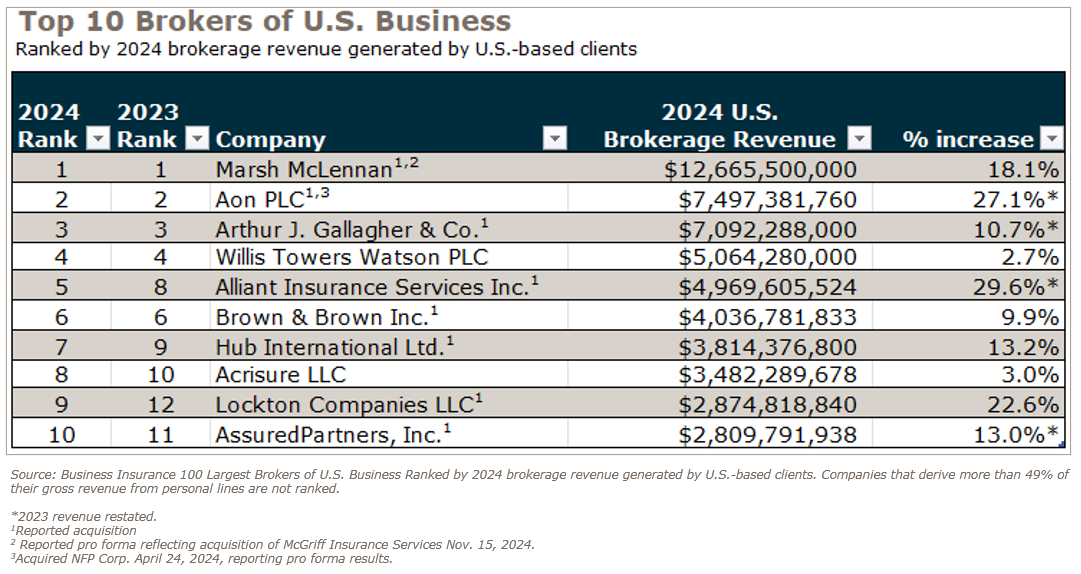

Business Insurance has published their annual report on the Top 100 Insurance Brokers, ranked by U.S. revenue for 2024. Total revenue for the top 100 insurance brokers reached $80.5 billion. Of that total, the top 10 firms represented 70% of it, with $54.3 billion. This year, for the first time since 2020, the top 10 firms include two new entries – Lockton Companies LLC and AssuredPartners.

