial Group acquiring the Liverpool-based DFM CAM Wealth for £210k.

Source: MarshBerry Proprietary Database and Companies House. Data as of 1/31/25

Notable transactions (January 2025):

- Evelyn Partners agreed to sell its Fund Solutions business, Evelyn Partners Fund Solutions Limited (EPFL), to Thesis Holdings for an undisclosed sum. EPFL, a leading Independent Authorised Corporate Director (ACD) with £10.6bn in Assets under Governance, will transfer approximately 75 staff to Thesis upon completion expected before the end of the first half of 2025, subject to regulatory approvals. Thesis, which operates £40bn in assets, will add 161 funds across over 40 sponsors and investment managers to its book through the acquisition.

- Lovell Minnick Partners agreed to make a strategic growth investment in Broadstone, enabling the company to expand its client proposition. Broadstone’s management team will retain a significant stake and continue leading the business. The deal, which is expected to close in Q2 2025 subject to regulatory approvals, underscores Broadstone’s growth ambitions. Lovell Minnick Partners aims to support Broadstone’s expansion, particularly in its newly formed Insurance, Regulatory & Risk unit, leveraging its expertise in scaling professional services firms.

Other UK transactions (January 2025):

- WHEB Asset Management was acquired by Foresight Group Holdings, adding £800m in assets under management to Foresight’s Capital Management division.

- Azets Wealth Management acquired Newcastle-based Laurus Associates Limited, enhancing its financial planning capabilities.

- Foster Denovo acquired Verum Wealth, marking its seventh acquisition in just over a year and adding £87m in assets under advice to its Glasgow hub.

- Pathline Pensions acquired Unity Sipp from PSG Sipp’s administrators following its October 2024 collapse, ensuring service continuity for clients while the rest of PSG’s schemes were transferred to Alltrust.

- Isle of Man-based Manx Financial Group acquired Liverpool DFM CAM Wealth, a boutique formed by Derek Gawne and Lizz Ewart, for £210k.

- Titan Wealth has announced the acquisition of Jersey-based Advisa Wealth, managing £525m for 1,800 clients, backed by Parthenon Capital Partners and Hambleden Capital. Additionally, Titan is in due diligence to acquire Norwich-based Finance Shop and merge it with Loveday & Partners.

- PE-backed Pivotal Growth expanded into the protection market with the acquisitions of Northern-Ireland-based Business Protection Solutions Limited and London-based Radcliffe & Newlands Mortgages Limited, strengthening its market position and diversifying its service offerings in business and corporate protection.

- Söderberg & Partners expanded its UK footprint by acquiring minority stakes in three IFA firms—Francis Clark Financial Planning, Qi Financial Solutions, and Radcliffe & Co—advising on over £2.5bn of combined assets.

- Hoxton Wealth acquired Darlington-based Family First Financial Services, adding over £85m in assets under management and strengthening its presence in the north of the UK.

- Perspective Financial Group surpassed its 100th acquisition milestone, acquiring Hallidays Wealth Management, Foinaven Asset Management, Tony Fenton & Sons, PW Financial Management, and the client book of an adviser at Perspective (Home Counties) Ltd, adding £375m in assets under advice, 1,100 households as clients, and expanding its footprint in Derbyshire, Lincolnshire, and Cheshire.

Transaction volumes in December reverted closer to the monthly mean for the year after extraordinarily high levels of activity in the preceding two months, finishing the busiest quarter since Q4 2023.

