Most personal and commercial lines brokers will find 2023 to be another year of rising premiums as firms continue to operate in a hard market. It will be a tough year in a challenging market requiring agents and brokers to double down on their commitment to working smarter, finding creative solutions and anticipating client needs. A hard market is the time for your producers to focus on new business, implement aggressive marketing efforts and proactively reach out to retain existing customers. With rate increases here to stay for the foreseeable future, what are your producers doing to stay relevant in the industry? They can’t simply rely on renewals and rate increases to show year-over-year growth any longer. So, what’s their business plan and who’s holding them accountable to create or sustain substantial growth?

What are the benchmarks producers need to reach to be successful?

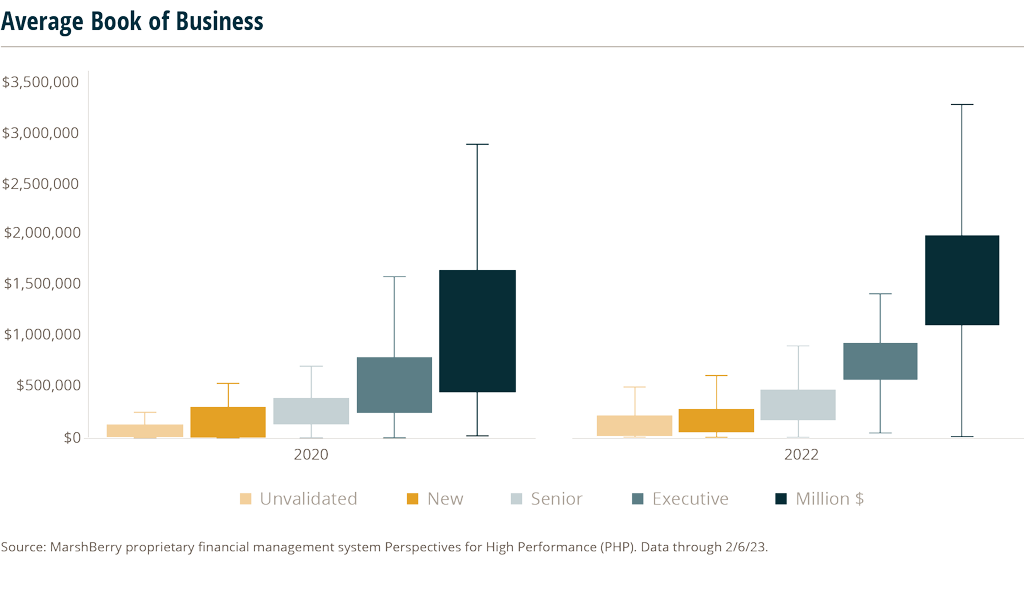

Data from MarshBerry’s proprietary financial management system, Perspectives for High Performance (PHP), shows that average benchmarks for producers have changed drastically in the last three years. Since 2020, the expected book sizes for producers have become more competitive, with each skill level having higher upper and lower quartile ranges. As shown on the charts below, producers should strive for their average book size to fall within the shaded region for their respective skill level, as that is where the majority of producers within the industry are performing. Anything below the shaded region signifies that they are performing well below industry standards and are likely to be outperformed by their peers.

The ranges for producers were more forgiving in 2020, allowing producers to have smaller book sizes (for their respective skill level) and still remain competitive. However, in 2022, those ranges became stricter and narrower. The minimum threshold for million-dollar producers’ average book size has increased from roughly $500K to over $1M. Similarly, executive producers needed a minimum of a $550K book in 2022 to be considered ‘average,’ whereas in 2020 they only needed a book size of $300K.

How can you boost insurance producer productivity and accountability?

Firms looking to achieve double-digit growth, in a highly competitive hard market, need to proactively give their producers new goals and strategies to increase productivity. Here are five ways to drive optimal insurance producer accountability.

- Set defined new sales expectations and goals. Setting individual producer goals requires historical reflection on several years of production and strategic planning. Here are some categories of goal setting:

- Minimum goal: Minimum amount of new business to maintain producer status. Could also be used for carrying-out negative ramifications if minimum goal is not achieved.

- Individual goal: Producer’s stated personal goal.

- Stretch goal: The best-case scenario goal typically used for closed business scoreboards. Could be set at individual or organization level.

