M&A Market Update

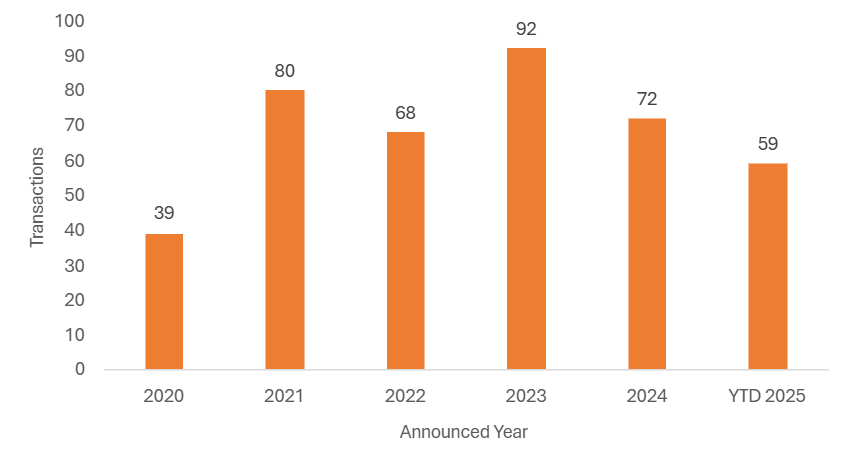

November resulted in one of the most active months for investment sector mergers and acquisitions (M&A) in 2025, with nine deals above £5m of value announced, bringing the year-to-date (YTD) total to 59.

During the month, there were three deals in the actuarial, pensions administration and employee benefits consulting space, including Gallagher’s acquisition of First Actuarial, Aptia’s acquisition of Atkin Pensions and Howden’s acquisition of Evelyn Partners’ employee benefits division. Three deals involved quoted targets, two of which were for businesses focused on wealth management and stockbroking activities, including TEAM plc’s merger with WH Ireland and PhillipCapital’s acquisition of Walker Crips Group, and the third involved a private equity (PE) target with Amundi’s stake in ICG. Another PE firm was also a target during November, with Coller Capital selling a minority stake to State Street Investment Management. The remaining two deals were for businesses operating in the financial advice space, including The Penny Group’s acquisition of Harridge Financial Services and Craven Street Wealth’s acquisition of Pharon Independent Financial Advisers.

Total Announced UK Investment Sector Transactions, Annual

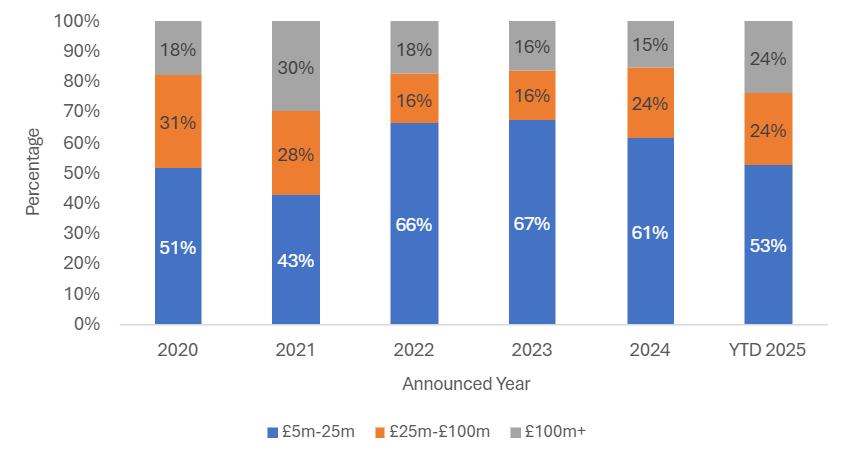

Most of the deals in November were at the lower end of the market with deal values trending between £5-25m. There were however two deals valued above £100m, bolstering the continued resilience at the higher end of the market throughout the second half of 2025. The YTD statistics suggest 2025 will result in the highest proportion of deals valued above £100m since 2021.

Announced UK Investment Sector Transactions by Target Size

There was a mixed bag of acquirer types during November, with four overseas acquirers, three PE acquirers, one quoted acquirer and one privately-held acquirer. Notably, overseas acquirers have regained momentum in recent months, indicating continued confidence in UK market fundamentals and long-term growth prospects. PE remains the most dominant acquirer group during 2025, and with only December left, it is very unlikely this will change.

PE-Backed Transactions as a % of Total Announced Transactions

Notable transactions (November 2025):

- Gallagher announced it had acquired First Actuarial. First Actuarial is a provider of pension administration, employee benefits and investment services to employers and pension plan trustees throughout the UK. The deal expands Gallagher’s pension service capabilities in the UK and complements its existing employee benefits consulting operations. MarshBerry served as advisers to First Actuarial in the transaction.

- Amundi announced it had acquired a 9.9% minority stake in private equity investment firm ICG. The investment will not dilute to ICG’s existing shareholders. The deal enables Amundi to expand private markets access for its wealth clients. Under the agreement, Amundi will serve as the exclusive global distributor in the wealth channel for select ICG products.

- Craven Street Wealth (CSW) announced the acquisition of Kent-based Pharon Independent Financial Advisers. The deal expands CSW’s presence in the South East and brings its headcount to c.130 staff, adding an additional £700m in assets under advice. This marks Craven Street’s first acquisition since parent company Wealthtime rebranded as The Quanta Group in April 2025.

Other UK transactions (November 2025):

- State Street Investment Management announced it had acquired a minority stake in private market secondaries manager, Coller Capital. Coller Capital manages over $46bn of secondaries assets across its funds, with the deal allowing both firms to expand client solutions and broaden their reach.

- Howden announced it had acquired Evelyn Partners’ employee benefits consulting division, Evelyn Partners Financial Services. The acquisition strengthens the scale of Howden’s corporate health and employee benefits offering in the UK and is part of Evelyn Partners’ strategy to focus on wealth management.

- TEAM plc announced the acquisition of wealth management and stockbroking group WH Ireland. The combined business is expected to oversee more than £2.1bn in client assets.

- The Penny Group announced the acquisition of Berkshire-based Harridge Financial Services, adding £350m of client assets.

- Singapore-based PhillipCapital announced the acquisition of stockbroking group Walker Crips, enhancing Walker Crips’ access to capital and sector expertise.

- Pension administration services provider, Aptia, announced the acquisition of Solihull-based Atkin Pensions, an actuarial and pension administration consulting firm.