Q3 M&A Marketplace Activity

As we head into the fourth quarter and month number seven of the domestic COVID-19 pandemic many continue to work from home, have invested in masks and other PPE, and likely have at least one eye on the upcoming presidential election. With the third quarter coming to a close, we’re taking a look at transaction values to see what has (or hasn’t) changed over the course of the year so far.

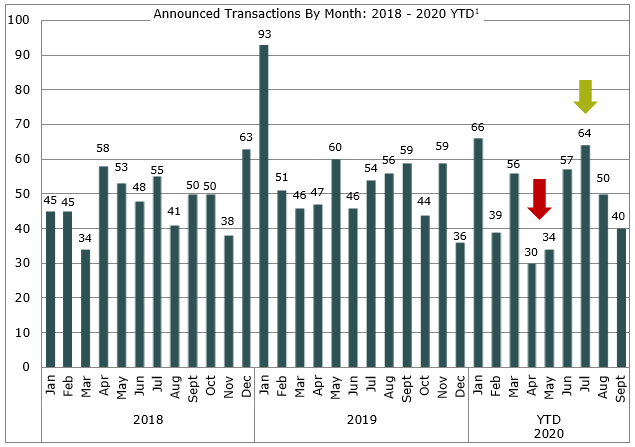

As you may recall, a number of deals nearing close during the first few weeks of the pandemic were put on hold until buyers (and sellers in some cases) could assess any potential damage to their business, firm value and the economy as a whole. The chart below details Merger & Acquisition (“M&A”) activity by month for the last two and a half years.

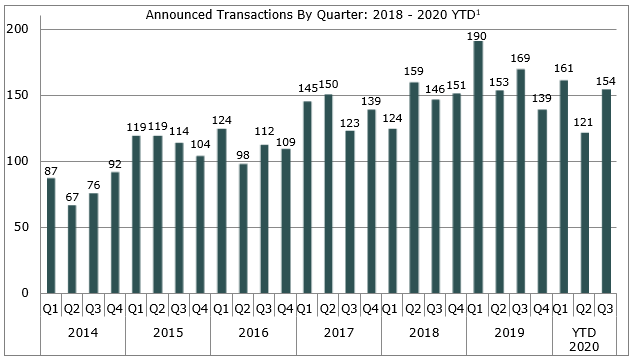

As indicated in the chart above, April and May 2020 were the two lowest deal announcement months since April 2018. However, the months of June and July 2020 showed some catchup, with July being the third highest activity month in the past 33 months. Total deals announced YTD through September are down only 2.9% compared to this time last year. Furthermore, buyers often announce transactions retroactively, so the numbers from 2020 YTD may increase throughout the fourth quarter. On a quarterly basis, a similar trend appears.

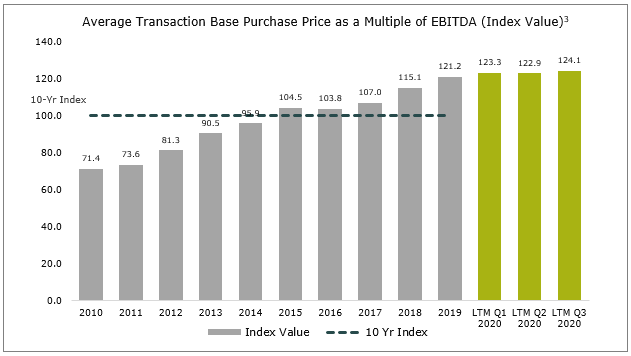

Valuations may not have taken the same leap forward after 2Q 2020, but it does appear slight declines in 2Q have been corrected in 3Q and valuations continue to climb as compared to year end and long-term averages. Below is an index graph showing Base Purchase Price2 as a multiple of EBITDA (Earnings Before Interest, Taxes, Depreciation & Amortization) across all the transactions in MarshBerry’s proprietary database as compared to the 2010-2019 average of that same measure. The most recent three data points are on a Last Twelve Months Rolling (“LTM”) basis ended in each quarter of 2020.

