Is there Going to be a Recession?

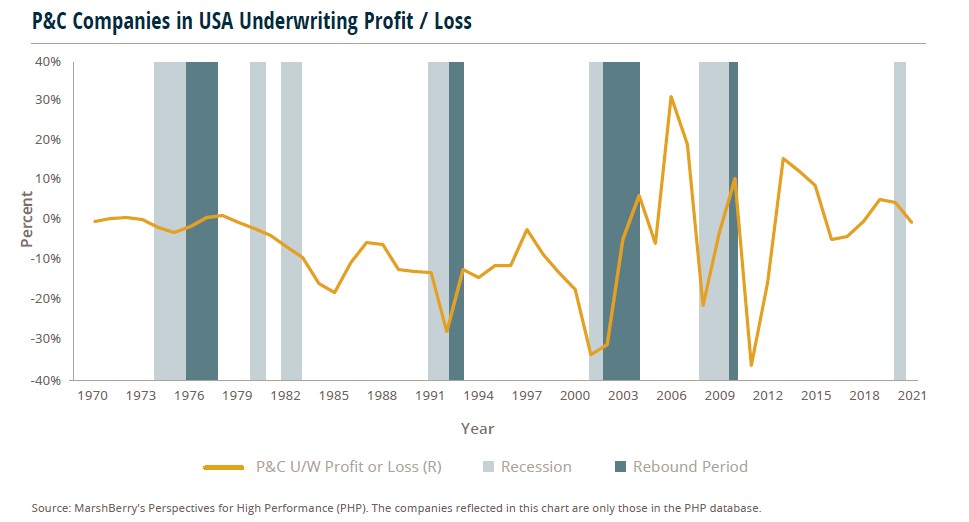

Plenty of industries describe themselves “recession-proof” but the insurance sector has one of the strongest claims to the accolade. Keep in mind – insurers aren’t immune to recessions. They tend to sustain underwriting losses and see their profits slump like everyone else. Carriers may also experience lower returns from their investment portfolios in slowdowns compared to higher growth periods. But the lasting damage from macroeconomic downturns tend to be minor for Property & Casualty (P&C) insurers, with rebound tendencies immediately following a downturn.

Insurance isn’t a discretionary purchase for many businesses and consumers, but an eternal necessity. Whatever the economic weather, businesses still need to buy property and liability insurance, while consumers still need to purchase health, auto, homeowners, and natural disaster insurance. In fact, Acts of God such as hurricanes, tornadoes and floods are the sector’s real bogeymen. Insurers won’t have any fond memories of 2005, the year of Hurricane Katrina, or of the destructive tornado season of 2011.1

The perennial need for insurance becomes the industry’s trusty armour during recessions. Typically, net written premiums soar2, and insurers pick up where they left off after a downturn. And even if demand for financial protection is limp, insurers don’t live or die by their annual balance sheet. Many carriers are major investors with long-term investment horizons who can withstand short-term hits.

The issue is particularly pertinent these days, of course. By many accounts, the United States is standing on the brink of a recession as the Federal Reserve raises interest rates to tame inflation, causing many businesses to rein in spending. But there are signs that this recession, should it hit, will be a relatively mild beast – meaning the insurance industry should be especially confident about weathering any slowdown.

Are We Going into a Recession?

A couple of leading economic indicators suggest the next few quarters contain plenty of upside potential for the world’s financial guarantors. In short, it looks like we’re facing a recession like no other.

What’s the argument for a recession?

First, let’s be clear: There remain important players who are sceptical we’re even facing a recession. In mid-March, Goldman Sachs’s top economists, put the probability of a recession at only 35% in the next 12 months. This was an increase from their previous assessment in early February of a 25% chance, driven by the recent collapse of Silicon Valley Bank and others.3

But that is well below Wall Street consensus, and few would deny that a measure of economic gloom is baked into the near future. Take a look at the Treasury Yield Curve, a historically reliable bellwether of our long-term economic fortunes.

In a typical economy, the longer the term of the U.S. Treasury note, the higher the interest rate, or yield, that it pays to the note holder, and vice versa. But now, the yield curve is inverted. Investors are worried about the near-term future and are seeking higher interest rates on two-year Treasury notes than for 10-year bonds.

