2023 European mergers and acquisitions (M&A) activity in insurance distribution reached a new high – and based on first quarter 2024 transactions it looks like this year will be no different. The potential for consolidation across the European insurance distribution market is strong, with deal activity across continental Europe increasing from both national consolidators and international platforms buying into new markets. The European insurance brokerage market is going from fragmented to consolidated at an incredible speed.

Across all sectors, M&A activity in Europe is seeing an upswing, after a few difficult years. Decelerating inflation, an expected decrease in interest rates, and continued strong financial markets underline optimism that 2024 will be a strong deal-making year for the insurance distribution industry.

In Q1 2024, inflation rates in the 20-nation eurozone continued to decline, easing to a 2.4% annual rate in March, a four-month low. In April 2024 the European Central Bank (ECB) maintained interest rates at their current level of 4% for the fifth consecutive meeting. However, the ECB provides strong indications of a potential rate cut in the near future.

Insurance brokerage remains strong

Insurance brokerage remains among the most active sectors for M&A in Europe and is highly sought after by private capital investors. Insurance brokerages are capital-light businesses that have high profit margins, strong client retention rates, and a proven history of generating consistent returns despite market volatility. The valuations of insurance brokerage firms are likely to remain robust. However, there is an emerging bifurcation in valuation between firms with strong management, high margins and a track record of strong organic growth, versus firms that still have significant improvement potential.

Higher insurance premiums in 2024, driven by last year’s inflation and higher risk premiums by insurance carriers, are positively impacting the financial results of insurance brokers. As more buyers (strategic buyers and private equity) compete for the same potential acquisition targets, supply and demand will continue to drive deal prices.

M&A market update

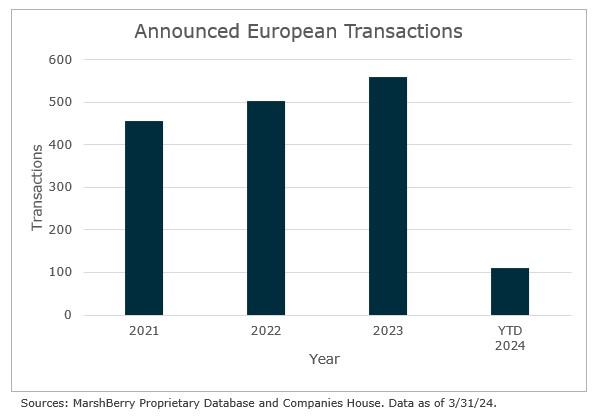

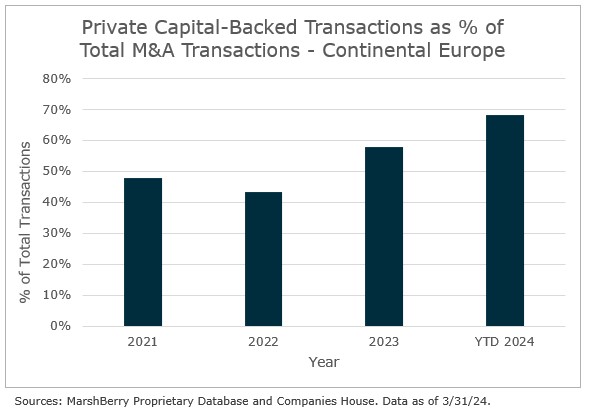

MarshBerry has identified 110 announced M&A transactions among European insurance brokers through March 31, 2024. Despite this impressive number, it is likely an underestimation as many small broker deals tend to go unpublished. As such, it can be difficult to include them in total counts. Of the Q1 2024 European transactions, roughly two thirds were backed by private equity firms.

The UK remains the leading country in Europe for transaction volume, but the deals are getting smaller. The reduced supply makes it unlikely that deal prices will go any higher in this geography (and may in fact begin to decline). Meanwhile, in most continental European markets consolidation continues at a strong pace. Many countries in the region registered notable transactions with the purchase of platform companies that will act as nuclei for further consolidation.

Notable transactions

Several notable transactions in the first quarter reflect the continued growth and consolidation of the European insurance distribution market.

- January 8: Arthur J. Gallagher & Co. made its first move into Germany with the acquisition of Köberich Financial Lines. The acquisition is part of Gallagher’s broader European expansion strategy.

- January 10: Corsair Capital acquired a majority stake in MJM Holdings, a leading Polish commercial line broker, creating a platform for further expansion in Eastern Europe.

- March 4: In Belgium, two independent corporate insurance brokers, induver and clover, announced their merger with the support of Hg capital.

Most active buyers in Europe

Private capital-backed broker groups continued to be the most active acquirers.

- Howden expanded its footprint across Europe, acquiring brokerages in several countries including France, Norway, Estonia, Belgium, Ireland, and their native UK.

- MRH Trowe, based in Germany, bolstered its buy-and-build strategy with four acquisitions within the country.

- PIB Group significantly increased its presence in Spain by acquiring three brokers, while in Italy, it has acquired two brokers. In Poland, PIB has merged two entities. Notably, Campion Insurance, a PIB subsidiary, acquired an Irish broker, marking the addition of the 20th Irish broker to PIB’s portfolio.

- Summitas Group, headquartered in Germany, is expanding its operations by acquiring four companies, all located within Germany.

- Alpina Group, based in the Netherlands, made an acquisition through its Belgian subsidiary, Hillewaere Groep, which purchased a consortium of five intermediaries along with another broker.

MarshBerry offers industry-leading data and insights, perspectives, and market conditions to help your leadership stay abreast of developments in the insurance industry. Learn more about these perspectives to gain deeper knowledge of trends in the international M&A market through MarshBerry’s in-depth insurance distribution reports for the UK M&A Market and Continental European M&A Market.