This graph is particularly interesting because we have heard anecdotally (and in fact public brokers said the same on their 2Q 2020 earnings calls) that valuations had been shifting to “earn out” proceeds rather than “up front” or guaranteed proceeds. However, our measure of Base Purchase Price is still up compared to LTM ended 1Q20 and 2019.

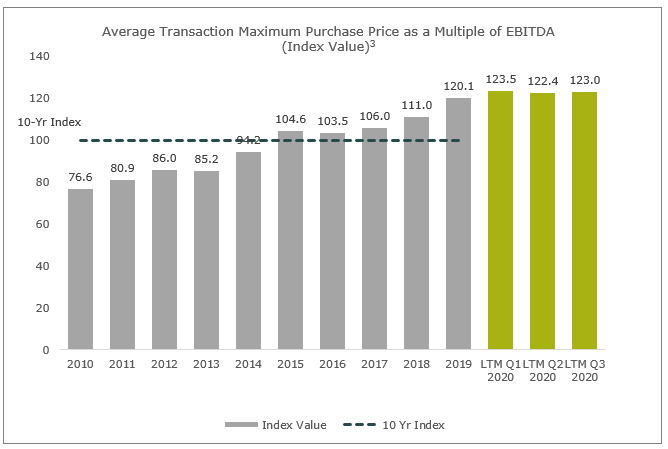

Additionally, Maximum Purchase Price4, or “total deal value” is also up in the LTM ended in 3Q compared to 2019 and the LTM ended in 2Q. Combining the chart below with the prior chart, it implies that contingent proceeds have declined slightly as a % of total purchase price from LTM 1Q to LTM 3Q. Maximum deal value is up 2.4% in the LTM ended 3Q20 as compared to 2019 and up 23% as compared to the 10-year average maximum purchase price.

Many market uncertainties remain, namely, the U.S. presidential election outcome and what, if any, impact that will have on the tax code and specifically capital gains tax rates. However, deal activity and deal values appear to be indicating what we had suggested from the beginning of the most recent economic crisis (and in fact have been saying for many years); the insurance industry will weather the storm more favorably than others, and investment thesis for private equity and other buyers remain fundamentally intact, supporting continued appetite to acquire, merge and pour capital into the insurance distribution space.

If you have questions about Today’s ViewPoint, or would like to learn more about recent M&A activity in the insurance marketplace, please email or call Phil Trem, President, at 440-392-6547.

Subscribe to MarshBerry’s Today’s ViewPoint blog for the latest news and updates and follow us on social media.

1

Year to Date (“YTD”) is as of September 30, 2020. All transactions are announced deals involving public companies, Private Capital backed brokers, private companies, banks as well as others including Private Capital groups, underwriters, specialty lenders, etc. All targets are U.S. only. This data displays a snapshot at a particular point in time and has not necessarily been updated to reflect subsequent changes in prior years, if any. MarshBerry estimates that historically, a low percentage of transactions were publicly announced, but we believe that this has risen to over 50% today. Source: S&P Global Market Intelligence, Insurance Journal, and other publicly available sources.

2Base Purchase Price defined as: The amount of proceeds paid at closing, including any escrow amounts for indemnification items, (i.e., Paid at Close) plus amounts that the buyer may initially hold back, but which are paid as long as the sellers performance does not materially decline, or which may be paid at closing but are subject to a potential adjustment (i.e., Live Out).

3MarshBerry proprietary database. Data compiled from transactions in which we were directly involved, those from which we have detailed information, and transactions in the public record. Numbers may not add due to rounding. Past performance is not necessarily indicative of future results. Individual results may vary. LTM: Last Twelve Months; Q1: Quarter 1; Q2: Quarter 2; EBITDA: Earnings Before Interest, Taxes, Depreciation, and Amortization.

4Maximum Purchase Price defined as: The additional earn out above the realistic level, that if achieved, would generate the maximum possible earn out payment.

Investment banking services offered through MarshBerry Capital, Inc., Member FINRA Member SIPC and an affiliate of Marsh, Berry & Company, Inc. 28601 Chagrin Boulevard, Suite 400, Woodmere, Ohio 44122 (440.354.3230)