At the midway point in a polarizing economic year, it would be difficult to predict how the second half might play out. At the end of Q1 – the pundits’ outlook on the U.S. economy created havoc on the equity markets. Most of it driven by projections on how President Trump’s tariffs may impact global trade, jobs and inflation, as economists at major U.S. banks raised their risk warnings on a potential recession.

By the end of Q2, the tariffs scare was scaled back, and the major market indices recovered nearly all of Q1 losses and ended H1 in positive territory. So much for “the sky is falling” pundits’ predictions.

However, before anyone gets too comfortable, Q3 has been kicked off with President Trump’s One Big, Beautiful Bill Act. Hold on to your seat, it may get bumpy. (Again.)

The One Big, Beautiful Bill Act (or OBBBA) was passed by both the House and Senate and signed into law by President Trump on July 4, 2025. It is a sweeping reconciliation bill that affects nearly every major area of federal policy. Its most controversial features revolve around tax reform, fiscal policy, and healthcare reform – and its projected economic impact.

At the root of the bill is the permanent extension of the 2017 Tax Cuts and Jobs Act (TCJA), which was set to expire at the end of 2025. This means lower income tax rates and a higher standard deduction for most taxpayers. For U.S. businesses, it means the federal corporate income tax rate of 21% is made permanent.

Just like tariffs, there are conflicting opinions on how the OBBBA will impact the U.S. economy. The cementing of the TCJA is promoted as a growth lever for further investment in American industry and workers. The other side of that coin is the potential impact on the U.S. debt, which critics are estimating will increase by $3 to $4 trillion over the next 10 years. Further stress on the economy could trigger fiscal tightening, reignite inflation and drive up the cost of capital.

For insurance brokers, as with most stress test environments, the OBBBA may create increased opportunities. Firms looking to remain competitive and invest in their growth, may look to extend into new segments and increase their advisory roles as clients adjust to potential new challenges.

For insurance brokerage mergers and acquisitions (M&A) – optimism for elevated deal activity remains. Through H1, M&A activity is still pacing above last year. Buyers remain focused on their goals for growth and for now, haven’t taken their foot off the gas pedal.

M&A Market Update

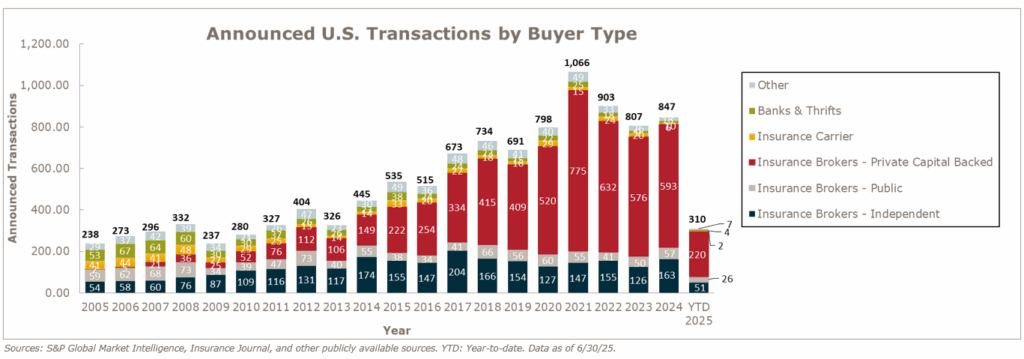

As of June 30, 2025, there were 310 announced M&A transactions in the U.S. This activity through June is up 2.3 % compared to this time last year, which saw 303 transactions announced through June.

Private capital-backed buyers accounted for 220 of the 310 transactions (71.0%) in 2025. This represents a substantial increase since 2019 when private capital-backed buyers accounted for 59.3% of all transactions.

Independent agencies were buyers in 51 deals so far in 2025, representing 16.5% of the market. There have been four announced transactions by bank buyers in 2025. Deals involving specialty distributors as targets accounted for 47 transactions, or 15.2% of the total acquisitions in 2025. This percentage share is in line compared to the 15% in 2024, continuing the trend of a low supply of specialty firm sellers.

