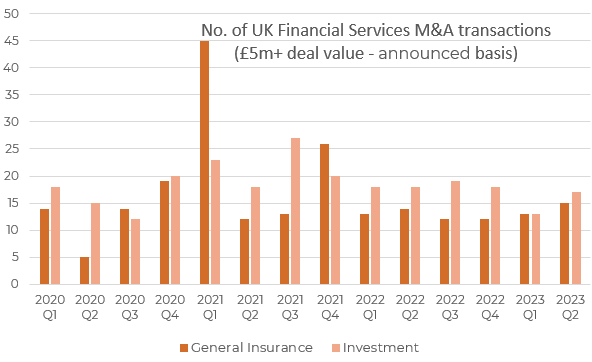

M&A volumes (announced basis) in UK Financial Services during Q2 were slightly ahead of Q1 2023 in both the General Insurance and Investment sectors. However, one has to be cautious about what these statistics say about market conditions today, for two reasons. Firstly, M&A is a bit like London buses (of old). One could wait for some time only to have three come along at once. Secondly – and more importantly – announced deals are a lagging indicator. Deals announced today reflect transactions agreed upon typically some 6 to 12 months ago.

Conditions have of course changed as the era of very low interest rates has gone and more broadly consumers face increasing pressures on the cost of living. That said, UK real interest rates are still negative (actual interest rate less inflation); this offers little immediate comfort to consumers, or those lending to them.

In the investment sector M&A volumes in 2023 YTD were very similar to those seen in 2022. Looking forward, activity remains robust and headline deal prices remain largely unchanged. The higher financing costs and risk of a recession/fall in equity valuations has resulted in more transactional risk being shouldered by sellers, with the earn-out elements increasing. Ongoing fee pressures encourage many trade buyers to look to replace organic growth with acquisitions. This same pressure means potential targets recognise that their value may be unlikely to increase much over the short to medium term, accelerating the decision to sell.

The experience of the Insurance industry is somewhat different. Scarce and costlier capital tends to push up rates, increasing commission-based earnings on the distribution side. Unlike saving, the majority of insurance expenditure – by companies and individuals – is non-discretionary and so short of a deep recession, industry revenues are robust. Most clients also pay upfront, so the industry typically has large cash balances to act as a nature hedge. Demand for targets is still outstripping supply and with highly predictable earnings, if anything we have recently seen purchasers willing to pay higher amounts upfront to secure acquisitions.

Valuations in many segments of the UK financial services sector remain near all-time highs. In part we have the FCA to thank for this. A demanding approval process and increased regulation creates a significant barrier to entry, pushing up the value of existing entities. Eventually interest rates are likely to fall back again. There is no suggestion that the FCA is looking to open any flood gate.

We are always happy to talk to clients thinking of selling, about macro issues or the details of their own businesses.

Insurance

When I wrote the first draft of this newsletter on Monday, the story was one of UK Insurance M&A activity beginning to slow as we got into summer, as at that point we had only eight new transactions to report on. However, over the course of the past five days there has been a flurry of newly announced deals (which we count as June) and that figure has doubled, suggesting that there has been no let-up in the frenetic pace of sector M&A we are seeing in 2023.

June’s transactions were all on the distribution side, with 15 broking deals and one acquisition of a network. Several of the ‘usual suspects’ on the buyside were active and indeed four different buyers announced more than one deal during the month. June’s deals were all also relatively small, with no transaction valued at above £25m during the month (based on IMAS estimates).

In the most high-profile transaction of the month, US group Acrisure became the latest consolidator to have an owned network proposition with the acquisition TEn Insurance Services, which it has announced it will rebrand as Eleven Network (geddit? It’s one louder).

