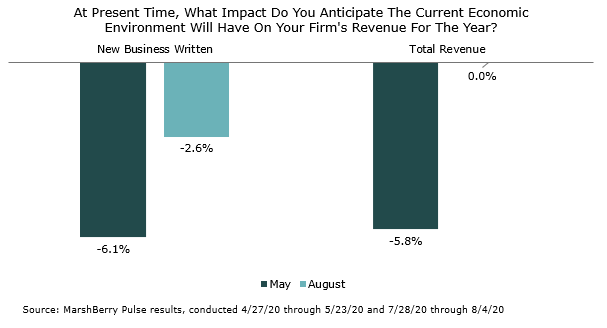

Revenue Expectations are Markedly Improved

To bring you meaningful insights into how insurance brokerage firms are responding to the business impact of COVID-19, MarshBerry recently conducted another Market Pulse survey to understand how industry sentiment has changed since the spring.

Earlier this year, when asked about anticipated revenue impact from the pandemic, survey participants indicated that they expected a decrease in revenue of approximately 6% – both in terms of new business written and total revenue for the year. When re-polled this month, expectations were markedly improved. On average, respondents indicated an expected decrease closer to 2.6% in new business and projected overall revenue for the year to be flat. Looking at the domestic Top 100 brokers cohort from June, respondents anticipated even higher growth – estimating an average of almost 5%. This tempered outlook appears consistent with the public brokers earnings reports last week where most reported positive earnings with neutral organic growth.

New business generation remains top-of-mind for most – three in four firms cited it as a significant concern. It seems that for many, concerns about revenue projections have been alleviated as states reopen and there is an uptick in economic activity and hardening rates in Property & Casualty counter reductions in business income, exposure base and headcount. Of course, some firms will feel the impact of the pandemic much more acutely, depending on their geography, industry verticals, and financial strength. We are not quite out of the woods yet but such small improvements in industry sentiment can be an indicator of improvements in market conditions that business leaders are seeing “on the ground.”

A lot can unfold in the second half of the year – but data from MarshBerry’s proprietary financial management system, Perspectives for High Performance (“PHP”), supports the revised projections. Preliminary 2Q 2020 data (for the twelve months ended) shows organic growth at 6.1% – down just half a percentage point from the same period in 2019. Additionally, new business as a percentage of prior year commission and fees for the twelve months ended 2Q 2020, is up by 0.3% percentage points over 2019.

If you have questions about Today’s ViewPoint, or about activity in the insurance marketplace, please email or call Gerard Vecchio, Senior Vice President, at 212.972.4886.

Subscribe to MarshBerry’s Today’s ViewPoint blog for the latest news and updates and follow us on social media.