Early 2025 ushered in growing uncertainty across financial markets and the U.S. economy, as tariffs, inflationary pressures, and concerns over economic growth fueled heightened stock market volatility. Although these concerns persisted through Q2 2025, the easing of tariff policies and a de-escalation of international conflicts fueled a strong rebound in U.S. equity markets. The S&P 500 surged more than 25% from its April lows, reaching new all-time highs by the end of June.

Against this backdrop, the specialty intermediary mergers and acquisitions (M&A) market has grown increasingly competitive due to the continued scarcity of high-quality sellers. Although buyer interest in specialty intermediaries remains robust, the average number of deals completed per buyer has declined meaningfully in 2025. This trend reflects an expanding pool of buyers vying for a limited supply of sellers.

Although U.S. financial markets rebounded in Q2 2025, several underlying factors still pose a risk of renewed volatility, potentially resulting in headwinds for the M&A market. While the ‘Liberation Day’ tariffs announced on April 2 remain paused, President Trump announced on July 7 that steep new tariffs could be imposed on imports from 14 countries starting August 1, 2025. There is also potential for a resumption of geopolitical tensions following the June ceasefire between Iran and Israel that could roil markets.

Further, on July 4, 2025, the One Big, Beautiful Bill Act (OBBBA) was signed into law, marking a major overhaul of the U.S. tax code. The legislation permanently extends key provisions of the 2017 Tax Cuts and Jobs Act (TCJA), which were previously set to expire at the end of 2025. As a result, many taxpayers will continue to benefit from lower individual income tax rates and an increased standard deduction. For businesses, the federal corporate income tax rate of 21% is now permanent, providing long-term clarity and stability.

It’s not yet clear how much the OBBBA will impact the U.S. economy. The permanent extension of the TCJA is promoted as a growth lever for further investment in American companies and workers. But there is the potential impact on the U.S. debt, which critics are estimating will increase by $3 to $4 trillion over the next 10 years. Further stress on the economy could trigger fiscal tightening, reignite inflation, and drive up the cost of capital – factors that may temper the elevated buyer demand currently seen in the specialty intermediary M&A market in 2025.

M&A Market Update

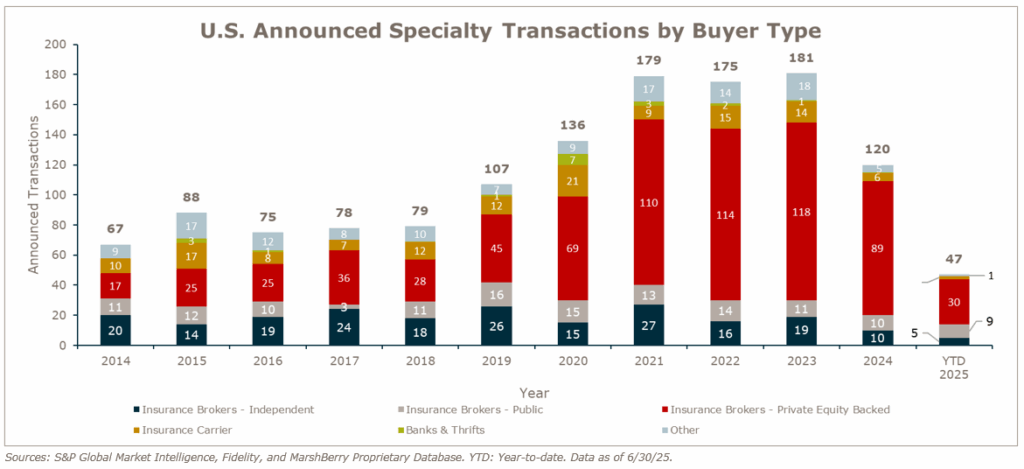

As of June 30, 2025, there have been 47 announced specialty distributor M&A transactions in the U.S, with 28 transactions announced in Q2. This activity is slightly below the 49 transactions announced in the first half of 2024, which ultimately closed with 120 deals — marking a 33% drop from the record 181 specialty distributor transactions recorded in 2023.

