Insurance brokers reported overall positive earnings results for Q1 2023, which were attributed to a combination of improving new business, strong retention, and continued insurance rate increases. These companies were also optimistic around meeting 2023 growth targets. Organic growth figures reported in Q1 2023 were comparable to slightly higher than those seen in the prior Q4 2022. Most brokers reported organic growth rates in a range of 7%-13%; compared to 5%-12% in Q4 2022.

- Marsh & McLennan Companies, Inc. (MMC) reported organic revenue growth of 9% for first quarter 2023, vs. 7% organic growth in Q4 2022 and 8% organic growth in Q3 2022.

- Brown & Brown, Inc. (BRO) reported impressive organic growth of 12.6% in Q1 2023, driven by 33.8% growth in national programs. This compares to BRO’s organic growth of 7.8% in Q4 2022 and 6.7% in Q3 2022.

- Arthur J. Gallagher & Co. (AJG) posted for its combined Brokerage and Risk Management segments 9.7% organic growth in Q1 2023, vs. 11.7% organic growth in Q4 2022 and 8.4% in Q3 2022.

- Willis Towers Watson Public Limited Company (WTW) posted 8% organic growth in Q1 2023, above the organic growth rates of 5% in Q4 2022 and 6% in Q3 2022.

- Aon plc. (AON) reported organic revenue growth of 7% in Q1 2023, up from 5% in Q4 2022 and Q3 2022. The firm noted continued strong retention and net new business generation.

- Ryan Specialty Holdings, Inc. (RYAN) again reported strong organic growth of 12.9% in Q1 2023, compared to Q4 2022 organic growth of 10.3%, and 20.1% in the prior-year period of Q1 2022. The firm saw broad strength across its lines of business, including strength in property.

- BRP Group, Inc. (BRP) once again reported organic growth that was far above the public broker group average, with Q1 2023 organic growth of 23% (vs. Q1 2022’s 16%); and Q4 2022 organic growth of 26%. This was the highest Q1 organic growth since BRP’s IPO, driven by strength across the business. While BRP sees global economic conditions continuing to be challenging, the company sees its business as very resilient and well positioned.

Brokers noted ongoing macroeconomic challenges

While management at many brokers noted uncertainty about the macroeconomic environment, many are also confident in their continued growth.

For example, AJG Chairman, President and CEO J. Patrick Gallagher stated on the firm’s Q1 2023 earnings conference call: “We also remain optimistic on our customers’ business activity during ’23. We have yet to see any significant shifts in our daily indications of client business activity thus far in April. We are also seeing encouraging employment levels for our benefits clients, suggesting the economic backdrop for ’23 remains broadly favorable.”

Despite higher macroeconomic uncertainty, and elevated inflation, Ryan is confident in the growth in the E&S space, commenting that it is outpacing the overall P&C insurance market. Chairman & CEO Patrick G. Ryan commented on the Q1 2023 earnings call: “Despite headlines in the banking sector, persistent inflation and heightened macroeconomic uncertainty, we believe our firm will continue to perform well through this economic cycle. Our products are largely compulsory.”

Merger & acquisition activity

BRO noted that merger & acquisition (M&A) volume was somewhat slower for the industry, but that high-quality companies are still trading at similar multiples seen in 2022. BRO CEO, President & Director J. Powell Brown noted on the Q1 2023 earnings call: “As it relates to the overall M&A market, the level of deals primarily from financial backers has slowed. That does not mean high-quality businesses don’t trade at similar multiples to what we’ve seen over the past year.”

AJG had another active quarter in Q1 2023, with 10 new tuck-in brokerage mergers completed, accounting for about $69 million of annual revenue. The company also has about 40 term sheets signed or being prepared, which is over $350 million in annual revenue.

RYAN noted on its Q4 2022 earnings call that its M&A pipeline remains robust, “including opportunities that would bring foundational capabilities and wholesale employee benefits.” RYAN closed on Griffin Underwriting Services in January 2023, a highly strategic acquisition that contributes to both RYAN’s binding authority and brokerage specialties. RYAN also noted that it does not require acquisitions to achieve growth targets in any given period.

