When homeowners or investors consider purchasing real estate in Florida, they usually factor in things like borrowing costs, taxes, renovation costs and property maintenance expenses. Last on the list for consideration? The cost to insure. In today’s marketplace, insurance premiums for Floridians are at their highest ever and on the rise. The average Florida homeowner currently pays upwards of three times higher than the national average, mostly due to the frequency of weather-related catastrophes.

So how can insurance brokers continue to do business in Florida amid tightening margins, reduced or completely eliminated carrier capacity and reduced availability to reinsurance?

More frequent and severe hurricanes are increasing costs to Florida’s homeowners and insurers

Hurricane Ian is projected to cost the insurance industry between $30-40 billion. While the National Oceanic and Atmospheric Administration (NOAA) is predicting even more hurricanes this season, homeowners and businesses are bracing for the impact on rates and/or insurability of their properties going forward.

In response to Hurricane Ian, the Florida Insurance Commissioner issued an emergency order preventing insurers from canceling or non-renewing any policies covering a property or risk in Florida for the 60 days ended November 28, 2022. This adds additional loss exposure for carriers in an already difficult market which would extend the life of existing policies through the end of hurricane season in the state.

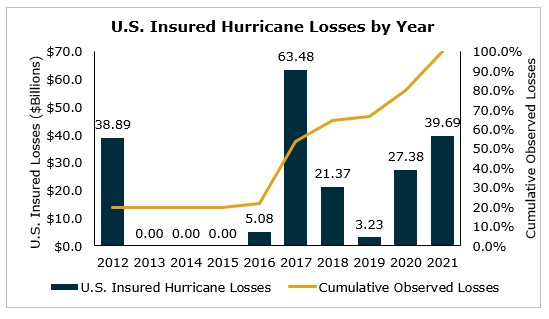

Source: AON PLC

Total insured losses due to hurricanes in the U.S. amounted to $199 billion since 2012 with the last five years totaling $155 billion (78%) in total observed losses. As storm frequency and severity increases, so do losses, creating a hard market with increasing premiums to cover current and expected losses.

Scarcity in reinsurance is impacting policy availability

A key factor in the availability of insurance in high-risk places is the ability to obtain reinsurance. Florida’s top reinsurers, by highest premium ceded as of December 2021, include Florida Hurricane Catastrophe Fund and Berkshire Hathaway – having the largest premiums ceded at $674.5M and $462.9M, respectively, for this period.

The state of reinsurance in Florida is nearly in crisis, with capacity shrinking across the market as leading reinsurers pull back or avoid Florida entirely – accompanied by a rising rate environment. In fact, Swiss Re and Munich Re have reduced their capacity by 50% in 2022, stifling placements by the insurers who remain in the area. In addition, RenaissanceRe Holdings has been steadily reducing its exposure in the Florida market to 2.5% of gross written premiums and raised its rates in excess of 10%.

As reinsurers re-evaluate their positions, insurance companies such as Southern Fidelity Insurance Company (SFIC) and United Property & Casualty Insurance Company (United) are left to contemplate their positions within Florida.

SFIC, which regulators have deemed insolvent as of June 10, 2022, announced in May they were suspending writing new business in key Florida counties due to lack of adequate reinsurance.

United announced it is planning to withdraw its operations in Florida, Louisiana and Texas, and is anticipating withdrawal in New York. In a statement given by Dan Peed, Chairman and CEO, surrounding these withdrawals, he says, “Due to significant uncertainty around the future availability of reinsurance for our personal lines business, I believe placing United P&C into an orderly run-off is prudent and necessary to protect the Company and its policyholders.”

Reinsurance is vital to insurers and having insufficient and unaffordable rates is putting insurance companies in an uncomfortable position which could lead to mass policy cancellations across the state.

