As the end of the year draws closer there was no real pickup in insurance distribution mergers and acquisitions (M&A) activity. With only a few weeks remaining in 2025, it is likely that the year will end with announced M&A volumes down by around a third relative to recent years. In value terms the drop is likely to be even more pronounced, as not only have there been fewer deals, but the average deal size has decreased. There have also been fewer very large deals announced in 2025. Taken together and barring the announcement of one or more mega-deals in the next 30 days, the value of sector deal activity in 2025 is likely to be the lowest since at least 2019.

M&A Market Update

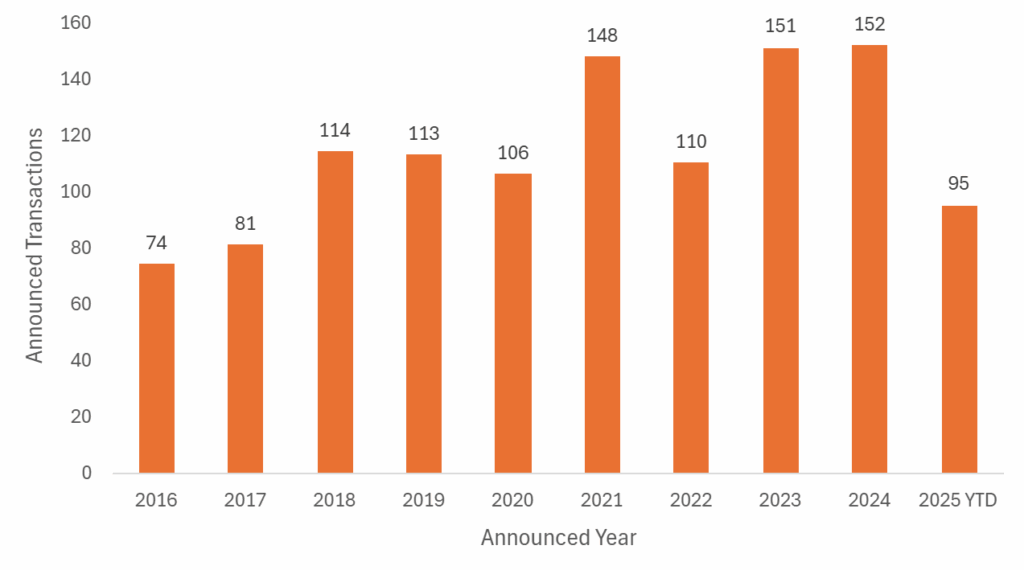

With eight new transactions to report on in November, the year-to-date (YTD) total stood at 95, against 144 at the same point in 2024, a decrease of 34%. December is a ‘short’ month in terms of business days and unlike the U.S. market it rarely results in a spike in UK M&A. There could be a slight uptick of new announcements in the coming days, as news of deals signed just prior to last month’s budget are made public. However, on the basis that Capital Gains Tax (CGT) was increased in 2024, and was one of few taxes where rumours had not been swirling in advance of Budget day, it is unlikely to be a major catalyst for transaction activity this year. Deal volumes for 2025 are likely to be above 100, as they have been in every year since 2017, but probably only just. MarshBerry will be publishing a detailed annual review analysing the full year in late February / early March. The 2024 review is still available to download here.

Total Volume of Announced UK Insurance Distribution M&A, Annual

Declining deal values remain a consistent theme

November’s new deals continued a theme that has run throughout 2025, in that they mainly involved smaller targets. Of the eight deals announced (and shown below) two were asset or ‘book’ deals rather than share acquisitions, only one involved a target employing ten or more staff, and the aggregate headcount across all deals in the month was only 54. Collectively they represent less than £10 million of income. Sector consolidation, measured by headcount and income, has slowed markedly in 2025.

MarshBerry will finalise the sums following the year end, but the combination of fewer deals, smaller deals, and a reduced number of very large transactions (there have been only five deals in 2025 with a value above £100 million), the overall value of sector M&A looks likely to be significantly lower than it has been for several years, and well below the c.£4bn it has averaged over each of the past three years. Of course, in any given year the total value of all sector deals tends to be dominated by only two or three ‘elephant’ transactions (think a GRP, CFC, PIB Group, or even JLT if one looks back a bit further) with a deal value that can exceed the combined total of the smallest 100 transactions in a year. (In 2024 there were 93 announced deals with an individual value estimated to be below £5 million.) There have been a handful of chunky transactions in 2025 (Jensten, Seventeen, BLP) but (so far) none substantial enough to get 2025 close to the level of any of the past five years.

