Estimated Reading Time: 5-7 mins

Over the past three years, a hard insurance market has allowed most brokers to achieve significant organic revenue growth in insurance brokerage. However, many firms have grown complacent, relying on increased revenue driven by higher insurance premiums within their existing client portfolios. As insurance premiums inevitably stabilise or decline in the years ahead, it will become clear which firms are genuinely attracting new business and which have been dependent solely on favorable market conditions to maintain their growth. Generating true organic growth can bring greater value to brokers and enhance the health of an organization.

Defining “Real” Organic Growth in Insurance Brokerage

Unlike industries reliant on one-time, transaction-based income, the insurance broking sector depends heavily on recurring revenue streams from its existing book of business. While this model ensures a stable and predictable income foundation, it often places greater emphasis on client retention, with less focus on aggressively pursuing new business opportunities regardless of hard or soft market conditions.

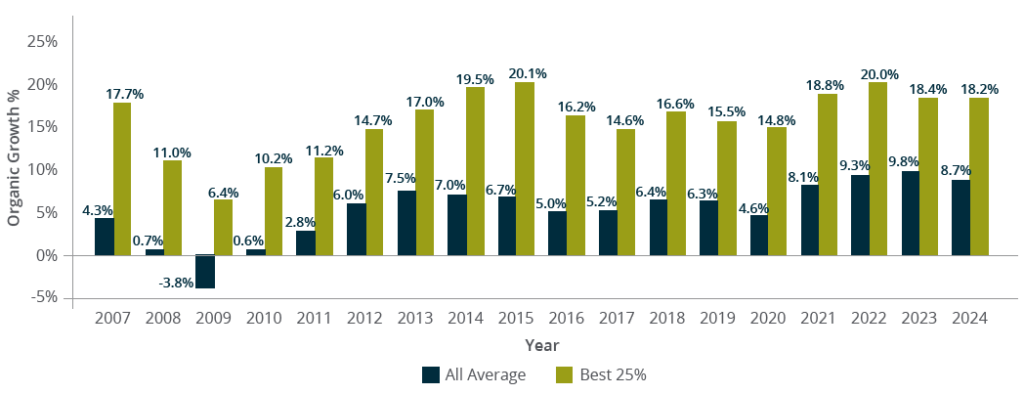

PHP Benchmarking: 8.7% Average vs. 18.2% Peak Performance

MarshBerry’s proprietary insurance broker financial benchmarking system, Perspectives for High Performance (PHP) evaluates key financial metrics, benchmarking them against both average performers and top performers (the top 25% of firms in the dataset). The chart below shows that while average firms achieved organic growth of 8.7% in 2024, peak performers reached an impressive average of 18.2%. This highlights the key differentiation in organic growth. These best-performing firms not only maintained high retention rates within their existing book of business but also excelled in generating significant new business.

Creating an Insurance Broker Organic Growth Platform

Companies achieving the most growth follow diverse paths. However, what all peak performers have in common is a clear and well-defined organic growth target. They don’t leave insurance broker revenue growth strategies to chance but instead commit to and plan for specific, measurable goals, then create a strategic roadmap to achieve them. This deliberate approach ensures sustainable growth that isn’t reliant on external factors like hard market cycles or incidental opportunities.

Setting goals is the visionary and inspirational part of the process, but enacting organisational change is the real challenge. Resetting rewards and pushing accountability, training for the future, developing leaders is all hard work. But the payoff can be a sustainable organisation with strong organic growth that is poised for profitability over the long-term. And while employees may feel uncomfortable with the plan at first, they will start to feel a sense of stability as the environment changes where they can do their best work and drive profitability.

Organizational Change Management for Growth

But the payoff can be a sustainable organisation with strong organic growth that is poised for profitability over the long-term. And while employees may feel uncomfortable with the plan at first, they will start to feel a sense of stability as the environment changes where they can do their best work and drive profitability.

In addition, peak performers in this industry do not allow external conditions to serve as excuses for success or failure. The best-performing insurance brokers share a fundamental belief: success is measured by delivering results, no matter the market conditions—whether it’s a soft market, hard market, recession, or economic boom.

Measuring and Improving Organic Growth: 5 Essential KPIs

When calculating “real” organic growth, you must consider the impact of things like inflation and rising insurance premiums. Many insurance brokers who boast a strong performance may find a different story when inflation-adjusted figures are taken into account. Calculating real organic growth is critical to gaining an accurate picture of your firm’s true performance. While there is no single formula for calculating organic growth in insurance brokerage, there are dozens of key performance indicators (KPIs) that can help track progress and offer measurable results, including:

- Customer retention: This refers to a firm’s ability to retain clients. A higher retention rate is linked to better organic growth, and client advisors have more time to focus on new business.

- Sales velocity: Sales velocity shows a firm’s growth in new business over the prior year. When faced with a hardening market, sales velocity is one of the strongest indicators of true organic growth because it does not include growth from existing policies.

- Total revenue per employee: Revenue per employee measures employee productivity. Generally, the higher this number, the greater the employee productivity.

- Average account size: Increased average account size is one of the main drivers of organic growth.

- Pipeline: This metric shows the number of prospects in various stages of the sales process and can indicate whether new business goals are on track.

Insurance Broker Organic Growth Quick Assessment

Rate Your Current Performance:

- Growth Rate Assessment

- Our organic growth exceeds 8.7% (industry average)

- We’re approaching 18.2% (peak performer benchmark)

- We track inflation-adjusted growth metrics

- Strategic Planning

- We have clearly defined organic growth targets

- We’ve created a strategic roadmap for growth

- Growth planning isn’t left to chance

- Market Independence

- Our growth isn’t solely dependent on premium increases

- We maintain growth regardless of market conditions

- We actively pursue new business opportunities

- Key Metrics Tracking

- Customer retention rate is monitored regularly

- Sales velocity (new business growth) is measured

- Revenue per employee is tracked

- Average account size is analyzed

- Sales pipeline is actively managed

- Organizational Readiness

- Rewards are aligned with growth objectives

- Accountability systems are in place

- Leadership development programs exist

- Employee training focuses on future needs

Scoring:

- 12-15 checks: Peak Performer Territory

- 8-11 checks: Above Average

- 4-7 checks: Average Performer

- 0-3 checks: Immediate Action Needed

Real organic growth is the heartbeat of a firm’s success. It’s likely that conditions will eventually shift to a soft market environment and less generous rate environment, so firms won’t be able to grow just due to high premiums. Accurately measuring organic growth for insurance brokers in Europe unlocks a clear vision of where a business stands today—and where it is destined to go tomorrow.

Download the 2025 Market Report Insurance Distribution in Europe and read about the latest trends and developments in the industry, exclusive insights into the Top 20 largest European brokers and answers to other key questions shaping the future of insurance broking.