Investment sector M&A market update

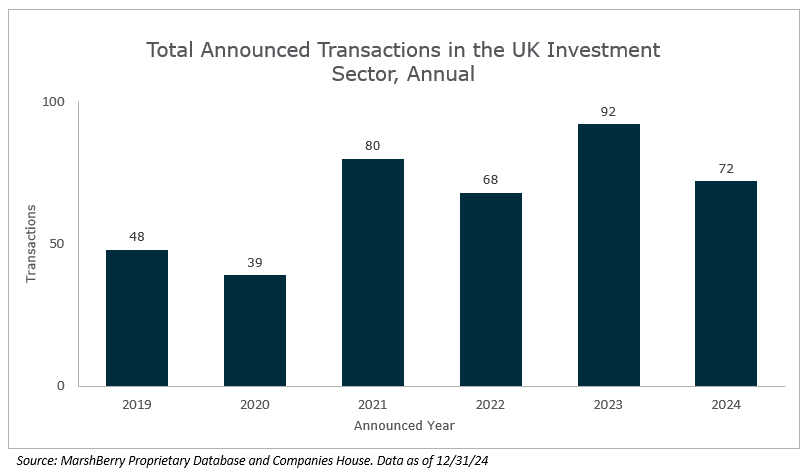

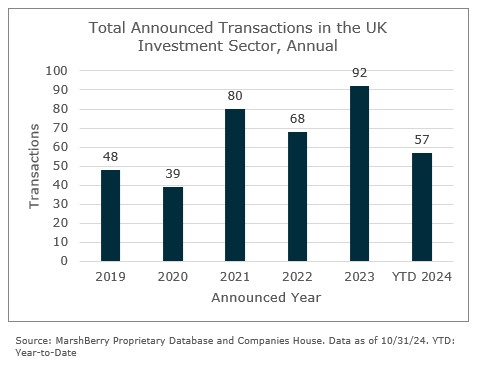

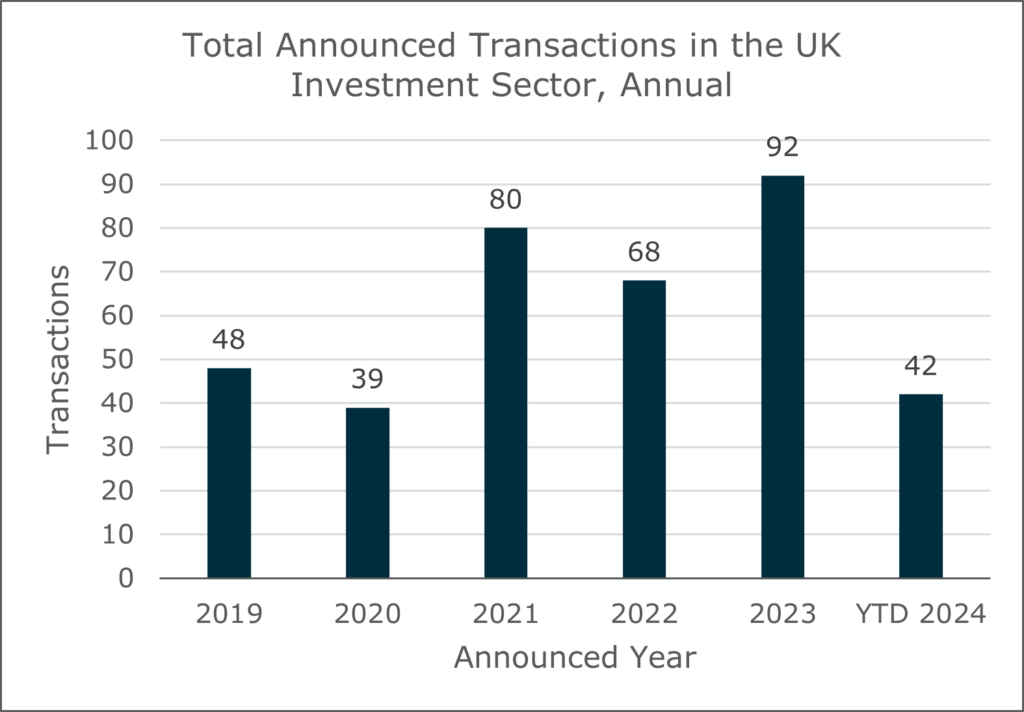

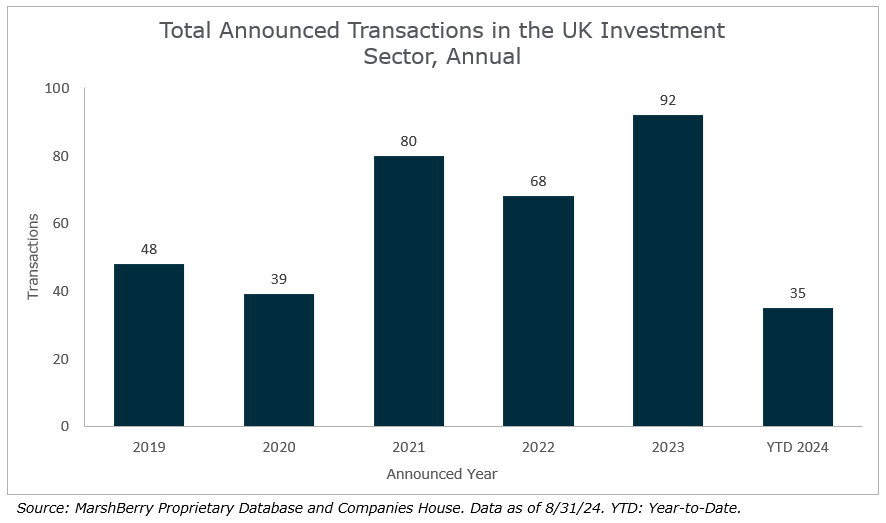

During 2024 there were 72 merger and acquisition (M&A) transactions in the investment sector with an estimated value over £5m each. Seven deals were announced in December, bringing the average to six transactions per month over the year. December’s M&A activity was lower than the other two months in the quarter, especially October which saw surging activity in the run-up to the Autumn Budget announcement. All of the transactions announced during the month involved wealth managers and financial planners bar one, which involved an advice tech firm.

While most of the transactions this month were below an estimated value of £25m, Titan Wealth’s acquisition of Independent Wealth Planners (IWP) exceeded that and represents an example of a consolidation of another consolidator, something we may witness more in the future.

December also saw the private equity-backed groups Söderberg & Partners and Shackleton (formerly Skerritts) announcing multiple deals during the month, adding to the long list of acquisitions this year by private equity-backed wealth managers.