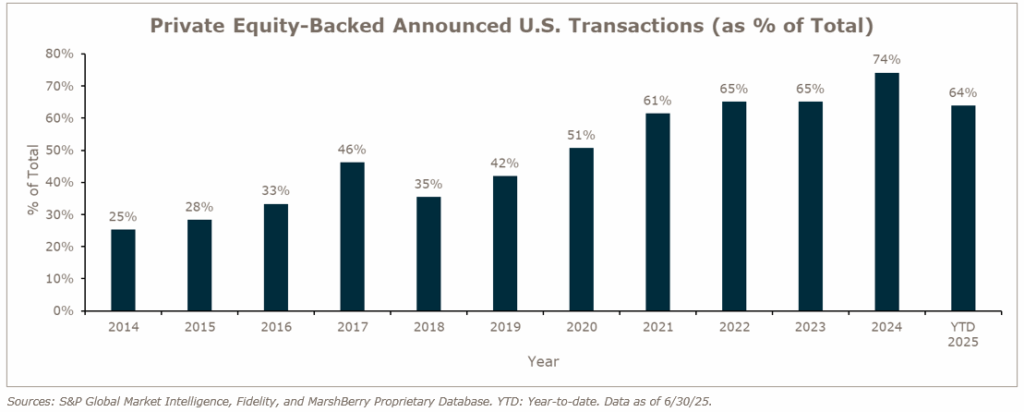

Transaction activity continues to be driven by private equity-backed organizations, which totaled 30 transactions through June 30, 2025 – a decrease from 36 deals announced through June 2024. Notably, all other buyers collectively completed 17 deals in YTD June 2025 compared to 13 in YTD June 2024. This trend was driven by publicly traded brokers who continue to take advantage of their rising valuations in the public markets, completing nine transactions through June 2025 compared to four through June 2024.

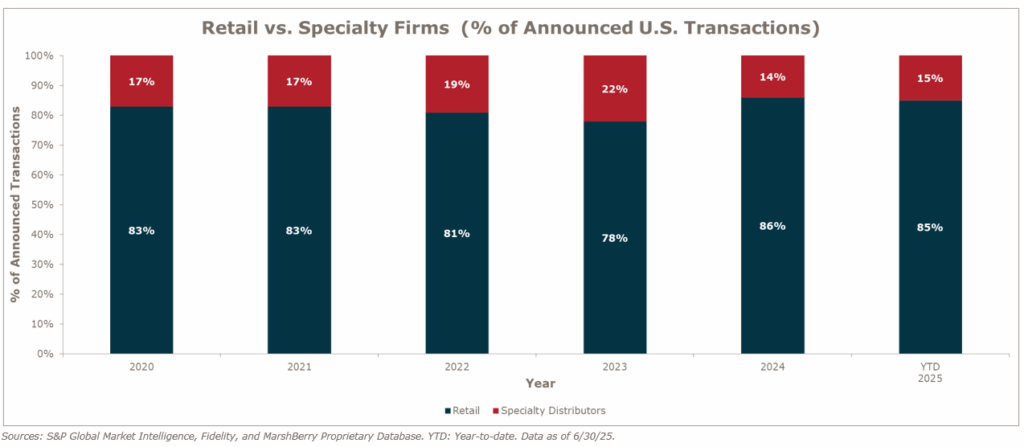

When compared to the insurance distribution marketplace as a whole, specialty transactions comprised approximately 15% of total deal activity in H1 2025, up slightly from 14% in 2024. These levels are still well below the range of 17% to 22% of deals specialty firms comprised from 2020 through 2023, underscoring the relatively greater availability of sellers in the retail broker segment when compared to specialty intermediaries.

