M&A market update

August proved to be a dynamic month in the sector, with notable developments across mergers and acquisitions (M&A), strategic exits and funding of new growth vehicles. Two new consolidators were created via platform investments in the wealth management market, one of which is linked to Paul Hogarth – renowned for his success with Perspective and Tatton. His involvement suggests it will likely become an active acquirer of IFAs (independent financial advisors). In a strategic shift, Aberdeen announced its exit from the financial planning market and Intelliflo began a new chapter under the ownership of U.S. private equity (PE) firm Carlyle, marking a significant milestone in its growth journey. The retail savings space also saw further consolidation with Octopus Money acquiring Virgin Money’s investment business. In total, five deals exceeding £5 million in value were recorded across the investment sector during August, reflecting continued momentum in M&A.

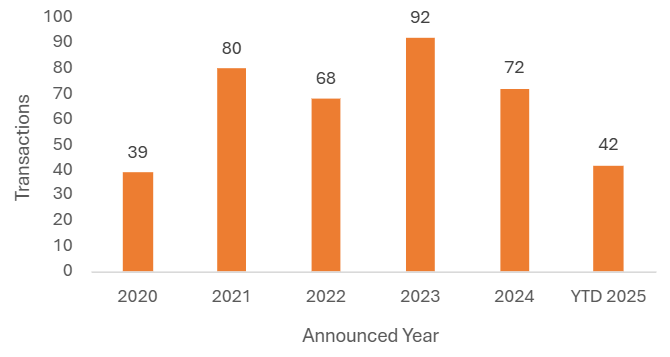

Total Announced UK Investment Sector Transactions, Annual

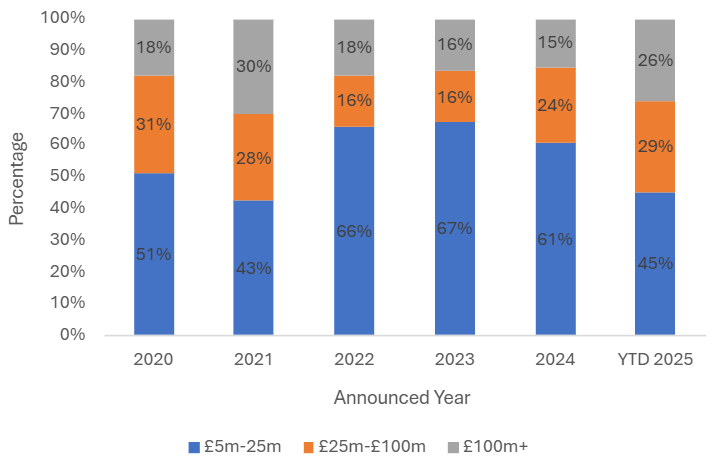

Deal activity in August was balanced across the market spectrum, with three transactions exceeding £25m in value, including one above £100m. This marks a moderation from the concentration of larger deals seen in July and signals a return to a more typical distribution of deal sizes. Year-to-date, most UK transactions (74%) remain below £100m, consistent with historical norms.

