M&A Market Update

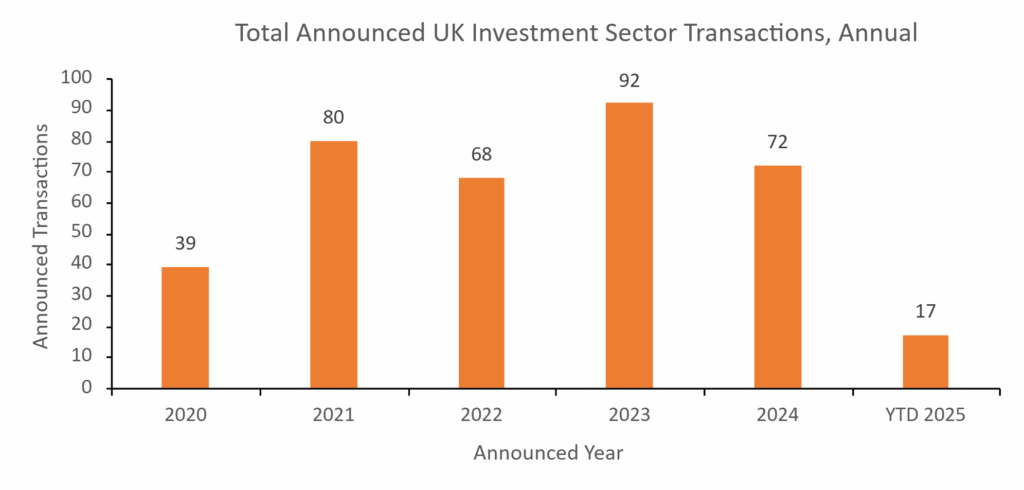

The volume of investment sector merger and acquisition (M&A) transactions above £5m of value halved in April to three, slowing the progress seen during March and returning to the levels seen in February.

Two of the deals this month involved private equity-backed (PE) consolidators acquiring wealth managers, with AAB Wealth snapping up Magus Wealth and Shackleton continuing its acquisitive streak with the purchase of IM Asset Management. The other deal this month involved Schroders-owned Benchmark Capital acquiring the remaining minority stake in boutique advice network Oculus Wealth Management. What isn’t shown in the chart below is the strong activity at the lower end of the market, below £5m of value, where the consolidators Finli Group and Soderberg announced several transactions each.

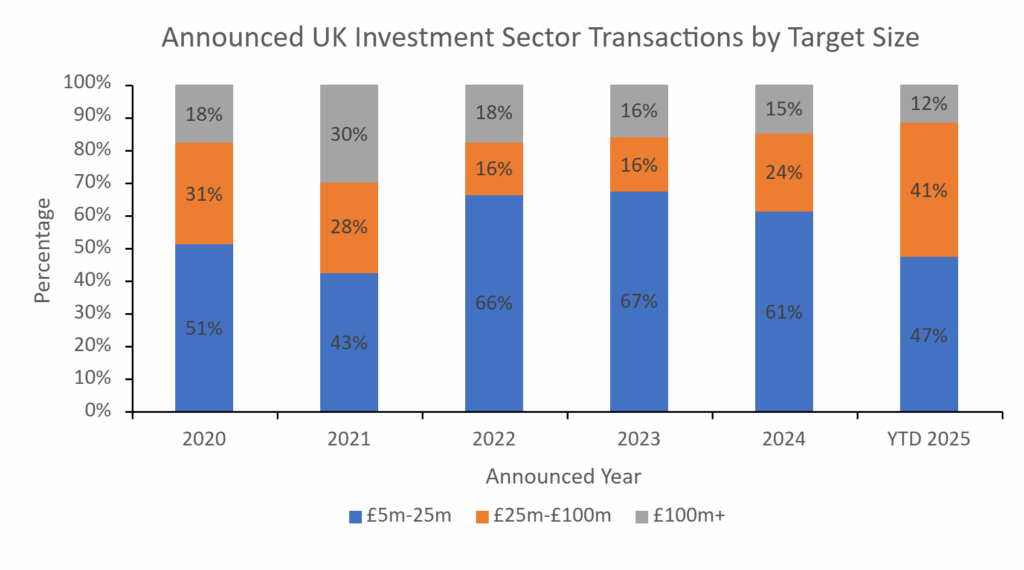

There was only one smaller deal during the month with a value between £5-25m whereas two transactions were over £25m. This is consistent with the trend that can be seen in the year-to-date (YTD) increase in the number of transactions in the £25-100m value range, the highest proportion of the total in five years. It reflects the consolidators’ growing scale and focus on quality opportunities in the mid-range of the value spectrum. Activity at the higher end above £100m of value remains subdued.

