After a softer than expected jobs report on August 1st, and a continued “pause” on interest rate changes by the Federal Reserve (Fed), the U.S. economy and financial markets continue to be in a limbo period – unsure what to react to. Most economic analysts are optimistic that the September Fed meeting will yield a quarter point cut in interest rates, which could spark a rally for the equity markets and capital borrowing.

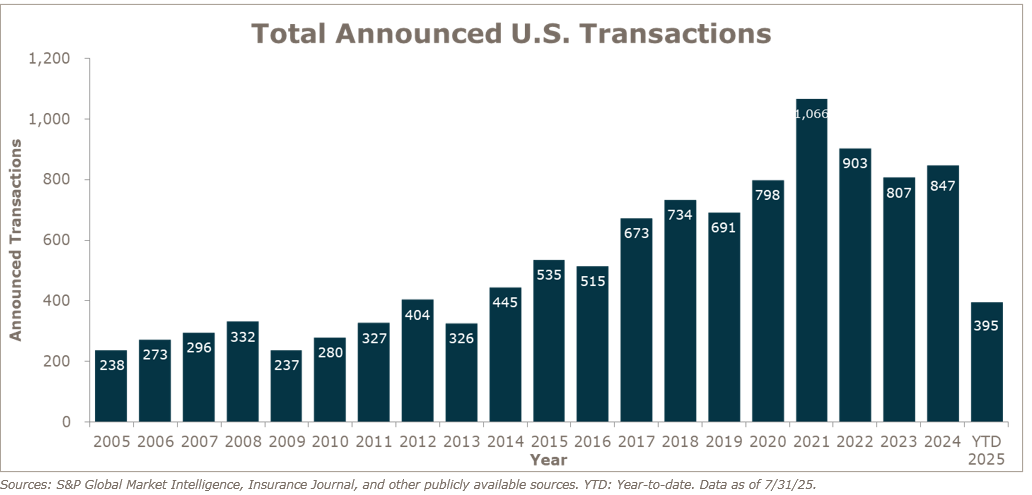

For insurance brokerage merger and acquisition (M&A) activity, July provided a continuation of elevated dealmaking with 87 announced transactions. This puts the year-to-date (YTD) total at 395 announced deals through the end of July – a 6.5% higher pace than last year, which recorded 371 deals by the end of July.

It is expected that this year will continue to see fluctuations in deal volumes, perhaps mimicking the continuously changing macroeconomic environment. A more favorable debt market for buyers in the final months of the year, and ongoing investor interest in the resilient insurance sector are expected to provide tailwinds. The focus may increasingly turn to strategic consolidations, niche market expansions, and the integration of technology as firms seek to optimize portfolios and enhance capabilities in a maturing market.

M&A Market Update

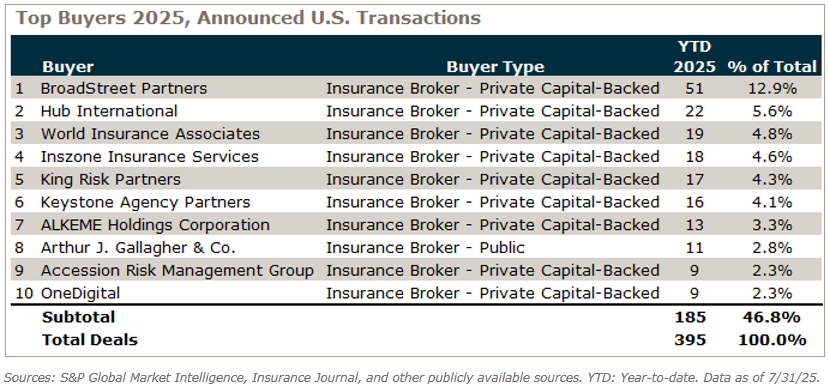

As of July 31, 2025, there were 395 announced M&A transactions in the U.S. Private capital-backed buyers accounted for 285 of the 395 deals (72.2%) through July. Independent agencies were buyers in 61 deals so far in 2025, representing 15.4% of the market. There have been six announced transactions by bank buyers in 2025.

Deals involving specialty distributors as targets accounted for 63 transactions, about 16% of the total market, continuing the trend of low supply of specialty firms.

Deal activity from the top ten buyers accounted for 46.8% of all announced transactions, while the top three (BroadStreet Partners, Hub International, and World Insurance Associates) account for 23.3% of the 395 total transactions.

Notable transactions:

- July 8: King Risk Partners moves into the Louisiana market through its acquisition of Louisiana Insurance Services, an independent agency based in Ruston. The deal aligns with King’s strategic expansion across the Southeastern United States. Louisiana Insurance Services now operate under the King Risk Partners umbrella. MarshBerry advised Louisiana Insurance Services on this transaction.

- July 22: Heffernan Insurance Brokers announced it acquired PAC Global Insurance Brokerage, formally integrating marine cargo expertise into its portfolio of services. PAC Global now operates as Heffernan’s Marine Cargo specialty practice out of El Segundo, California. The acquisition strengthens Heffernan’s offerings for freight forwarders, customs brokers, and global import/export operations by providing specialized coverage and full-service support across the logistics sector. MarshBerry advised PAC Global on this transaction.

- July 31: Specialty Program Group (SPG), a subsidiary of Hub International, acquired ANOVA Marine Insurance Services, a South Florida-based managing general agency specializing in cargo, logistics, transportation, liability insurance, and bonds. Founded in 2011, ANOVA is known for its tech-enabled insurance solutions and strong presence in the marine sector across the Americas. The firm will continue to operate independently under the leadership of founder and president Bradford Boyd. The acquisition enhances SPG’s capabilities in the marine insurance space, while providing ANOVA with broader distribution opportunities and resources to scale its technology-driven offerings. MarshBerry advised ANOVA on this transaction.