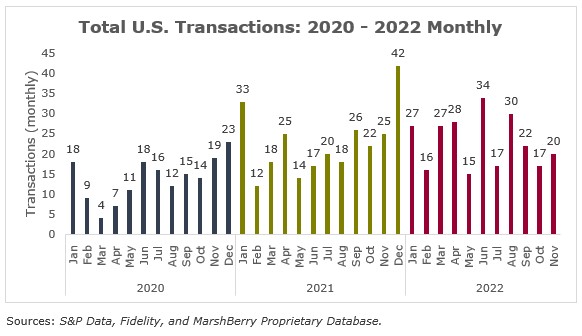

Merger & acquisition (M&A) activity, guided by wealth management M&A consulting, in the wealth advisory space continues to be robust and is expected to continue at a record pace through the end of 2022. Through November, there have been approximately 253 announced wealth M&A transactions in the U.S., compared to 230 deals through the same time period last year, representing a 10% increase over last year. December only needs 20 transactions to exceed last year’s total of 272. For the last two years, deals in December averaged 14.6% of the total deal volume for the year. This data point bodes well for the final count in 2022.

Understanding the Benefits of Partnerships in Wealth Advisory during Economic Uncertainties

It’s no secret that 2022 has been an economically challenging year, especially for the financial markets. With wealth firms’ earnings intrinsically connected to market performance, there have been signs that valuations in this space may be softening. However, this perception is creating even more enticement from buyers looking to diversify and create more consistent revenue streams by partnering with wealth advisory firms. Sitting on the sidelines might not be the best strategy.

If you’ve built a strong business, have the right leadership in place and have solid drivers of continued value – don’t let the market dictate your decision to partner. Depending on your plans for organic growth, or investments in technology and people, the current economic environment might not allow you to move on those goals. Now might be the perfect time to look for a partner. And if you have older leadership or financial advisors, you may not be able to afford the luxury of timing the market. Keep in mind, partnerships can take any shape or form, and may not necessarily be a traditional transaction. Right now, there are a number of buyer types actively looking for investments, ensuring that the consolidation trend should continue in 2023.

The Rising Role of Private Equity and Insurance Brokers as Top Acquirers in Wealth Advisory

There are several types of potential buyers and partners in this space – ranging from private equity (PE) backed firms to publicly owned RIAs to independent wealth management firms. Many of those PE backed firms are insurance brokers. In years past, most of their activity focused on adding retirement planning capabilities to their platforms. More recently, however, it appears they are expanding into the pure play wealth advisory space, a trend that is expected to continue in the future.

Through November, there have been 31 wealth advisory deals transacted by insurance brokerage buyers, or 12.3% of the 253 total deals. And 29 of the 31 deals were done by PE backed insurance brokerage firms.

PE buyers see massive synergies between their insurance brokerage firms and wealth advisory targets. Oftentimes they have similar clientele which presents cross selling opportunities and more robust service offerings. They are also attracted to the recurring revenue model of wealth advisory, with more stable investment opportunities.

Deal Spotlight: Demonstrating the Power of Insurance Brokerage M&A in Wealth Advisory

November 10, 2022: Hub International Limited (HUB), a global insurance brokerage and financial services firm, announced that it acquired Bridgecreek Investment Management, LLC (Bridgecreek) an independent boutique portfolio management firm based in Tulsa, OK, with over $1 billion in client assets. The Bridgecreek acquisition gives HUB a strong presence in Middle America and helps round out their full service offering to private clients. The Bridgecreek team will provide HUB additional capabilities and expertise in portfolio management. HUB continues to be a leading acquirer of elite RIAs throughout the U.S. MarshBerry served as a strategic advisor to HUB on this transaction.

If you have questions about Today’s ViewPoint or would like to learn more about how MarshBerry can help expand your wealth management portfolio, please email or call Kim Kovalski, Managing Director, at 440.769.0322.

Investment banking services offered through MarshBerry Capital, LLC, Member FINRA Member SIPC and an affiliate of Marsh, Berry & Company, LLC. 28601 Chagrin Boulevard, Suite 400, Woodmere, Ohio 44122 (440.354.3230)