Many years ago, at a barbeque, a smart investment banker remarked, “I don’t think house prices in Chelsea will ever go down.” The response offered was, “I’m sure you’re right, but that’s also the one condition you need to create a bubble.”

The smart banker remained correct for many years—until he wasn’t. A Savills report this month stated, “prices in the prime markets of central London are now -22.4% below their 2014 peak.” While early entrants to the market likely performed well, latecomers may have suffered losses.

The UK insurance distribution market is undergoing a similar moderation. The declines in valuation are far less dramatic, but many private equity-backed (PE) firms expecting exits at 16 to 20 times EBITDA (earnings before interest, taxes, depreciation and amortization) have had expectations tempered. The recent sale of AssuredPartners to Gallagher at a reported low teens EBITDA multiple—despite specific contributing factors—has influenced sentiment. Other large recent transactions have also closed at lower-than-anticipated multiples, and pricing at the top of the market quickly filters down to smaller deals.

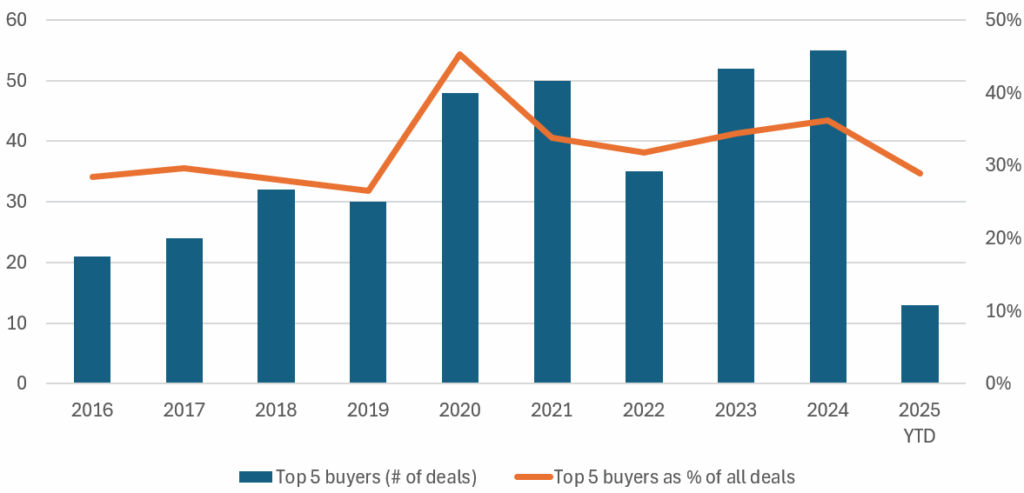

A classic sign of an overheated market is dominance of merger and acquisition (M&A) activity by a handful of the most active buyers, which suggests a rush for scale and urgency to deploy capital, rather than decisions based on fit or commercial logic. That dynamic peaked in 2020 and has decreased substantially in 2025.

UK insurance distribution M&A – Top 5 buyers by deal numbers and as % of all deals

A common phrase when house prices surge is, “first-time buyers are being priced out of the market.” And the reverse also holds true. As prices drop, new buyers get more opportunities. A similar silver lining exists in insurance distribution M&A: As the largest buyers account for a smaller share of transactions, a wider pool of buyers—not necessarily first-timers—are gaining the opportunity to compete.

Today, deal volume in the U.S. far exceeds that in the UK—yet there’s still less market consolidation. But large supply is not the same as infinite supply, which is why many U.S. firms are expressing interest in establishing a UK presence as a platform for the sort of European expansion that can help them maintain the deal momentum that has driven growth.

But even this interest is not immune to market trends. The recent strong pricing of UK broking assets raises the question, why buy in the UK, with all the attendant issues of acquisitions in a foreign country, when there remains so much to be done in the U.S.? The recent amelioration of prices is widening the buyer pool.

All of this continues to keep MarshBerry busy, having been recently tasked by a major Middle Eastern conglomerate to conduct a comprehensive review of the Lloyd’s broking sector; facilitated an in-office meeting between an Iberian broking group and a London Market broker; and have set up face-to-face meetings with a North American broker interested in acquiring a UK retail broker. Similar activity is expected to continue.

It’s encouraging to see the market once again prioritizing strategic fit over scale for the sake of scale. In this type of market, experience, focus, network, and strategic insight is what truly differentiates advisors

With over 30 years in the market and a reputation for producing best-in-class research, MarshBerry can selectively engage the full range of global buyers—across the UK, the U.S., Europe, and beyond. And MarshBerry recently expanded its reach in Europe by adding a dedicated German team—expanding the presence to 20 professionals based on the continent.