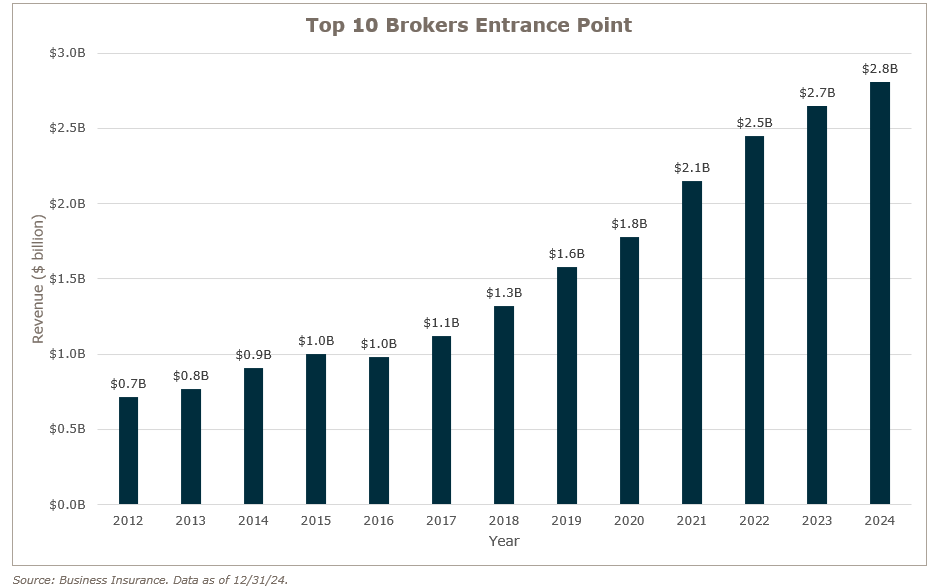

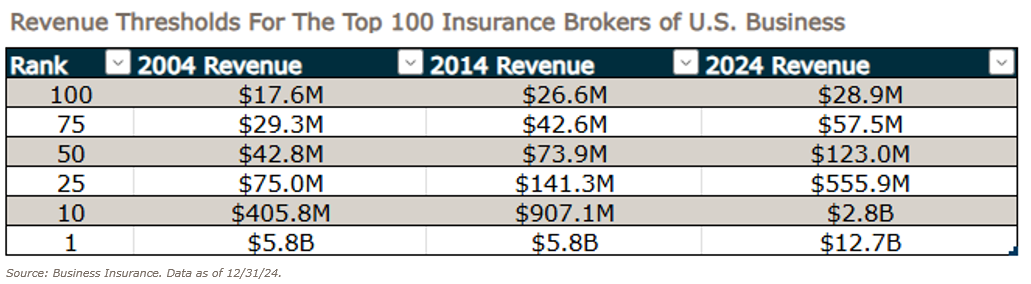

The total revenue of the top 100 brokers in this year’s ranking rose by 6.6% (compared to last year’s list) – an increase of nearly $5 billion. Most of that growth was concentrated among the top 10 firms, which added close to $4.4 billion in revenue – a gain of 8.8% over last year’s top 10. To enter the top 10 insurance brokers (of U.S. business) bracket today, a firm would need a staggering $2.8 billion in revenue. This is compared to just $907 million needed 10 years ago in 2014, a 210% increase in this revenue threshold.

Newsworthy takeaways from the top 10 list

2024 was shaped by several headline-making announcements of big insurance brokers acquiring other big brokerages. Because of this, there has been some shifting within the top 10 list.

MarshBerry’s chairman and CEO, John Wepler stated, “The step up in large deals reflects the strong stock performance of publicly traded brokers.”

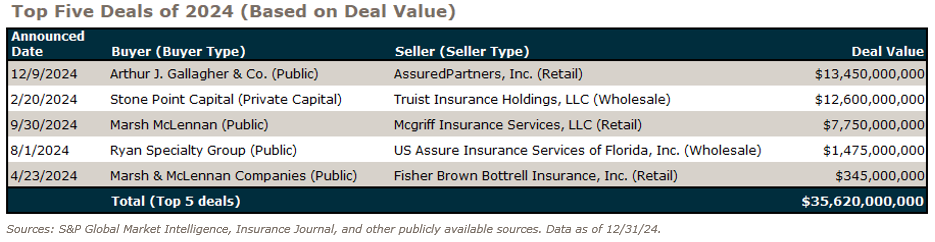

Marsh & McLennan, Aon, and Arthur J. Gallagher, the top three ranked brokers and publicly owned, all conducted historically sized deals in 2024 (with Aon’s acquisition of NFP announced in 2023). It made for a record year in enterprise values for publicly announced insurance brokerage transactions.

“The public brokers are doing a victory lap because their currency wasn’t such that they could compete as well with the private-equity-funded brokers five years ago,” said Mr. Wepler. “Public brokers have traded up so dramatically, and their currency is so valuable, that they have a currency to be able to do accretive deals at market-clearing multiples.”

Here are some of the most noteworthy takeaways from the top 10 list:

TIH Insurance Holdings LLC is no longer in the top 10 (or in the top 100), after previously ranking #7 in 2023. In November 2024, TIH sold McGriff Insurance Services (the retail division of TIH) to Marsh McLennan (MMC) for $7.75 billion. MMC’s pro forma for 2024 reflects this acquired revenue. In March 2025 TIH was rebranded as CRC Group.

AssuredPartners (#10) and USI Insurance Services LLC (#11) swap places on the list this year, based on revenue. The swap knocks USI out of the top 10 for the first time in over a decade. However, USI’s position drop may be short-lived as it was announced in December 2024 that AssuredPartners had agreed to be acquired by Arthur J. Gallagher (AJG) for $13.45 billion. The deal is still in regulatory review but is expected to close in 2025. AssuredPartners delivered $2.81 billion in revenue in 2024 (a 13.0% increase), with the help of eight announced acquisitions. AssuredPartners has been a serial acquirer for the past decade, making over 300 announced acquisitions since 2011. Because of this deal, it is possible that next year’s list may see AJG leapfrog Aon into the #2 spot.

