Over the past 15 years, the insurance broking sector has thrived in a remarkably favorable environment. Since the global financial crisis of 2008-2009, brokers across much of Europe and beyond have benefited from steady economic growth, expanding insurance markets, generally supportive interest rate conditions, and rising premiums, often driven by prolonged hard market cycles. This combination has fueled consistent increases in commission income, robust organic growth, and strong profitability across the industry.

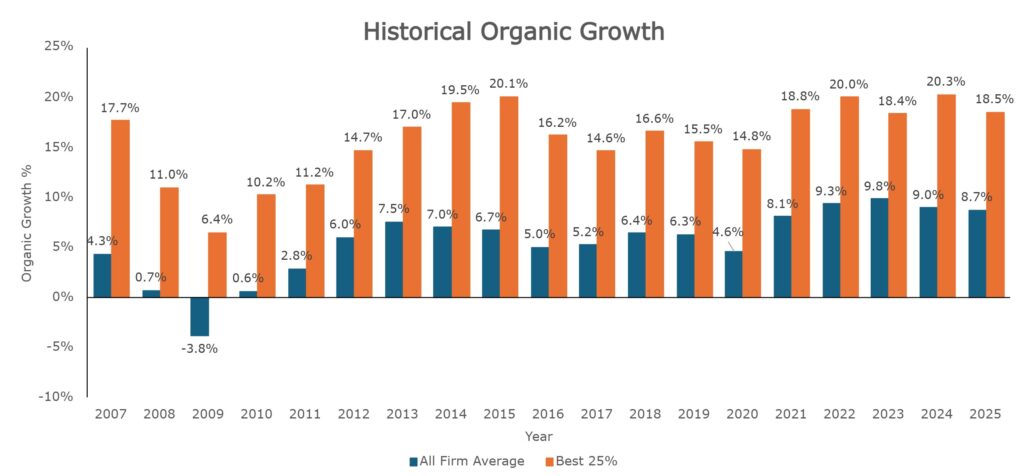

In 2024, this momentum continued: the global insurance sector posted an average organic growth rate of 8.7%, with the top quartile of firms achieving an impressive 18.5%. These sustained performance levels have attracted strong capital market interest, driven up company valuations, and delivered record returns for both public and private investors in the sector. The average guaranteed transaction price for an insurance broker has more than doubled over the past 15 years.

While no one can say for certain if – or when – the favorable environment for insurance brokers will come to an end, it’s worth asking: what if the growth graphs stop trending upward? What if change arrives, and the conditions we’ve come to rely on begin to shift? Rising economic uncertainty, escalating geopolitical tensions, and the growing unpredictability of political leaders are making the end of the current supercycle feel more plausible than ever. The world is becoming increasingly complex. Strained relations between major powers like the U.S. and China are weighing on global market stability, while some of President Trump’s policy decisions have injected volatility into international relations and trade. These forces are chipping away at predictability, unsettling investor confidence, and casting doubt on the long-term sustainability of today’s favorable conditions.

The ‘What If’ Scenario

To be clear, there’s no immediate cause for alarm. The European economy has shown resilience throughout the first two quarters of 2025, despite trade tensions and mounting global uncertainty. There are no clear indicators that the insurance broking sector is entering a downturn marked by slowing organic growth or declining profitability. On the contrary, private equity (PE) continues to display strong interest in the space. Consolidators remain active across Europe, and a steady stream of PE investors are still looking to enter the market – provided they can identify the right acquisition targets.

Still, it’s a worthwhile exercise to consider the alternative. What if the “best of times” come to an end? A market shift would quickly reveal which brokers have genuine, sustainable fundamentals –and which have been riding external tailwinds. In less favorable conditions, those appearing to grow today may be exposed as merely treading water once inflation-adjusted performance is taken into account.

Should economic conditions turn negative, the insurance broking mergers and acquisitions (M&A) landscape is likely to undergo a significant – though not structural – reset. Valuations may soften, deal timelines could lengthen, and we may see more creative structures emerge, such as earn-outs or seller financing. At the same time, well-capitalised firms and PE-backed consolidators often double down, using a combination of cash and debt to pursue opportunities. In this environment, due diligence becomes more rigorous, with increased focus on client retention, cost discipline, and inflation-adjusted earnings.

Even if deal volume dips, the market is unlikely to stall. In fact, M&A activity in insurance broking often proves resilient during economic downturns – a trend consistently highlighted by MarshBerry. This strength stems from the sector’s stable and recurring revenue streams, grounded in long-term client relationships and renewal commissions. These predictable cash flows provide a level of financial security that few other industries can match, making brokers highly attractive acquisition targets even in turbulent times. Moreover, consolidation continues to offer strategic advantages, enabling firms to unlock economies of scale and enhance their competitive position. It’s this rare combination of stability and opportunity that keeps investor interest in insurance broking high – even when the broader economy slows down.

Not a balloon poised to pop

At MarshBerry, we believe that the high valuations seen in today’s insurance broking market are not a balloon poised to pop anytime soon. Even in a scenario with mounting economic headwinds, M&A activity is likely to remain strong and sustained. There are simply too many indicators pointing in the right direction: a crowded field of active buyers – many backed by private equity – and an industry with an exceptional track record of resilience during downturns. But does that mean it’s time to sit back and wait? Far from it. This is a critical moment for every insurance broker to make smart, strategic choices. When the economic pressure rises, the difference between strong and weak performers will become much more apparent. Strategic buyers and investors are becoming more selective. Brokers with a clear strategic plan, strong organic growth, scale, comprehensive product portfolios, and a forward-looking approach to technology – especially in areas like AI – will remain attractive, even in tougher times. For those who don’t meet these criteria, the story may look very different. So don’t treat this article as reassurance, but as a wake-up call. The supercycle won’t last forever—and now is the time to build resilience and future-proof your position in the market.

Download the 2025 Market Report Insurance Distribution in Europe and read about the latest trends and developments in the industry, exclusive insights into the Top 20 largest European brokers and answers to other key questions shaping the future of insurance broking.