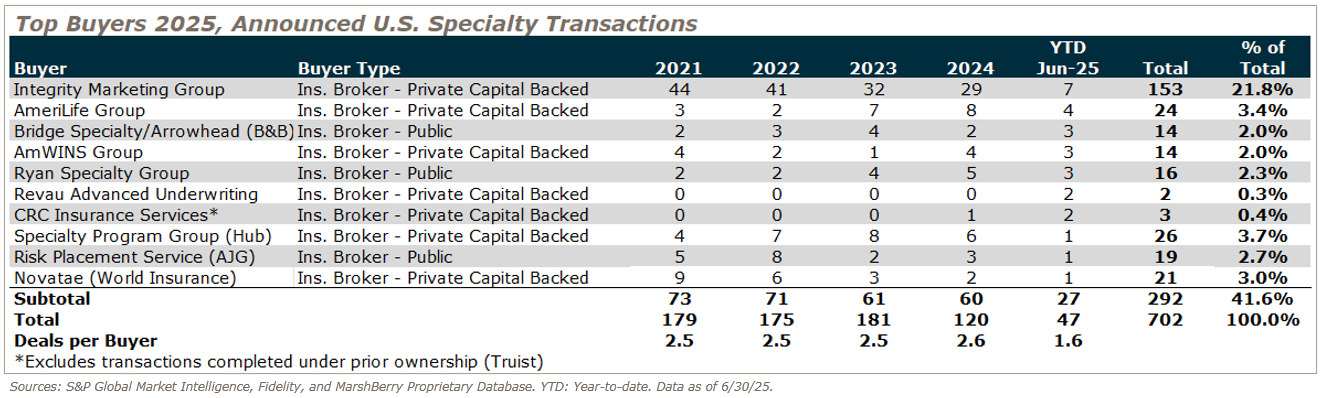

Deal activity from the top ten buyers accounted for 27 of the 47 announced transactions (57.4%) in H1 2025, down from 2024 when the top ten buyers accounted for 59.5% of all transactions. Notably, only seven buyers successfully closed multiple transactions through June 2025, accounting for a combined total of 24 deals this year (51.1%). The remaining 23 transactions (48.9%) represented buyers who were only able to win and close one acquisition opportunity through June 2025.

On average, buyers completed just 1.6 deals in the first half of 2025, a significant decline from the ~2.5 deals per buyer completed historically. While the primary catalyst of this decline is lack of supply, the trend has been further amplified by the entry of new buyers into the specialty market, especially those driving up competition on smaller acquisition opportunities.

Notable transactions:

- April 2: Warner Pacific acquired Phoenix, AZ-based Black, Gould & Associates who provides back-office services to over 2,500 agents and represents over 8,000 group insurance clients. This marks Warner Pacific’s seventh acquisition in the past year, reinforcing its position as a growing consolidator in the Life and Health (L&H) specialty distribution space. The firm’s momentum has accelerated since receiving investment from private equity firm Lovell Minnick Partners in 2021, a deal in which MarshBerry served as the exclusive financial advisor to Warner Pacific.

- May 1: CRC Group (CRC) acquired ARC Excess & Surplus, LLC (ARC). ARC, one of the largest specialty wholesale distributors in the U.S., is known for its expertise in management and professional liability insurance. The private equity investor Stone Point owned a significant stake in both ARC and CRC. The acquisition added over $1 billion in annual premium to CRC’s significant existing wholesale platform. The transaction reflects the continued consolidation within the wholesale Property & Casualty (P&C) market, where a small number of dominant players are steadily increasing their market share.

- June 10: Brown & Brown, Inc. (BRO) has agreed to acquire Accession Risk Management Group, Inc., the parent company of Risk Strategies and One80 Intermediaries and the ninth- largest privately held brokerage in the U.S., for $9.8 billion. The purchase price reflects a ~12x EBITDA multiple, including expected synergies, but the headline number without synergies is ~16.4x EBITDA. Accession reported $1.7B in pro forma revenue with an estimated ~$600M in pro forma adjusted EBITDA. Approximately 30% of Accession’s business comes from its specialty distributor arm, One80 Intermediaries, which will merge with BRO’s existing specialty arm Bridge Specialty / Arrowhead.

Looking ahead

In the second half of 2025, the imbalance between robust buyer demand and limited seller supply will likely continue to define the specialty intermediary M&A landscape. While this dynamic has intensified competition and elevated valuations, it also underscores the strategic importance of timing and positioning for sellers considering a transaction. Until the supply side meaningfully expands, buyers will need to remain agile and disciplined, while sellers are likely to benefit from a market that still favors those ready to engage.