Meanwhile, USI posted $2.78 billion in revenue in 2024 (a 5.1% increase) with only one transaction, after conducting 18 deals over the previous three years.

Lockton Companies LLC quietly enters the top 10 list at #9 with $2.87 billion in U.S.-based revenue (a 22.6% increase). Lockton hasn’t been in the top 10 since holding the #9 spot in 2017 – but has been securely positioned at #12 since 2020 before making this move back into the top 10. Lockton made no U.S. acquisitions in 2024. “Virtually all of Lockton’s growth has come from existing operations”, said Chairman and CEO Ron Lockton. “This first year, the focus has been primarily on leadership and talent. I knew that we were going to need the right leadership team.”

Firms no longer in the top 100

Aside from TIH Insurance Holdings’ departure from the top 100 due to the sale of McGriff Insurance Services to MMC, there are five other firms (from last year’s list) that are no longer in the top 100.

- Woodruff-Sawyer & Co., Inc. was acquired by AJG for $1.2 billion. The deal closed in April 2025. Woodruff was ranked #37 in 2023 before being acquired.

- AmeriTrust Group’s subsidiary, Meadowbrook Insurance Group, Inc., was acquired by AJG in October 2023. AmeriTrust was ranked #52 in 2023 before divesting Meadowbrook.

- Horton Group, Inc. was acquired by MMC in August 2024. Horton Group was ranked #55 in 2023 before being acquired.

- The Loomis Company, previously ranked #82 in 2023, is no longer ranked.

- James G. Parker Insurance Associates, previously ranked #89 in 2023, is no longer ranked.

Biggest movers in the top 100

As firms are acquired, or underperform, and drop off the list, it is natural for other firms to move up several spots, which is not always an indictment of their own performance. While strong organic growth continues to be a driver for firms moving up the top 100 list, M&A activity is often the key to significant movement.

In 2024 there were 847 announced M&A transactions, a 5% increase over the previous year. Strong firm valuations, consolidation goals and private capital investments were still key drivers of M&A activity last year. Of the top 100 brokers, 44 of them transacted one or more deals in 2024, representing 69.1% of total deals and 28.8% of total buyers of the U.S. insurance brokerage M&A market.

Here are 14 firms (seven private capital-backed, seven independently owned) who have moved up six or more spots on this year’s list, due to M&A activity, organic growth or both.

- Holmes Murphy & Associates moved up eight spots to #27 with $363.2 million in revenue (a 15.7% increase). Holmes Murphy & Associates had no publicly announced deals in 2024 or 2023.

- Keystone Agency Partners LLC continues to move up the top 100 list, jumping seven spots this year to #31 with $326.8 million in revenue (a 42.1% YoY increase). Keystone has moved up 25 positions since debuting on the list in 2022. This Bain Capital Credit backed firm was helped by the 30 publicly announced deals in 2024, after completing 24 deals in 2023.

- Alkeme Inc., backed by GCP Partners, who debuted on the top 100 list in 2021 at #64, moved up six spots to #43 with $180.5 million in revenue (a 58.3% YoY increase). Alkeme completed 21 publicly announced transactions in 2024, after completing 15 in 2023.

- Inszone Insurance Services, backed by BHMS, debuted on the top 100 list in 2022 at #64. This year, Inszone moved up six more spots to #44, with $177.3 million in revenue (a 59.1% YoY increase). Inszone had an aggressive M&A year completing 60 publicly announced transactions in 2024, after completing 45 in 2023.

- Oakbridge Insurance Agency, after receiving an equity investment from Audax Private Equity in 2023, has broken into the top 50 by moving up six spots to #50, with $122.9 million in revenue (a 22.9% YoY increase). Oakbridge completed 10 publicly announced transactions in 2024, and 14 in 2023.

- Shepherd Insurance, backed by private capital, moved up seven spots to #53 with $115.6 million in revenue (a 34.3% increase). Shepherd Insurance had no publicly announced deals in 2024 or 2023.