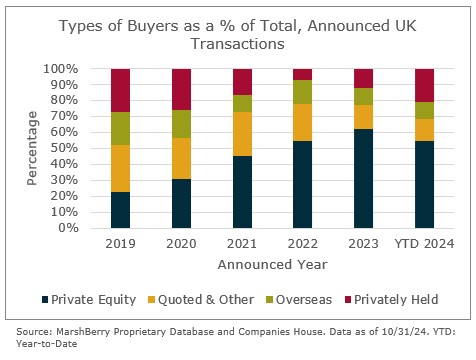

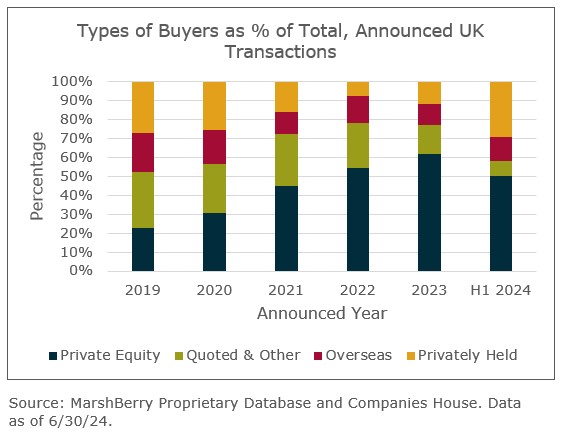

All but one of the deals announced during December involved a private equity-backed buyer. This did not negate the increased proportion of overseas buyers, who have nearly tripled their share of the total deal count compared to 2023 levels. It should be noted however that some of the overseas buyers are funded by international private equity firms.

Notable transactions (December 2024):

- Titan Wealth announced the acquisition of Independent Wealth Planners (IWP). The transaction includes IWP’s two trading entities (IWP Financial Planning Limited and IWP Investment Management Limited) and brings £6.6bn in client assets to Titan, raising Titan’s total assets under management and advice to £35bn. The acquisition also propels private equity-backed Titan to become one of the largest financial planning businesses in the UK.

- Söderberg & Partners announced it had acquired minority stakes in three advice businesses: Norfolk-based Hoyl Independent Advisers (£3bn of client assets), Midlands-based Intelligent I-FA (over £300m of client assets) and Yorkshire-based Mosaac (£230m of client assets). The Nordic wealth manager, backed by private equity firms KKR and TA Associates, has invested in over 20 UK firms this year as part of its strategy to grow advice firms and integrate its technology and investment solutions.

Other UK transactions (December 2024):

- Skerritts announced it had rebranded to Shackleton and acquired four advice firms: Save & Invest Group, Fleming Financial, Robson Lister and Shorts Financial Services, adding a combined total of £1.5bn in client assets and offices in Scotland, Bristol, Plymouth, Sutton Coldfield and Chesterfield.

- Foster Denovo announced the acquisition of Staffordshire-based advice firm Brian Mole Independent Financial Advisers, adding £300m of assets under advice. The deal brings seven advisers, nine support staff and 1,300 clients to the group.

- Moneyfarm announced it had agreed to acquire Borehamwood-based direct-to-consumer investment and cash solution services provider Willis Owen. The transaction expands Moneyfarm’s UK footprint and adds £680m in client assets, taking Moneyfarm’s total assets under management to over £5bn.

- Milecross Financial announced the acquisition of Buckinghamshire-based The Martin Cliffe Practice. The deal brings four advisers, three administrators, 650 clients and £80m of client assets to Milecross.

- Focus Business Solutions announced it had completed its management buyout from Abrdn marking a return to independence after nearly 14 years. The advice tech business’ buyout was led by Dave Upton who has been with the business since 2007 and became CEO on completion.

After a record-breaking October, merger and acquisition (M&A) transaction volumes unsurprisingly dropped in November. The surge in October was partly driven by business owners rushing to sell before the anticipated increase in capital gains tax rates being announced in the Autumn Budget. There was more activity in investment management and continuing consolidation in wealth management, as well as cross-border consolidation in securities exchange platforms, involving strategic acquirers and consolidators.

Investment sector M&A market update

There were eight deals recorded in the month of November, bringing the year-to-date (YTD) total to 65 transactions estimated to be worth over £5m each. Whilst significantly below the extraordinarily busy October, which saw 17 transactions, it still counted higher than the YTD monthly average of six deals (and higher than last year’s average of 7.7 deals per month). Half of the deals were acquisitions of asset management and trading platform firms. The other half was accounted for by smaller wealth management businesses being acquired by larger peers.

Five of the deals have an estimated value between £5m and £25m, two deals between £25m and £100m, and one deal exceeding £100m, including the £207m public offer for Aquis Exchange by SIX Group, the main stock exchange in Switzerland. This follows the broader trend of declining public ownership of companies in the sector which has seen public companies be taken off the market including, most recently, Hargreaves Lansdown, Mattioli Woods and STM Group. The shift reflects the growing interest from private equity funds and strategic acquirers in arguably under-valued opportunities for long-term value in the public market.

Having said that, half of the deal count this month was accounted for by public companies acquiring businesses, including Aviva-owned Succession Wealth and Pinnacle Investment Management (being listed in Australia). Additionally, there was a rise in the proportion of overseas buyers acquiring UK-based firms with the number YTD nearly tripling compared to last year.

Notable transactions (November 2024):

- Evelyn Partners agreed to sell its professional services division, including tax, assurance and advisory services, for a reported £700m, to the private equity fund Apax. Pending regulatory approval, the deal is expected to complete in early 2025, with the division, including 1,600 staff across 15 offices, to be rebranded to Smith & Williamson (S&W) to honour its heritage. The deal will allow Evelyn Partners to focus on its wealth management operations.

- SIX Group agreed to acquire Aquis Exchange plc for £207m, valuing shares at 727 pence each—a 120% premium over Aquis’s recent share price. Aquis, a multi-product European exchange group, operates across trading, technology, and data services. The deal aligns with SIX’s strategy to enhance its pan-European exchange capabilities, combining Aquis’ technologies with SIX’s platform to create a competitive growth listing venue.

