“My firm doesn’t write small business.” Does that sound familiar? If so, you’re not alone. Many of the insurance firms MarshBerry meets with agree. There are a lot of reasons why firm principals claim they don’t write small business:

- Firm revenue is usually supported by larger accounts representing a higher premium/revenue volume.

- They don’t have a Small Business Unit (“SBU”) or utilize carrier service centers.

- It’s perceived as not profitable and a resource drain.

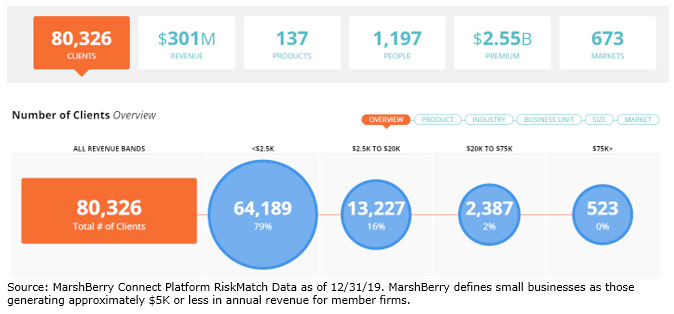

But no matter your size, your focus, or your thoughts on small business, the fact is – you do. Consider the following snapshot highlighting MarshBerry’s Connect Platform clients. When looking at their data, 79% of their business, or 64,000+ clients, would fit into an SBU. Would it surprise you to hear only 52% of these firms have a designated business SBU? By implementing an SBU, you’re enabling your more tenured staff to focus on larger accounts where they can add more value.

Why You Should Consider Using Small Business Units

Unfortunately, many firms pass on creating small business units based on the sheer volume of accounts and a lack of direction on where to start. In today’s market, there are multiple technology solutions available to help firms implement, manage and grow this business segment. Critical to this technology are forward-thinking carrier partners who are engaging with these technology solutions. With a central mission of reinforcing a carrier’s underlying value proposition to the insured, these technologies empower sales and service teams to more effectively find best in class new business and renewal solutions for these same insureds. Successful firms with SBU’s are using Single-Entry Multiple Carrier Interface (SEMCI) to help ensure this customer experience is both institutionalized and enhanced.

If you have questions about Today’s ViewPoint or would like to learn more about using technology or our financial advisory solutions to drive efficiencies in your business, please email or call Eric Kuhen, Strategy Consultant – Connect Platform at 440.637.8118.

MarshBerry’s Connect Platform team is hosting a webinar highlighting how technology and carriers are “Connecting the Dots” to help insurance agents and brokers better manage (and grow) their SBU. Join the panel discussion with representatives from Grange, Hanover, Tarmika and ITC.

“Connecting the Dots: How Carriers & Technology Partners Can Help Accelerate Your Firm’s Growth”

- Date: Wednesday, July 22, 2020 @ 11:00 am ET

- Click HERE to register. Space is limited.

Subscribe to MarshBerry’s Today’s ViewPoint blog for the latest news and updates and follow us on social media.