On July 22, 2020, fifteen U.S. Surplus Lines Stamping and Service Offices published their individual state totals for premium volume and items (i.e. policies) for the first half of 2020. Aggregate premiums for all fifteen reporting offices increased by a little more than 10% over the first half of 2019 despite the negative effects of the COVID-19 pandemic. More interesting, however, is that total policies decreased by approximately 2.5% for this same measurement period.

As most of our readers know, total premium change is a product of

(a) exposure base (b) insurance rates and (c) policy count. While we do not have specific data on exposure changes, we can make an educated guess that exposures were up for the first quarter of 2020 before the pandemic hit, and then were down in the second quarter as businesses shut down and unemployment skyrocketed. Extrapolating these assumptions, MarshBerry believes it is reasonable to assume that the overall change in exposure was likely neutral to up slightly during the first half of 2020.

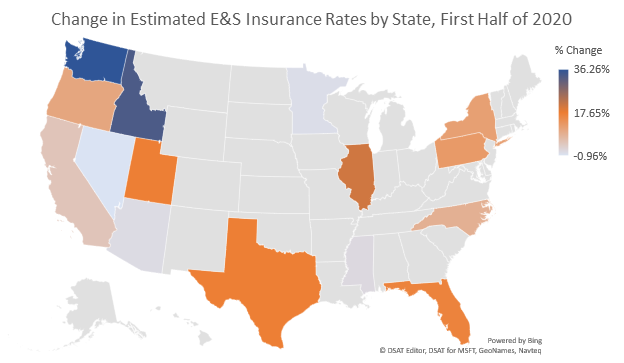

If, in fact, exposures were flat overall during the first half of 2020, then the difference between change in premiums and change in total policies should be substantially attributable to rate changes (i.e. pricing). Across all fifteen Stamping Offices, it would appear that Excess & Surplus (E&S) rates were up approximately 13%, with two of the largest states, Texas and Florida, up in the 16%-17% range. Of the top four states, California, the largest E&S state by premium volume, was below the overall 13% average. New York, the fourth largest E&S state by premium volume, was a median performer at approximately an 11% rate increase.

Source: Wholesale and Specialty Insurance Association (WSIA.org) website

For specialty MGAs and wholesaler insurance brokers, the implications of this continued “hard market” are significant.

- Individual accounts with recent losses could likely see rate increases at least as large as the averages implied above, likely requiring diligent efforts to successfully renew coverages;

- Individual accounts with no losses may require some level of “shopping” the risk to minimize premium increases;

- Regardless of the loss history, tightening rates are likely resulting in reduced overall capacity, which would, in turn, result in fewer placement options;

- On the M&A front, for those MGAs and wholesalers contemplating a transaction or those who have recently sold to a larger enterprise and for which they are currently in their “earn-out1” period, the tightening rate cycle may provide tailwinds in maximizing earnout payments. This occurs as the raising rate environment may result in greater commission income for the same risk. This incremental revenue/profit would then accrue to the benefit of sellers during an earnout period.

- For those MGAs and wholesalers who are currently contemplating selling their firm in the near term, today’s rate environment may make an earn-out structure more realistic.

As an aside, these results dovetail nicely with MarshBerry’s anecdotal conversations with many specialty distributors who have almost universally indicated that the E&S marketplace is as strong as any time in recent (and not so recent) past.

A little good news in an otherwise trying operating environment!

If you have questions about Today’s ViewPoint, or about activity in the E&S marketplace, please email or call Gerard Vecchio, Senior Vice President, at 212.972.4886.

Subscribe to MarshBerry’s Today’s ViewPoint blog for the latest news and updates and follow us on social media.

1An “Earn Out” is a typical mechanism to increase the total deal consideration to sellers by incentivizing the seller to grow revenues and/or earnings in exchange for a higher all-in sale price.