Losses are piling up for insurers despite premium increases

Florida homeowners have seen dramatic property insurance rate increases since 2019. In 2019 the average U.S. homeowner paid $1,272 while the average Florida homeowner paid $1,988 for property insurance1. In 2022, Florida homeowners pay average premiums of $4,231 for property insurance which is nearly three times higher than the U.S. average of $1,544 and over double the average from three years prior2. Despite massive rate hikes, Florida insurance companies are struggling to find profits as claims frequency and severity, along with expensive lawsuits rise, erode profits.

As claims and litigation expenses outpace premium growth, losses pile up. In Q1 2022, Florida’s top domestic residential property insurers racked up losses nearing $100 million, a 42% improvement from net losses of $168 million this period last year. Policyholder surplus decreased by $73 million (2.4%) from December 31, 2021, to March 31, 2022, as litigation and claims liabilities weigh down the balance sheet3. Despite the improvements in financial performance, over half of Florida’s insurers experienced losses, with seven of these carriers having losses in the first quarter of both periods.

Florida had approximately 100,000 lawsuits against insurance companies in 2021, while all other states combined had around 20,0002. With five times more litigation than other states, a direct result of increasing fraud schemes, profits are stifled by increased expenses.

Florida insurers in receivership

After feeling the pain from Q1 2022 losses, some insurers took action to mitigate additional losses – including FedNat Insurance Company (FedNat) and Peoples Trust Insurance Company who both cited they are not writing new business. FedNat has gone as far as cancelling numerous policies this year.

Adding to this, there are ten insurers who are currently in receivership, but all were deemed insolvent and placed into liquidation:

- August 8, 2022: Weston Property & Casualty Insurance Co.

- June 15, 2022: Southern Fidelity Insurance Co.

- April 28, 2022: Lighthouse Property Insurance Corporation (Louisiana)

- March 14, 2022: Avatar Property and Casualty Insurance Company

- February 25, 2022: St. John’s Insurance Company

- July 28, 2021: Gulfstream Property and Casualty Insurance Company

- April 14, 2021: American Capital Assurance Corp.

- October 2, 2019: Florida Specialty Insurance Company

- October 1, 2018: Sawgrass Mutual Insurance Company

- June 3, 2014: Sunshine State Insurance Company

This has put tremendous pressure on the remaining insurers in the area, including Florida’s own state funded Citizens Property Insurance Corporation, to assume these additional policies subject to liquidation proceedings, many of which cannot profitably take on the original risk.

The Road Ahead

There are considerable challenges in admitted markets and no cut and dry solutions to remedy the current situation. And now with the financial aftermath of Hurricane Ian still in question, the road ahead for insurers and the insured may have gotten more difficult.

A possible first step is to begin addressing the market’s deficiencies in the legal realm as claims legal budgets continue to rise. Assignment of Benefits (AOB) fraud claims continue to be the largest source of legal expenses Florida’s property insurers face and are only expected to increase as remaining insurers increase their policy count. These insurers need governmental assistance in solving this issue by writing new legislation to curtail these fraud schemes.

Despite the unsettling performance in admitted markets, there may be strategic opportunities for insurance brokerages to broaden their portfolios in Florida’s non-admitted market by writing risk in non-traditional and innovative ways to take additional market share. One such way is to fortify their operations in the specialty distribution space.

As brokerages expand deeper into specialty distribution, they can offer customers a variety of different cost effective and profit conscious products with custom-tailored solutions to address insured’s specific needs. By partnering with a Managing General Agent, or an alternative risk manager, insurance brokerages can offer additional noteworthy benefits as players look to penetrate or expand their footholds in this market.

If you have questions about Today’s ViewPoint or would like to learn more about current developments in the insurance brokerage market, email or call Graham Gould, Vice President, at 616.283.3344.

Contributing Author: Nick Armao, Financial Analyst.

Investment banking services offered through MarshBerry Capital, LLC, Member FINRA Member SIPC and an affiliate of Marsh, Berry & Company, LLC. 28601 Chagrin Boulevard, Suite 400, Woodmere, Ohio 44122 (440.354.3230)