- Ninety-One announced that it is acquiring the assets of Sanlam Investment Management. The transaction will result in £17bn of client assets moving to Ninety-One, of which £3.4bn are based in the UK. Ninety-One will assume the responsibility for managing the assets, with Sanlam’s UK entity, Sanlam UK Investments, remaining under the ownership of the Sanlam Group.

Other UK transactions (November 2024):

- Mattioli Woods acquired North-West based financial planning firm Cullen Wealth.

- Brooks Macdonald enhanced its regional reach by acquiring CST Wealth Management, a Welsh financial planning firm.

- One Four Nine acquired Castlegate Capital, a chartered financial planning firm in the UK.

- ASHL sold Lync Wealth Management to a 7IM subsidiary. Lync Wealth Management, managing £500m, plans to acquire up to seven advice firms while remaining tied to ASHL’s Lyncombe network.

- Advanta Wealth acquired City Financial Planning, adding £800m in assets under advice (AUA) and offices in Bath and Exeter.

- Succession Wealth strengthened its regional footprint by acquiring True Wealth Group, a Leeds-based financial planning firm.

- WBR Group acquired Bristol-based NM Perris & Co Ltd (trading as Brunel Trustees), adding £300m in AUA. The transaction also included the acquisitions of associated companies Brunel Trustees Limited and Omniphi Systems Limited.

- The Penny Group expanded its advisory services by acquiring Whiting Financial Limited, a Surrey-based IFA with £90m of AUA.

- Margetts Wealth Management announced a management buy in with Directors Ian Butler and James Vickers taking equal stakes, joining the Chairman Kevin Smith. The deal allows the Birmingham-based firm to remain independent and focus on growth.

- Tavistock Investments announced the acquisition of London-based DFM Alpha Beta Partners. Alpha Beta has £3bn in AUM and will further Tavistock’s presence in the UK retail market.

- Australia’s Pinnacle Investment Management strengthened its position in the UK funds market by acquiring a 25% stake in Pacific Asset Management.

- MKC Wealth expanded its operations in the North with the acquisitions of Stockport-based IFA Warr & Co Independent Financial Advisers Limited and Urmston-based Halstead Independent Financial Management.

Partly driven by vendors aiming to finalise deals ahead of the Autumn Budget announcement on 30th October, with expected increases in capital gains tax (CGT), the sector saw unusually high levels of deal activity. Aside from bolt-on acquisitions by wealth management consolidators, volumes were also supported by strategic transactions in asset management and investment consulting, resulting in October being the busiest month of the year in terms of merger and acquisition (M&A) activity.

Investment sector M&A market update

Year-to-date (YTD), the total number of transactions announced (with estimated values at over £5m each) stood at 57, including 15 deals in October alone, aligning with the typical quarterly deal volumes this year. The consolidation in the advice sector continues to be a key driver of activity, in the midst of the Financial Conduct Authority (FCA) conducting a review to assess the prudence of the acquisition-led growth of the consolidators. Undeterred, several consolidators, including Perspective Financial Group, Söderberg & Partners, Foster Denovo and Ascot Lloyd were extraordinarily busy in October and, some made multiple acquisitions of small advice businesses.

This month’s M&A activity saw seven transactions in the £25m to £100m range, exceeding all the previous months this year. Combined with seven deals valued between £5m and £25m and one deal exceeding £100m—a minority investment by Bain Capital in Openwork, the IFA network—the overall distribution of transaction values year-to-date remained consistent with trends observed in 2022 and 2023 with a slight bias towards the £25m to £100m bracket. This highlights the current focus by financial sponsors on opportunities in the mid-market.

That being said, there’s been an increase in acquisitions by public companies, as exemplified by WTW’s, Arthur J. Gallagher’s, Brooks Macdonald’s and Jupiter Asset Management’s acquisitions announced this month. In fact, over one in four deals this month were acquisitions or investments by quoted companies, marking a significant rise compared to typical levels, while privately held transactions accounted for just above one in ten deals.

Notable transactions (October 2024):

- The Openwork Partnership’s advisers voted in favour of Bain Capital acquiring a 30% minority stake in the network for £120m, pending regulatory approval. This investment aims to strengthen Openwork’s offerings in wealth, mortgage, and protection advice, supporting technology upgrades and strategic growth initiatives across its 4,750-strong adviser network.

- 7IM agreed to acquire Rockhold Asset Management, a subsidiary of ASHL Group, to bolster its managed portfolio services and discretionary management offerings. The deal, which adds around £2bn in client assets, will bring 7IM’s total assets under management (AUM) to £27bn. The acquisition will proceed under Rockhold’s existing brand and management team, pending regulatory approval.

- Arthur J. Gallagher & Co. acquired Redington, a London-based investment consultancy primarily serving pension funds and institutional investors. The acquisition is set to expand Gallagher’s UK advisory services, enhancing capabilities in investment strategy, risk management, and financial sustainability.

- CBPE invested in Clifton Asset Management, a wealth management, and pensions administration firm with £1.8bn in assets under management and administration on behalf of over 9,000 clients. The partnership, pending regulatory approval, aims to accelerate Clifton’s growth through organic expansion and strategic acquisitions, with Clifton’s CEO Neil Greenaway reinvesting alongside CBPE.

