While merger and acquisition (M&A) activity in the overall insurance distribution market experienced some challenging headwinds in 2022 (a 19% decrease in transactions from 2021), an interesting trend continued for Brokerage General Agents (BGAs). For this article, BGA refers to wholesalers of life and annuity products or firms that distribute these products through a network of retail insurance agents and/or wealth advisors. Despite coming off a record level of transactions in 2021, these firms experienced an increase in M&A activity in 2022.

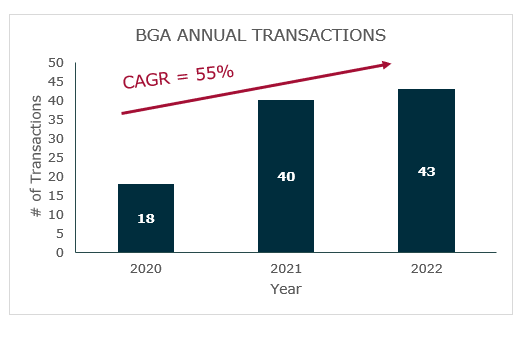

Originally, higher M&A activity in the BGA space appeared somewhat of an anomaly, as the transaction count in 2021 was over double the 18 BGA acquisitions announced in 2020. However, as 2022 came to a close, the numbers solidified a growth story. There were 43 publicly announced transactions in the BGA space in 2022, representing an 8% increase from 2021 and a Compound Annual Growth Rate (CAGR) of 55% since 2020.

This may appear minor when looked at in a vacuum. But considering the headwinds the M&A market faced in 2022, including depleted buyer backlogs resulting from the threat of tax changes pulling deals into 2021, record high inflation, and the increasing cost of capital – the increase in transaction activity in 2022 was no small feat. BGAs also faced an additional hurdle of overcoming a record high of 40 publicly announced transactions in 2021.

What Changed With the BGA?

Because BGAs historically played a minor role in the booming consolidation in the insurance distribution industry, the natural question those familiar with the space ask is, “What’s changed?” While several factors are leading to the increasing consolidation of BGAs, three primary catalysts are driving the trend:

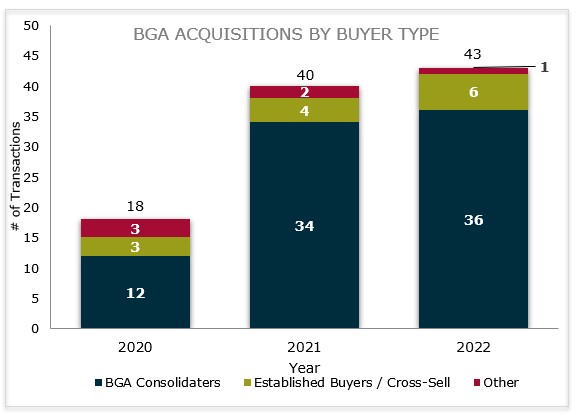

- BGA-focused consolidators: Private equity-backed consolidators emerged over the last several years, focusing on the life and annuity space. To name a few, Integrity Marketing Group, Simplicity Group Holdings, and AmeriLife Group (including a recent joint venture “ICON”) are all actively rolling up BGAs. In 2022, these three consolidators accounted for 36 transactions, boasting an 84% market share.

- Cross-sell opportunities for established buyers: The well-established buyer community within the insurance distribution space continues to look for and benefit from cross-sell synergies across various verticals (P&C, employee benefits, wealth managers, etc.). Bringing in experts within the life and annuity space allows those buyers’ existing customers to access a more robust product offering. For BGAs, this is especially noteworthy for buyers building out wealth management divisions, whose customers directly overlap with those purchasing life insurance and annuities.

- Increasing valuations: Historically, valuations in the BGA space did not move the needle for owners. As BGA’s revenue streams are heavily weighted towards first-year commissions (i.e., largely non-recurring revenue streams), the business model forces firms to (re)create revenue streams each year, albeit ideally from a recurring referral base (e.g., wealth managers and retail insurance agents). This fact naturally leads to a valuation discount compared to typical insurance brokers, who benefit from direct interactions with insureds, which lends itself to consistent renewal commissions and highly predictable cash flows that attract investors to the industry. However, due to the trends discussed, BGA owners are discovering the marketplace’s attitude towards BGAs is changing, and an uptick in valuations is becoming increasingly hard to ignore.

The impact of this trend

For those BGA owners considering a sale, the results of this trend are positive. Compared to where these owners found themselves just a few years ago, sellers in today’s market are presented with increased valuations and a broader potential suitor base, including 17 unique buyers in the last three years alone. However, for owners that desire to remain independent, an increasingly challenging path lies ahead as they continue to compete with firms with more resources and better technology. One question both sets of owners must address… “What should I do next?”

Investment banking services in the USA offered through MarshBerry Capital, LLC, Member FINRA and SIPC, and an affiliate of Marsh, Berry & Company, LLC, 28601 Chagrin Blvd, Suite 400, Woodmere, OH 44122 (440) 354-3230