That strongly suggests that we could be in the eye of the storm in just a matter of months. An inverted yield curve has been the harbinger of every recession over the past 60 years, except for 1966, when the U.S. economy merely experienced a slowdown.

Yes, but today’s economy isn’t so simple

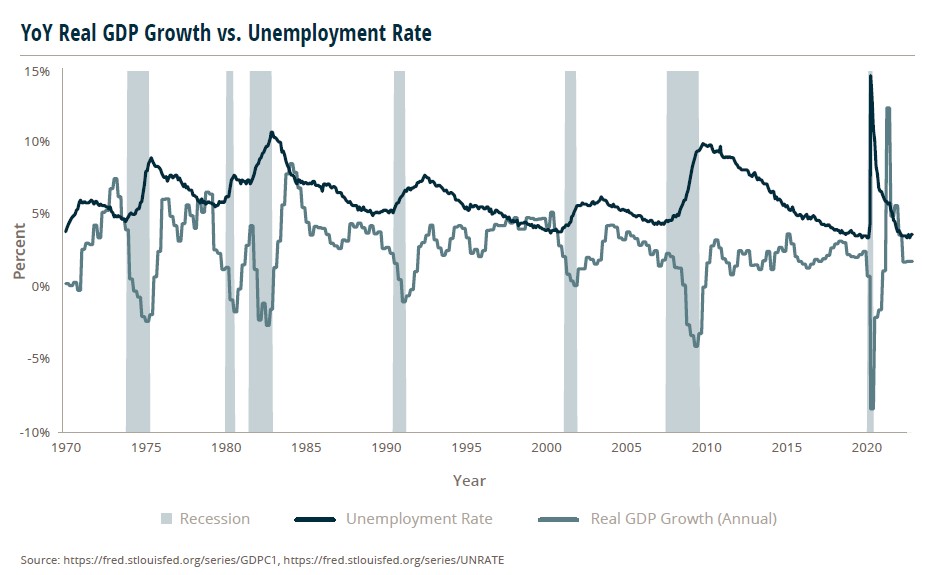

Look closer, and you can see why this recession may unfold like no other. Why? For one thing, study the correlation between gross domestic product (GDP), the measure of the nation’s economic output, and employment. In every U.S. recession since World War II, GDP growth rate goes down, while unemployment goes up.

During the Iran-Energy Crisis of 1981-1982, real GDP fell by 2.6%, while unemployment rose to 10.8%, the highest since the Great Depression. During the Great Recession of 2008-2009, GDP decreased by 4.0% while unemployment reached 10%. In the short, deep COVID-19 recession, GDP fell by 9.6% while unemployment peaked at 14.7%.4,5

The relationship between the two indicators is one of tight inverse proportion because they feed off each other. Companies lay off workers when they’re feeling less confident about the future, which has a knock-on effect on consumer sentiment and spending. As consumers cut back, it impacts companies’ profits, leading to further redundancies, and so on.

This time round, there has been a decoupling of GDP and unemployment movements. Consumer sentiment is understandably pessimistic given the inflationary environment and other ongoing global macroeconomic factors. But – unemployment is at a 40-year low, and there are more jobs than bodies to fill them. (At the last count, there were nearly 10 million open positions in the U.S., with around 6 million Americans unemployed.6) In fact, the double whammy of retiring Baby Boomers and the COVID-19 pandemic has precipitated a labor force participation crisis. Most companies aren’t laying off workers. Instead, they’re desperate to hire.

Companies are also cash rich. Businesses are coming off months of healthy demand for goods and services, thanks to the billions of dollars in fiscal stimulus pumped into the economy during the pandemic. Companies in various sectors have recorded double-digit profit growth in recent quarters and filled their coffers.7 In fact, U.S. firms are sitting on close to $4 trillion in cash, which is a hefty downturn buffer. An average firm may not have to face the tough choice of firing workers or cutting back on investment. And a high-performing company may even have the money to weather a prolonged economic storm and continue to grow.

Not only will this type of financial protection break the usual cycle of previous recessions (i.e., lower consumer spending, high unemployment), but it means that the prospect of a “jobless recovery,” whereby GDP bounces back and unemployment rises, is very slim. This recession will probably be the opposite of most recessions, with output decreasing and companies hiring. That is why some pundits are already labelling it a “jobful downturn.”

What does it mean for the insurance industry?