Other UK transactions (October 2024):

- WTW invested in Atomos, acquiring a 25% stake to deepen their collaboration and capitalise on Atomos’s growth within the UK wealth management sector.

- Brooks Macdonald acquired LIFT-Financial Group, with c. £1.6bn of assets under advice (AUA), to accelerate growth and expand its reach in UK wealth planning.

- Titan Wealth acquired Ravenscroft Investments’s UK investment management, adding some £600m of AUM.

- Jupiter Asset Management acquired Origin Asset Management, taking on £800m in mostly institutional assets.

- IPS Capital expanded its advisory proposition by acquiring Greenwood Financial Planning, raising IPS Capital’s AUM close to £1bn.

- Cazenove Capital acquired Whitley Asset Management, a boutique advisory providing services for high-net-worth clients.

- Ascot Lloyd expanded in Scotland by acquiring the Fife-based advice firm Create and Prosper with £254m in assets, enhancing its national advisory footprint.

- Foster Denovo expanded its advisory footprint by acquiring 80Twenty, adding a focus on sustainable investing.

- Perspective Financial Group acquired 13 firms in October to beat anticipated CGT rises announced in the budget.

- Fairstone finalised its acquisition of Forbes Lawson Wealth Management, an Aberdeen-based advisory firm, reinforcing its footprint in Scotland.

- Söderberg Partners acquired minority stakes in four UK firms, George Square, Cheltenham IFA Ltd, Bluezone Capital and Alexander Bates Campbell.

- Clarion Wealth Planning’s management team completed a buyout, positioning the firm for independence and growth.

- Towergate Health & Protection bought Benefiz, the employee benefits consultant for SMEs, bringing it in under the Ardonagh Group umbrella.

- Moneybox, a financial app designed to help users save and invest for life goals like retirement and home purchases, raised c. £70m in primary and secondary capital from Apis Partners and Amundi, valuing the company at £550m to enhance product innovation and digital offerings for younger investors.

- Westbridge acquired a majority stake in Causeway Securities, an international distributor of structured products.

- ECI Partners acquired a stake in pensions management and governance services provider Independent Governance Group.

September saw significant transactions and high levels of merger and acquisition (M&A) deal activity in the investment sector. Prominent quoted companies sold non-core subsidiaries and the consolidators continued to acquire smaller wealth managers across the country. In fact, September was one of the busiest months this year.

Investment sector M&A market update

At of the end of September, a total of 42 deals valued at over £5m have been announced in the investment sector year-to-date (YTD), including 17 in the last quarter. Following the typical summer slowdown, M&A activity significantly rebounded in the month, reflecting the seasonal trends commonly observed in the market.

It involved the usual activity by consolidators acquiring smaller wealth management firms, some of which may have been prompted by owners seeking to realise value ahead of the widely anticipated increase in capital gains taxes to be announced in the Autumn Budget at the end of October. More notably, three public companies announced the sales of non-core subsidiaries to private equity funded companies and vehicles.

Source: MarshBerry Proprietary Database and Companies House. Data as of 10/1/24.

As seen in previous periods, most of the deal activity took place at the lower end of the scale in terms of transaction size, ranging from £5m to £25m, as acquirers benefitted from ample access to capital to support bolt-on and strategic acquisitions. But there was also a fair number of mid-sized and large deals, resulting in a distribution of transaction values YTD being very similar to 2022 and 2023.

Source: MarshBerry Proprietary Database and Companies House. Data as of 10/1/24.

Privately held businesses as buyers continues to increase compared to previous years. However, private equity still remains the dominant force in funding acquisitions, either directly from their funds or indirectly via their portfolio companies. A notable example of the former this month was the announcement of Oaktree Capital Management’s acquisition of Close Brothers Asset Management, creating a new sizeable stand-alone wealth management group in the UK. An example of the latter was Saltus, being backed by Preservation Capital, announcing it had agreed to acquire Tavistock’s financial planning businesses which it intends to manage as a separate division. This shows how powerful a force private equity can be in helping to restructure the industry.

Source: MarshBerry Proprietary Database and Companies House. Data as of 10/1/24.

Notable transactions (September 2024):

- Close Brothers agreed to sell its wealth management arm, Close Brothers Asset Management (CBAM), to Oaktree Capital Management for up to £200m. The deal is set to close in early 2025 after gaining regulatory approval. Oaktree Capital Management, which has also invested in Atomos, another wealth manager, intends to manage CBAM as a separate investment in its portfolio.

- Brooks Macdonald agreed to sell its international arm, Brooks Macdonald Asset Management, to Canaccord Genuity Wealth Management (CGWM) for up to £50.85m as part of a strategic review to focus on UK operations. The deal, which is expected to close by March 2025, offers a strong strategic fit for CGWM’s international division and integrated wealth management proposition.

- Saltus agreed to acquire Tavistock Investments’ financial advice businesses, Tavistock Partners, and Tavistock Estate Planning Services, for up to £37.75m, pending regulatory approval. The deal adds £2.4bn in assets and over 140 advisers, bringing Saltus’s total assets under advice to over £7bn. Saltus will manage the acquired business as a separate unit under the continuing leadership of Mal Harper.

Other UK transactions (September 2024):

- Skerritts acquired Harrogate-based Ellis Bates Financial Advisers, adding over £1bn in assets under management and expanding its presence in the North of England.

- Ascot Lloyd acquired Bristol-based Whitechurch Securities, enhancing its £10bn asset portfolio amid financial challenges for the latter.