In contrast, BRP CEO Trevor Baldwin said on the Q1 2023 earnings call that “we do not currently expect to execute any material partnerships in 2023 as we remain committed to deleveraging and continue to expect the market to soften over the balance of 2023, a trend we are starting to see.”

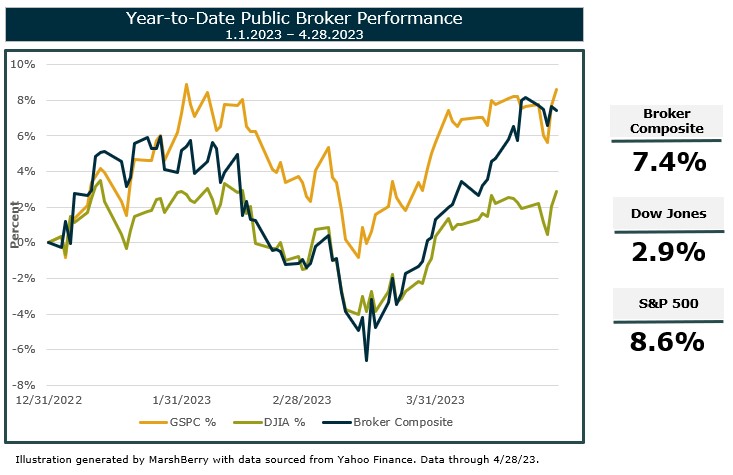

Stock performance of public brokers vs. major benchmark indices

Amidst the current market volatility, six public brokers, as measured by MarshBerry’s Broker Index, again outperformed benchmark indices in the period from January 1, 2022, through April 28, 2023, highlighting the strong fundamentals of the insurance brokerage industry.

The following publicly traded insurance brokers are included in the Broker Index: Arthur J. Gallagher & Co. (AJG), Aon plc. (AON), Brown & Brown, Inc. (BRO), Marsh & McLennan Companies, Inc. (MMC), Willis Towers Watson Public Limited Company (WTW) and BRP Group, Inc. (BRP).

These brokers outperformed the Dow Jones Industrial Average (DJIA) for the period ended January 1, 2022, through April 28, 2023. However, the S&P 500 outperformed both the brokers group and the DJIA during this time.

2023 outlook

While many brokers continued to note greater uncertainty from the impact of continued inflation, heightened economic concerns (including the banking turmoil), and geopolitical tensions, they remained confident in their abilities to meet their growth targets for 2023.

WTW reiterated its prior 2023 guidance for mid-single-digit organic revenue growth and adjusted operating margin expansion. The company’s solid Q1 2023 results give it confidence in delivering on these goals.

MMC said on its Q1 2023 earnings call (in-line with its commentary from the Q4 2022 earnings report) that it continues to expect mid-single-digit or higher organic revenue growth in 2023, with margin expansion and strong adjusted earnings per share growth.

Overall, Q1 2023 results from the public insurance brokers came in fairly strong with management teams confident around meeting their guidance for 2023.

If you have questions about Today’s ViewPoint, or would like to learn more about services available to your firm including customized financial advising, investment banking, and consulting services – email us today.

Investment banking services in the USA offered through MarshBerry Capital, LLC, Member FINRA and SIPC, and an affiliate of Marsh, Berry & Company, LLC, 28601 Chagrin Blvd, Suite 400, Woodmere, OH 44122 (440) 354-3230

The MarshBerry Broker Index is a composite of market data sourced from Yahoo Finance: BRP, BRO, AON, AJG, MMC, WTW. It is prepared for analytical purposes only. This information is not to be construed as an offer to buy or sell or a solicitation of an offer to buy or sell any securities, financial instruments or to participate in any particular trading strategy.

This earnings summary has been prepared by Marsh, Berry & Co., LLC. and is not intended to provide investment recommendations on any company. It is not a research report, as such term is defined by applicable laws and regulations, and it does not contain sufficient information upon which to make an investment decision. It is not to be construed as an offer to buy or sell or a solicitation of an offer to buy or sell any securities, financial instruments or to participate in any particular trading strategy. These materials are based solely on information contained in publicly available documents and Marsh, Berry & Co., LLC has not independently attempted to investigate or to verify such information.