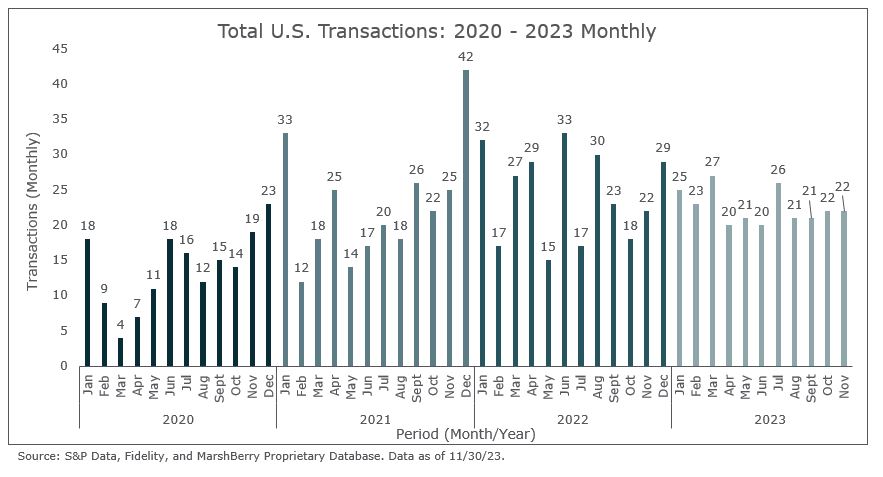

Once again, there were 22 announced wealth advisory merger and acquisition (M&A) transactions in year-to-date (YTD) November 2023 – the same amount from October 2023. In an odd coincidence, the 22 deals in November 2023 are the same amount of activity as November 2022. November 2023 brings the year-to-date total deal count to 248, compared to 263 deals through November 2022.1 The YTD gap between 2022 and 2023 is 15 deals, representing a decrease of approximately 1.5 deals per month – not a materially different amount.

It’s safe to say that the total 2023 deal count will likely not beat the all-time high in 2022 of 292 deals. While December historically brings an increase in activity as firms scramble to close transactions, it would have to be a record-breaking month to approach last year’s deal volume. There has only been one month with deal volume greater than 40 deals in a month, December 2021, but that year was impacted by anxiety from potential tax changes.

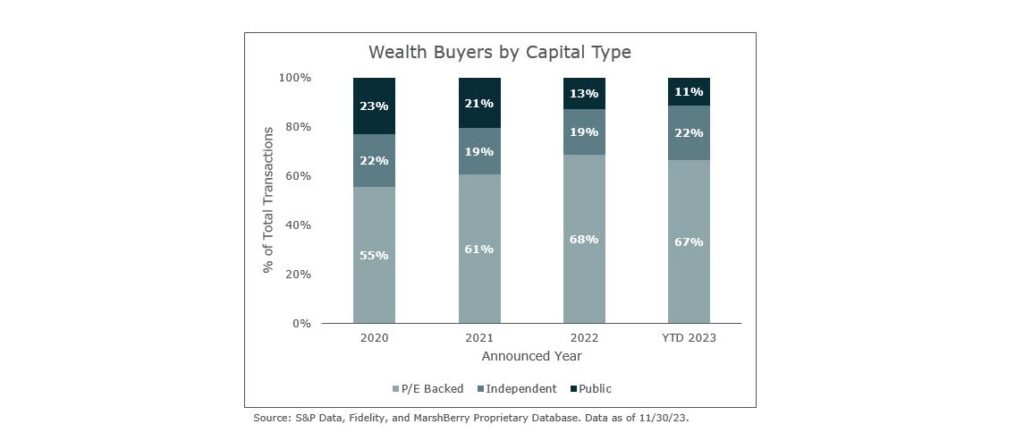

Buyer types

Private equity-backed buyers accounted for the majority of the transactions YTD through November, with 165 (67%) of the 248 wealth advisory transactions maintaining their dominance in the marketplace. Independent firms accounted for 55 (22%) of the total deals so far, with public firms making up the remainder with 28 (11%) deals YTD.

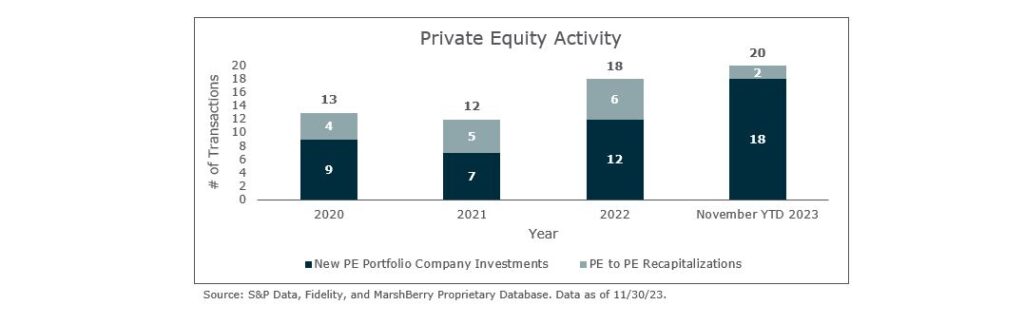

Private equity activity

There were no announced private equity investments in November 2023. This leaves the year-to-date total at 20 private equity investments, of which new money investments represented 18 of the 20, or 90%. For comparison, there were 17 private equity investments at this time last year. Through November, there were two more deals than the entirety of last year’s activity. This highlights the increased focus that private equity firms have placed on the industry, with a majority coming in as new investments.

Deal spotlight: Franklin Financial Group

November 3, 2023: Hub International Limited (Hub), announced their acquisition of the financial services businesses of Maryland based Franklin Financial Group, LLC and Franklin Investment Group, LLC – collectively, Franklin Financial Group (FFG). MarshBerry served as the exclusive financial advisor to FFG on the transaction.

Based in Hunt Valley, MD, FFG is a wealth, retirement, and employee benefits consulting firm. FFG’s experienced professionals advise and guide clients toward their financial goals while navigating today’s global business environment to ensure the protection and growth of their wealth.

Joe DeNoyior, Hub Retirement and Private Wealth President, had this to say about the acquisition: “The Franklin Financial Group team brings amazing depth of experience across retirement plan management, wealth management solutions and employee benefits and insurance. They will be a great presence for us in the Baltimore area.”

Phil Trem, MarshBerry President, Financial Advisory, stated, “FFG sought a strategic partnership to accelerate their growth across multiple markets. By partnering with Hub, they now have the resources to serve their diversified, multi-generational client-base. We were proud to be selected to represent FFG based on our unique understanding of the broader wealth, retirement, and employee benefits universe. We wish both FFG and Hub success in all their future endeavors.”

Read more about this transaction

A look ahead

While it’s likely that 2023 will not reach the transaction levels of 2022, there are still a lot of positive takeaways for the year. For one, there was not a single month with deal volume under 20 deals. This indicates a sustained appetite from buyers, plus a long runway. Even though the top buyers have shifted somewhat in the prior years, when one buyer drops off, another buyer steps up to take their place. Stay tuned for MarshBerry’s 2023 year in review report, to be published in Q1 2024.

1 There is a general caveat about timing of deals being reported that could affect the distribution.

Investment banking services in the USA offered through MarshBerry Capital, LLC, Member FINRA and SIPC, and an affiliate of Marsh, Berry & Company, LLC, 28601 Chagrin Blvd, Suite 400, Woodmere, OH 44122 (440) 354-3230