M&A Market Update

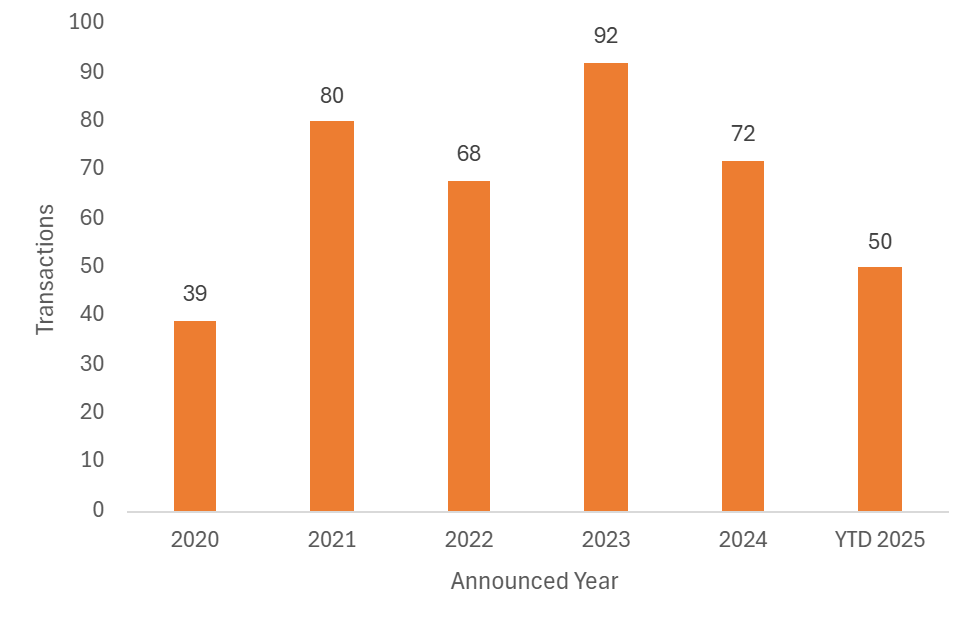

Transactions involving deals above £5m were few and far between in October, with only four deals recorded, bringing the year-to-date (YTD) total to 50. This represents a modest slowdown compared to the same period in 2024, when deal volumes were slightly higher at 57.

During the month, two notable transactions involving wealth management firms were announced: AFH Financial’s acquisition of Avidity Wealth Management and Sovereign Capital Partners’ investment in Equilibrium Financial Planning. The latter is another addition to the growing list of private equity (PE) backed consolidators in the UK wealth management market. The remaining two deals focused on fund management, including U.S.-based Ares’s acquisition of systematic fixed income specialist BlueCove and Australia-based EC Pohl & Co’s purchase of equities manager Sanford DeLand Asset Management.

Total Announced UK Investment Sector Transactions, Annual

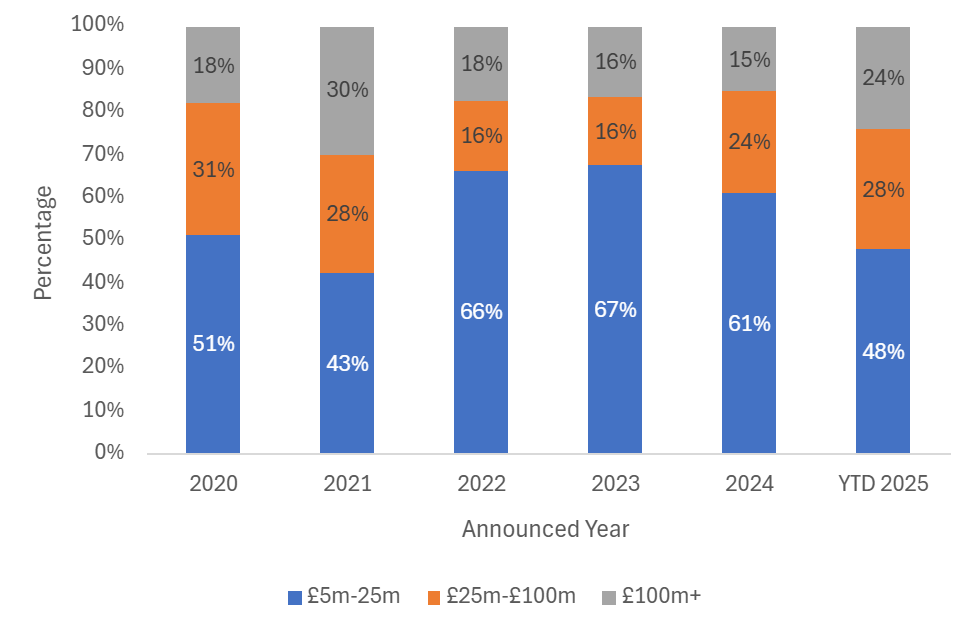

Deal values trended lower in October, with all four transactions valued below £100m. While YTD there were several deals that breached the £100m threshold, October’s figures reflect a reversion to smaller deal sizes, reflecting more bolt-on acquisitions which are typically below £25m. Despite this, the YTD proportion of deals above £100m still remains significantly higher than the historical norm.

