On the surface, this may look like good news: while U.S. unemployment held steady at 4.1% in 2024, insurance industry unemployment remained significantly lower, rising modestly from 2.0% to just 2.5%. In addition, employee turnover in insurance brokerage firms was 16.4% in 2024, notably below the 20%-25% range seen across the broader financial services sector.1 But is there a problem lurking beneath the surface? These apparently favorable comparisons may actually reflect a level of stagnation resulting from a lack of competition for insurance jobs—possibly adding evidence to the argument that an industry “talent challenge” continues to exist.

Why the insurance talent-crunch persists

The insurance industry is bracing for a major talent drain, with projections from the U.S. Bureau of Labor Statistics2 indicating a loss of approximately 400,000 workers by 2026 due to attrition. Additionally, nearly half of the current workforce is expected to retire by 2028.

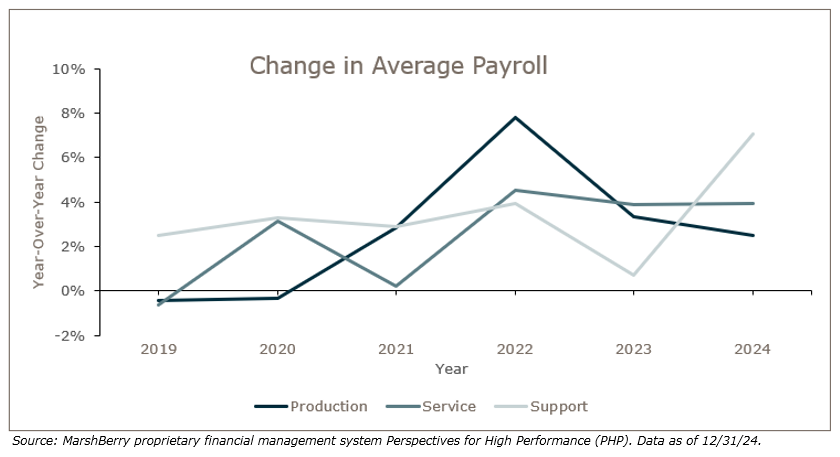

The insurance brokerage industry is also expanding, with total occupations (including insurance producer roles) projected to increase by 11.1% by year 2032.3 Based on these factors, compensation increases will likely continue across the insurance sector. MarshBerry’s data shows that, with the exception of 2021, percentage increases in compensation at insurance brokerages have been rising across most roles since 2019.

A shrinking insurance workforce, combined with greater staffing needs, presents a unique challenge. To avoid compromising standards when it comes to hiring, firms must be intentional in how they attract, retain, and develop talent.

Compensation plays a critical role in that effort, but it’s not the only consideration. Once pay is “in line” with the market, here are other factors that will become the true differentiators:

- Creating a culture where employees feel valued and connected to a clear mission.

- Providing training and development programs that expand skills and keep careers moving forward.

- Clearing pathways for advancement and leadership opportunities.

- Providing flexibility and benefits that align with evolving employee expectations.

These elements collectively form your employee value proposition (EVP)—the reason people choose to join, stay, and grow with your firm. However, competitive compensation is the foundation on which the rest of the EVP stands. Without it, even the strongest culture or career opportunities can be overshadowed by pay that’s out of step with the market. That’s where a strategic, data-informed approach to compensation becomes a competitive advantage.

Strategic compensation: the competitive advantage

MarshBerry’s proprietary financial system, Perspectives for High Performance (PHP), reveals that total compensation typically accounts for around 62% of net revenue—making it the largest expense for brokerages. To retain top performers and attract new talent, firms must be intentional about how they structure and allocate compensation.

Here are two key strategies for refining a firm’s approach to compensation:

1. Leverage data for smarter decisions

High-performing firms use benchmarking and peer data to guide compensation planning. Metrics like Net Unvalidated Producer Payroll (NUPP) help assess investment in emerging talent. MarshBerry’s Connect peer exchange shows that top-performing firms invest more in unvalidated producers than the average. Another valuable metric is Total Commissions & Fees per Service Person, which links service staff productivity to firm revenue. PHP data shows that higher pay correlates with stronger performance and organic growth. Regular benchmarking helps firms set realistic goals, fosters a culture of continuous improvement and uncovers opportunities for optimization.

2. Evolve compensation models

In a hard market, compensation strategies must adapt. Incentive programs—such as milestone bonuses, profit sharing, renewal commissions, or enhanced expense accounts—can keep producers motivated and loyal. Competitive packages attract top talent and reduce turnover, but without benchmarking, there’s no way to know if a compensation strategy is competitive. Staying informed on industry compensation trends is an absolutely essential for success, especially since access to market data for various roles creates a rock-solid foundation for informed negotiations and successful recruitment.

MarshBerry’s 2025 Agency & Brokerage Compensation Report: Available for Purchase

MarshBerry’s 2025 Insurance Agency & Brokerage Compensation Report explores the prevalent compensation trends concerning insurance agents and brokers. This one-of-a-kind report comprehensively examines current compensation data for 38 roles commonly found across insurance agents and brokers. The report offers insight into Executive & Management Compensation, Production, Service Staff, and Support Staff.