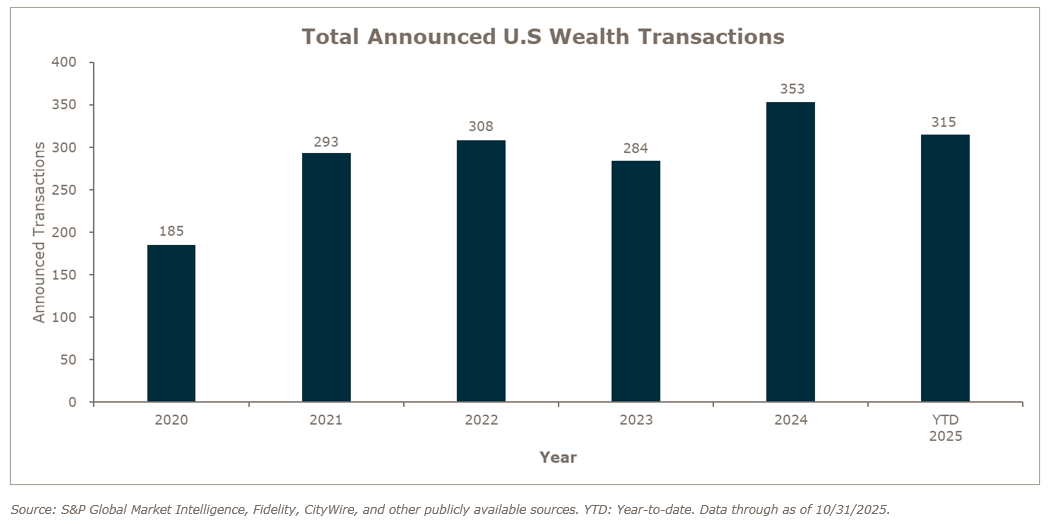

Wealth management merger and acquisition (M&A) activity remained robust in October, with 34 transactions bringing the year-to-date total to 315 announced deals – a 13.7% increase over the same period in 2024. The pace of activity underscores the market’s continued depth and resilience, even as macroeconomic crosscurrents have led some sectors to cool. Strategic acquirers and private capital-backed consolidators alike continue to find opportunities in a marketplace that rewards focus, scalability, and operational sophistication. With year-end approaching, the sustained volume suggests that the appetite for growth through acquisition remains both broad-based and disciplined, as buyers emphasize fit, integration capability, and long-term strategic alignment over pure expansion.

Beyond the numbers, a subtle evolution is unfolding in how firms define value and competitive advantage. As the wealth management industry matures, acquirers are increasingly differentiating through culture, leadership depth, and platform economics, not just assets under management (AUM) growth or advisor headcount. Firms that can combine scale with agility, technology enablement, and a clear client experience vision are beginning to separate themselves from peers. This maturation signals that the next phase of consolidation will not be driven solely by capital availability, but by the ability to execute consistently, retain talent, and deliver sustainable performance across market cycles.

M&A market update

Private capital-backed buyers accounted for 229 of the 315 transactions (74.0%) through October, a slight increase from the 2024 year-end figure of 71.7%. Independent firms accounted for 66 deals and 20.0% of the market, also in line with 2024’s final percentage of 21.0% (on 76 total independent deals). Insurance brokerages have acquired 24 wealth management and retirement firms in 2025.

Notable transactions:

October 14: NorthRock Partners, a Minneapolis-based RIA managing over $9.4 billion, acquired WGG Wealth Partners, a Roseville, California-based firm with $2.7 billion in client assets and 15 advisors. Led by former Ameriprise advisors Stephen Westlake, Colin Grahl, and Bret Glover, WGG brings deep experience and a strong West Coast presence to NorthRock. This marks NorthRock’s third acquisition in 2025 and supports its goal to grow from $6.5 billion to approximately $13 billion in AUM by year-end. The firm follows a fully integrated, W-2 advisor model, emphasizing cultural alignment and a team-based client service approach across disciplines such as investment, insurance, tax, and estate planning. NorthRock is backed by Sammons Financial Group, which acquired a majority stake in 2023 and continues to fuel its national expansion. With this acquisition, NorthRock strengthens its California presence and advances its long-term vision of becoming a $100 billion national wealth platform.

October 28: OnePoint BFG Wealth Partners, backed by Rise Growth Partners, has acquired Spahn Financial Partners, a Chicago-area advisory firm managing $2 billion in client assets. The deal marks OnePoint BFG’s largest acquisition to date, boosting its total assets to over $15 billion and expanding its team to 200 professionals nationwide. Founded in 1994, Spahn Financial was previously affiliated with Northwestern Mutual. Founder Kevin Spahn and partners Timothy Funke, Kyle DeRaedt, and Nirav Patel will become equity holders in OnePoint BFG and operate under its W-2 integration model. This transaction follows OnePoint BFG’s recent rebranding from Bleakley Financial Group and supports its vision of delivering a fully integrated, planning-led advisory experience. The firm has made several strategic moves since Rise Growth Partners’ investment, including exiting its brokerage affiliation with LPL Financial, launching an advisor equity program, and strengthening its leadership team.

Looking forward

MarshBerry expects 2025 to conclude as another record-setting year for wealth management M&A activity, driven by strong buyer demand and consistent access to private capital. As market participants look ahead to 2026, early signs of declining interest rates are expected to sustain this momentum and further strengthen acquisition appetite. Lower financing costs may unlock additional opportunities for both established consolidators and first-time buyers seeking scale. While broader economic and policy developments remain areas to watch, the fundamentals of the Registered Investment Adviser (RIA) market continue to support a healthy transaction environment. MarshBerry anticipates that disciplined execution, integration readiness, and long-term strategic alignment will remain key differentiators for firms pursuing growth in the year ahead.