M&A Market Update

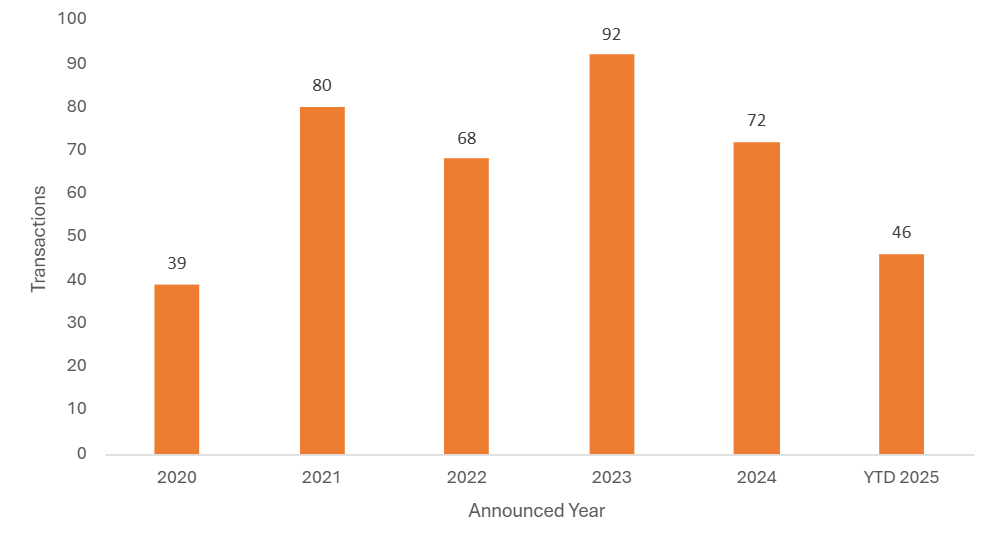

Whilst merger and acquisition (M&A) activity involving deals above £5m slightly slowed in September, with only four transactions announced, the third quarter emerged as the most active quarter of the year thus far, resulting in 17 deals announced. However, this figure represents a slight decline compared to Q3 volumes recorded over the past three years (19 in Q3 2024, 23 in Q3 2023 and 19 in Q3 2022).

Wealth management and financial planning continued to drive volumes in investment sector M&A, accounting for half of the transactions recorded in Q3. All four deals announced during September involved targets operating within the wealth management space, including Corient’s acquisition of Stonehage Fleming and Stanhope Capital, Bixby’s investment in James Hambro & Partners and Tavistock’s acquisition of Lifetime Financial Management. The robust deal volumes in the wealth management sector underscore the continued investor interest and consolidation within the sector.

Total Announced UK Investment Sector Transactions, Annual

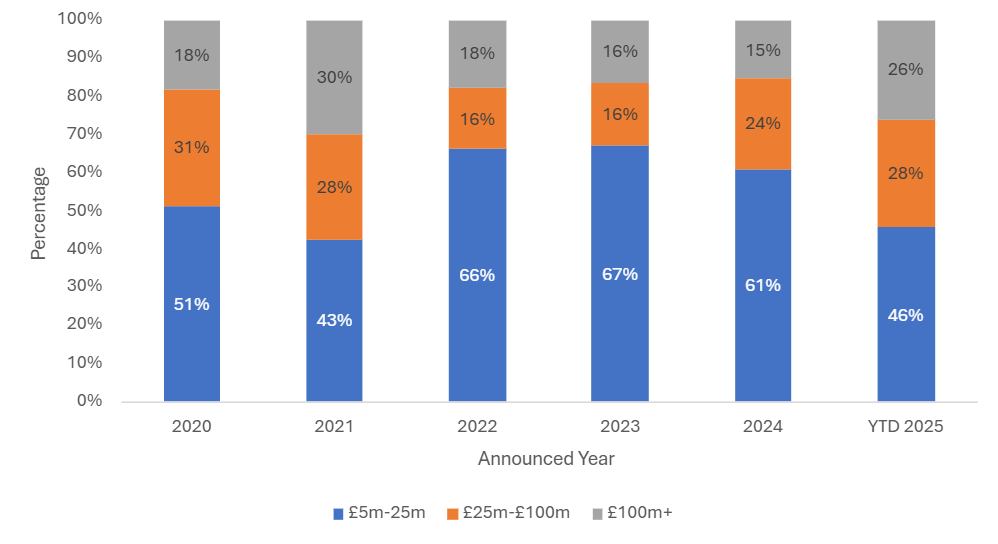

Deal values varied in September, with one transaction exceeding £100m in value and three falling below. In fact, Q3 marked a record-breaking period for transactions over £100m, with eight deals being announced—the highest quarterly total since Q1 2021. Notably, the year-to-date distribution of deal values closely mirrors those observed in 2021, a year with the highest aggregate transaction values for the past five years. This reflects strong interest shown by North American strategic acquirers and private equity (PE) in leading businesses in the UK investment sector.