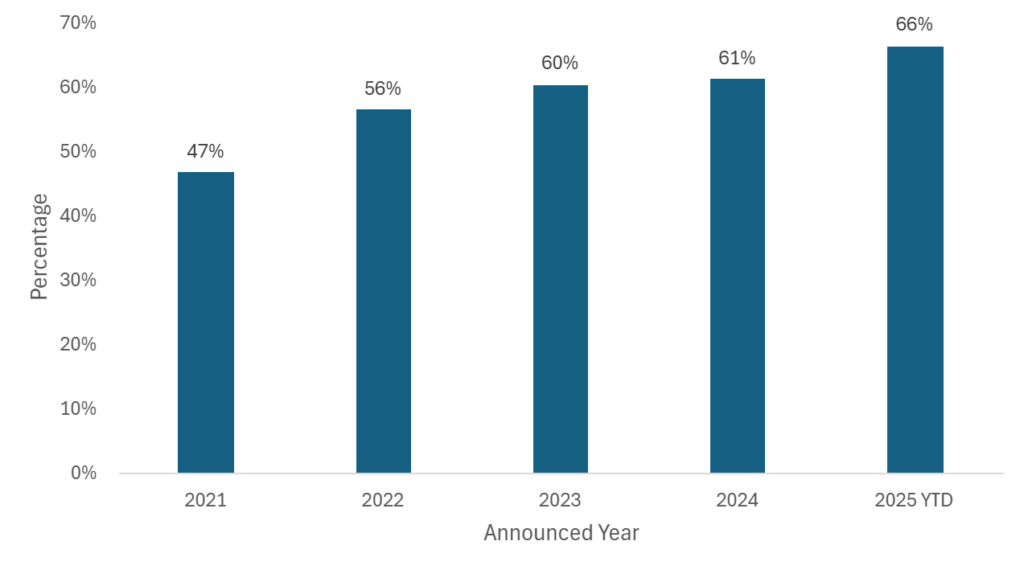

Of the 95 deals* YTD in 2025 MarshBerry estimates that 63 (or 66% of all deals) will have been done at a deal value of less than £5 million. This is a higher percentage than in any of the past five years, in spite of the impact of inflation and increased sector valuations over time, and above the long-term average (10 year) of 59% of all deals. Furthermore, only 13 deals in 2025 have involved targets with an estimated value of above £25 million.

The prevalence of smaller average deal sizes is likely to remain, because it reflects the remaining ‘supply’ of UK targets. Years of consolidation have hollowed out the number of privately-owned mid-sized brokers available to acquirers, but there are still a plentiful – albeit gradually diminishing – number of smaller (<10 staff) brokers left to go for. MarshBerry’s most recent analysis has the number of fully authorised groups at just under 2,000, or ~3,700 firms if including relevant Appointed Representatives.

Targets in UK M&A: Percentage of All Announced UK Deals Involving Target Valued Below £5m

Specialty intermediaries continue to draw interest

One continuing bright spot in M&A activity in the UK has been in deals involving specialty targets, by which we mean wholesale brokers (including Lloyd’s Brokers) and Delegated Underwriting Authority Enterprises (read: MGAs or Managing General Agents), which borrows the U.S. terminology (MarshBerry defines specialty firms as those with delegated authority or that act as intermediaries between retail brokers and risk-taking markets).

Such firms are reportedly now forming at a faster rate than commercial brokers, typically have the potential to grow more rapidly on an organic basis (as wholesale business is less sticky), and are in high demand. Private equity (PE), overseas buyers, domestic consolidators of Lloyd’s brokers, MGAs and commercial business are all keen to acquire in the specialty segment. In 2025 YTD 23% of all deals have involved a specialty target, the highest proportion in the past five years, and there were two notable such acquisition in November (see below).

Targets in UK M&A: Retail vs. Specialty Distributors, % of Announced UK Transactions

Notable transactions (November 2025):

- In the latest example of a UK commercial lines focused broker acquiring a Lloyd’s broker, Partners& announced that it has acquired 3 Dimensional Insurance, based in Essex.

- PE-backed digital personal lines business Ripe announced the acquisition of Schofields, a long-established family-owned holiday homes specialist based in Bolton, adding a new arm and more than 10,000 policyholders to Ripe’s existing suite of leisure products.

- U.S. PE firm Aquiline (which also owns Ripe, above) announced a majority investment in Clearwater Underwriting, a marine MGA. Clearwater was only founded in 2024 and the investment highlights a growing trend of PE investors becoming involved in backing MGA businesses at a very early stage of their development, in order to support what can often be very rapid organic or inorganic growth.

Other transactions (November 2025):

- It was reported that Manchester-based motor broker Principal Insurance acquired the business of Peart Performance Marque, a personal lines broker that entered administration in October.

- Jensten Group, flush with new capital following its recent refinancing with Bain Capital, acquired Northern Counties, a commercial broker in the North East.

- Howden acquired the business of Church of Scotland Insurance Services, which provides cover for church properties through a scheme with Aviva, and with which Howden had an existing consultancy relationship.

- In addition to its 3DI deal noted above, Partners& added Avenue Insurance Partners, a trade credit specialist previously owned by the Tavistock Group.

- The Broker Investment Group (TBIG) owned firm Mark Richard Insurance acquired a controlling stake in Portal Broking Group in Cheshire.

* Note that the YTD figure of 95 includes two unannounced deals added to our listing during November but completed in July and August. These were identified via Companies House PSC notifications. This explains why the total in this Today’s Viewpoint increases by ten since the October publication, rather than the eight deals noted above.