Announced UK Investment Sector Transactions by Target Size

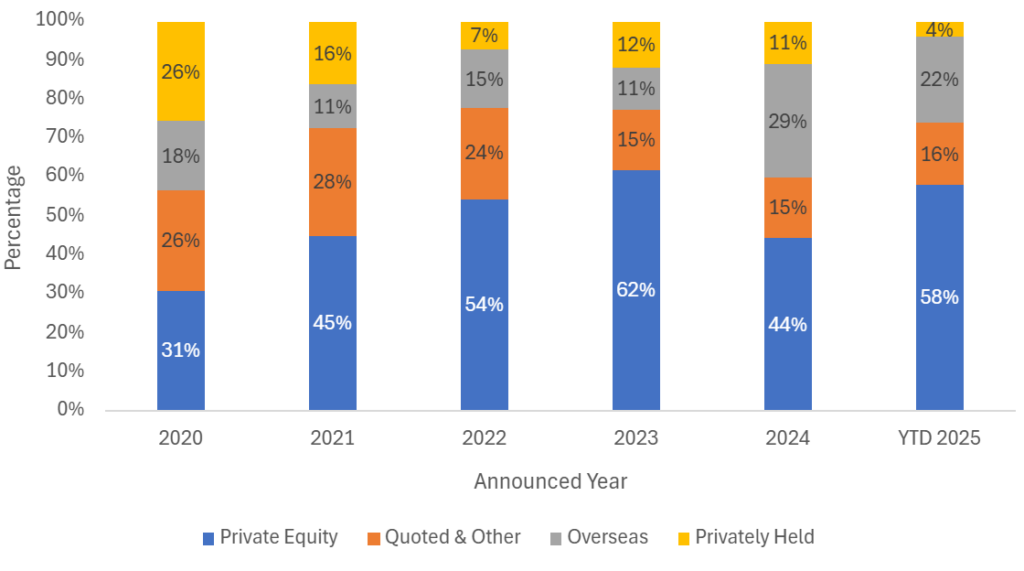

PE remained the dominant acquirer group in October, participating in three of the four deals either directly or via PE-backed platforms. This underscores PE’s continuing interest in the investment sector with its attraction to the scalable recurring revenue models. Notably, overseas acquirers—while less active than in 2024—have regained momentum in recent months, indicating renewed confidence in UK market fundamentals and long-term growth prospects.

PE-Backed Transactions as a % of Total Announced Transactions

Notable transactions (October 2025):

- Sovereign Capital Partners announced the acquisition of Handforth-based Equilibrium Financial Planning. Sovereign’s investment will support Equilibrium in pursuing a national buy-and-build programme with the aim of adding to its current £1.3bn of client assets. Sovereign has experience in the wealth management space, having previously backed Shackleton from 2021 until its sale to Lee Equity in June 2025.

- Turicum Private Bank announced the acquisition of a stake in London-based Hassium Asset Management. The transaction marks Gibraltar-based Turicum’s entry to the UK market, enhancing client service with expanded investment and banking capabilities.

- AFH Financial announced the acquisition St. Albans-based advice firm Avidity Wealth Management, adding £750m in AUM (assets under management) and c.1,800 clients. Following completion, Avidity will be rebranded as AFH Wealth Management St Albans.

Other UK transactions (October 2025):

- Finli announced the acquisition of four financial planning firms: Stirling-based Catterson Wealth Management, Swindon-based Groundwell, Birmingham-based Oaklands Wealth Management and Chester-based Peter Guy Financial Planning. Combined, the deals add a total of £259m of client assets to Finli and expand its regional presence.

- Hoxton Wealth announced the acquisition of Manchester-based Haven IFA adding £140m of client assets.

- MKC Wealth announced the acquisition of four financial planning firms: Kingston-Upon-Thames-based Money Flow, Surrey-based Goldcrest Financial Planning, Suffolk-based Berg-Davies Associates and Sherpa Financial Solutions in London.

- Titan Wealth announced the acquisition of Gibraltar-based international advice firm Blacktower Group, adding £2.2bn in assets under management.

- U.S.-based Ares announced the acquisition of London-based systematic fixed income manager BlueCove.

- Australia-based investment firm EC Pohl & Co announced the acquisition of London-based Sanford DeLand, the asset manager behind the £286m UK Buffetology fund.