The record shows how this industry can successfully weather stormy times. Since 1985, the U.S. insurance industry has enjoyed growth in net written premiums every single year, apart from the 2007-2009 period of the Great Recession. Premiums even continued to grow during the slowdowns caused by the Gulf War in 1990-1991, the September 11 attacks of 2001, and the COVID-19 pandemic.

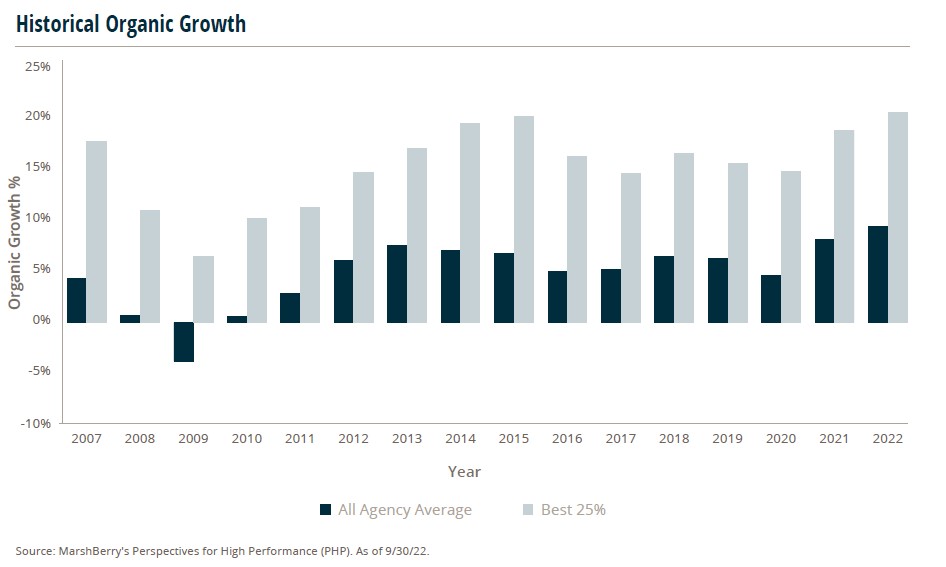

The steep but short COVID-19 slowdown in 2020 is a good example of the sector’s resilience. A year later, brokerage and agencies reporting to MarshBerry’s proprietary financial database Perspectives for High Performance (PHP) saw, on average, a nice lift in organic growth, from 4.6% in 2020 to 8.3% in 2021. This increase in organic growth was likely driven by such factors as higher premiums and increases in asset prices. The Best 25% of firms fared even better. They not only grew more than the average firm in 2021 but they saw less of a drop in organic growth levels during the pandemic-related slowdown vs. in the prior recession in 2009.8

Since the millennium, property and casualty (P&C) insurers have also recorded healthy underwriting profits in the years following losses, allowing them to break even. The industry’s performance has been bolstered by net investment gains that have consistently been in the $20-30 billion range every year since 2000.9

The insurance industry can take this kind of recession in stride. Jobful downturns mean fewer claims and pay-outs, which limits their underwriting losses. Businesses also have plenty of cash on hand to beef up their protection once calmer economic waters prevail.

A Recession like no other

While public sentiment matches up with the idea that the U.S. is headed towards some sort of recession, business leaders are a bit more optimistic that this could be a recession like no other.

Nearly eight in 10 business leaders are expecting a recession, and most are feeling the acute effects of inflation and supply chain disruptions. Despite this, two in three of them have a positive outlook on the economy, compared to only 13% of the public.10

And although the sales of cappuccinos are an unscientific method of gauging the severity of a recession, Starbucks is reporting a sales boom, even as its prices continue to soar.11

Explore Consulting Services & Prepare for the Impending Recession

Say it softly, but this recession won’t be anything like 1981, 2008, or even 2020. For the insurance industry, as long as carriers manage their long-term investments astutely, they may have nothing to fear from the next few quarters.

If you have questions about Today’s ViewPoint, or would like to learn more about our consulting services or how market activity may impact your firm, email or call Eric Hallinan, Managing Director, at 949.234.9652.

Investment banking services in the USA offered through MarshBerry Capital, LLC, Member FINRA and SIPC, and an affiliate of Marsh, Berry & Company, LLC, 28601 Chagrin Blvd, Suite 400, Woodmere, OH 44122 (440) 354-3230