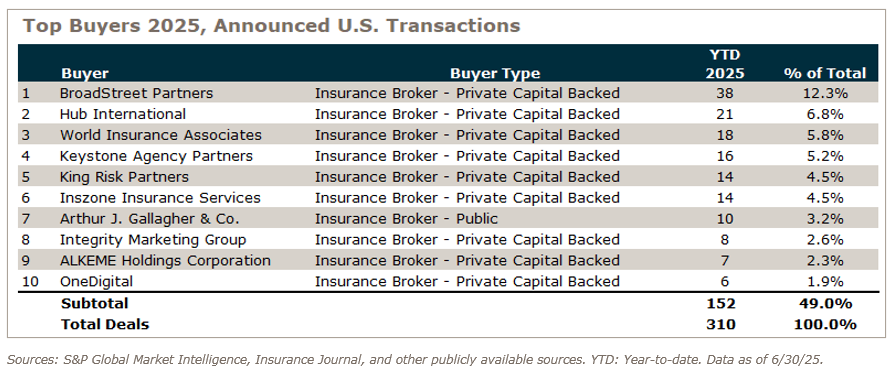

Deal activity from the top ten buyers accounted for 49.0% of all announced transactions, while the top three (BroadStreet Partners, Hub International, and World Insurance) account for 24.8% of the 310 total transactions.

Valuations remain strong for high performing firms

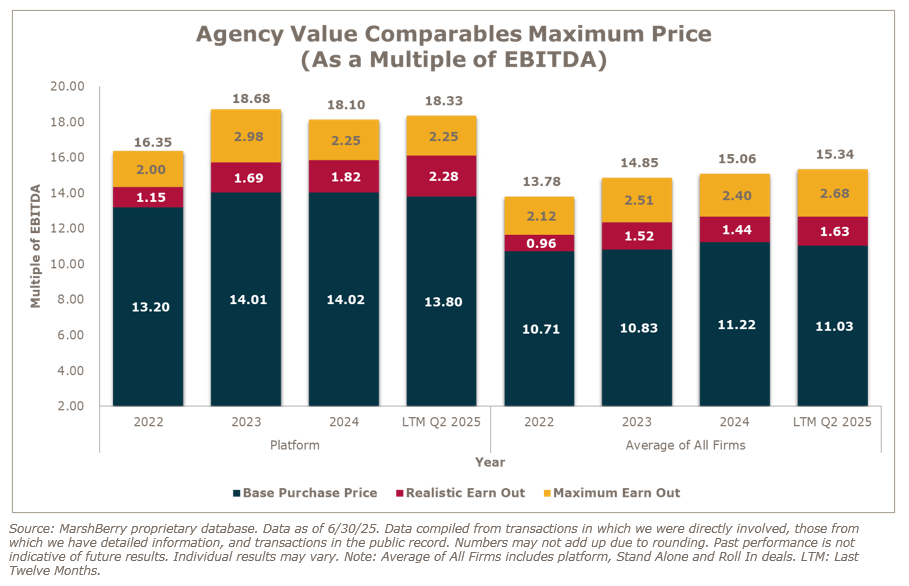

Driven by continued demand for high performing firms with strong organic growth and high margins, the first half of 2025 maintained elevated valuations for both average of all firms and platform firms. When compared to 2024 levels, valuations through Q2 2025 are basically flat for all firm average and platform firms.

Valuations as a multiple of EBITDA (earnings before interest, taxes, depreciation & amortization) on upfront base purchase price for the last twelve months (LTM) ending Q2 2025 came in at an average of 11.03x across all firms. Platform firms for LTM ending Q2 2025 are averaging 13.80x at closing.

We may see continued pressure on valuations for firms who are not able to generate organic growth outside of rate or exposure base expansion. Firms who are able to generate sales velocity in the mid to high teens should still command aggressive valuations as the buyers are continuing to look for ways to enhance their own organic growth metrics.

Notable transactions – Q2 2025:

- May 12: Private investment firm Aquiline Capital Partners acquired Intercare, a leading independent third-party administrator based in Rocklin, California. Founded in 1994, Intercare specializes in workers’ compensation and liability claims administration, along with managed care services. The acquisition marks a significant move by Aquiline to enter the specialized TPA (Third-Party Administrator) space. MarshBerry served as advisor to Intercare in this transaction.

- June 3: Hub International acquired the assets of the Fenner and Esler Agency, a century-old, New Jersey-based insurance brokerage specializing in professional liability and risk management services for architects, engineers, surveyors, and environmental professionals. Principals Tim and Kevin Esler, along with their team, will join Hub Northeast, and the firm will now operate as Fenner & Esler, a Hub International Company. MarshBerry served as advisor to Fenner & Esler in this transaction.

- June 10: Brown & Brown announced a definitive agreement to acquire RSC Topco, the parent company of Accession Risk Management Group, for $9.825 billion on a cash and debt-free basis. Expected to close in Q3 2025, the acquisition includes both Risk Strategies and One80 Intermediaries. With approximately $1.7 billion in 2024 pro forma adjusted revenue and more than 5,000 professionals across the United States and Canada, Accession ranks among the largest privately held insurance brokerages in the country. Post-acquisition, Risk Strategies will join Brown & Brown’s Retail segment, while One80 Intermediaries will integrate into a newly formed Specialty Distribution segment.