Announced UK Investment Sector Transactions by Target Size

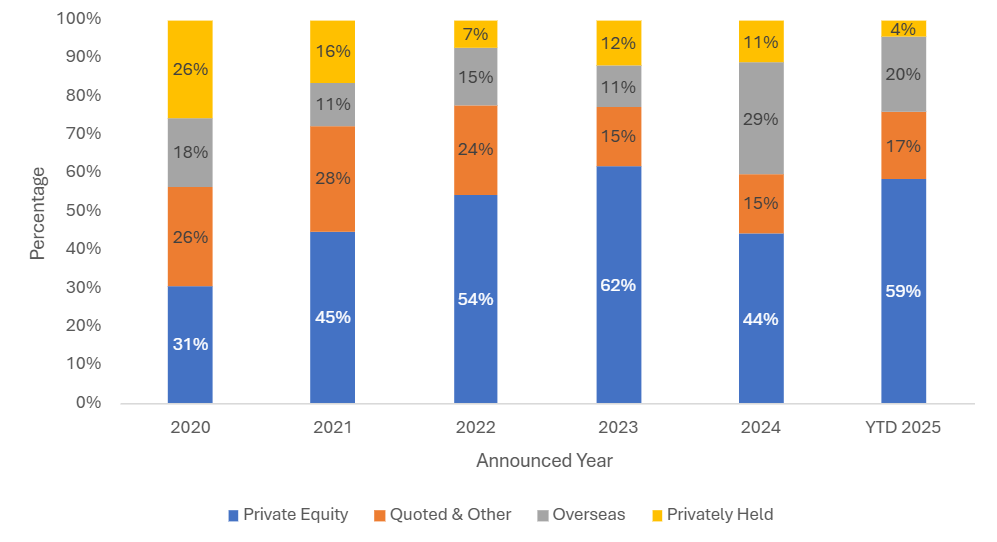

Private equity continues to be very active in Q3

PE was the most prolific acquirer group in the first half of this year, and Q3 2025 maintained the trend. Almost 65% of all deals announced during the quarter involved a direct or indirect PE-backed buyer, including overseas buyers with PE ownership. Of the four transactions announced in September, three involved overseas acquirers backed by PE, while the remaining deal was executed by a UK-listed company. The increased proportion of direct PE investments observed during H1 2025 continued during Q3 with the announcement of two new PE-backed advice consolidators. Meanwhile the number of privately owned buyers has decreased significantly in the face of fierce competition from buyers with better access to capital, including PE-backed businesses, both from the UK and overseas.

PE-Backed Transactions as a % of Total Announced Transactions

Notable transactions (September 2025):

- U.S.-based wealth adviser Corient announced the acquisition of both Stonehage Fleming and Stanhope Capital, adding $214bn in client assets. Stonehage Fleming has over $175bn in combined client assets and operates in 14 countries. Stanhope Capital adds further scale with $40bn in client assets. Corient is the U.S. advice arm of Canadian asset manager CI Financial. The combined entity enhances Corient’s provision of wealth management globally.

- U.S.-based Bixby Wealth Solutions took a strategic minority stake in James Hambro & Partners, a London-based wealth manager with £8bn in assets under management. The investment will support James Hambro’s growth plans, including regional expansion and digital platform enhancements. Bixby, backed by Carlyle’s Global Credit Business, is part of Moontower Group and is a specialist investor in independent wealth management firms.

Other UK transactions (September 2025):

- Tavistock announced it had acquired a 76.59% stake in Barnsley-based financial advisory firm Lifetime Financial Management.

- Beckett Investment Management announced the acquisition of Ipswich-based Swallow Financial Planning, strengthening its presence in the South East and adding £90m in client assets.

- Gresham House announced it had acquired SUSI Partners, a Switzerland-based investment manager focused on energy transition infrastructure.

- Oberon Investments announced the purchase of WH Ireland’s wealth management business, adding £850m of client assets.

- Artorius announced the acquisition of Manchester-based wealth firm Lunesdale Investment Managers, adding £95m in assets under management.

- Clifton Wealth Partnership announced it had acquired two financial planning firms: Grovebridge Financial and Clifton Business Consultancy, adding £146m in client assets.

- Pivotal Growth snapped up the Doncaster-based mortgage brokerage firm Believe Money Group, continuing its regional consolidation strategy.

- Shackleton announced it had acquired Group Rapport, the employee benefits arm of Stonewood Financial Planning, adding 130 corporate clients.

- Fairstone announced the acquisition of Norfolk-based IFA Allen Tomas & Co, adding £120m in client assets and 260 clients.

- AAB Wealth announced the acquisition of Surrey-based Integrity Financial Management, marking its fourth acquisition in 15 months.

- UK specialist lender Shawbrook announced the acquisition of ThinCats, a leading SME lending platform, both of whom have provided loans to businesses in the investment sector. The acquisition aligns with Shawbrook’s strategy to diversify its lending portfolio and enhance its technology-driven underwriting capabilities.