- Brooks Macdonald Group is set to acquire Norwich-based Lucas Fettes Financial Planning, adding £890m in assets under advice and enhancing its financial planning capabilities, pending regulatory approval.

- Foster Denovo acquired Glasgow-based Rosemount Asset Management, its fourth acquisition in a year, establishing a significant foothold in Scotland with over £200m in assets.

- Loyal North acquired Hertford-based IF Wealth and Essex-based Powell Financial Planning, adding a combined £56m in client funds.

- Quilter acquired fintech firm NuWealth to enhance digital capabilities and better support clients starting their investment journeys while bridging the advice gap.

- Goshawk Asset Management acquired Vermeer Investment Management and its £60.8m fund, now named the Goshawk Global Fund.

- Wealthtime is in talks to buy Craven Street Wealth, a financial advisory firm with £1.8bn in client assets.

Increased investment sector merger and acquisition (M&A) transactions in August involved private banks, financial planners, wealth managers and asset managers. Key deals were led by trade buyers expanding their geographic footprint and pursuing scale economies, as well as consolidators in the wealth management sector acquiring smaller financial planning firms. Aside from four deals this month, most transactions were estimated to be valued below £5m, showing the continued resilience and rationale for the consolidation of the wealth management sector.

Investment sector M&A market update

Year-to-date, a total of 35 deals (estimated to be above £5m of value) have been announced in the investment sector. While M&A activity usually slows in the summer holiday season, potential changes in UK capital gains tax legislation are expected to drive some business owners to accelerate the completion of their sales ahead of the Autumn Budget announcement at the end of October in the hope of avoiding any adverse tax implications. As a result, it is possible volumes of deals across the sector, particularly among privately held businesses, will increase in the next couple of months and reverse the subdued activity in August.

Year-to-date, transactions with values exceeding £100m have seen an increase compared to 2023. One example is the acquisition of Kleinwort Hambros this month, which also represents the first deal over £100m this year not involving a private equity fund, or an acquirer backed by one, but rather a family-owned Swiss Bank. In the meantime, transaction volumes of smaller scale have continued to account for the lion’s share of deal activity this year.

This is reflected in the more balanced distribution of buyers developing this year, with private equity becoming less dominant as an acquirer, albeit still being present as a buyer in just over half of all acquisitions. Meanwhile, privately held business has shown a sharp increase in relation to other buyer categories, being the acquirer in almost one in every third deal in the market.

Notable transactions (August 2024):

- Axa and BNP Paribas are in exclusive talks for a €5.4bn deal where BNP Paribas would acquire Axa Investment Managers (Axa IM) for €5.1bn in cash and €300m for Axa IM’s select business. The deal, valued at 15 times Axa IM’s 2023 earnings, will create Europe’s second largest asset manager with €1.5 trillion in assets under management. A long-term partnership will also have BNP Paribas providing investment management services for Axa, with completion expected by Q2 2025, pending regulatory approvals.

- Union Bancaire Privée (UBP) acquired Societe Generale’s UK private bank, Kleinwort Hambros, as part of a €900m (£771m) private banking deal that also includes Societe Generale Private Banking Suisse. The acquisition adds €25bn in client assets to UBP and expands its presence in the UK, with Kleinwort Hambros’s offices in Cambridge, Edinburgh, Leeds, Newbury, and London.

- FNZ sold its stake in Timeline, a comprehensive financial planning platform for UK IFAs, for £10.2m after Timeline partnered with rival platform Seccl. FNZ had been a minority investor since 2018, but the sale followed Timeline’s decision to work with Seccl instead. The shares held by FNZ were sold to existing shareholders, possibly funded by a loan from Seccl’s parent company, Octopus Investments.

- Howden acquired Help Me Compare Group Limited (ActiveQuote), a leading UK health and life insurance broker, boosting its presence in the market and expanding employee benefits capabilities. ActiveQuote, managing £60m in premiums with 132 employees, strengthens Howden’s position amid rising demand for private medical insurance.

Other transactions:

- Azets acquired Glasgow-based Milne Craig, a chartered accountancy and wealth management firm with over 2,000 clients and 90 employees throughout Scotland and the UK.

- Wren Sterling’s acquisition of Hampshire-based In Focus Group adds £450 million in assets and 2,500 clients, marks its third 2024 acquisition, and converts the Fareham office into its new Solent office, enhancing its presence on the south coast.

- Perspective Financial Group acquired Whittington Goddard Associates and Copthorne Financial Services, increasing its client assets by £185m and bringing its total to £8bn across 39 offices.

- Fairstone acquired Grayside Financial Services and Executive Wealth Management, adding £318m in funds held by 1,250 clients, while also launching its sixth UK hub in Farnborough.

- Tweed Wealth Management acquired Glasgow-based Capital Wealth Consultants, expanding its team, and enhancing its services, particularly for sports professionals.

- AAB Wealth acquired WealthFlow, boosting its assets under advice to over £1bn and strengthening its position in financial planning, especially in medical negligence and injury settlements.

July 2024 was a busy month in the investment sector, with several notable deals involving pensions specialists and support providers in the sector. Most of the deal activity took place among smaller financial planners and wealth managers, and only six deals were worth £5m or more. There was also plenty of speculation in the market about the exit plans for some of the owners of the larger wealth management groups, some of which should be announced in the next few months.

