Organic growth – what is enough to sustain your current value? 5%? 7%? 15%?

Organic Growth: What’s Your Target?

Last week, we published a series in Today’s ViewPoint emphasizing the critical steps to putting your firm on the path to predictable, sustainable, organic growth. There are countless reasons why organic growth is important: employees thrive in growing organizations, attracting and retaining talent is less difficult, growth can fund investments for your firm’s long-term viability, and many more. But perhaps most important of all, is what growth can do for your firms’ value in either an internal or external perpetuation plan. Without growth, it may be hard to find willing or able internal buyers for the company’s stock. Without growth, fewer external parties will be eager to pay market multiples for the business. Even more critically, in an environment where multiples are likely to decline, without growth, your firm’s value can potentially decline over time.

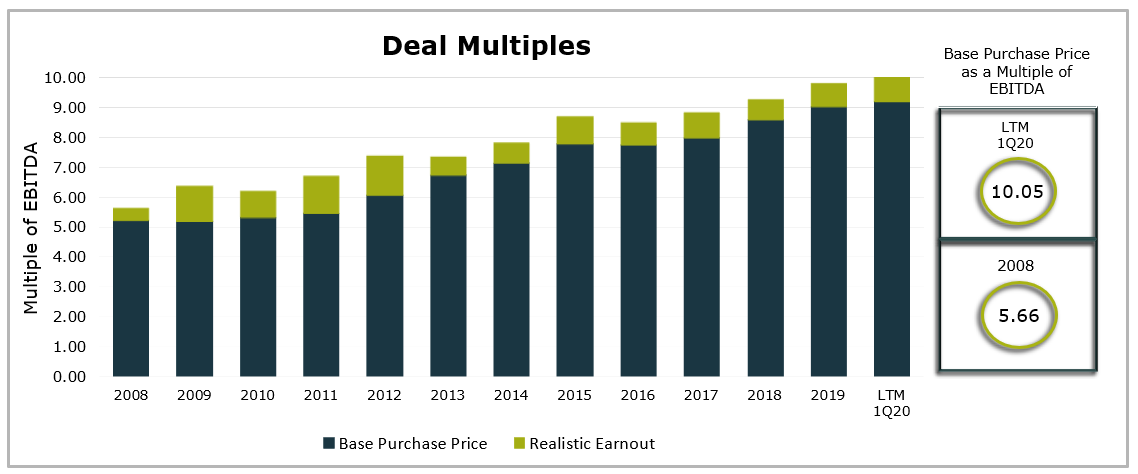

The following chart illustrates annual average purchase prices for insurance distribution businesses as a multiple of Earnings Before Interest, Taxes and Depreciation (“EBITDA”) and includes the Base Purchase Price1 and Realistic Earnout2. The most recent three years ranging between 8x to 10x EBITDA.

Consider this scenario using 2008 as historical low. If you assume multiples turn back to those seen in the 2008 recession (5.66), that would be a 44% decline from the LTM (Last Twelve Months) 1Q20 (10.05) levels over the next 10 years. For simplicity sake, let’s just say that multiples could be cut in half (a 50% drop from current levels).

Now, the “Rule of 72” implies that to double your firm’s size over that same time horizon of 10 years, you’d have to grow by roughly 7.2% per year, or just over a 7% Compound Annual Growth Rate (“CAGR”).

Put these two concepts together and the result is a business that is worth an equal amount but is twice the size it was 10 years ago. Add on the potential capital gains tax rate changes from the election, for illustrative purposes say it doubles, and you’d have to grow twice as much, nearly 15% rounded up per year, to have the same after-tax proceeds from the sale of said business today versus 10 years ago. Is your organic growth target even close?

Looking from a different angle, if your firm were to grow 4% a year for the 10-year period, your firm would be about 50% larger, but realize only 75% of its current value in a hypothetical transaction if multiples fall by 50% over the same time period.

You may be thinking: “Does MarshBerry REALLY expect multiples to be cut in half?” While the answer is, “it’s not likely,” it’s important to drive home the message about how important organic growth is to the vitality of an organization. Whether you are planning to perpetuate internally or externally, growth is a critical component to value. And in the current environment, it may be the underpinning to maintaining value as multiples are expected to decline.

If you have questions about Today’s ViewPoint, or would like to learn more about the Evolution of M&A and Succession Planning in today’s marketplace, please email or call John Wepler, Chairman & CEO, at 440.392.6572.

Subscribe to MarshBerry’s Today’s ViewPoint blog for the latest news and updates and follow us on social media.

Source: MarshBerry proprietary database. Data compiled from transactions in which we were directly involved, those from which we have detailed information, and transactions in the public record. Numbers may not add due to rounding. Past performance is not necessarily indicative of future results. Individual results may vary. LTM: Last Twelve Months; Q1: Quarter 1

1 The amount of proceeds paid at closing, including any escrow amounts for indemnification items, (i.e., Paid at Close) plus amounts that the buyer may initially hold back, but which are paid as long as the sellers performance does not materially decline, or which may be paid at closing but are subject to a potential adjustment (i.e., Live Out).

2 The amount of proceeds realistically anticipated to be achieved in the future based on a number of factors including seller historical and expected performance, buyer and seller realistic discussion of earn out metrics, etc.

Investment banking services offered through MarshBerry Capital, Inc., Member FINRA Member SIPC and an affiliate of Marsh, Berry & Company, Inc. 28601 Chagrin Boulevard, Suite 400, Woodmere, Ohio 44122 (440.354.3230)