In the first article in our series on the benefits of cross-selling, Boost Retention and Revenue with Account Rounding Strategies, MarshBerry shared insights on the benefits of using account rounding to increase revenue and build trust. But implementing this strategy can be tough, particularly for teams who are concerned about taking on a process that feels in conflict with their current role or apprehension about obtaining their property and casualty (P&C) license, if not licensed today. Service team members are typically more comfortable working within established boundaries and could be resistant to adding a task that feels more like sales than service. Here are common objections from service teams and how to not just overcome them, but get team buy-in and enthusiasm.

Objection #1: “This will damage the client relationship.”

Service and other support teams tend to thrive on stability and structure, often fearing disruption to their traditional working style. They frequently have low risk tolerance and are empathetic to client interests, so it’s natural for them to raise concerns about something that feels counter to nurturing that relationship. Many service teams believe account rounding could cause a negative impression with clients or even risk losing them.

Solution: Communicate that the service team may be in the best position within a firm to identify opportunities to offer clients new coverage or increase their existing coverage limits. They’re the ones maintaining client relationships, uncovering individual needs, and listening to concerns. These professionals have direct insights into the problems that account rounding can solve and can more seamlessly present solutions that meet those needs.

Also ensure the service teams understand that this process isn’t an aggressive sell, but consultative risk reduction. By adding account rounding to conversations, they can help clients find specialized policies for unique needs and educate them on the benefits of adding those policies and products. For example, maybe they have a client who would benefit from adding additional workers compensation coverage. Service staff should rely on their proven communication style and persuasion skills to convey why the workers’ compensation policy is a necessary safety net, helping the client to mitigate any financial burdens. In the end, proposing another solution often enhances the client relationship by showing that you understand their needs and further positions yourself as a trusted advisor.

Objection #2: “I don’t have time.”

For any professional, taking on a new, seemingly complex task is going to come with resistance. Particularly true of top performers, staff might feel that their current workload is already quite challenging and that adding something else is going to be unmanageable or cause setbacks for individual or firm goals.

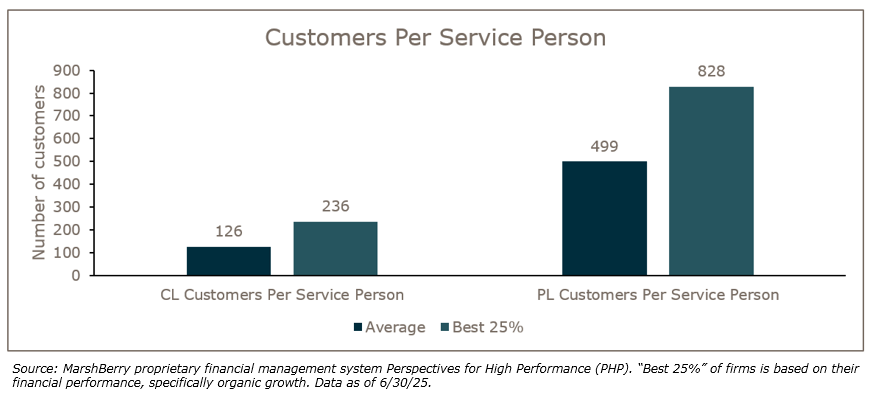

Solution: Before dismissing this concern, it’s important to examine the average book size of your service staff and how it compares to the rest of the industry. In the chart below, the average commercial line service person serves about 126 customers, while service persons from top firms serve closer to 236 customers on average. The difference is even more striking on the personal lines side – service staff in top firms service twice the number of customers compared to average firms.

If analysis proves that the service team genuinely is overloaded, look into virtual assistants or an outsourcing service that can take over time-consuming tasks. But if the numbers show that their workload is lighter than service teams of similarly sized firms, that could signal a different problem. Figure out if the issue is something the firm needs to fix, such as a poorly designed process, technology problems, or training limitations, or due to an individual performance problem like time management issues, knowledge gaps, even poor job fit.

Objection #3: “I don’t have those skills. I don’t have that training. It’s not my job.”

Some service staff may see this process as hard selling, a skill that feels contradictory to their role of cultivating long-term relationships. They could also feel this process is more similar to the producer role and worry that their lack of sales experience will prevent them from being successful.

Solution: The truth is that account rounding is a skillset very similar to what they already do today. Service staff tend to be very empathetic, consultative, and detail oriented, and they’re able to uncover complex coverage solutions — all skills that are useful in account rounding.

To help service teams more easily agree to an extra task, consider adding additional compensation or bonuses as they achieve growth goals. Beyond financial rewards, what else motivates them to perform – is it recognition, advancement opportunities, schedule flexibility? All these perks can be offered as rewards as the business grows.

Since account rounding generates additional revenue and improves long term retention, it’s beneficial to the business and employees. Frequent, consistent communication and leadership alignment are critical to driving success and trust in this endeavor. Once service teams understand how account rounding actually strengthens client relationships, improves service, and boosts retention renewal rates, the change in mindset and attitude can be significant.