Although headlines this year have focused on a decline in venture capital funding in the InsurTech industry, this does not equate to shrinking tech investment in insurance. While the threat of a potential economic slowdown continues to loom, insurance industry leaders continue to focus direct investment into technology as many large firms continue to allocate sizable funds to tech. Insurance brokerage firms can also benefit from continued investment to help boost efficiencies and improve organic growth.

In Q1 2023, venture capital (VC) activity, $1.1 billion, was invested in the InsurTech space across 115 deals, a decrease of 9.9% in deal value from Q4 2022. However, valuations are recovering, according to the HSCM Public InsurTech Index, which is up 15.9% through the first three months of 2023. This follows the index’s decline of over 70% as of year-end 2022 from its high in early 2021.

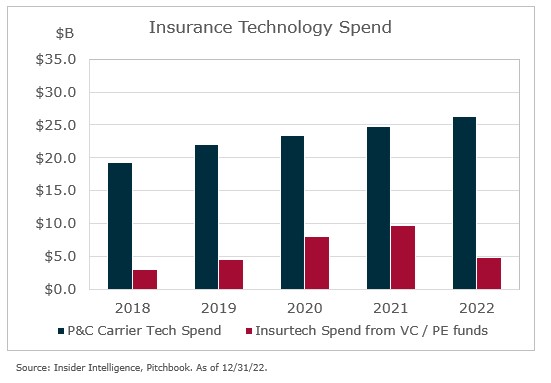

Although InsurTech investments appear challenged due to poorly performing public offerings, the challenging economic environment, and higher competition – some of the largest P&C (Property & Casualty) carriers are continuing to spend hundreds of millions or more each year on technology to remain competitive, grow revenue, and improve margins. Technology investments in the P&C space are up ~36% from 2018, with an estimated $26 billion of direct investment in 2022 from U.S. P&C carriers.

Large carriers are continuing to spend on technology and transformation

Several of the largest carriers in the industry are actively investing in their digital capabilities. For example, Chubb invests in robotics, artificial intelligence, and machine learning to gain insights into underwriting and claims while improving efficiencies. The company projected $500 million in run-rate cost savings in 2023 in its 2021 annual report. “We are already achieving current run-rate savings of more than half that amount…and investing hundreds of millions more in transformation,” noted Chubb in the same report.

Furthermore, in Chubb’s 2022 annual report (released in 2023), the company commented that it “continued to invest in digital technology to deliver an industry-leading customer experience and enhance risk selection through the application of data and analytics.”

Travelers is another large carrier that is heavily investing in technology. In the company’s 2021 annual report, Travelers describes how investing in tech drives value today and in the future, stating: “Our scale, profitability and cash flow all support our ability to invest well over $1 billion annually on technology, and we are confident that these ongoing strategic investments will continue to drive successful top and bottom-line results going forward.”

Then, in its 2022 annual report, Travelers continued to show its commitment to innovation, stating: “Over the past five years, we have meaningfully increased our overall technology spend. Importantly, we have also improved the mix of our technology spend, increasing our spending on strategic initiatives by nearly 70% since 2017 while holding routine but necessary expenditures about flat.”

In The Hartford’s 2023 Letter to Shareholders, Chairman and CEO Christopher J. Swift commented: “We will continue to invest in technology and data capabilities that advance underwriting excellence, digitize business processes, differentiate the customer experience, and increase efficiency while enabling our workforce to contribute to their full potential.”

How insurance brokers can remain competitive in a volatile, fast-changing space with the help of technology investments

As firms explore ways to embrace change and grow, here are four strategies for capitalizing on the digitalization of the insurance value stream:

- Understand the “build vs. buy vs. partner” dynamic. We often see independent agents deploying capital in home-grown solutions that may not always be the best use of capital relative to current solutions in the marketplace.

- Leverage current technology partners. Start with an AMS or CRM provider to better understand potential partner solutions. However, those solutions may be biased towards your incumbent systems.

- Don’t go at it alone. While remaining independent, the resources of a larger group can benefit your firm and your customers. Joining a peer network or exploring the benefits of an agency network allows firms to stay current with the latest emerging technologies.

- Focus on and proactively plan for the future. Ensure your firm’s long-term planning team is adaptive and responsive to changing conditions. Consider creating an internal team or bringing in partners to prepare the company for future disruptions and align strategies with the ever-changing landscape in areas such as AI, advanced robotics, and cloud-based solutions.

Despite the difficult road the InsurTech industry has traveled over the past few years, the technological evolution of the insurance industry will only accelerate from here. Brokers must stay current on technological developments and adopt solutions that will enable them to remain competitive – even relevant.