Investment sector M&A market update

With 30 merger and acquisition (M&A) transactions announced in the sector so far this year, activity is rebounding from the slowdown in the previous quarter. Notably, the consolidation in the wealth management space has largely involved smaller entities below the value limit for tracking deal data and, therefore, disguises the true rise in deal activity. In addition, it is possible that UK consolidators will start to expand offshore. For example, this month Titan Wealth acquired AHR Group, an international wealth management group headquartered in Dubai, United Arab Emirates, with over 150 professionals in seven locations across six jurisdictions and $2bn of assets under advice and under management. Again, that is not included in the data below.

Another factor that has played a major role is the anticipation of increased tax rates on capital gains being announced in the Autumn Budget set for 30 October. That has prompted many private vendors to accelerate their discussions with acquirers in their attempt to conclude the transactions ahead of that date.

Private equity funds remain a dominant force as investors in the industry, albeit the data would suggest this group has passed its peak last year in terms of deal volumes. Most notable is the increase in privately held business as a proportion of acquirers this year. But, this is more a reflection of the relative decline in private equity funds’ activities than a rise in owner-managed business engaging in acquisitions.

Notable transactions (July 2024):

- The board of Hargreaves Lansdown unanimously agreed to recommend the £5.4bn takeover offer from a private equity consortium comprised of CVC Capital Partners, Nordic Capital, and Platinum Ivy, a subsidiary of the Abu Dhabi Investment Authority. The consortium extended the bid deadline from 19th July to 9th August to finalise its offer and present its plans for Hargreaves Lansdown.

- Söderberg & Partners raised £225m to support its expansion in the UK and Spain, with funding sourced from KKR and TA Associates. The company remains controlled by its founders and chairman, aiming to enhance efficiency through technology and grow its presence in the UK financial advice market. Managing over £60bn in assets and employing 3,000 people across seven countries, the firm has made 14 investments in UK advice firms, including three that were announced in July: HCF Partnership and Essex Financial Management; Grosvenor Consultancy; and Prosperity IFA.

- Marwyn Acquisition Company II Limited (MAC II) acquired pensions services provider InvestAcc for £41.5m. Led by former Curtis Bank CEO, Will Self, MAC II is a special purpose acquisition vehicle (SPAC) targeting the wealth management industry. The acquisition of InvestAcc, funded in part through an equity raise, is the first step in its strategy to build the leading specialist pensions administrator in the UK, focusing initially on the SIPP (self-invested personal pension) sector.

- Isio, the rapidly growing UK pensions, rewards, benefit, and investment advisory firm, secured a new investment from Aquiline Capital Partners to support its continued growth, with Exponent exiting its investment. Over the past four years, Isio has more than doubled its revenue, profit, and headcount, now employing 1,200 people across 10 UK offices.

Other transactions:

- Skerritts Group expanded its presence in the South East and London by acquiring KMG Independent and KMG Investment Management, and London-based Black Swan Financial Planning, adding over £940m in assets under management.

- Redwheel signed a definitive agreement to acquire Ecofin, a specialist in sustainable infrastructure and environment solutions with $1.4bn in assets under management, enhancing Redwheel’s sustainability capabilities.

- Wren Sterling acquired Howe Maxted Financial Services, adding 500 families with £200m in assets to its portfolio, while Howe Maxted’s general insurance division was sold to JM Glendinning.

- PE-backed Pivotal Growth expanded its portfolio with the acquisitions of Charleston Financial Services and Morrison Ward Associates.

- Hoxton Capital Management acquired Chequer Financial Services, marking its fourth UK IFA purchase this year, boosting its client base by 80 households.

- Traditum invested in Method Asset Management, an IFA founded by ex-rugby player Jonnie Whittle, to expand its financial services for high-net-worth clients and businesses.

- Mayfair Equity Partners announced the investment in a majority stake in Jersey-based VG, a leading provider of private wealth and fund administration services.

- Defaqto acquired RSMR to enhance its fund research and ratings capabilities for advisers, integrating RSMR’s expertise into its own platform and expanding distribution among advisers and their clients.

- Oxfordshire-based CMS Wealth announced the acquisition of Hayward Manning, an ultra-high-net-worth advice firm.

As the UK considers what impact the fiscal plans of the newly elected Labour government may have on individuals and businesses, now is a good time to look at merger and acquisition (M&A) activity in the investment space for H1 2024.

Investment sector M&A market update

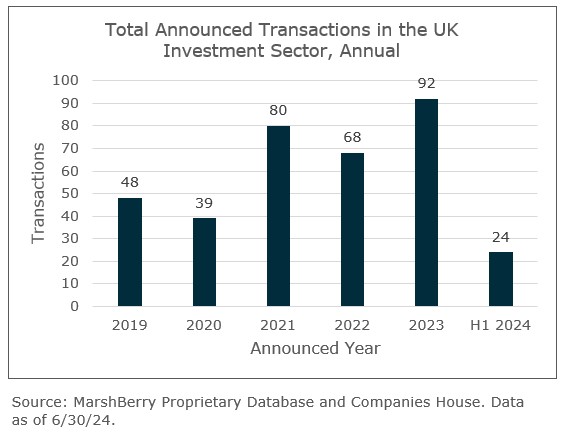

At the halfway point in 2024, there have been 24 M&A transactions announced in the UK Investment sector (each with an estimated value of £5m or more), showing a sharp drop in activity from the previous three years. The deal count in Q1 this year was substantially below the level reached in Q4 2023 and, similarly, Q2 of this year was less than half of Q1, so the trend is seemingly pointing downwards.

