There’s an old saying: “Without data, it’s just an opinion.” A strong data strategy helps businesses create a roadmap for everything from technology to marketing to hiring. In the insurance industry, measuring organic growth rate, expense ratio, renewal/retention rate, and many others is typical. But one data point often overlooked or misinterpreted is Policies in Force, or PIF.

Defining Policies in Force

First, what is Policies in Force? PIF measures the insurance policies that an insurance company has in effect. In other words, it demonstrates the number of active policies across all business lines, providing coverage to policyholders at a point in time. PIF is typically used to measure overall exposure and the amount of risk an insurance company has assumed. This metric helps insurance companies evaluate their financial stability, assess their capacity to pay claims, and determine the overall performance of their insurance portfolio.

For insurance brokers, PIF can help identify growth opportunities for underperforming producers or lines of business. It’s also a good way to identify and reward your most successful producers. There are many ways to use PIF to measure your firm’s success, but remember that a higher number of PIFs doesn’t automatically equal strong performance.

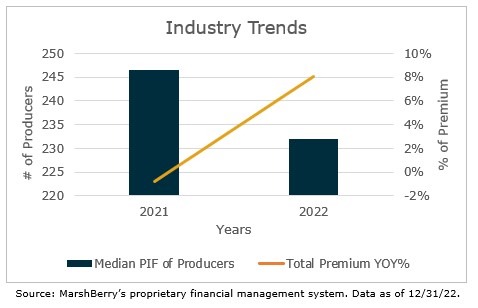

The relationship between Policies in Force and premium

In a hard market, the price per policy typically becomes more expensive due to increased rate changes. As a result, PIF may decrease as clients look for better pricing or decline renewals. Even then, firms may still see rising revenue with rate increases. But without additional new business, PIF levels may start to drop. However, when the market softens, rates start to drop, and given any decreases in PIF, firms will likely see a dip in revenue. Ramping up new business efforts on high-quality premium accounts could lessen this dip and give a more competitive advantage.

The link between Policies in Force and new business

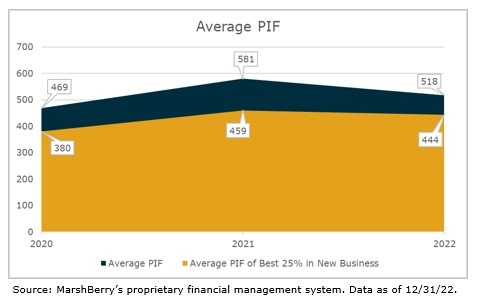

Based on MarshBerry’s proprietary financial management system, the average firm’s PIF has been higher than the Best 25% of firms. For this metric, the Best 25% is based on the amount of new business or total sales velocity, not revenue size. Those with higher new business tend to have lower PIFs, likely due to these customers driving larger commissions.

The firms that are growing the quickest tend to have fewer active policies than those growing at a slower rate. This data suggests that these firms focus on higher quality policies rather than a higher quantity of policies. Being selective in the business they write, rather than writing everything, allows these firms to grow faster. Using PIF as a growth metric can help producers spend their time on high-premium accounts, freeing up their time prospecting for new business.

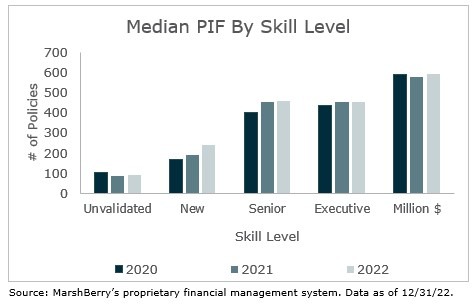

The link between Policies in Force and skill level

When the skill level of the producer increases, it’s likely that PIF will increase as well. This metric helps companies track who their star performers are and encourages healthy competition between producers. New, senior, and executive producers demonstrate a similar trend – their PIF numbers tend to increase over time. Over the past few years, during this hard rate environment, the less tenured and unvalidated producer PIF numbers have decreased, indicating that inexperienced producers are less likely to drive new business in tough times.

To help remedy this potential challenge, consider adding PIF goals for newer producers and their revenue goals. Therefore, regardless of market behavior, you can feel confident that your greener producers have the momentum to remain successful.

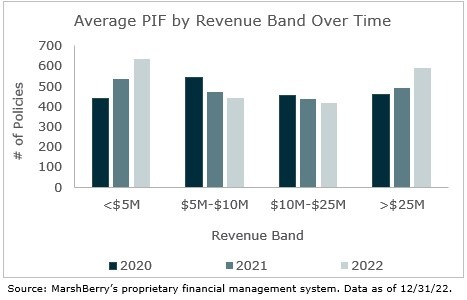

Average Policies in Force by revenue band

When comparing PIF levels by revenue band for firms generating less than $5 million in revenue and those generating more than $25M in revenue, the PIF number jumps considerably each year. These groups, on average, are more growth-focused. The less than $5M group is writing new business to grow into the next revenue band, while the greater than $25M group is more likely to acquire smaller firms.

The greater than $25M band tends to have a healthy lineup of producers with good relationships to maintain a solid PIF number. Meanwhile, the middle groups are likely more strategically focused. While new business is important, these firms must have the right talent, resources, and technology to support their desired growth.

Tracking the number of Policies in Force within your firm is important. These metrics can help evaluate whether a firm achieves a product risk profile that matches its strategy. Or, if your numbers are much lower than the average, this could indicate procedural or training issues that need to be addressed. To drive performance, you must actively track and act on your team’s metrics. MarshBerry’s expertise in market trends can help you use PIF and other kinds of data to get a clearer picture of your firm’s progress and opportunity areas.