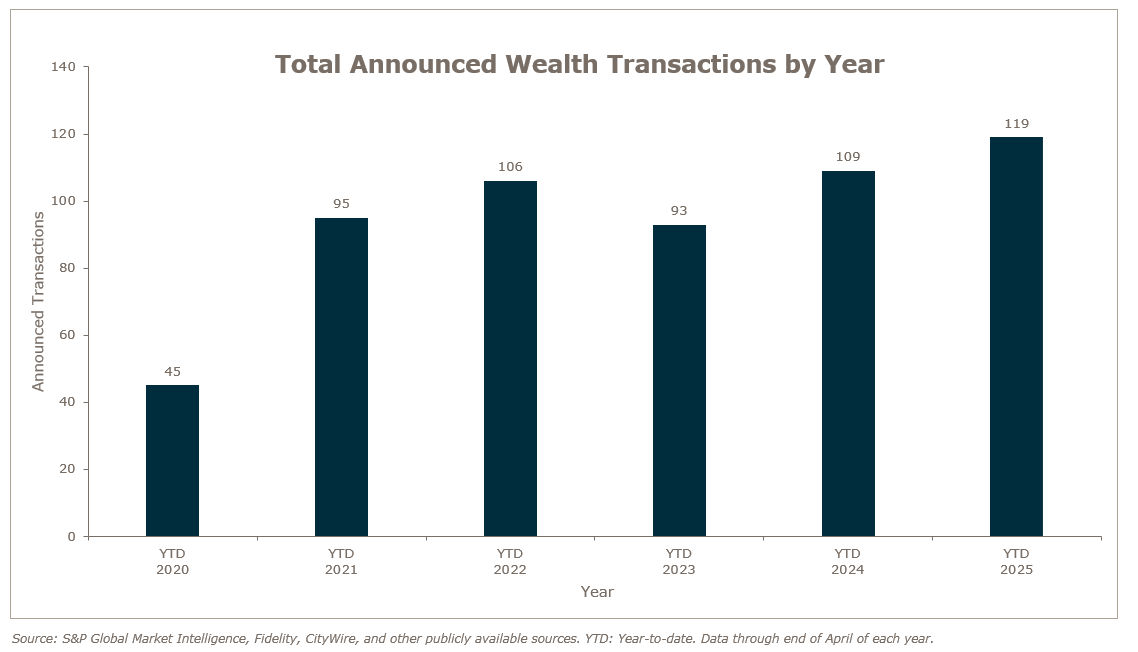

Wealth advisory merger and acquisition (M&A) activity has continued to build momentum in 2025, with 119 announced transactions in the U.S. through April—a 10% increase over the same period last year. Private capital-backed wealth management firms remain the primary drivers of this activity, further cementing their dominant role in reshaping the industry’s landscape. With deal volume tracking ahead of 2024 and sustained interest from both strategic and financial buyers, MarshBerry remains optimistic about the trajectory of wealth management M&A for the remainder of the year.

What was once a succession-driven market is now undergoing a fundamental transformation, as private capital moves from the margins to the mainstream. Today’s transactions are increasingly shaped by a focus on unlocking growth, managing risk, and building scalable platforms for long-term success. The growing influence of private equity has brought greater structure and strategic rigor to the space, encouraging sellers to look beyond headline valuations and evaluate deeper factors such as alignment, integration capability, and cultural fit. In this evolving environment, firms with a track record of consistent organic growth are commanding premium valuations and attracting interest from a more sophisticated class of investors.

M&A Market Update

Private capital-backed buyers accounted for 83 of the 119 transactions (69.7%) through April, a figure similar to what was reported in 2024. Independent firms accounted for 28 deals and 23.5% of the market, an increase from 2024’s final percentage of 21.0% (on 76 total independent deals). Insurance brokerages have acquired nine wealth management and retirement firms in 2025 as of April.

Notable Transactions:

April 8: Aspen Standard Wealth has acquired New England Private Wealth Advisors (NEPWA), a Boston-based registered investment advisor managing $2.9 billion in assets as of December 31, 2024. Founded in 2005, NEPWA serves high-net-worth individuals, families, and institutions with tailored investment advisory and wealth planning services. The acquisition aligns with Aspen’s strategy of forming permanent, long-term partnerships with successful RIAs, offering growth support while preserving each firm’s brand and culture. This deal marks another step in Aspen’s mission to provide enduring stability and resources to its RIA partners without plans for resale.

April 14: Cary Street Partners Financial (CSP) has entered a strategic partnership with private equity firm CIVC Partners, marked by a significant investment that recapitalizes its earlier outside investors. The deal provides CSP with additional capital to support organic growth and strategic acquisitions, while enabling the firm’s next phase of expansion. CSP insiders will retain roughly half ownership and have named new internal partners as part of the transaction. The partnership enhances CSP’s access to institutional resources, accelerating its recruitment and M&A strategy. With approximately $10 billion in assets under management and operations across 19 offices in seven states, CSP aims to build on its proven platform and broaden its national footprint.

Looking forward

MarshBerry remains confident in the outlook for another strong year of M&A activity in 2025, with the potential to surpass previous records. Many business owners are seeking to proactively shape the future of their firms, rather than waiting for external market forces to dictate their options. While policy shifts such as potential tariffs under a renewed Trump administration have introduced uncertainty, they could also prompt strategic sales in sectors aiming to mitigate financial headwinds. Although public sector layoffs may place upward pressure on unemployment, the steady influx of private equity capital into the registered investment advisor (RIA) space continues to fuel optimism. MarshBerry will continue to track these developments closely and provide insights on how they may influence the M&A environment in the months ahead.