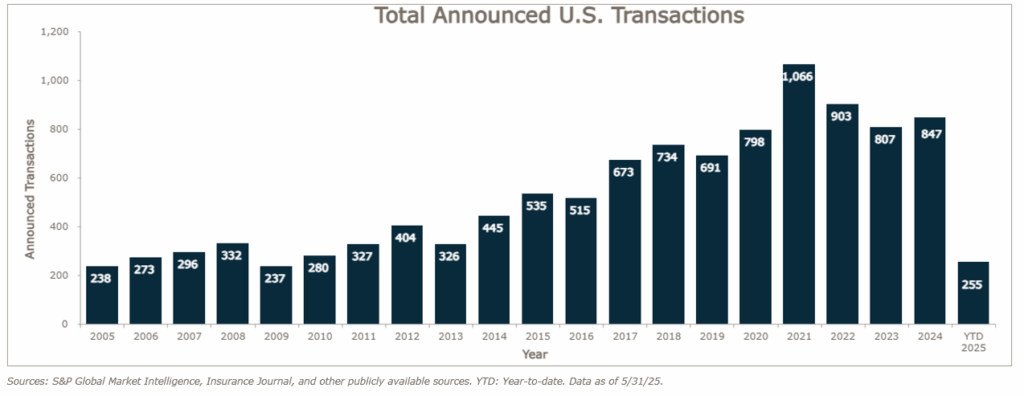

After a slow April, May came back with 59 announced insurance brokerage merger and acquisition (M&A) transactions in the U.S. There was a total of 255 announced M&A transactions through May 31, 2025, putting the year-to-date pace at 5.4% higher than last year, which recorded 242 deals by the end of May.

It is expected that this year will continue to see monthly fluctuations in deal volumes, perhaps mimicking the continuously changing macroeconomic environment. However, underlying factors point to a continued, albeit more measured, level of activity in 2025. Stabilizing inflation, a more favorable debt market for buyers, and ongoing investor interest in the resilient insurance sector are expected to provide tailwinds. The focus may increasingly turn to strategic consolidations, niche market expansions, and the integration of technology as firms seek to optimize portfolios and enhance capabilities in a maturing market.

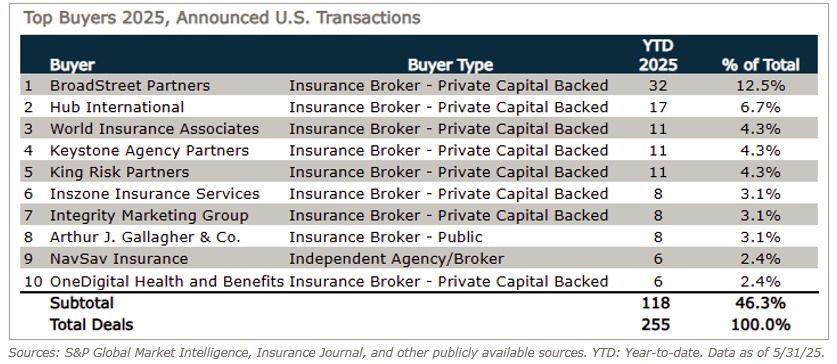

Private capital-backed buyers accounted for 174 of the 255 deals (68%) through May. Independent agencies were buyers in 48 deals so far in 2025, representing 18.8% of the market. There have been four announced transactions by bank buyers in 2025.

Deals involving specialty distributors as targets accounted for 41 transactions, about 16% of the total market, continuing the trend of low supply of specialty firms.

Deal activity from the top ten buyers accounted for 46% of all announced transactions, while the top three (BroadStreet Partners, Hub International, and World) account for 23.5% of the 255 total transactions.

Notable transactions:

- May 12: Intercare, a leading independent third-party administrator (TPA) based in Rocklin, California, has been acquired by private investment firm Aquiline Capital Partners. Founded in 1994, Intercare specializes in workers’ compensation and liability claims administration, along with managed care services, and is known for its integrated approach that combines litigation and medical management to reduce client loss costs. The acquisition marks a significant move by Aquiline to enter and expand within the specialized TPA space, positioning Intercare for accelerated growth and expanded service capabilities. MarshBerry served as advisor to Intercare in this transaction.

- June 3: Hub International Limited has acquired the assets of Fenner and Esler Agency, Inc., a New Jersey-based insurance brokerage specializing in professional liability and risk management services for architects, engineers, surveyors, and environmental professionals. Founded in 1923, Fenner & Esler brings deep industry expertise and a century-long legacy to Hub’s growing specialty practice. Principals Tim and Kevin Esler, along with their team, will join Hub Northeast, and the firm will now operate as Fenner & Esler, a Hub International Company. The acquisition further strengthens Hub’s position in the design and engineering insurance segment. MarshBerry served as advisor to Fenner & Esler in this transaction.

- June 10: Brown & Brown, Inc. has announced a definitive agreement to acquire RSC Topco, Inc., the parent company of Accession Risk Management Group, for $9.825 billion on a cash and debt-free basis. Expected to close in Q3 2025, the acquisition includes both Risk Strategies and One80 Intermediaries—two major players in the specialty brokerage and wholesale insurance markets. With approximately $1.7 billion in 2024 pro forma adjusted revenue and more than 5,000 professionals across the U.S. and Canada, Accession ranks among the largest privately held insurance brokerages in the country. Post-acquisition, Risk Strategies will join Brown & Brown’s Retail segment, while One80 Intermediaries will integrate into a newly formed Specialty Distribution segment. The deal enhances Brown & Brown’s market reach, specialty capabilities, and client offerings, positioning the combined organization for accelerated growth and expanded carrier partnerships.