- Sterling & Sterling LLC moved up six spots to #57 with $96.9 million in revenue (a 29.2% increase). Sterling & Sterling had no publicly announced deals in 2024 or 2023.

- First Insurance Group (FNIC) moved up six spots to #67 with $67.6 million in revenue (a 20.4% increase). FNIC had no publicly announced deals in 2024 or 2023.

- King Insurance Partners, backed by BHMS, debuted on the top 100 list in 2023 and continues its growth, moving up eight spots on this year’s list to #71 with $64.6 million in revenue (a 33.4% YoY increase). King Risk Partners completed 14 publicly announced transactions in 2024, after completing nine in 2023.

- Choice Financial, backed by Northlane Capital Partners, has moved up 12 spots to #73 with $61.9 million in revenue (a 36.4% increase). Choice Financial completed four publicly announced transactions in 2024 (through Choice Insurance Agency), after completing six in 2023.

- Hotchkiss Insurance after debuting on the list last year at #93, has moved up nine spots to #84 with $48.1 million in revenue (a 19.5% increase). Hotchkiss had no publicly announced deals in 2024, after completing one deal in 2023.

- Gibson Insurance Agency moved up seven spots to #87 with $43.4 million in revenue (a 15.2% increase). Gibson had no publicly announced deals in 2024 or 2023. In July 2025, Gibson announced a strategic merger into Unison Risk Advisors (currently ranked #38).

- Brightline Insurance Group after debuting on the list last year at #98 has moved up nine spots to #89 with $41.2 million in revenue (a 19.5% increase). Brightline had no publicly announced deals in 2024 or 2023.

- Unico Group Inc. after debuting on the list in 2022 has moved up seven spots to #90 with $40.2 million in revenue (a 13.0% increase). Unico had no publicly announced deals in 2024 or 2023.

Takeaways from the top 50

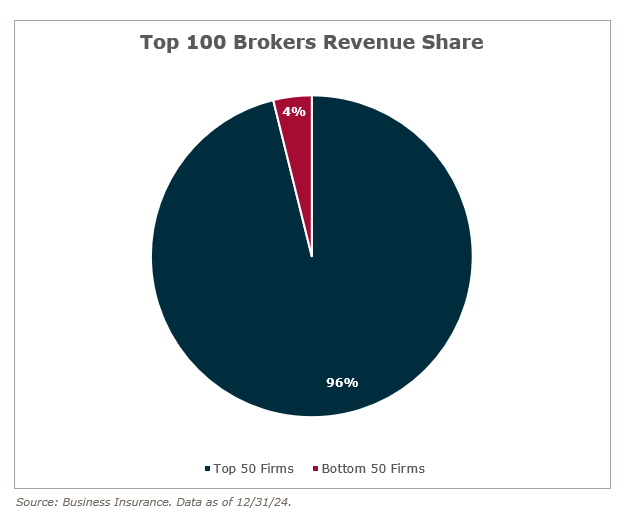

The top 50 firms in 2024 represent $77.5 billion in revenue – which is 96% of the total revenue for the top 100. In 2024, a firm needed over $123.0M to break into the top 50, a 66% increase in this revenue threshold vs. 2014 when firms needed $73.9M to get into the top 50.