Announced UK Investment Sector Transactions by Target Size

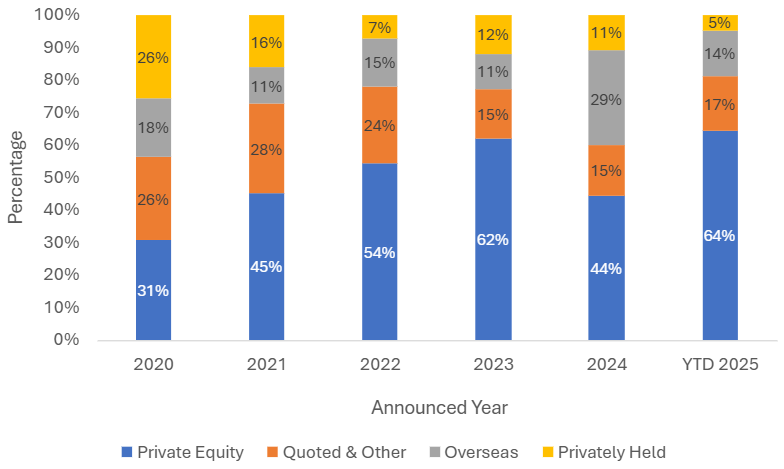

PE-backed buyers remained the dominant acquirer group in August, accounting for four out of the five recorded transactions, either directly or through portfolio companies. The remaining deal involved a privately owned buyer, only the second such transaction in 2025. This aligns with historical patterns, where privately owned firms tend to be one of the least acquisitive cohorts. Notably, there were no acquisitions by overseas or publicly listed buyers during the month.

PE-Backed Transactions as a % of Total Announced Transactions

Notable transactions (August 2025):

- Absolute Financial Group launched with the acquisition of Absolute Financial Management, a Kent-based IFA firm advising on £1.1bn in client assets. The national advice consolidator raised a commitment of £115m from a consortium including Inflexion Private Equity, Tatton Asset Management, and the senior management of Tatton. The group will be led by David Carter as chief executive and Paul Hogarth as non-executive chair.

- Carlyle announced it had acquired Intelliflo from Invesco in a deal worth up to $200m (£149m). London-based Intelliflo provides cloud-based practice management software to over 2,600 advisory firms, supporting £450bn in client assets. The acquisition includes Intelliflo’s U.S. subsidiaries RedBlack and Intelliflo Portfolio, which will be carved out as standalone entities. Carlyle will support growth in the UK and Australia in a move that resembles Blackstone’s purchase of Iress, the parent company of Xplan, and highlights the sustained institutional interest in technology platforms serving financial advisers.

- Aberdeen announced the sale of its financial planning business, Aberdeen Financial Planning (formerly 1825), to Ascot Lloyd. The Edinburgh-based unit adds £3.6bn in assets under advice (AUA) and 6,300 clients, bringing Ascot Lloyd’s total AUA to £14.5bn. The deal supports Aberdeen’s strategic focus on its core wealth and investment platforms.

Other UK transactions (August 2025):

- K3 Capital Group launched a new financial services division through investments in Manchester-based Pareto Financial Planning and Luna Investment Management. Pareto advises individuals and SMEs across pensions, investments, and tax planning, while Luna offers discretionary fund management. The move marks K3’s fifth operating division and expands its lifecycle advisory model.

- Perspective Financial Group completed five acquisitions: Lifestyle Financial Services, Sirius Money Management, Mat White Financial Services, Sapient Wealth Management, and Bayham Wealth. The deals add a total of £310m in AUA, 825 households and new offices in Crewe, Cheshire, bringing Perspective’s total acquisitions to 121.

- Advies Private Clients, backed by Saltus, acquired the London-based, specialist IFA Nicholas Trayford, adding 100 clients with £100m in assets. The addition enhances Advies’ presence in the South East.

- Pivotal Growth, backed by LSL Property Services and Pollen Street Capital, acquired Bedford-based More Choice Financial and Northern Ireland-based McPolin Financial Services. The firms will be integrated into existing subsidiaries Grange Mortgage and Select Mortgage, respectively, strengthening Pivotal’s UK footprint.

- Octopus Money announced the acquisition of Virgin Money’s investment business, adding £3.8bn in assets and 150,000 customers. The deal accelerates Octopus’ growth in the direct-to-consumer wealth market and expands its hybrid digital-advice platform.

- JTC announced the acquisition of Kleinwort Hambros’ trust business from UBP for £20m. The 70-year-old trust arm will be integrated into JTC’s Private Client Services division, strengthening its Channel Islands presence and adding a UK trust business for the first time.

- Brown Shipley announced it had sold its international expat high net worth arm to Investec Switzerland. Following the agreement with Brown Shipley, a team comprising five client advisers and a small group of dedicated support staff is set to join Investec in early 2026.

- Hoxton Wealth announced it had acquired Malaysia-based expat services provider Infinity Financial Solutions, adding £225m of assets under management. The deal marks Hoxton’s largest acquisition to date and its first in Asia, expanding its international footprint.