- Implement incentives. Ensure you have a measurable spread between new and renewal commission percentages. MarshBerry typically recommends a 15% to 20% difference between new and renewal rates, which helps producers focus on new business production over renewal compensation, as new business is vital to the firm’s success.

- Create accountability in the sales process. Producer accountability should be based on a mandatory minimum level of new business production (e.g., $100,000 in revenue) and a stretch goal (e.g., $150,000 in revenue). The plan should also incorporate negative and positive compensation incentives. For example, a producer who does not meet the minimum should face an automatic renewal rate reduction (e.g., from 25% to 20%). Those who hit the stretch goal should be eligible for enhanced new business commissions (e.g., from 40% to 50%).

- Establish minimum account thresholds. Small business units (SBUs) are accounts that fall below a certain commission dollar amount and are handled by dedicated service staff. Firms striving to increase growth should establish a minimum account threshold for which producers are not paid renewal commission.

- Have a carrier strategy. Having a strategy surrounding carrier relationships can be the difference between not hitting a goal or hitting a stretch goal. In what ways can you partner with a carrier to maximize success? Carriers hold a lot of industry data that can help your producers stand out and differentiate them from their competition. Additionally, find a niche that gets your producers excited and figure out what carriers support that niche. Spending more time here can be critical to a producer’s success.

Measuring success: Producer Stack Rank

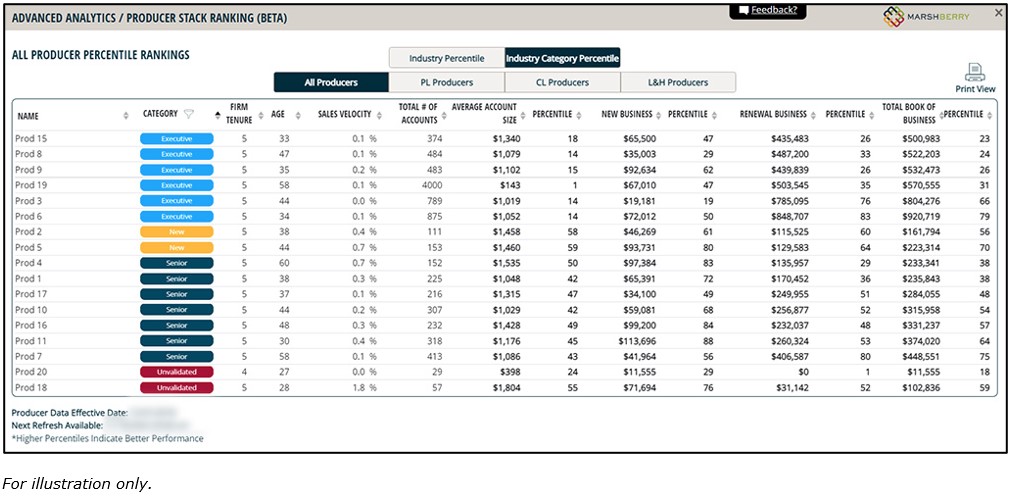

With each producer focusing on expanding their own book, and rates still rising, it is hard to determine if your producers are “producing enough” to grow the firm at a competitive rate. Organic growth and sales velocity are the leading indicators of a firm’s longevity, both of which are highly dependent on the performance of production staff. But at the individual producer level, do you know how much your producers need to grow their books of business to secure your firm’s permanency in the market?

MarshBerry’s Producer Stack Rank models statistics on how your producers are performing on an individual level compared to all producers within MarshBerry’s proprietary database. This tool can help reveal whether your producers are growing at the rate of other similar producers within the industry – or falling behind.

To learn more about how to drive producer productivity and accountability, or how to measure their success with MarshBerry’s Producer Stack Rank, please email or call Eric Kuhen, Vice President, at 440.637.8118.

Contributing Author: Gabby Iacona, Data Science Manager

Producer Academy – Register Today!

Chicago: November 19-21, 2024

Developing producers takes strong commitment and dedication to instill the skills and knowledge that can inspire them to reach their validation goals.

At MarshBerry’s Producer Academy, attendees take a deep dive into proven sales training methods and industry best practices. Both new and accomplished producers will gain the knowledge to sharpen their skills, help realize their full potential, and generate revenue. Register Today!