Perhaps this is not surprising in the light of the record high levels of transactions over the last three years, especially against the backdrop of increasing cost of capital and the pressures of Consumer Duty.

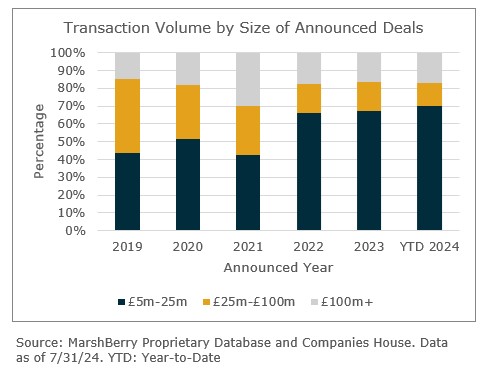

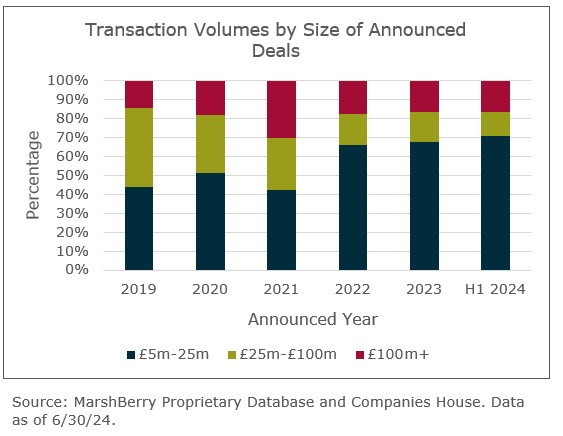

Volumes have also become increasingly biased towards smaller transactions, which made up almost three quarters of all deals in the first half of this year – an all-time high. For this segment of the market, funding and integration of operations are for many buyers less challenging and remain very much core to their bolt-on growth strategies.

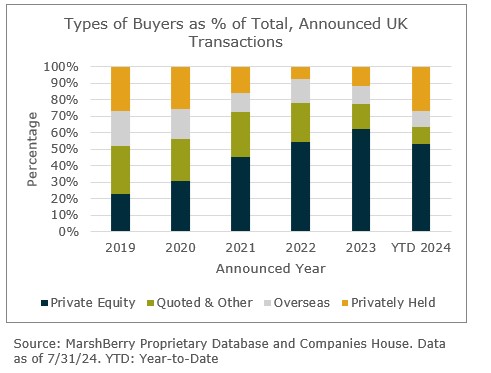

In recent years, deal activity has been boosted by private equity (PE) backed “buy-and-build” vehicles. However, their consolidation of the market has slowed down quite significantly this year and almost one in every third acquisition in the first half of this year was sponsored by North American PE funds. Their scale and ambitions have supported slightly larger acquisitions by more selective acquirers than the usual suspects among the “consolidators.”

What is also noteworthy is the increased percentage of transactions involving privately owned acquirers this year. It has reverted back to its “norm” seen in 2019 and 2020 of little over a quarter of the volumes, when other categories of buyers were less prominent.

In the meantime, public companies continued their decline as a buyer category and were, in fact, more likely to be at the receiving end of a bid, such as in the cases of Hargreaves Lansdown and Mattioli Woods.

Notable transactions (June 2024):

- The board of Hargreaves Lansdown announced that it is willing to unanimously recommend a £5.4bn takeover offer from a private equity consortium consisting of CVC Capital Partners, Nordic Capital and Platinum Ivy (a subsidiary of the Abu Dhabi Investment Authority). The consortium has until 19th July to finalise its bid and outline its plans for Hargreaves Lansdown.

- Succession Wealth announced the acquisition of London-based advice firm London Wall Partners. The acquisition adds £900m of client assets, and marks Succession Wealth’s fourth acquisition under Aviva ownership and its second in 2024.

- The equity investment trusts Alliance Trust and Witan announced a merger creating a £5bn super fund. The tie-up, which is subject to shareholder approval, would see the £1.8bn Witan portfolio rolled into Alliance Trust under the new banner of Alliance Witan.

Other transactions:

- In a push to focus on wealth management, WH Ireland announced that it had sold its capital markets arm to investment bank Zeus Capital for up to £5m.

- Milecross Financial expanded its operations to the south-east with the acquisition of Surrey-based financial advice firm, The Centre Court Partnership, adding 2,000 clients and £40m of assets.

- Hoxton Capital Management made its third IFA acquisition of the year with the purchase of Devine Financial Management. Devine operates from offices in London and Southend.

- MPA Financial Management announced the acquisition of Worcester-based Suckling Waddington and Partners.

- Sale-based pensions administrator iPensions Group announced the acquisition of a legacy SIPP and SSAS book from Morningstar Wealth Retirement Services.

- IFA network ValidPath facilitated the purchase of Ledbury-based firm Winnell Douglas through its succession solution tool.

- Newcastle Financial Advisers bought Hexham-based financial planning firm Keith Dyson Financial Consultancy, adding 300 clients.

- Alpha Financial Markets, an LSE-listed consultant to wealth and asset management firms, was acquired by listed private investments firm Bridgepoint.

- Fintel announced it had acquired Threesixty from abrdn. Threesixty provides compliance and business support services to wealth and asset management firms.