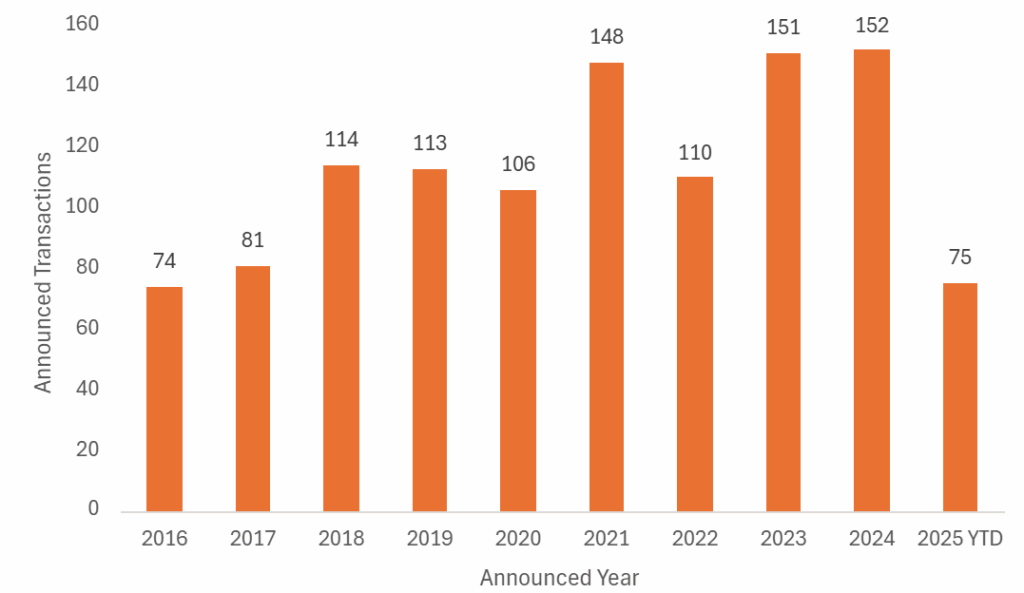

The third quarter came to an end with a flurry of new deals being announced, with September’s ten transactions making it the busiest month since April 2025 (which was of course the end of the last tax year). The quarter ended with 25 transactions, down from the 30 in Q2 and bringing the year-to-date (YTD) total to 75 deals. At the same point in 2024 the total transaction count was 114, meaning deal volumes are running 34% below the prior year. September also saw one of the biggest deals of the year – the widely trailed refinancing of Jensten Group – and a number of much smaller ones. JMG Group, with six new acquisitions announced this month, has set a recent buyer record for the most deals in a single month.

M&A Market Update

September’s new deal count of ten was (just) above the long-term average of 9.6 deals a month and began with one of the biggest deals of the year: private equity (PE) investor Bain Capital acquiring Jensten Group from Livingbridge, which first backed the business (which was then still called Coversure) in 2018. With around 1,000 staff, Jensten is the largest UK insurance distribution business (based on headcount) to have sold in 2025. Bain Capital is no stranger to the sector and earlier this year made a major investment in U.S. broker Acrisure, which has also been acquisitive in the UK but has recently slowed down M&A (mergers and acquisitions) as it seeks to deleverage, ahead of a planned IPO expected in 2026. With the new backing, Jensten is expected to again become more active in UK M&A, where it had slowed down its pace of acquisitions over the past twelve months (although it has still been quietly working on some deals and acquired a small commercial broker in Kent in August).

Total Volume of Announced UK Insurance Distribution M&A, Annual

Private equity buyers maintain pace

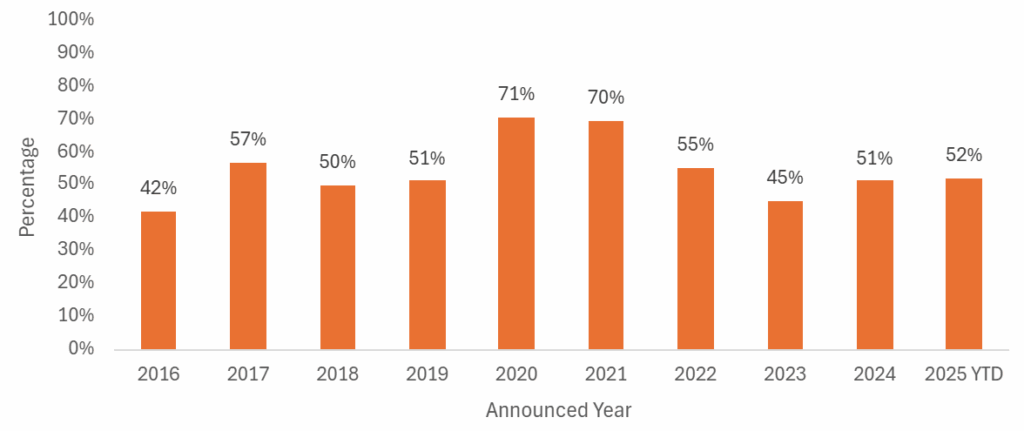

A running theme in 2025 had been a modest reduction in the proportion of UK M&A transactions that involved PE, either directly or indirectly (i.e., where the acquisition was made by a PE-backed firm). However, nine of the ten new deals (which incidentally all involved commercial broking targets) in September involved PE and given the relatively low volume of deals overall in 2025, this has pushed the proportion to just above half of all deals, which is consistent with 2024. Bain’s investment in Jensten Group is the fourth £100m+ UK transaction of 2025 involving a PE buyer, demonstrating that the consolidation opportunity in the sector still holds appeal and is attracting PE capital, even as deal volumes have fallen and the underlying pace of consolidation has slowed.

