Average insurance brokerage transaction value increased 4% in the Q2 of 2022 compared to 12/31/2021 despite multiple headwinds – high inflation, increasing cost of capital and a looming recession. For firms over $20 million in revenue, deal valuations increased almost 7% in Q2 of 2022 compared to 12/31/20211. Compare this to other industries where merger & acquisition (M&A) valuations aren’t increasing or are even dropping, such as healthcare, banking and technology.

So, as you can imagine, some buyers of insurance brokerages are conveniently promoting that deal valuations are too high and can’t possibly go (or shouldn’t go) any higher. A few are even whispering that deal valuations could start to come down.

But their actions speak louder than their words. In fact, they continue to buy and the valuations they agree to pay continue to rise, despite the headwinds. Why? Because they know the dirty little secret. They know that the returns on investments in insurance brokerage have been exceptional, especially considering the low risk of the insurance brokerage industry. The risk-return paradigm states that investors should be satisfied with a lower return on an investment with lower risk. Returns have been great in this low-risk industry. So good, in fact, it’s no wonder the capital floodgates have opened, and the number of private capital funded brokers has swelled from seven in 2007 to 42 in 2022.

Have Insurance Brokerages Been Valued Fairly?

The fact is – even at their current levels – there has been somewhat of a governor placed on insurance brokerage valuations. That governor was artificially created by the industry’s collective memory of how valuations have changed (increased) over the past years, and as a result a gut feeling that current valuations “should” be the maximum, especially in light of the macro-economic headwinds that exist. However, according to MarshBerry M&A Advisory Services, notwithstanding their increase over the past decade, valuation multiples have not increased enough to reach true value. Admittedly, it is hard to accept such a concept given our strong memory of the cheap valuations of yesteryear.

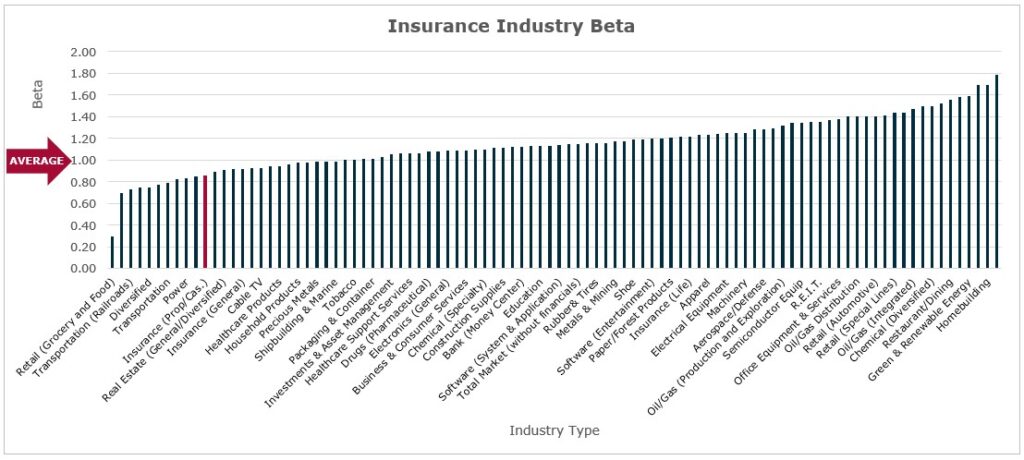

If you consider the beta (the volatility of an industry compared to all other industries) of the Property & Casualty (P&C) insurance industry – insurance is among the lowest of all betas – almost as low as groceries.

People need to eat to survive. They also need to buy insurance. It’s not a nice to have, it’s a must have. As a result, the volatility of the P&C insurance industry is significantly less than other industries. A low-risk industry usually means investors are satisfied with a lower return on investment. Therefore, conventional wisdom would indicate that investors in this industry should be satisfied with a lower return on investment – a return commensurate with lower risk. But investors haven’t been setting lower return targets or achieving lower returns. They have been setting standard return targets and outperforming those targets. Thus, the dirty little secret.

Will M&A Valuations Remain Strong Despite Economic Headwinds?

Private equity (PE) buyers know that if the world were to remain still, there is quite a bit of room for valuations to increase even further. Especially considering that returns on investments made in the insurance brokerage community have been better than the returns targeted. But the world isn’t standing still. Economic headwinds are here. Even with the headwinds, there is a strong chance that valuations will continue to rise. At the very least, there is room for investment returns to decline without negatively impacting deal valuations.

We all have witnessed the resilience of this industry in periods of volatility, time and time again. Many to this day still cannot fathom how the average insurance broker only declined 3.8% in commission and fees during the Great Recession trough of 2009. The stability of this industry in a down economy is the very reason billions upon billions of dollars have been spent acquiring in the space.

But the economic environment is only one ingredient in the formula that determines a firm’s worth to potential buyers. That formula also looks at cost of capital, the amount of leverage, the projected insurance rate environment, the tax environment, and of course – supply and demand. There’s also the subjective assessment of the strength and quality of the company’s leadership team and the expected strength of the market when the investment is eventually divested.

