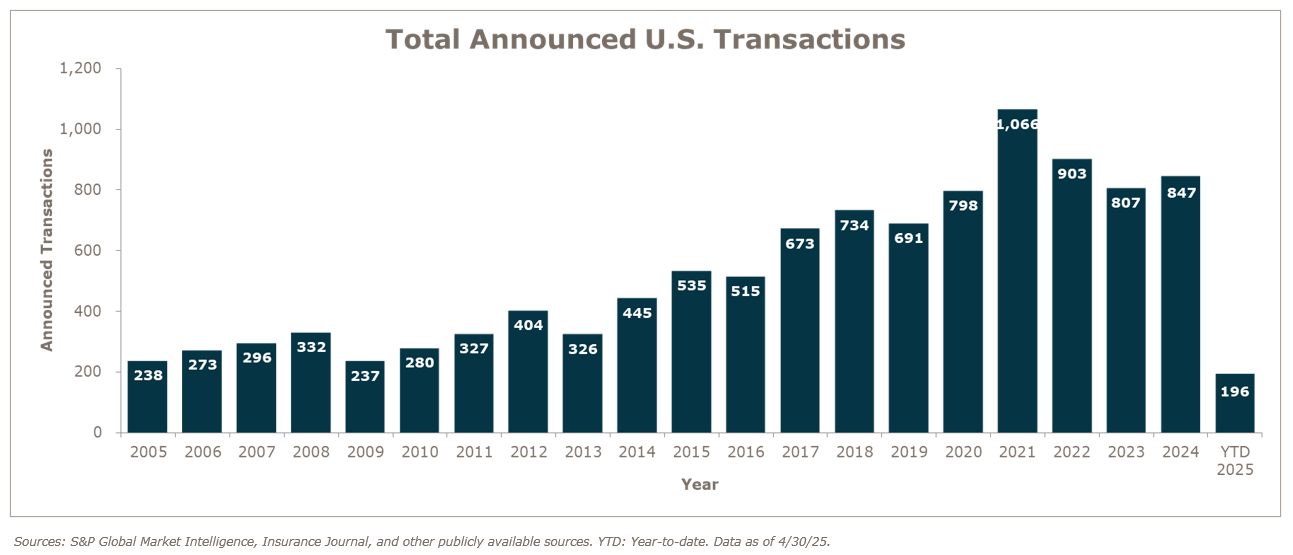

The quick start to the year for insurance brokerage merger and acquisition (M&A) activity has finally caught up to the overall tone of uncertainty on the U.S. economy. The delay in deal closings at the end of 2024, many of which were put on hold to push their timing on paying taxes, contributed to the early surge of deals to start the year. After Q1, M&A activity was 11% ahead of last year’s Q1 volume. But with April’s 69 announced deals (significantly less than the 83 deals announced last April) the year-to-date (YTD) total is now 196 – one deal less than the number of deals announced by the end of April last year.

The overall mood for the U.S economy in the first four months of 2025 certainly hasn’t been ideal. The economy has battled trade tariff news, equity market volatility, and ongoing fears of an economic slowdown. According to The Wall Street Journal, U.S. GDP (Gross Domestic Product) shrank by 0.3% in Q1 of 2025, marking the first contraction in three years, as businesses rushed to stock up on imports and consumer spending slowed. This was down from 2.4% growth in Q4 2024, and below the 0.4% to 0.8% growth expected by economists. Net exports subtracted nearly five percentage points from GDP – the biggest hit on record since 1947.1

On the positive side – the equity markets, which has seen extreme volatility tied to tariff-related news, managed to close out April only marginally lower. On April 30, the S&P 500 and the Dow Jones Industrial Average were down 4.3% and 4.4% respectively YTD.

For buyers, the theme remains consistent – optimism in the potential for more affordable debt should the Federal Reserve cut rates (while holding rates at the last three meetings) and the number of attractive firms who are performing beyond hard market-driven premium growth. And while inventory has increased, there is still outsized demand by buyers seeking quality partners that will make them better and even more competitive.

M&A Market Update

As of April 30, 2025, there were 196 announced M&A transactions in the U.S., putting the year-to-date pace at 0.5% lower than last year, which recorded 197 deals by the end of April.

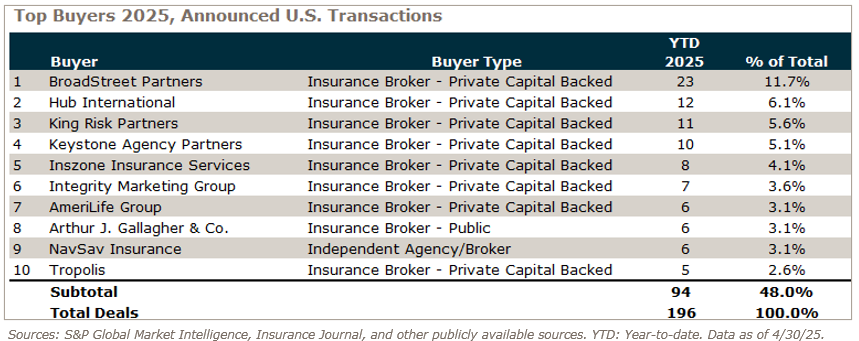

Private capital-backed buyers accounted for 133 of the 196 deals (68%) through April. Independent agencies were buyers in 39 deals so far in 2025, representing 19.9% of the market. There have been four announced transactions by bank buyers in 2025.

Deals involving specialty distributors as targets accounted for 31 transactions, about 16% of the total market, continuing the trend of low supply of specialty firms. (For more on the specialty market, see the Q1 2025 Specialty Insurance Brokerage Market Update.)

Deal activity from the top ten buyers accounted for 48% of all announced transactions, while the top three (BroadStreet Partners, Hub International, and King Risk Partners) account for 23.5% of the 196 total transactions.

Notable transactions:

- April 11: BroadStreet Partners, a North American insurance brokerage specializing in middle-market P&C and employee benefits, is set to welcome a new investor group led by Ethos Capital, British Columbia Investment Management, and White Mountains Insurance Group. Ontario Teachers’ Pension Plan, the company’s majority shareholder since 2012, will retain a significant co-control stake and continue its strategic partnership. BroadStreet operates through a co-ownership model, with over 800 employees holding equity in their local agencies. The new partnership is expected to support BroadStreet’s long-term initiatives, including digital transformation and further expansion across North America.

- April 15: NSM Insurance Group has finalized the sale of its U.S. commercial insurance division to New Mountain Capital, a private equity firm managing over $55 billion in assets. The deal includes NSM’s portfolio of 15 specialized insurance programs across property and casualty, accident and health, and reinsurance, as along with its retail agency, NSM Insurance Brokers. The sold division will operate under a new brand to be announced, with Aaron Miller, formerly NSM’s chief commercial lines officer, stepping in as CEO. NSM founders Geof and Bill McKernan will join the new entity’s board.