Private Equity-Backed Transactions as % of Total, Announced UK Transactions

JMG Group, with fresh backing from GTCR, announced six new deals in September. There is of course bound to be a “London buses” effect (younger readers who have grown up knowing only digital bus stop displays may have to Google what this means …) in this number, with deals that have been worked on over the summer and granted regulatory approval by the FCA all completing around the same time and being announced together. Nevertheless, six deals in a single month is no mean feat and demonstrates that the business is able to successfully identify, negotiate and perform due diligence on a large number of deals in parallel. The six businesses acquired were all relatively small and in aggregate, add fewer than 30 employees to the group, which is less than most medium-sized firms. However, medium-sized firms are now in short supply, and generally cost buyers more than small firms (<10 staff) where unadvised deals are routinely done at single-digit multiples of EBITDA. For buyers that can do these deals in consistent volumes, and then integrate the targets effectively, improving their operating margin along the way, they can be highly accretive to value.

Overseas buyers deal volume declines, but interest remains

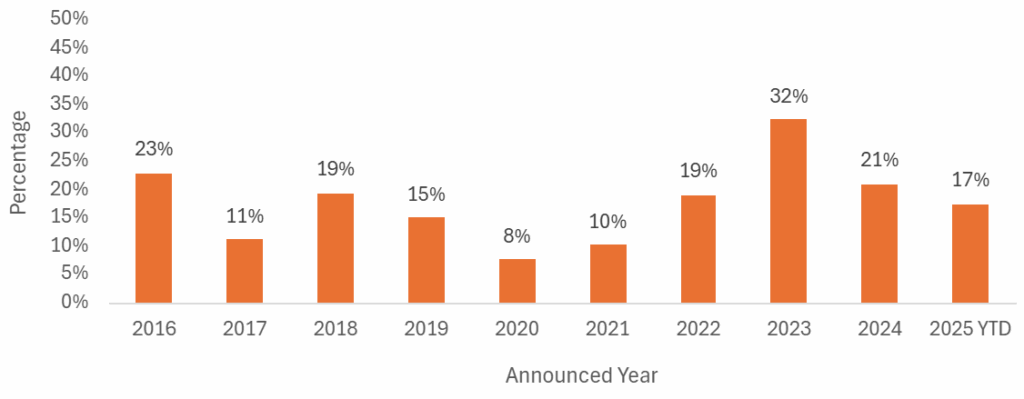

UK M&A: % of Announced UK Transactions involving an overseas buyer

Other buyers in September included Partners& and Specialist Risk Group, both UK firms. There have been 45 unique buyers in 2025, across 75 deals. Only 13 transactions (or 17% of all deals) have involved an overseas buyer, which is the lowest level since 2021. However, this does not mean that the UK has lost its allure for overseas acquirers, or that the trend of increased internationalisation and cross-border M&A has reversed. It is largely the result of a reduced volume of smaller UK M&A from some of the U.S.-based acquirers that have been most active in recent years (e.g., Gallagher, Brown & Brown) during a period when several domestic UK consolidators have been very busy (e.g., the aforementioned JMG Group).

Those same U.S. buyers have been undertaking large transactions over the past twelve months, including in overseas markets. More North American buyers continue to weigh up acquisitions in the UK and there’s likely to be continuing inflows of U.S. (and indeed European) capital into the sector in the coming months.

Notable transactions (September 2025):

- The biggest transaction of the month saw U.S. PE firm Bain Capital acquire consolidator Jensten Group from Livingbridge, in a deal that had been widely expected following reports in the trade press several weeks ago. It was widely known that Livingbridge had been seeking an exit.

- JMG Group announced six acquisitions: Allsop Commercial Services in Gainsborough, Highhouse Insurance Services in Sussex, Insursec Risk Management in Essex, Boston Insurance Brokers in Solihull, Hayton Insurance Brokers in Kendal, and Gateway Insurance Services in Scotland.

- Specialist Risk Group continued its strong run of deals in 2025 with the acquisition of Champion Insurance Group, a retail broker based in Manchester that will strengthen SRG’s presence in the North West.

Other transactions (September 2025):

- Partners& acquired Citytypes, a commercial broker in Nottingham that trades as Pargeter & Associates.

- In August Jensten Group acquired Martin Insurance Services in Kent. Note, this deal was not reported in MarshBerry’s August UK M&A Update but is being included here and is in the figures above. During September Lloyd & Whyte was reported in the trade press to have acquired holiday home specialist Boshers, in a transaction that was highlighted in their annual report but had in fact happened several months ago.