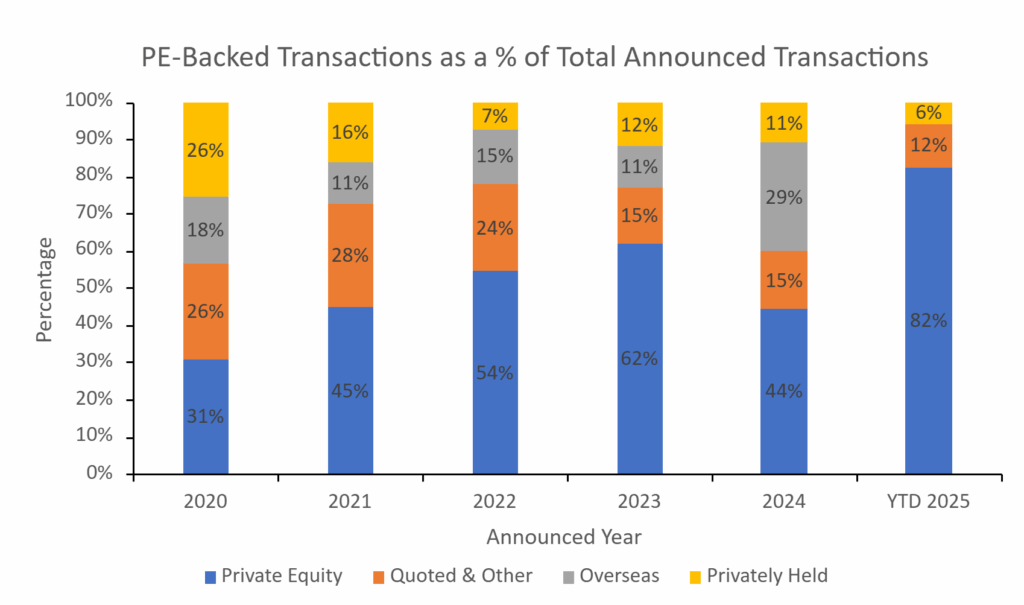

As in Q1, PE was the most prolific acquirer group during April, with two of the three acquirers having PE-backing. In the YTD figures, 82% of acquirers were linked to PE, either as direct investors or via their portfolio companies. One of the deals during the month concerned a quoted group’s subsidiary network, showing public companies’ contribution to the consolidation of the sector.

Notable transactions (April 2025):

- Benchmark Capital announced it had agreed to acquire the remaining minority stake in Harrogate-based advice network Oculus Wealth Management. Oculus operates an IFA appointed representative model with 46 advisory firms and has partnered with Benchmark since 2015, with Benchmark subsequently taking a stake in Oculus in 2022.

- AAB Wealth announced the acquisition of London-based Magus Wealth, adding £650m of assets under advice (AUA) and taking its total AUA to £1.8bn. The deal increases PE-backed AAB’s total staff count to over 1,000 (which includes AAB’s professional services divisions) and expands the bandwidth of its wealth management services in London.

- Shackleton Group announced it had acquired IM Asset Management (including TWP Wealth) from law firm Irwin Mitchell, launching a personal injury and court of protection division in the process. The deal will bring 20 advisers and client assets of £1.4bn to the PE-backed consolidator.

Other UK transactions (April 2025):

- Finli Group announced the acquisition of five financial planning firms: Somerset-based Beaufort Financial Taunton (Mark Cooper) and Simon Brannigan; London-based Elaine Snow; Merseyside-based Penny Smith; and Cardiff-based Lifestyle Financial Choices. The transactions added an additional £220m of client assets in aggregate to Finli.

- Soderberg & Partners announced it had invested in four more advice firms: Chorley-based Cheetham Jackson (£775m of client assets); Buckinghamshire-based Blakes Financial Management (£125m of client assets); North East-based Active Financial Planners (£450m of client assets); and Glasgow-based Murphy Wealth (£250m of client assets).

- Scottish Friendly announced the acquisition of the pension and annuity books from Fidelity International. The acquisition includes a £2.16bn Section 32 pensions book covering 40,000 policyholders across 76 schemes.

- Titan Wealth announced the acquisition of Stoke on Trent-based workplace pensions solutions business Workplace Advice Group, bringing its total assets under management and advice to £36bn.

- MKC Wealth announced it had acquired fund research and advice firm Yodelar Investments and Yodelar.com, adding £120m of AUA.

- Beckett Investment Management announced the acquisition of Suffolk-based advice firm Green Rose.

- Quilter acquired MediFintech, a specialist provider of NHS pension analysis and support services.

- Newcastle Financial Advisers announced the acquisition of County Durham-based financial planning firm Orchard Financial Management.

- The Westerby Group announced it had acquired Manchester-based pension provider and IFA firm Redswan.

- FE Fundinfo announced the acquisition of Lunar AI, a provider of artificial intelligence enabled support solutions to investment managers.