In broking, J.M. Glendinning continued its busy 2023 (it is the most active UK buyer YTD based on number of announced deals) with two new announced transactions, adding G R Marshall & Co in Southampton and Blackfriars Group in Cheshire. Ardonagh also announced two new UK deals, adding York-headquartered PB Curran and self-drive hire specialist Sentinel Insurance Solutions in Reading. Both will sit within the Ethos Broking segment of the group. Global Risk Partners acquired both Amicus Insurance Solutions in Surrey and KPTI (trading as IS Insurance Solutions) in London. Finally, Clear Group also added a brace, announcing deals for MJB Finningley in Amersham and Mayor Broking in Doncaster, both small deals and conveniently located close to existing Clear offices.

Elsewhere amongst the mainstream broking consolidators (none of whom ever thank me for describing them as such…), AssuredPartners added recycling specialist GM Insurance Brokers in Exeter, Howden announced a deal for Film & TV specialist Media Insurance Brokers International, Jensten Group added Simpson and Parsons in the Lake District, and Partners& continued to build out its presence in Scotland with the acquisition of Hart Insurance Brokers in Helensburgh.

Among the less frequent buyers, Australian group PSC Insurance was revealed in Companies House filings to have acquired commercial broker Turner Rawlinson & Company in London, in an unannounced transaction that actually completed in the Spring.

Lastly in commercial broking, Peter Cullum’s The Broker Investment Group was reported to have bought out Hallsdale Insurance Brokers in Kettering, a business in which it already owned a minority stake.

In personal lines, Kingfisher Insurance announced that it had acquired the business of REIS Motorsport Insurance, a specialist broker that has previously been part of the Markerstudy group, who had acquired the business from Chaucer in 2015.

Investment

M&A activity in the investment sector did not slow during June, with another strong month of deals particularly in the wealth management sector, including Evelyn’s acquisitions of Dart Capital, adding £739m of AUM, and Glasgow-based PPM Wealth, expanding Evelyn’s footprint further in Scotland. Adviser Services Holdings Limited announced two further additions to its national advice business, Lync Wealth Management with the acquisition of Friarsgate Financial Planning (Chester) and Richard Armitage Wealth Management South West, increasing AUM by £200m. Tyron Edmonds, the former CFO of St James’s Place partner firm, Morrison Wealth, acquired Jackson Hodge Wealth. Perspective Financial Group increased its AUM by £310m with another streak of acquisitions, purchasing Brighter Financial Services in Halifax, Airedale Personal Financial Solutions in Holmer Green, Granite Coast in Cambridge and Brigham Wealth Management in Harrogate, marking twelve acquisitions for the company in 2023. Shawbrook-funded advice network, Corbel Partners, with over £2bn AUM, acquired Midlands-based Wealth Design Holdings. Jersey-based asset manager, Team Plc, announced the acquisition of Isle of Man-based Thornton Chartered Financial Planning, increasing its AUM by £120m, and UAE-based Globaleye Wealth Management, increasing its AUA by £242m.

Dealmaking elsewhere in the sector included Lumin Wealth taking a majority stake in specialist mortgage adviser Davidson Deem and Shawbrook Group acquiring specialist lender Bluestone Mortgages. Titan Wealth purchased investment research and consultancy firm, Square Mile, increasing its headcount by 21 research analysts and an investment management team responsible for £2.6bn MPS solutions. Fintel, the parent of Defaqto and SimplyBiz, took a 25% stake in Plannr Technologies, a financial planning CRM business, and BlackRock, through its Aladdin Wealth business, acquired a minority stake in Swiss banking software maker, Avaloq.

Activity in the asset management sector included Man Group taking a 51% stake in ESG boutique Asteria, and Switzerland-based GAM selling its loss-making fund services business to Dublin-based Carne Group, as well as Pacific Asset Management announcing a joint venture with Australian bond boutique Coolabah Capital. BlackRock announced a further acquisition during June, the acquisition of London-based private debt manager, Kreos Capital. Dual-listed Investec furthered the trend of consolidation in the investment banking industry by doubling its stake in European boutique adviser, Capitalmind Group, to 60%.

*IMAS Corporate Finance LLP has been acquired by MarshBerry.