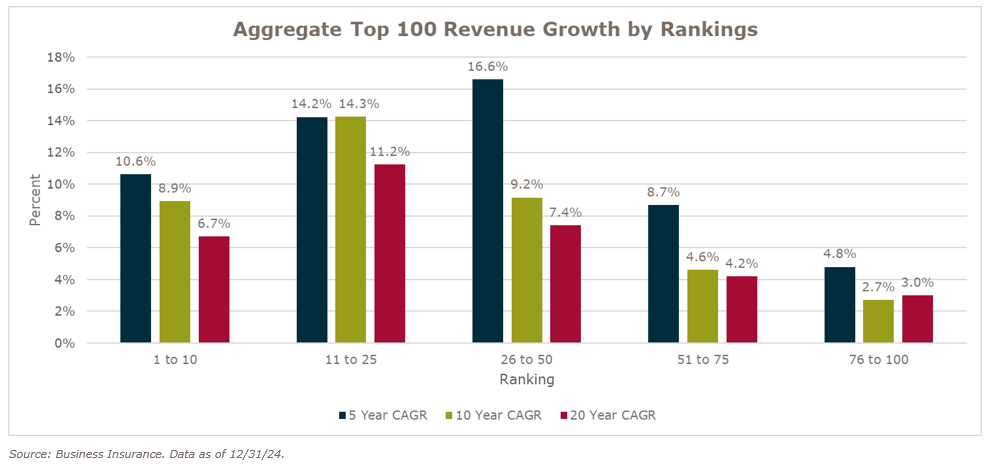

There is a clear growth trend dividing the top 50 (with 96% of the total revenue) and the bottom 50 (with 4% of the total revenue) on the top 100 list – especially for the 11-50 ranked firms. The average 5-year CAGR (compound annual growth rate) for firms in the top 50 is 11.8%. But for firms ranked 51-100, the CAGR drops to 7.2%. This speaks volumes to how quickly and consistently these larger firms are growing, and how challenging it is for smaller firms to be consistent in their growth in order to keep pace.

This challenge for the bottom 50 firms also represents an opportunity for other firms, on the outside, looking in, to break into the top 100 list.

Opportunity to enter the top 100?

The overall YoY revenue growth of the top 100 firms was 6.6% (compared to last year’s list). This is down from 13.5% for last year’s list. This may be because 41 of the top 100 firms individually failed to grow by double digits in 2024. Of the 41 firms that failed to grow by 10% or more, 26 of them were ranked in the bottom 50.

For firms on the outside, looking in – this is where the opportunity for entry is relatively open. The barrier for entry into the Business Insurance’s Top 100 hasn’t risen significantly in the past ten years. In 2014, a broker needed $26.6M to enter the top 100. Today – they would need $28.9M (only an 8.6% growth in revenue since 2014). A significant task for some firms, but not impossible.

Six new additions to the top 100

As the consolidation of firms continues, some firms from last year are no longer on the top 100 list. But with vacancy comes opportunity, and six firms have joined the top 100 list this year for the first time. These firms include:

- Superior Insurance Partners enters the top 100 list at #64 with $67.6 million in revenue (a 172.6% YoY increase). Superior completed nine publicly announced transaction in 2024, after having done no prior acquisitions.

- Signers National, LLC enters the top 100 list at #70 with $65.9 million in revenue (a 27.6% YoY increase). Signers completed three publicly announced transaction in 2024, after completing seven in 2023.

- Seubert & Associates Inc. breaks into the top 100 list at #95 (after being previously ranked #102) with $35.0 million in revenue (a 14.2% YoY increase). Seubert did not publicly announce any M&A transactions in 2024.

- The Daniel & Henry Co. breaks into the top 100 list at #96 (after being previously ranked #101) with $34.1 million in revenue (a 10.1% YoY increase). Daniel & Henry did not publicly announce any M&A transactions in 2024.

- Morris & Garritano Insurance Agency Inc. breaks into the top 100 list at #99 (after being previously ranked #107) with $29.7 million in revenue (an 8.5% YoY increase). Morris & Garritano did not publicly announce any M&A transactions in 2024.

- Moody Insurance Agency Inc. breaks into the top 100 list at #100 (after being previously ranked #106) with $28.9 million in revenue (a 5.5% YoY increase). Moody did not publicly announce any M&A transactions in 2024.

How can firms grow and compete if they aspire to make or remain on the list?

Sustainable organic growth fueled by predictable sales velocity continues to be the most controllable method for taking a firm to the next level – for increasing revenue and for attracting possible partners. Here are common strategies that firms of all shapes and size should address.

- Reassess your capital structure to build capacity and capital for growth.

- Re-think your risk tolerance as it relates to debt and leverage.

- Deliver a process driven new client acquisition strategy.

- Embrace aggressive new business goals and real production accountability.

- Build industry vertical specialization supported by data analytics.

- Double down on hiring new production talent.

- Design a wealth creation perpetuation plan to attract and retain talent.

Building a cultural commitment to an organic growth strategy, identifying potential best-in-class agency partnerships, and doubling down on opportunities for reinvestment (capital, talent) can be keys to the future outlook and success of firms that wish to compete to make the coveted Top 100 Broker List.