What Impact Might Rising Interest Rates Have on Multiple of Invested Capital (MoIC) and Deal Valuations?

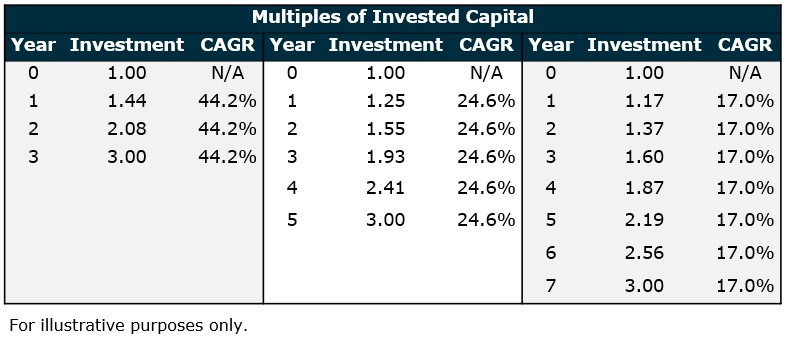

It has not had an impact yet. Valuations have continued to increase. But why? Most PE investors target a three times multiple on invested capital (3X MoIC) in five years. Essentially, a typical fund has a target of turning every dollar invested into three dollars within a five-year period. When investors are asked “What will happen to valuations in the insurance brokerage space if the cost of capital goes up?” the answer is fairly consistent. Most respond that returns in this sector have been better than expected (achieving 3X MoIC in less than five years), capital has already been raised and must be deployed and buyers that drop valuations will suffer as they will be cut out of the deal market. To illustrate the amount of dry powder that is available from debt capacity alone, over $18 billion dollars has been raised by insurance brokers in the rated institutional debt market during the past 12 months. If you add in unrated private and club debt, it is probably at least double that.

Most immersed in the deal market know the above. The dirty little secret is just how outsized the returns have been relative to the risk of the insurance brokerage business. If the average investment thesis is 3X MoIC in five years in all middle market PE, and if the insurance industry has a very low beta, the risk return trade off should push investors to be satisfied achieving three turns in seven years – or even longer.

A 3X MoIC in five years translates to a 24.6% CAGR (Compound Annual Growth Rate) in return on invested equity capital. Even as interest rates have risen year-to-date, so have valuations. As interest rates continue to rise, valuations should at the very least hold until returns shrink to 3X MoIC in five years. Valuations could remain high even with a larger increase in interest rates if the investment community chooses to acknowledge the dirty little secret that required returns should be reduced given the low relative risk of this industry.

To look at it another way, assume for a moment that interest rates continue to rise and valuations either continue to increase or flatten out. If returns fall to 3X MoIC in seven years, the CAGR would drop to 17%. The PE community should recognize this is not a low return, it is an appropriate return on invested equity capital relative to risk – especially considering the imbalance between supply and demand.

To further this point, consider that the Dow Jones Industrial Average just celebrated a 40-year run with a CAGR of 9.6% since 1982.2 Investors often assume the public markets will generate average annual returns of roughly 8% over multiple years in the future. PE funds geared toward lower risk industries target returns to investors that range from 500-700 basis points over those achievable in the public markets, or overall returns to investors in the 13%-15% range. Given PE fund fees (1%-2% management fee plus 10%-20% carried interest), adding 400 basis points to the net investor returns produces required returns on individual investments in lower risk industries to a range of 17%-19%. Hence, the return commensurate with a 3x MoIC in seven years.

In short, as rates and the cost of capital go up, valuations may continue to go up. But at the very least, valuations can hold since there is room for the return on invested equity capital to decline and possibly still hit 3X MoIC in five years. If there was an appropriate perspective on the risk-return paradigm, valuations could increase or at the very least hold and withstand further degradation of the environment and still achieve an appropriate return of 3X MoIC in seven years.

The good news is that regardless to what happens to valuations, MarshBerry firmly believes that insurance brokerage is the greatest industry in the history of mankind. And the real drive to the rise in value is that the world now knows it, too.

If you have questions about Today’s ViewPoint or want to learn more about insurance agency valuations and how to differentiate your firm in today’s marketplace, please email or call John M. Wepler, Chairman & CEO at 440.392.6572.

Sources: stern.nyu.edu

1Trailing twelve month comparison as a multiple of EBITDA of the upfront purchase price. 2https://www.wsj.com/articles/rip-big-bull-market-1982-2022-bear-stocks-investors-productivity-tax-rates-supply-side-innovation-apple-ibm-intel-silicon-valley-machine-intelligence-11659889307

Investment banking services offered through MarshBerry Capital, LLC, Member FINRA Member SIPC and an affiliate of Marsh, Berry & Company, LLC. 28601 Chagrin Boulevard, Suite 400, Woodmere, Ohio 44122 (440.354.3230)