The phrase “Don’t sweat the small stuff” was popularized by Dr. Richard Carlson in his 1997 book of the same name, aimed at helping people manage stress by focusing on what truly matters.

In consulting, however, the mantra has evolved into “Sweat the big stuff.” No business ever scaled to greatness by obsessing over paperclip budgets—though there is the oft-cited (and likely apocryphal) tale of a senior executive walking out of a marketing meeting baffled as to why so much time was spent discussing “paperclips.”

In insurance distribution, the “big stuff” for driving growth is people. With ongoing challenges around attracting and retaining skilled professionals, the focus is less on reducing headcount and more on getting the most from existing teams. This often involves prioritizing the most profitable clients, even if that means letting go of the least profitable ones.

Platform vs Average Firms: What Drives Insurance Broker Valuations

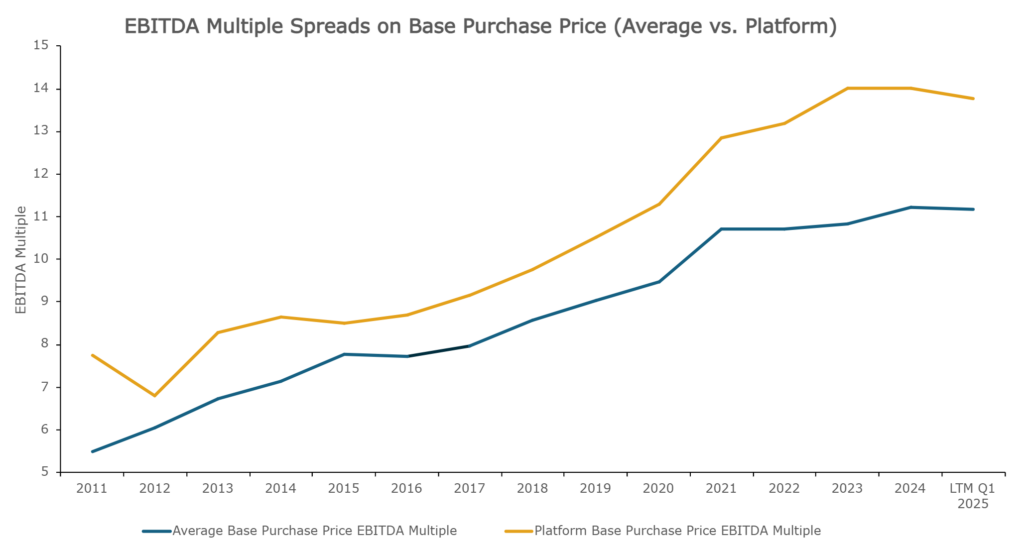

Merger and acquisition (M&A) strategies for insurance brokers are evolving as well. For more than a decade, deal pricing (typically expressed as a multiple of EBITDA) has been steadily increasing across European markets. This trend has driven a focus on acquiring EBITDA rather than generating real organic growth, as consolidators aim to leverage earnings arbitrage from scale.

But there’s a downside: when acquisition targets lack strategic fit or operational synergy, the promised efficiencies from integration never materialize—and organic growth often stalls or even reverses.

As a result, we are now seeing a significant divergence in valuation between (truly) integrated businesses and non-integrated ones.

Buyers of insurance brokerages are shifting their focus from pure EBITDA multiples to considerations of business fit, integration potential, and talent retention—all key to sustaining long-term organic growth.

Although the headline number of potential buyers in the market hasn’t changed dramatically, the real buyer pool has narrowed, particularly for the largest businesses. Strategic fit has become a top priority for consolidators.

EBITDA Multiples and Integration: The Big Stuff That Matters

Increasingly, insurance M&A buyers want to know that the leadership of the target insurance brokerage business is committed to “staying onboard” and willing to work collaboratively within a larger consolidated platform organization. A well-run process should deliver the right headline numbers. Management meetings with potential buyers, before offers are submitted, should focus on the commercial benefits of the transaction. Detailed negotiations between heads of agreement should seek to address the needs of both parties. The less risk the buyer perceives in a transaction, the greater the price the buyer will be willing to pay. So, seeing the deal from the buyer’s perspective can actually increase the insurance broker’s valuation.

Insurance Broker Earn-Out Negotiations: The Small Stuff

The normalisation of EBITDA earnings is an important part of an insurance broker transaction and something the adviser will quantify and provide support for. But insisting that a “£500 sponsorship of the local youth rugby club should be added back into the EBITDA” will suggest to the buyer that reaching compromises during the earn-out period will be difficult and could strain the relationship.

Nitpicking over trivial items as parties move to completion—such as the premises dilapidations, a perennial last-minute haggle in an M&A deal but often representing perhaps 0.1% of the deal value—can damage the trust built up earlier in the process that is so necessary for a successful long-term partnership.

With this growing emphasis on strategic alignment and team dynamics, sellers must work to build constructive, trust-based relationships with potential acquirers to maximize long-term value for both parties, who should operate as partners. Not sweating the small stuff, and focusing on what truly matters, is important in managing stress, running a business, and increasingly – in achieving a successful exit.

| Category | Value Drivers | Value Detractors |

|---|---|---|

| Focus Area | Strategic fit and integration potential | Minor EBITDA adjustments |

| People | Leadership commitment to stay onboard | n/a |

| Financial | Long-term organic growth potential | £500 sponsorship add-backs |

| Integration | Willingness to work within larger organization | Resistance to operational changes |

| Negotiations | Commercial benefits of the transaction | Nitpicking over trivial items |

| Deal Terms | Collaborative earn-out approach | Haggling over 0.1% items (e.g., dilapidations) |

| Relationship | Building trust-based partnerships | Straining relationships over minor issues |

| Buyer Perception | Reduced transaction risk | Difficulty reaching compromises |

| Value Impact | Increases purchase price willingness | Damages trust and reduces value |

| Long-term View | Sustainable growth and synergies | Short-term thinking |

For the latest insights and analysis into the UK insurance distribution landscape and industry trends – download MarshBerry’s Insurance Distribution Market Report – UK.