In August 2025, the U.S. economy continues to show signs of resilience after starting the year off with tempered caution. Q1 saw U.S. real GDP decrease by 0.3%, only to rebound with a 3.3% annualized growth rate in Q2. This was driven by stabilized inflation, strong consumer spending, a rise in personal income and reduced imports.

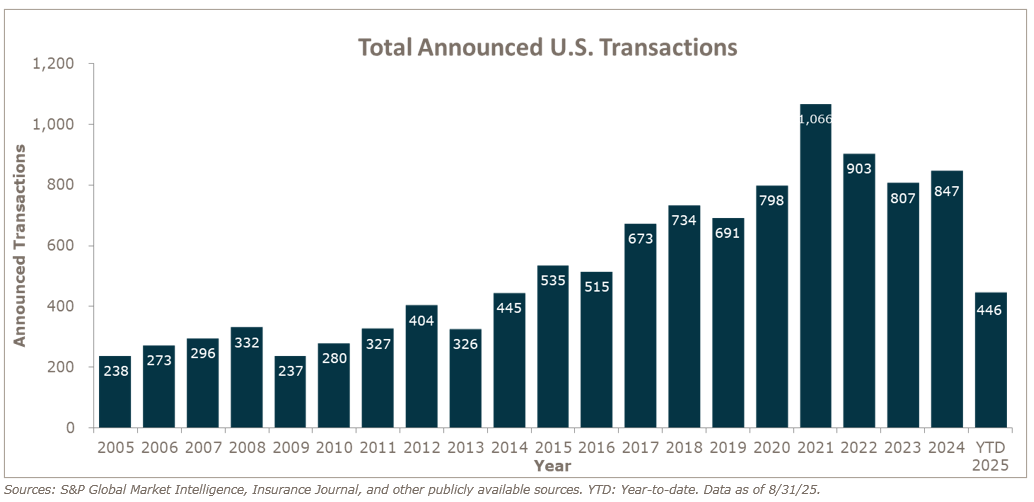

This economic backdrop is influencing insurance brokerage merger and acquisition (M&A) activity in nuanced ways. Deal volume through August 2025 is up 9.6% year-over-year, with 446 announced transactions in the U.S., signaling cautious optimism. The August Federal Reserve (Fed) symposium featured a speech by Fed Chair Jerome Powell, who suggested that a rate cut as early as September is possible. Economic analysts are also suggesting the possibility of one or two additional cuts in Q4. It is expected that any improvement to the debt markets will encourage buyers, particularly private equity-backed firms.

Overall, while macroeconomic volatility remains a factor, the insurance brokerage M&A landscape is adapting with strategic intent and measured momentum.

M&A market update

As of August 31, 2025, there were 446 announced M&A transactions in the U.S. – putting deal activity on 9.6% higher pace than last year, which saw 407 transactions announced through this time last year.

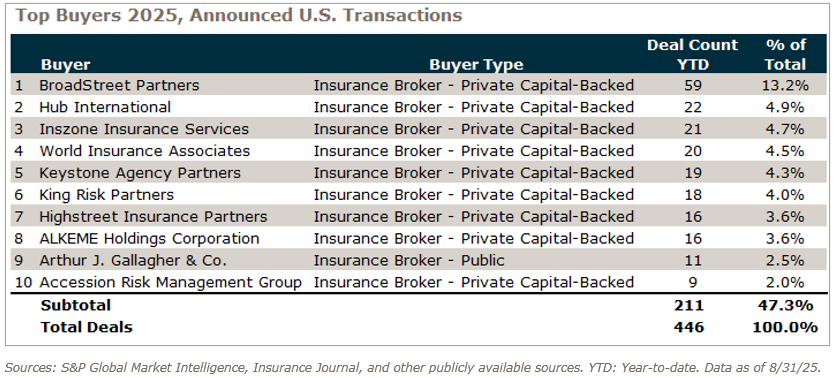

Private capital-backed buyers accounted for 324 of the 446 deals (72.6%) through August. Independent agencies were buyers in 65 deals so far in 2025, representing 14.6% of the market. There have been six announced transactions by bank buyers in 2025. Deals involving specialty distributors as targets accounted for 71 transactions, about 16% of the total market, continuing the trend of low supply of specialty firms.

Deal activity from the top ten buyers accounted for 47.3% of all announced transactions, while the top three (BroadStreet Partners, Hub International, and Inszone Insurance Services) account for 22.9% of the 446 total transactions.

Notable transactions:

- August 15: Brightstone Specialty Group, a Michigan-based subsidiary of Highstreet Insurance Partners, has acquired RMS Hospitality Group and its affiliated claims firm, Fortis Risk Solutions, from RMS Insurance Brokerage. Based in Garden City, NY, RMS Hospitality brings over 20 years of experience providing insurance solutions to franchise food, hospitality, and restaurant sectors, while Fortis serves as a third-party claims administrator. The acquisition strengthens Brightstone’s presence in these industries and aligns with its strategy to build a platform of specialized insurance innovators. MarshBerry advised RMS Hospitality on this transaction.

- August 29: Marsh McLennan Agency (MMA) has acquired Robins Insurance, a Nashville-based independent agency founded in 1976. Robins specializes in business and personal insurance, with niche expertise in sectors such as real estate, construction, hospitality, community associations, and manufacturing. The acquisition strengthens MMA’s footprint in the Southeast, particularly in the fast-growing Nashville market and enhances its service capabilities with Robins’ deep industry knowledge and client-first approach. MarshBerry advised Robins Insurance on this transaction.